If you’re new around here (chances are, you might be, especially after Business Insider just republished my journey to $500,000 by age 30 on their front page) then welcome to the monthly net worth update!

Every month I track my progress to my goal of about $1 million in net worth, which I’m hoping will allow me to take an early retirement from my white collar office job. I’m currently 30 and hoping to retire within the next 5 years. Read on for the latest progress!

*As always, I am not an expert or financial advisor, so nothing on this site should be considered financial advice. These are just like, my opinions, man. Always do you own research, and always abide by The Dude.

Life Update: March 2021

In typical COVID fashion, there’s no wild adventures to report this month… other than a new member in the family!

It’s true, it’s true… The Money Wizard household caved in the name of a Pandemic Pet.

Well, not exactly.

Long story short, a few months ago we came home to see a friendly orange cat on our porch.

When he came back a few days later, we noticed the poor fellow was walking with a limp and mangled with flees. So, we decided to see if we could catch him and get him some of the treatment he needed.

After a trail of treats, we did manage to catch the guy. We brought him to the vet where there was just one small hiccup…

They lost him.

Literally, they lost “our” cat.

Poof. Gone.

Apparently, as they were bringing him inside (curbside dropoff, for COVID safety… add it to the list of new normals…) the unlucky vet tech dropped his carrier, which exploded into a million pieces and left the cat fleeing for the forest.

A ferocious lover of animals, Lady Money Wizard wasn’t one to be deterred. She immediately went to work printing flyers for the neighborhood, and she spent the next few nights cat hunting.

After day three, a Good Samaritan found the orange guy, and they returned him for the vet visit that started this whole saga.

By this point, Lady Money Wizard’s heart stood no chance, and she pleaded with me to keep the poor stray.

A few months later, I’m now a guy with three pets.

Oh well, at least the new one is a total heart throb.

Plus, he gets along great with Money Meow #1, which severely decreases the amount of times #1 tries to rip the cords of out my computer while I’m typing up these posts.

We’ll call it a win for the blog?

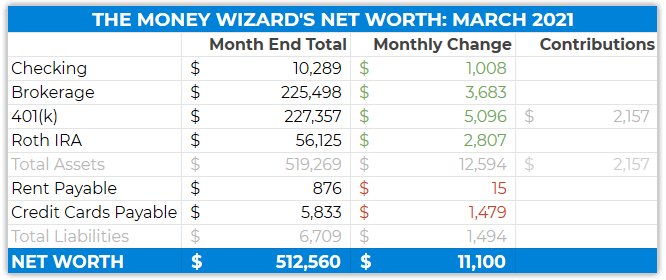

Net Worth Update: March 2021

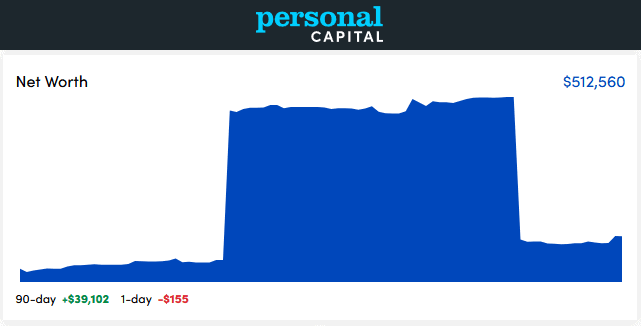

With my Personal Capital back up and running, we can now see the handy dandy chart…

Whoa! What-the…

It turns out, due to some technical behind the scenes stuff on Vanguard’s end, Personal Capital briefly counted my Vanguard accounts twice.

As nice as it was to be temporarily $150,000 richer for a few days, I’m sad to report that this wasn’t real life. Dang! I’ll have to put those borrowed fur coats back in the closet, and return to life as a regular Joe.

Which, as it turns out, isn’t so bad! Especially since the net worth stayed above the glorious half-million milestone after crossing the threshold for the first time last month.

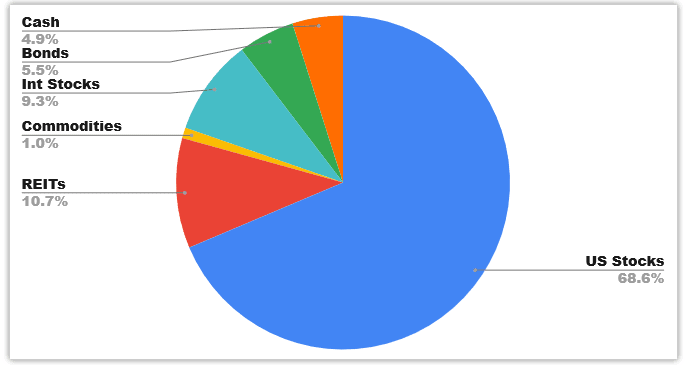

And with Personal Capital back in the action, I can finally provide a detailed portfolio breakdown again:

As usual, this doesn’t count my roughly 10% cryptocurrency exposure. With bitcoin continuing to the moon, that part of the portfolio is getting harder and harder to ignore. BUT, we shall continue ignoring, both in the interest of security and not counting on those risky investments for early retirement’s sake.

Checking Account: $10,289 (+$1,008)

Normally I don’t like for the checking account to be this high, but I just finished meeting with my accountant and am currently bracing for the extra $4,000 tax bill that will slap me in the face mid-April.

Brokerage: $225,498 (+$3,683)

No contributions this month, so just market movement here.

For newer readers, the brokerage account is mostly just general stock market index funds, like VTSAX. (If you’re ambitious or craving particulars, take a look through previous net worth updates where I provided exact numbers.)

401(k) : $227,357 (+$5,096)

The 401(k) stays ahead of the brokerage account, which is no surprise considering it’s helped along by about $2,200 of my contributions and employer matching every month.

My contributions are still invested like so:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $56,318 (+$2,807)

I contributed the $6,000 maximum back in January, so this is just investment returns in action.

The Roth is still roughly 75% VGSLX and 25% VTIAX.

PS – here’s why I like VTIAX more than VFWAX.

Rent Payable: $876 (+$15)

Nothing exciting here. I’m still splitting the mortgage on a house that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $5,833 ($1,479)

Bam! I got blasted with $750 of credit card annual fees for a bunch of travel credit cards I’ve barely used in a year. (That’s how they get you, btw…) That said, even with the fees I should come out ahead… if I ever book another trip this year.

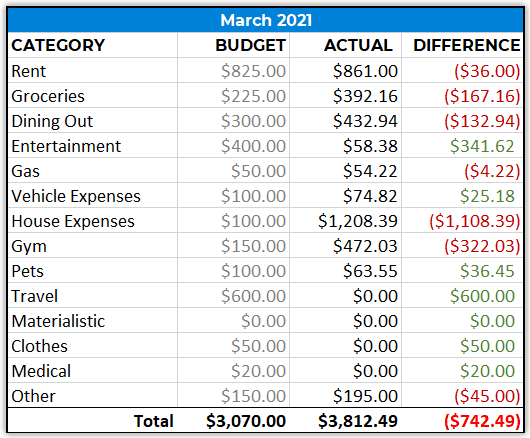

Total March Spending: $3,812

Budget alert!

$800 over!

And crazier, that was all because of one thing I bought…

House Expenses: $1,208

The big one. We finally bit the bullet and decided to get our 100-year-old historic house in Minneapolis some insulation.

What’s that you say? You can’t believe a house in a place with -20 degree Winter days didn’t have any insulation?

Neither could we. But that was the reality we faced after opening up the walls and finding a completely empty chasm. Nothing. (Not even old newspapers!)

The insulation guys were just laughing at how inefficient the house was. And they do this for a living!

The total bill was 5 big ones. As in, $5,000. Split between Lady Money Wizard and I, and that’s $2,500 per person. The $600 per month we save together into our home maintenance fund still wasn’t enough to cover it, so we both topped off the bill with some extra money from our personal stash.

Sounds expensive, and it is. That said, the difference between insulation vs. no insulation (and I should stress again, literally zero insulation…) should actually pay for this entire bill in a couple of years.

I’m pretty excited about it! And as an added bonus, I no longer hear every single outside noise like it’s occurring in my living room. (It turns out, having insulation makes a house quieter, too. Who would have guessed?)

Gym: $472

I officially cancelled the Globo Gym for good. To help mourn the loss, I grabbed a set of free weights in the most cost effective and space efficient way I could find – a set of Powerblocks.

How was your March?

Adopt any new pets? Haha!

In any case, hope you’re doing great!

-Sean aka The Money Wizard

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Hi Sean,

I’m a college student (finance major) that will be graduating in May. Earlier this week I landed an entry level financial analyst position, so I’ll officially be starting my career in mid May. I just wanted to say thanks for everything. I’ve read your blog for several years now and you’ve inspired me to pursue FI. Love your writing – keep it up!

Ryan

Congrats on the addition to the family!

I see insulation as a high-yielding investment rather than an expense. Should reduce your bills and raise the value of the house. I’m curious to learn more – what type of insulation did you get? Also I’d be curious to see how well it pays off in terms of energy savings.

Keep it up.

Nicely done! That was a fast trip from stray to family member, but it always is 🙂

I’ve never been able to make the gym work – financially or operationally. Let us know how the Powerblocks work as I’m decidedly lower tech for my at-home gear.

What REITS do you invest in?

Hey Sean. Love the blog. I was wondering if you could talk a little about two things: 1) How did you choose and how are you thinking about asset allocation (I.e. stocks, bonds, real estate, crypto, international, etc.). How did you decide on these levels? Do you rebalance annually? Will your allocation change if you retire or get closer to it. And 2) How do deal with volatility on a day-today or month-to-month level? With a $500K portfolio, I’m sure you have $5-10K swings in net worth in a day. Do you just ignore that? Do you LIKE when your portfolio drops? How often do you check your accounts?

This may be too much for a message and may make a good blog post. Thanks!

Great post!

I’m also in an uninsulated house in a cold climate. I’d be very interested to know what type of insulation and method you used to fix it.

Thanks!

Aron

Great photos of the cat. Side note, I have seen Personal Capital do some weird things as well. Especially if you open/close an account. I have found that it is important to go in the day you close down an account and close it down on PC. Otherwise you’ll see the Net Worth swing up/down sharply and/or double count any moved holdings.

Hi Sean,

Been following for about a year now. My biggest question is why are there months where you don’t make a contribution to the Brokerage? I’m trying to treat my brokerage account like a monthly expense and always make a contribution, trying to follow the dollar cost averaging theory. Any reason or just too many expenses this month?

You guys do anything interesting with your stimulus checks, or did they go towards the insulation? Love the new cat.

Congratulations! Mine just passed $350,000.

What a cute addition to the family!! That cat is so adorable and looks so sweet!! For your credit cards, have you tried calling customer service to see if they can waive the annual fee just for 1 year considering the pandemic etc? They might be able to do that and/or give you some statement credits so it might be worth calling them. That’s awesome that your net worth continues to grow. I really enjoy reading your blog and it really motivates me to stick to my investing and saving goals!

Congrats on the $150,000 increase in net worth in one month!!

Kidding kidding, that would’ve been a great April Fool’s post 🙂

Pandemic Pet looks like a great addition to the mymonewizard family.

There’s really no reason not to include crypto as part of your overall portfolio. If it dips, it dips. If it rises, it rises. I don’t see how you wouldn’t include that as part of your retirement portfolio. Risk is risk.

Love these updates in my email. It’s nice to see the journey ahead. I invest more heavily in Real Estate, but knowing, at any level, that you can have half a mill net worth by 30 is insane!!!! My mother-in-law just told us they passed the half mill mark at almost 50 years old so I’m hoping to follow more closely on your path. I’m currently sitting at $150k at 25 years old and ready to see it take off!! Excited to see your portfolio soar for the skies in the near future

Congrats on the green for March, especially in the 401k and brokerage accounts. The market is still on a tear!