Here’s an epiphany that hit me the other day.

I was deciding on my annual money goals, and I hit a mental wall. I was dreaming up an ambitious plan: to see if I can save $40,000 over the next year.

And yet, all the typical excuses started crawling out from their hiding places and creeping into my mind.

You know the type – the procrastination and rationalization that peeks out whenever you try to do something uncomfortable or tough, even though you know it’s for the best.

- “Isn’t aiming for $40,000 a little crazy?”

- “Shouldn’t I take it easy and just blow some cash?”

- “Will saving an extra $5,000 really make a difference in the long run?”

I had to silence those siren calls, because here’s the truth:

When it comes to saving money, numbers that seem similar can lead to extremely different amounts of future wealth.

Why?

Because each additional dollar that you save is NOT equal to your previous.

We all know about the exponential effect of compound interest. But what’s easy to overlook is how your savings also carry a sort of exponential effect that propels you closer and closer to your money goals with each additional penny.

The Tale of Two Savers

Consider the typical financial advice of saving 10% of your income. Someone earning earning $60,000 a year and following this sort of mainstream advice will save $6,000 a year. That’s better than nothing, but we can do better.

Now imagine there’s a money wizard to compare our mainstream saver against. She’s read about the ideas of financial independence, and she finds herself a little less interested in big houses and fast cars and a little more interested in saving towards freedom.

So, through some clever budgetary tweaking (mostly focusing on the big three) she increases her savings to 40% of her income.

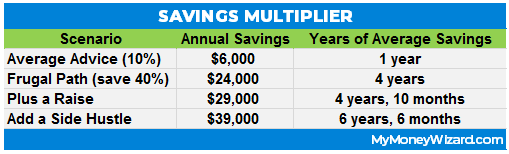

What’s important about this difference isn’t just the increase in percentages. It’s the multiplying factor at play. She’s saving 40% vs. 10%, or $24,000 a year vs. $6,000. Okay, duh.

But consider this. She’s racking up four years of savings for every one year of a “normal” person’s savings.

She’s buying time at such a rapid rate, an average saver can’t even begin to compete.

Basic multiplication tells the rest of the story. After two years, she’s already saved up 8 years of the average person’s savings, then 12 years… 16… etc.

Looking at it another way, a savvy saver can get done in 10 short years what it takes the usual cubicle slave an entire 40 year working career to build.

Looking good – now let’s kick it up

So far things have followed a relatively linear path, but here’s where things get really crazy.

Now let’s say we keep the same frugal principles that allowed us to 4x our savings rate, and then for good measure, we added more income to the equation.

For example, let’s say our money wizard starts a modest side hustle. Flipping furniture, opening a craft store, walking dogs, or anything else that pretty much anyone could use to earn an extra $10k a year.

Because that $10k of extra income is, well… extra… it flows into her bank account at a 100% savings rate.

The impact of this shouldn’t be understated. At first glance, saving another $10k when you’re already socking away $24k might not sound that different. After all, it’s only a marginal percentage increase in savings.

But that $10,000 means she’s nearly doubling the 10% saver’s $6,000 total. Again.

Think about this. Diverting just a fraction of her free time to Uber rides or puppy play dates lets her walk away with the same amount of extra money it takes the average saver 1 year and 9 months to pocket.

Let’s run one last quick example to show how this spirals out of control.

Say she saves that same $10,000 of side hustle income and then also decides to use her time more efficiently at work, play the politics game a little better, or even just muster up the courage to negotiate a little harder come performance review time. For her efforts, she adds another $5,000 raise or bonus at her career.

With her side hustle income, she’s suddenly saving an extra $15,000 a year, or the equivalent of 2 year and 6 months of her average coworker’s savings. Add that to her 40% savings rate, and she’s building wealth at a rate of 6 and a half times faster than she started.

Mapping It Out

Here’s a summary of the three scenarios:

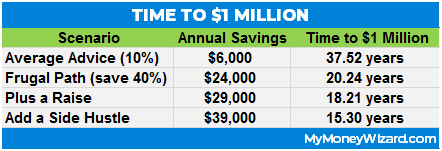

If we charted out the time to reach $1 million with 7% market returns, we’d see this:

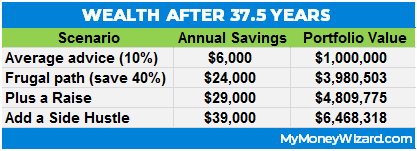

Which only tells half the story. Because it took our average saver 37 and a half years to reach $1 million. Where would the other scenarios be after 37 and a half years?

Shocking to see, but there’s no surprise there. Because she’s saving 6.5 times faster, she finishes 6.5 times richer.

Compound Saving is more important than the little details

This is how real wealth is made. It’s forged in frugality, and then accelerated with extra income.

So start with a laser focus on the most important expenses, and then take every opportunity you have to maximize your income.

You can worry about the ideal index fund strategy, minute details between Vanguard or Betterment, or the exact perfect order to invest that money later.

Because if you get compound saving right, you’ll be building wealth at such a rapid pace, early financial freedom becomes inevitable.

PS – As usual, if you want to get serious about tracking your savings and building wealth, I recommend Personal Capital. It lets you easily and automatically track your spending, calculate your net worth, and avoid overpaying on fees.

Related Articles:

Hi MW,

Really enjoying your content, since discovering your blog a few months ago.

I have a question (and I wonder if anyone else has asked you this yet…), you are at the stage of accumulating your wealth, so I suspect your index tracker funds are in the accumulation share classes, as opposed to the income distributing classes.

When it comes to retirement / when you want to take an income from your investments, do you intend to switch into the distributing share classes of the funds you’re invested in, or perhaps leave your monies in the accumulation share class and simply sell x% to generate the income needed? I wonder if there would be tax benefits/implications to which option you choose.

Looking forward to receiving your thoughts.

Nice Article, Money Wiz!

As I was reading, I realized a couple maxing out their 401(k)s are already at $38K/year, and that’s not including any employer match! In your frugal example, do you consider the 40% to include all types of savings (401(k), IRA, take-home)?

Damn right! It starts with frugality, definitely! This fits what I did almost to a ‘T’. Both me and the misses saved about 50% of our income and in 15 years we each had a million saved. That was five years ago, and we’re into our 3rd million now.

Of course, we can’t forget compound interest — that definitely helped too! The problem is, I think most people get so distracted by that shiny compound interest that *they miss* the fact that most of the heavy lifting is done by saving.