Hey Money Wizards,

It’s time for another Net Worth Update!

Here’s my usual spiel for the newbies. Every month I track my progress towards a goal of around $1 million dollars. I’m hoping that amount will let me leave my office job. FOR GOOD. Within the next four years.

The goal? Early-retirement and/or hobby employment by age 35. I’m currently 31, getting closer to 32 every day, but hopefully getting even closer to the goal!

Life Update: November 2021

Other than the usual Thanksgivings and turkey stuffing (I’m talking about my stomach, not the side dish…) the biggest news in November was what only our second non-honeeymoon trip of the year.

We started November with some much needed time away from work.

Welcome to New Orleans!

For my money, there’s nothing quite as soul-recharging as some live Jazz music and a cup or twenty of Gumbo.

Truly one of my favorite places, and November’s lack of crowds made for a nice little travel hack.

Once back in Minnesota, it was back to the grind. Or at least as much grinding as could be done between Thanksgiving breaks and the beginning of Holiday festivities.

‘Tis the season!

Net Worth Update: November 2021

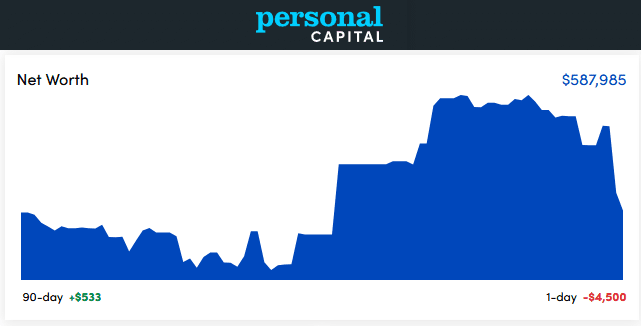

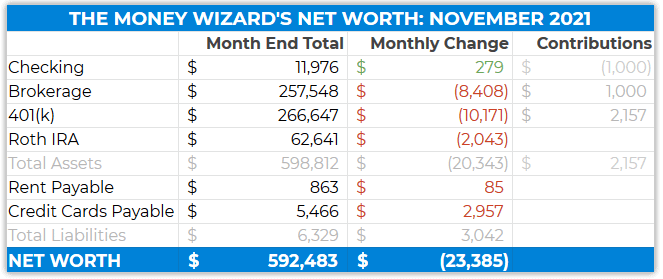

And the detailed net worth update:

Wait, the pic above doesn’t match the detailed table below!

That’s because I took a screenshot of my dashboard, then promptly forgot to save it. And you know, Personal Capital is just so dang good at updating in real time that by the time I realized my mistake, the numbers we’re all off.

And yes, my net worth dropped by several thousands of dollars in a matter of hours… which is either really depressing or just another reminder that stressing too much over changes on a computer screen isn’t worth it. These things really do go up and down all day, by a lot!

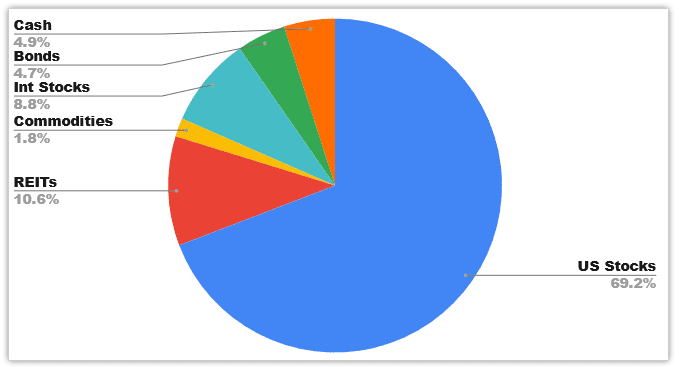

Anyway, here’s the updated allocation:

Checking Account: $11,976 (+$279)

Despite November being an oh-so-glorious three paycheck month, my checking account balance barely moved.

That’s partly because I transferred $1,000 cash to my brokerage account via Vanguard’s automatic investing feature. But also, I think I just had a lot of leftover credit card spending from the honeymoon and pre-booked stuff for November’s travel.

Brokerage: $257,548 ($8,408)

In November, the stock market dropped like a brick, thanks mostly to concerns over a new COVID variant.

(And yet I see that today, stocks are rising due to… a lack of concern over the new COVID variant. Oh, how we love you, market madness…)

Here’s a not so scientific breakdown of what this includes:

- Vanguard Stock Market Index Funds (almost entirely VTSAX): $165K

- Vanguard Bond Market Funds (mostly VBTLX): $30K

- Vanguard Money Market Fund (VMFXX): $15K

- Individual stocks from when I was a teenager trying to be the next Warren Buffett: $30K

- Gold & Silver ETFs: $11K

401(k): $266,647 ($10,171)

I actually contributed over $3,000 to the 401k this month (despite the table up there saying $2.1K… man, this net worth update is a mess!) thanks to the three paycheck month.

And it still dropped by $10K!

As always, I max out my 401k and get a healthy match from my employer, which means about $1,000 every two weeks added to the 401k balance.

Roth IRA: $62,641 ($2,043)

This portfolio is about 75% REITs (through Vanguard’s VGSLX index fund) and 25% international stocks (via Vanguard’s VITAX index fund.)

Here’s my full explanation for why I hold REITs in my Roth.

Rent Payabale: $863 (+$85)

Some good news! And some bad news.

Good news – our first winter heating bill came in after our house’s multi-thousand dollar insulation project, and we used nearly half as much gas as last winter!

Bad news – Lady Money Wizard forgot to pay the bill, so the balance is higher than it should be.

(For newer readers, I live in a house that Lady Money Wizard bought before we got married. We’ve split the payments for years, but now that we’re married, we’re still deciding on how we want to combine finances.)

Credit Cards Payable: $5,466 ($2,957)

Jumped up because of charges from our New Orleans trip. And then when we got back from New Orleans, we were feeling the Wunderlust bug and immediately booked another trip in May.

(We’re planning on heading to our original Honeymoon destination… pre-wedding delay and pre-COVID shutting down the Canadian border – Vancouver Island, British Columbia!)

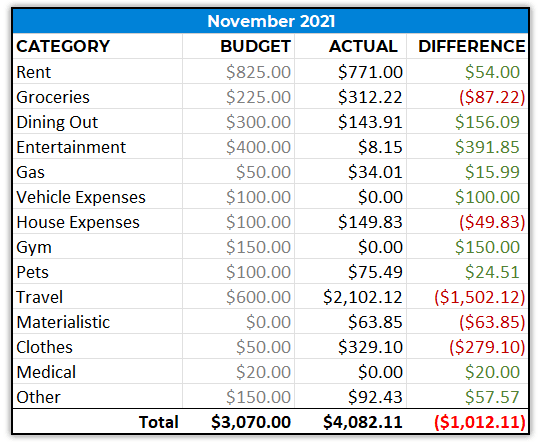

Total Spending: November 2021 ($4,082)

Travel: $2,102

The Big Easy ain’t cheap!

Thankfully, since most of 2021 has been a hermit-like existence with no travel for a pandemic or two, I’d built up quite a bit of tolerance for travel spending.

This was also the first trip where, as a married couple, Lady Money Wizard and I stopped stressing over splitting stuff, and instead just let loose and allowed me to pay for everything.

I find that simplified approach is actually much easier. (And easier to track, too!)

Clothes: $329

Despite my $89 thrift store suit from last month, I also found a great deal for a regular suit, which I ponied up and bought for $300.

(In the suit world, that’s still a great deal, I promise! And us guys with business jobs need more than one suit, anyway.)

Groceries: $312

Man, I feel like inflation is just pummeling my old $35 a week grocery bills.

Oh wait, inflation doesn’t include groceries, and it might be total BS anyway.

Readers, how was your November?

I can’t believe it’s nearing the end of the year!

Hope you’ve had a great one! And a belated Happy Thanksgiving!

Related reading:

Hey Money Wizard,

You have helped me a lot through the last few years, and I thank you. Another financial hurdle is coming up for me and my wife, we are having a baby soon. I’d love to see an article on parenting expenses, risk/reward, savings, investing. Just an idea. All the best!

Been following you for a few years. I wonder if you could find a way to go back and check your performance by investment sector. I have to presume that stocks are your best performer, but how have your REITs done/ US stocks vs International?

Money Wiz- You’re the man!!!

You mentioned that you’re still deciding how you’re going to combine finances now that you’re married but I’d love to hear more about that. These updates have all been about YOUR personal net worth but I assume Mrs. Money Wizard has some too? Should you be tracking yours together? Does she have the same goal of retiring early? I know it’s personal but I’d love to hear more about that.

I’d also love to hear about how you mentally approach looking at losses in your account. When you have $600K invested, a 3% drop can mean losing $18K in one day. You’re obviously a long term investor and you’re not the type to panic or sell but I think there may be a potential lesson there for other folks.

I love your blog! If it doesn’t feel too personal to share, I would love to know more about how you and Lady Money Wizard plan on combining (or not combining) finances in the future. I saw your note above that you’re still figuring it out and I’m in the same boat with my partner :).

I generally spent $250-$350 for a suit and was accused of wearing $3,000 suits (as an oil lobbyist). I found that if you were slim and fit suits just look expensive on you even if they were budget, off the rack ones. Our net worth dropped by $67,000 in November but it is still up $207K for the year.

What is you match from your employer? The match I get is 6% overall. With my max out and match, it’s $492 a week on average so my guess is you’re right about there. We get paid weekly though. Only difference is I defer money from my bonus to save on the 39.6% tax on my bonus to get more value there and it keeps me weekly contributing since I max out on the last week of the year, so I get a match every week for the most possible. We actually only lost $7600 this month but are up over 100k on the year.

Love the blog and keep it up.

Keep riding the waves….

My very-own Lady Money Wizard and I read your blog together and always say “I bet you we’d get along with them!”. We’re both 31 and financially focused on our future just like you two. In fact, we say our financial like-mindedness is one of the main (and many) reasons we became attracted to each other. We live in San Francisco, typically frequent National Parks as our vacations, love dogs, beer, good food, and live music.

It would be cool to grab a beer sometime. If you’re ever in the Bay Area, shoot me a note.

As a native New Orleanian and resident, I’m glad to hear that it’s one of your favorite places. It surely is a unique place. Come back soon!