Hey Money Wizards,

As you probably know by now, every month I track my updated Net Worth, so that I can hopefully leave my office job in the next few years. I’m currently 32 with a goal of a million bucks within the next three years, so let’s see the progress!

Life Update: June (to Mid-July)

First things first… I apologize for being M.I.A.

As many, many readers have point out to me… It appears that I quit on this blog as soon as the stock market’s first bump in the road came along.

I can promise you that’s not the case, although I can definitely see why it’d look that way from the outside.

The truth is that there’s just been lots going on around the Money Wizard house, which has made keeping up with the blog somewhat difficult.

Summer in Minnesota is when everyone comes out of their abusive relationship with the weather. Hibernation ends, the good times start rolling, and everyone is busy living life.

Off the top of my head, stuff going on since the last update:

- Hosting family who came for a reprieve from the brutal Texas heat and enjoy our wonderful Minnesotan summers

- A cabin trip to some northern lakes

- Weekly coaching of the hilarious chaos that is our toddler-nephew’s soccer practice

- The annual all-you-can-drink summer beer fest in the garden of Minneapolis’s legendary giant cherry spoon

- Multiple summer parades

- Buying a new road bike! And promptly riding a few hundred miles all over the city

- Getting our annual kale and flower garden thriving

- More lake trips

- A few dinners out, including an awesome food and wine pairing last week.

- And maybe worst of all, downloading the dreaded Roller Coaster Tycoon again, which regular readers know is that fastest way for Money Wizard to get completely distracted and waste far too much time gaming instead of blogging.

I’m probably forgetting a ton more, but you get the idea.

Unfortunately, all this action also coincides with a bit of a market downturn, which makes ole Money Wizard look like he’s been doing some Winter Hibernation in the Summer.

Speaking of which, let’s take a look.

Net Worth Update: June 2022

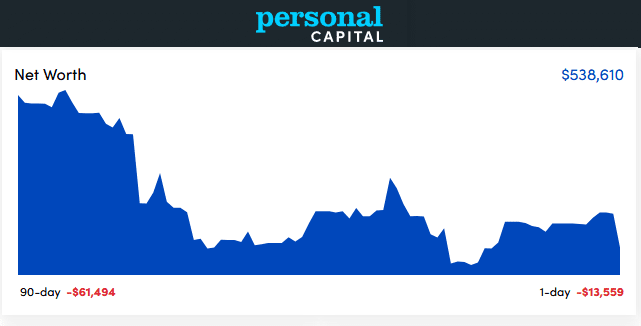

(The above screenshot was taken in the first week of July.)

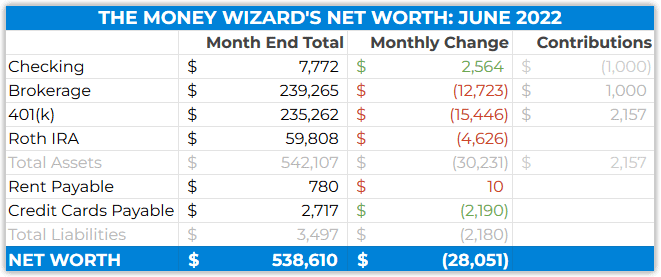

(These details were also pulled the first week of July)

All in all, some serious bathing of blood in the portfolio. All this was spurred on by some legendary craziness going on in the markets.

The big headline news was a 40-year high of inflation, at an “official” 8.6%.

(I have my concerns that the inflation calculations are too complicated for their own good. I suspect that any number of different approaches to the official calculation would be far higher, and I suspect anyone who’s been to the grocery store lately would agree.)

In response to this madness, the Fed reversed course. In May, they said a 0.75% increase in interest rates wouldn’t be considered, but then a month later they went ahead and raised interest rates by 0.75%, haha.

(We can only assume they saw those 8.6% inflation numbers and panicked. Either that or they actually went to the grocery store.)

In either case, like we discussed in previous updates, the Fed raising interest rates is their primary tool to combat inflation, due to some economic theory that’s too boring and detailed for me to want to type out and for you to want to read. The only catch is that raising interest rates also has the effect of crushing asset prices, especially “risky” assets like the stock market.

End result? A $28,000 drop in my portfolio over the last 30 days.

For those who are counting, that’s a 4.9% drop in a month. (Personally, I find it more comforting to look at downward portfolio changes in percentage terms, since it usually doesn’t look as devastating, and it’s a reminder that these changes are just part of the ebb and flow of compound growth.)

Account Changes

Question for the readers… Do people read/care about these details?

My accounts are mostly on autopilot, so there hasn’t been significant news to most of them in over a year.

- I continue to automatically transfer $1,000 a month from my checking account to my brokerage account, which gets invested in Vanguard’s Total Stock Market Index fund.

- I continue to max out my 401k, which means a little less than $2,000 a month from my paycheck, plus some hefty employer matching.

- I max the Roth IRA out at the beginning of each year, and then the waves of the market take it from there.

- The credit card details are far less accurate than the actual monthly spending below.

Since the numbers are already in the table up above, I think it’d make sense to change this section to a “My Current Strategy” section. Let me know your thoughts!

My Current Strategy

Economic downturns are when the real riches are made.

It sucks to see my portfolio down so much, but it’s pretty comforting to know that the $3,000 of automatic investments each month is now buying the exact same stocks, just at a 15% discount.

I’m continuing to add to the amount of wealth I own, as measured by total assets (aka, shares of stock) rather than the dollar value. When the market recovers, (not if) that larger number of shares will be worth far more than what I could have purchased if the never-ending rally continued.

So, no changes to the current strategy.

That said, I have had “buy $10,000 of I-Bonds” on my to-do list for an embarrassingly long amount of time, so I should probably get around to making that happen. They’re currently yielding around 10% and should help protect against inflation.

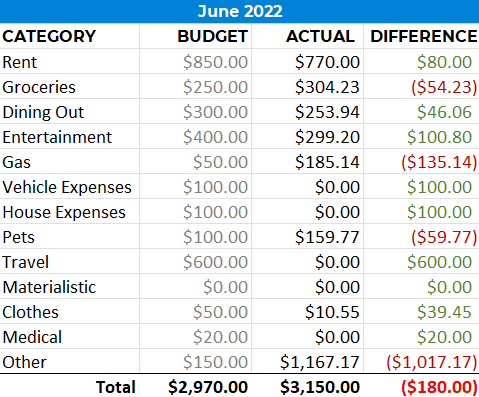

Total Spending June 2022: $3,150

Entertainment: $299

A lot of that stuff I listed at the top costs moolah, the more significant ones being the cabin trips with family, beer fests, and other such shenanigans.

Pets: $159

A little scare with The Money Pup. We thought we found a tumor while he was getting his regular belly rubs, but thankfully it was just a false alarm.

Other: $1,167

The bike!

Bought myself a new $1,000 Trek road bike, which surprisingly is about as cheap as a new road bike comes. I’m already having a blast riding it all around town for getting some summer exercise.

It fits in the back of my hatchback, but I also might grab a bike rack soon, so Lady Money Wizard and I can really expand the bike-able radius!

Final Thoughts

Thanks for sticking with me all these years.

With how busy life is getting, I can’t promise that I’ll be as timely and consistent as I’ve always been, but I do promise that I won’t give up on the blog any time soon.

See you around!

PS – Want to track your net worth like this? Personal Capital’s free net worth tracker is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

What about your crypto?

What are you curious about? I always exclude the crypto details for security reasons.

I think the account changes are interesting to see; I like to compare them to my current strategies.

Ok, thanks for the feedback!

“A wizard is never late, nor is he early, he arrives precisely when he means to.” – Peter Jackson

Haha, perfect!

Although the Tolkien family will probably sue ya for claiming Jackson made that quote.

Hello,

Thanks for another good read! May I ask which bonds you are specifically planning to buy? Are there any you would recommen?

Series I Savings Bonds aka I Bonds. As far as I know, they’re only available on the TreasuryDirect.gov website, which is currently down, haha. Typical.

You are on the right path. I don’t see any reason to believe otherwise despite the stock market downturn…and keep auto saving. Your strategy will work and you’ll attain your goal(s).

Appreciate the support!

Glad to see you’re still updating. You should get your net worth history page ( https://mymoneywizard.com/net-worth/ ) up-to-date with the latest few months as well, and maybe even add a column for an “inflation-adjusted” value (i.e. list all the amounts in “today’s” dollars). Especially with inflation so high, I think it makes a difference – a million dollars today is worth a lot less than a million dollars 10 years ago, or even just 1 year ago for that matter.

Good call, I updated the net worth history page.

The inflation adjusted idea is a really cool one, but I think it’s not feasible at the moment. In order to stay updated, I’d have to recalculate all 60+ months every month.

Sometimes Personal Capital just slaps you in the face when you log in, doesn’t it? Just for grins I looked at my 30 day results and they are down over $70K and what’s really inspirational is I’m down half a million so far this year. And we are retired and no longer adding to our nest egg, in fact we are withdrawing quite a bit. However I was you a few (a lot) of years ago and your plan is golden. In fact you’ll be like me and losing half a mil will not even phase you because you will have seen it several times. We are headed up your way shortly to do a Michigan UP road trip and hope to even hit Minnesota while we are in the neighborhood. We have extreme heat warnings every day here and are hoping it’s cooler up there! One weird thing just now, I looked at the markets this morning, it was in its normal melt down, then the Fed raised another 3/4% and the market took off like a bottle rocket. I may have slept through economics that day but I thought higher interest rates hurt the stock market?

Sure does! But it’s all part of the ride.

It’s beautiful here this time of here. Hope you luck out on some good weather!

Interesting comment on the market. Up is down and down is up right now, it seems.

Thanks for the update. Still interested in the blog. It’s just nice to get a sense of another human’s sitch to gauge your own. Also insightful to see your thought processes and different investment vehicles. I, too, have been on the “maybe I should buy some i-bonds” for a few months now. Bought more stock instead… which is down. LOL (I think).

Thanks!

I would definitely be interested to learn about bonds in a blog post if you were up for writing it! I started following you years ago and this website is where I learned the foundation for all of my investing and saving. I will say though, I know nothing about bonds so if you have already written something that I missed, feel free to point it out.

Thank you!

Thanks for the feedback!

During this downturn, I transferred my bank and investment accounts from BoA to Alliant CU & Schwab, rather than bucketing them all at the same bank. I hated having to see my investments go down everyday just to login to check my checking account balance or pay my credit card bill. I may revert to only tracking my net worth quarterly instead of monthly. This will give the stock market more time to smooth out, and more time for my contributions to (partially) offset any losses so that the market declines will be easier to handle psychologically. I just setup my investments to auto invest into Schwab’s SWTSX instead of having to manually buy VTI every two weeks, so I no longer need to login to my brokerage accounts. I’m trying to take a set it and forget it approach and not sweat over the day to day fluctuations.

All of my friends called me crazy when I told them in December 2021 to buy iBonds. I sold $20k of stocks and bought $10k of iBonds for 2021 and another $10k in January 2022. I plan to hold and keep buying them as long as the rate they are paying is at least 2-4% higher than the 10yr treasury.

Should have gotten a gravel bike. They’re more versatile, especially with the trails that are probably common in your area. You could probably put wider tires and a lower gearing cassette on your road bike though and do some trail riding.

I like the set it and forget it approach.

To be honest, checking your net worth every month probably isn’t healthy. But I gotta give the people what they want!

Gravel tires would fit on the bike, so we’re good.