Aloha, fellow Money Wizards!

No, I’m not in Hawaii. But it is Summer. And time for another net worth update!

If you’re new here, every month I share my progress in growing my investment portfolio to a point that will let me walk away from work by age 35. I’m currently 29 with a couple hundred thousand to go, so let’s see the latest!

Life Update: June 2019

June had some big shoes to fill. But to be fair, topping May’s wild ride of going on vacation, getting engaged, and even experiencing real life Grand Theft Auto might have been way too much to ask.

Instead, the month-over-month systematic downgrade in excitement, from National Park vacations to low-key cabin trips with friends, from dramatic proposals to much more mundane wedding planning details, and from victims of theft to… not victims of theft… was actually a welcome development!

So, what’s there to type about? Not a whole lot, and I’ll count that as a good thing!

On the wedding planning front, Lady Money Wizard and I think we finally found a wedding venue in the in the sub $800 range, which should be more than fancy enough to accommodate myself, Lady Money Wizard, and 50 of our closest friends.

Getting to that number was shockingly hard. As everyone who’s ever planned a wedding says, the number ads up quickly! And we had to make some tough calls to keep it intimate. (Sorry Aunt Petunia, if our paths haven’t crossed in eight years, you probably aren’t making the cut!)

We still plan on side hustling our way to cover the entire cost, so stay tuned for that.

Outside of those plannings, I settled into a pretty normal routine of going to work, relaxing at home, and doing it all over again. And the craziest part, I actually enjoyed it!

Is this a glimpse of the slow slide into married life? 😱

On a few occasions, we did break up the routine with some relaxed events at the house. One night, we decided to stay in and put an old cooking class’s recipe to the test, by rolling up a mega-batch of 50+ homemade egg rolls!

To my surprise, I had a blast impersonating an overworked cook, and the whole experience was an awesome reminder about how the “simple” things often bring even more entertainment than the elaborate ones.

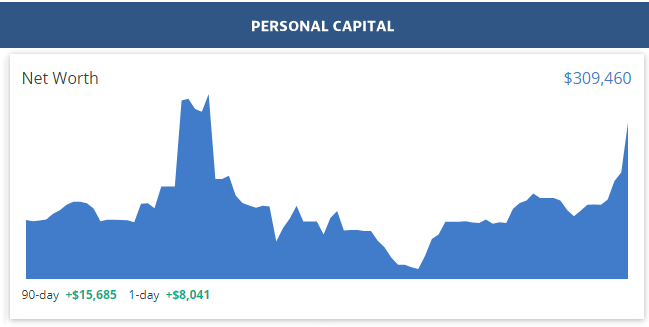

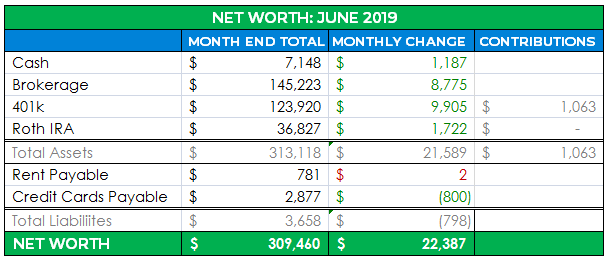

Net Worth Update: June 2019

And the month to month spreadsheet:

Mostly all green! And maybe the craziest growth since I started the site!

I passed $300,000 for the second time. And while it’s kind of bitter-sweet to pass the same net worth milestone more than once, it’s definitely better than the alternative!

Cash: $7,148 (+$1,187)

Just more savings from my salary. As a write this though, I’m realizing I should at least be transferring some of this growing balance into a better cash investment.

Brokerage: $145,223 ($8,775)

The big news here is that after the S&P 500 fell nearly 7% in May, the ‘ole invincible stock market came surging back in June.

Of course, I don’t actually think this stock market is invincible, and I’m still waiting on the same market correction I’ve been wondering about since… 2015? Oh well, bad things usually happen to people who try to outsmart the market, so here we are.

Despite all the volatility, my brokerage allocation remains mostly unchanged:

- 69% Vanguard Large Cap Index Funds (65% is the VTSAX fund and 35% is Vanguard’s VUG and VTV etfs.)

- 14% Individual Stocks back from the when I was young and dumb and thought I could beat the market

- 10% Vanguard Federal Money Market Fund

- 7% Bond Index Funds (2/3 in Vanguard’s VBTLX fund and 1/3 in Vanguard’s BSV etf)

This allocation certainly isn’t perfect, but it’s not bad, either. On my to-do list before the end of the year is to really think about what sort of portfolio I want for the long haul. With the crazy market rallies, all time highs, and less than six years until “retirement,” I’ve got a some decisions to make.

401(k): $123,920 ($9,905)

My usual $1,000 of paycheck contributions and employer matching, plus the big stock market rebound.

My 401k allocation is roughly 40% large cap index funds and 60% small cap and international stock index funds. Apparently, the latter had a pretty good month.

Roth IRA: $36,827 (+$1,722)

Inside my Roth, I converted $2,000 from Vanguard’s Federal Money Market Index to Vanguard’s REIT Index fund.

I now have just $1,000 left to be converted from the $6,000 I maxed out earlier this year. I’ll make the final move in July, at which point, the Roth will be back to 100% invested in Vanguard’s REIT Index.

One cool note about the Roth this month – quarterly dividends! I scored a $330 check… just for having money? Investing is a beautiful thing.

Rent Payable: $781 (+$2)

Hopefully I’m not jinxing anything, but it’s been a nice and cool summer here in Minnesota. So, we haven’t had to run the AC much at all.

For newer readers, this cost represents my half of the mortgage, utilities, and anticipated home maintenance. We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.

Credit Cards Payable: $2,877 ($800)

This question comes up a lot, so I thought I should address it. This number represents my monthly credit card statements, which I pay off in full every single month.

Credit card interest is a huge wealth killer. If you’re paying it, time to adjust everything and start investing your money in the correct order.

That said, as usual, I had some reimbursable work expenses on here which inflate the total credit card amount, so let’s look at the detailed monthly spending report.

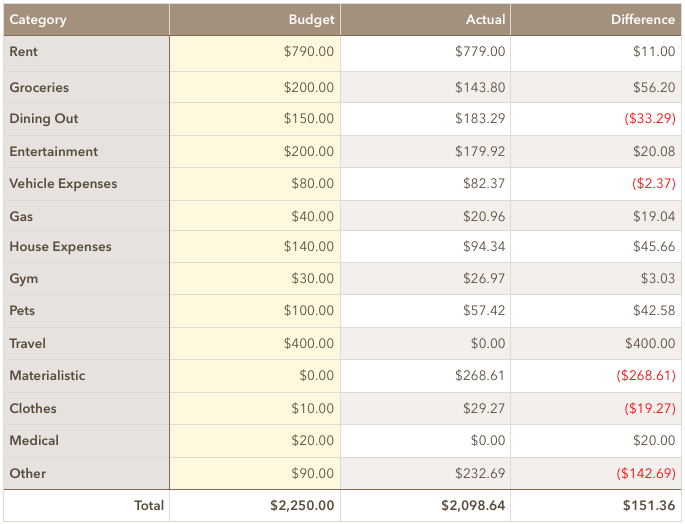

Total June Spending: $2,099

Entertainment: $180

Despite the homemade eggroll events, this was a little higher than usual, most likely because of the lack of travel.

Highlights included a taco night / margarita night at a friend’s house, a wedding, and a night on the town with an out of town friend. Town-ception.

House Expenses: $94

One thing they don’t tell you when you buy a fridge with a water dispenser… those replacements are insanely expensive! All $94 this month was devoted to a couple year’s supply of refrigerator water and air filters.

Pets: $57

A re-up on medicine for The Cash Cat.

Materialistic: $269

Everyone’s got that one splurge they’re not ashamed of. For me, that’s always been high-end sunglasses.

I’m a sucker for scenery, and for me, Maui Jim’s sunglasses are so next level they legitimately make the world a more beautiful place. Not to mention, they put all the pretend high-end sunglasses (cough… Ray-Ban!) to shame.

With summer rolling around, I thought it was finally time to replace my last pair, which are probably still flying around at 30,000 feet on the airplane I left them on two years ago.

Other: $233

I’ve been on a book reading rampage lately (6 books finished in the last two months!) so I placed a $30 Amazon order to replenish the reading list.

This category also included $115 to get Lady Money Wizard’s engagement ring resized to perfection, plus a gift to a friend who finally finished a lengthy post-grad program.

How was your June?

I look forward to hearing about your summer in the comments!

PS – If you haven’t jumped on the bandwagon yet, I’m still obsessed with Personal Capital. Personal Capital will automatically track your spending, double check your portfolio allocation, and add up your entire net worth in one place.

Related Articles:

The markets goes up and down. But the trend is upwards, just enjoy the ride. Nothing to worry about. My June was rather boring – financial wise. I wrote about it on my blog if anyone is interested https://10yeartarget.com/financial-status-june-2019/

Congratulations Sean. Almost half way there. Love also getting dividends. Maui Jims the best sunglasses. My husband flies a lot and agrees. Doing the best as only 13 more years for retirement. Mandatory for my husband. But I am sure he would love to grow some orchids and looking into lotus. A passion for him as he grew up in South America and Thailand one of our trips had rows of them like vineyards. Our favorite place if you have a honeymoon. Inexpensive. All the best. I am thinking of Vanguard’s VTSAX fund also? You recommend? I have VOO and VTI and Admiral. Have a great week. Congratulations again on your engagement and almost meeting your half way goal.

If you don’t mind another opinion, yes, I’d agree that VTSAX is a great choice. I’ve had for years (thanks to my dad) VTSMX shares, which is pretty much the same as VTSAX but with a lower minimum to start, the cost per share is about half, and maybe slightly more expensive for management fees. VTSMX is now closed to new investors btw.

Perhaps a reason not to include VTSAX in your investment portfolio is if you already had a fund that had same or similar holdings with on par returns and reasonable fees. It may not be advisable to sell one (say VTSMX) for shares of VTSAX; yet, that gets into tax implications. You may then want to consult a financial/ tax adviser to see what may be better for your situation.

You mentioned having VTI, that’s essentially the same as VTSAX. The main difference is how they’re traded.

There are also competitive, comparable funds held by Schwab.

Btw I’m just another investor just trying to save for retirement as well. There’s also further info out on web for researching and comparing things.

Hello Ian,

Thank you for the advice. Schwab manages the 401K account. I can look into their funds. Want to have 2 IRA’s. Once we stop working at 65 can we contribute the max 6500 each until we are 70.5? if you might know the answer to this. Thank you for the advice. Good Luck with also saving for retirement. The years go fast, wish I started earlier but with the article from Sean about Orville Rogers, I guess I will be happy. Just have to max out everything. Take care.

Right, invest what you can when you can.

You can open as many IRA accounts you may want. Having more than 1 IRA doesn’t mean you can contribute more. One’s combined contributions into multiple IRA accounts can not exceed the annual limit for that tax year. For instance, I could only do no more than the max ($6,000) contribution for a Roth IRA for 2019 year whether it is towards one account or 3; my wife could also do no more than the max for her Roth (collectively $12,000).

There are situations where owning multiple IRAs can be helpful or beneficial.

How you envision and plan for retirement could help with what you want.

And towards your specific question …

You each could contribute the max allowed per that tax year for your respective IRA(s) – say you had one or two and spouse had one or two. Though, combined contributions for one person (E.g. for one person over 50 age, Roth IRA ($3,000) + Traditional IRA ($4,000) ) no more than max contribution limit. The max limit had increased for 2019.

Some of the eligibility and constraints change from year to year. A professional tax advisor probably would help best.

Btw as I understand, you could still contribute to a Roth if you’re working and 70.5 and older.

In brief, yes I believe so. Though max contributions increased for 2019.

Keep in mind total combined contributions for that tax year can not exceed the max contributions. And, as I understand it, someone 70.5 and older can still contribute to a Roth if they’re working.

I had a lengthier draft that disappeared.

To make a contribution to either a traditional or Roth IRA, you have to have what the IRS defines as “earned income.” The one exception is a spousal IRA for a non-working spouse. If you don’t qualify for an IRA but have other sources of income.

The only way to put money in a Roth IRA if you have no earned income is to do a Roth Conversion from your Traditional IRA assets to your Roth IRA.

Thanks Tracy! It didn’t even register that I’m almost halfway there. Good eye!

Keep it up, btw! Sounds like you’re doing great and even a late start can put you in an awesome position eventually.

Congrats on the engagement! I am also recently engaged and have been in a long term relationship where expenses have been split for the last few years based on percentage of total combined income. Do you split everything 50/50? Will you be combining accounts once married? We also have plenty of wedding planning spreadsheets and are trying to keep our costs minimal by really deciding what is important to us and what we can skip. Some of the decisions we have made to save money include skipping a DJ with a Spotify playlist, getting our cake from Costco (they are delicious!), having a good friend be our photographer, and buying a simple dress online for $100. Even with foregoing some of the big costs, things add up very quickly. I would love to see a post in the future highlighting some of the steps you are taking as you transition to married life!

Nice tips!

We split most things 50/50, but we also don’t stress about keeping it exact. I’m still not sure what we’re going to do with the accounts once we’re married…

Congrats!!

This month I also got above 300k, for the first time 🙂

Congrats, Sean! Are we the same person? Haha!

On the book expense…. consider joining your local library. You can download ebooks already available, but you can also request titles that may not be available at the moment, and the library can order them. Ours does that, and my husband (who reads about 4-5 books a month!) basically dropped his book expense completely! Thanks for a wonderful blog, and congrats on the engagement!

I agree on the book expense.

Phone apps such as Libby and Hoopla can be very useful.

If you really want a print copy of a book, consider second hand stores or auction sites.

Yes, good call! There’s a thrift store near me that sells paperbacks for 50 cents and hardcovers for $1. It’s my go to for books, although I’ll still place the occasional amazon order for the ones I can’t find.

I started downloading audiobooks from the library, which is a big reason for the spike in reading lately. I didn’t realize libraries would order books though, I’ll have to check this out. Thanks for the tip!

Congrats on engagement and upcoming wedding!!

My wife and I just celebrated our anniversary and we got kids as well. Keep in mind kids can get expensive if they’re part of future planning. Just thought I’d mention.

Random thought wife and I had in hindsight was to elope and later have party with friends and family. Not sure how much that’d save us, though expectations on either side may or may not be factors of consideration.

Thanks Ian! And congrats on the anniversary and kiddos.

That’s basically our plan – no formal ceremony followed by a small party. I’ll definitely post about it more in the future.

Thanks!!

Btw, Costco carries Maui Jim sunglasses. I too am a fan of those sunglasses. Maybe that could be a way of saving on that cost.

Awesome tip! I’m seeing lots of Maui Jim’s on the Costco website for $100-150 cheaper than the Maui Jim store. I reached out to Maui’s customer service and they said Costco sells legitimate Maui Jim glasses, just older discontinued models. Looks like a legit way to get Maui Jim quality lenses for half price!

You’re doing great! Keep at it! In 30 years, you’ll blink and wonder where the time went as you see your portfolio statement and smile!

Thanks Scott! I’m still a year away from 30 and already wondering where that time went!

I am trying to wrap my head around dividends in IRA. Do you not reinvest your Roth IRA dividends? You mentioned you a got a $330 check – does this money get taxed? Thanks!

Good luck with the wedding planning. We saved a lot of money by having ours at a restaurant – they charged us only for food and drinks and nothing for the venue. Almost hassle free and worked out great.

I should add that we had the top floor of the restaurant with a terrace for ourselves. It was super pretty even if it sounds dull on paper.

By the way, really cool idea!

It was a metaphorical $330 check. I set my Vanguard settings to reinvest all my dividends, so the “check” shows up as a $330 distribution in the Roth followed by an immediate purchase of $330 worth of shares in the index fund which paid it. (VGSLX in this case)

I didn’t withdraw it, and Roth IRAs grow tax free, so the money doesn’t get taxed.

Roth IRA’s grow tax free but if you ever take the money out prior to 59.5 your gains will be subject to the 10% Penality and Taxes. That is why every year when you file your taxes you should be tracking your Cost Basis with your Taxes. You can always take out your basis out anytime Tax-Free.

If you want to use your Roth IRA for a down payment on your 1st home and some other exceptions you have to have a minimum of a 5 year holding period. So if you started your first contribution 7.1.2014 and later you would be able to take the full amount penalty and tax-free if you use the funds for your 1st home purchase and some of the other exceptions but have to be coded appropriately in your tax returns.

We don’t recommend anyone to use their Roth IRA to fund their 1st time home purchase but there are people that do that and need to be aware of the implications if not done correctly.

Yep, good point. I wrote about that a little bit here:

How to Hack Your Roth IRA as an Emergency Fund

Really solid moth!

And a nice blog too, keep it up 🙂

-NF

Hello to the Money Wizard,

This is my first time on this incredible blog that you have here about personal finance. I have a question, for the cash proportion, do you pay off your credit cards every month with that cash or do you leave a specific amount of cash on the side to pay off the credit cards when ready to do so? For example, I have $10,000 worth of credit card debt, do I keep $10,000 in a money market fund?

Hey Mr. Money Wizard,

You should link this page to your net-worth page (June is missing there) 🙂

All the best!

Thanks for the heads up Kitty! Just linked it.

https://mymoneywizard.com/net-worth/

Do you contribute enough to max out your 401(K) each year? I believe the maximum amount in 2019 for people under 50 is $18,500. That does not include employer contributions. That means you would have to contribute around $1541.67 of your own money each month to max out your 401(K). At a little over $1000 contribution each month, it looks like you won’t max out. Am I reading this correctly, or do you prioritize other accounts, like a brokerage, over the 401(K)?

I used to max out my 401k religiously. But last year, I lowered my contributions to start saving up cash for a rental property. Check out this post for my thought process:

https://mymoneywizard.com/unusual-alternatives-401k-too-much/