Hey Money Wizards,

As you probably know, every month I track my updated Net Worth, so that I can hopefully leave my office job in the very near future.

I’m currently 32 with a goal of a million bucks within the next three years. The race is on!

Life Update: September 2022

September was an awesome month.

Lady Money Wizard and I joined a group of 12 friends for the trip of a lifetime… in Greece!

Our dirty dozen found ourselves in a beautiful villa overlooking the bluest water I’d ever seen, where we spent 10 days exploring one of Greece’s most beloved islands, (Paros, for any trip planners out there) and making memories with some of our favorite people.

It was a life of luxury, complete with private catamaran cruises, wine tours, chef-prepared dinners, and ATV adventures to the most idyllic Greek villages around.

And if that wasn’t enough, we spent the last few days living in a cliff-side house in the legendary Santorini, which somehow exceeded all that Instagram hype.

As a friend and I sat on the balcony, looking at this exact jaw dropping view, she asked me, “Do moments like this ever make you wonder if we’re living life the right way?”

“Every day,” I answered.

Because truthfully, despite this vacation’s endless pampering, without question, the best part of this trip was the company.

I won’t complain about a poolside massage before our private-chef dinner. But as we prepared to say our goodbyes, everyone agreed their favorite memories of the trip were a little more subtle.

- The inside jokes made after drinking entirely too much wine on night one (because we were so excited to see each other)

- The stray cat that tried to attack us and steal our breakfast

- A clogged toilet that we won’t get into…

It was the longest vacation I think I’ve ever taken, and I left with a newfound appreciation for what exactly we’re doing all this working and earning for.

The goal isn’t to afford a beach-side mansion, although I can now confirm that’s certainly a nice change of pace.

But a little more free time to take a break and make memories?

Or more specifically, the ability to spend two fantastic weeks with friends, with money being the last thing on anyone’s mind? Now that’s what it’s all about.

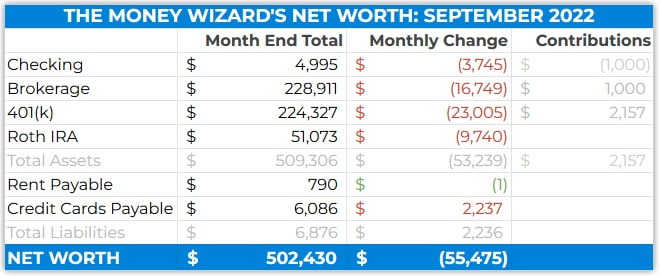

Net Worth Update: September 2022

Ahh!! Back to reality!

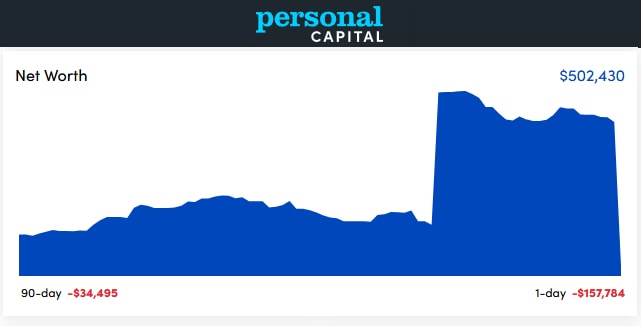

*Note that despite the chart, I didn’t actually lose $157,000 in a day, thank the heavens. Personal Capital was just glitching and accidentally quadruple-counted one of my accounts. So as nice as it was to log in and see myself $157,000 richer, unfortunately it wasn’t real life…

Put simply: September was a brutal month in the stock market.

The official numbers had the S&P500 dropping 9.something percent during the month.

The reason is much of the same: inflation continues to be higher than the geniuses at The Fed had predicted, which led to more discussion about continued interest rate hikes, which led to more market participants getting scared about the future, which led to lots of people selling stocks, which led to… The Money Wizard’s portfolio folding like a cheap suit.

And the losses keep coming. As of this writing, we’re nearly halfway through October, and the market has almost lost another 2.something percent so far.

For the past few years on this blog, I’ve joked about “The Everything Bubble.” The idea being that with the entire economy pumped up by the Fed’s unlimited money printing, that they’d basically turned everything into a bubble – A correction to one asset class could lead to a correction in all asset classes.

And so far? That seems to be where we’re headed.

Stocks are down. Real estate is down. Gold is down. Even crypto is down!

My Current Strategy

In a nutshell: hold onto my job.

IF we are headed into a legitimate recession (and most signs seem to indicate that we are) then priority number #1 is to keep the income stream steady.

Why? Because how many times have you looked back at 2008 and said, “Oh man, if I just knew what I know now.. I’d have bought up so much [insert real estate, stocks, or basically any other asset class.]”

Not so great for these net worth updates, but there’s a silver lining!

If I can keep my income stream, then I can deploy that income into assets that are further and further discounted. A big old market tumble might not be the most pleasant experience, but it’s a whole lot better when you’re in a position to take advantage of it.

If, over the past few years, you’ve ever found yourself worried that stocks were too expensive, then this one’s for you!

These sorts of corrections are when the big bucks are made. Hold onto your hats!

Account Changes

As is my theme these days, more autopilot around here.

- The checking account is still set to automatically transfer $1,000 per month into my brokerage’s Total Stock Market Index Fund.

- The 401(k) keeps getting the maximum allowable contributions each paycheck.

- And the Roth was maxed out in January.

Total Spending August 2022: $6,843

No surprise on blowing the budget this month.

It was almost entirely due to the travel costs, which covers both myself and Lady Money Wizard.

Travel: $3,579

Honestly, not terrible for two weeks of luxury for two people. We saved on this cost significantly by booking the international flights with credit card points. (That would have added another $2,000+ to the bill.)

Clothes: $981

My once every half-decade trip to update my wardrobe. Although I have a few returns which should get me $100 or so back.

Vehicle Expenses: $711

The ‘ole Mazda needed its first significant servicing (new brake pads, some other stuff that I can’t remember… can you tell I’m not a car guy?)

Otherwise, she’s running along like a champ with less than 50k miles on her.

Groceries: $37

Okay okay, I’m frugal with groceries but even this is too low for me.

Upon further inspection, Lady Money Wizard bought 3/4 of the groceries for the two weeks we were in town last month.

Final Thoughts

How are you handling this market turmoil?

PS – Want to track your net worth like this? Personal Capital’s free net worth tracker is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Do you think your net worth will increase to $1M in 3 years from $500K? What are your initial thoughts on long term horizon/how are you feeling?

Answer is worth a full post, but based on my savings rate of about $50k per year, $500k to $1 million in three years would need a 34% annual rate of return per year. So, a pretty tall ask.

My original goal of $750k would be about a 20% annual rate of return, which is high, but not completely unheard of for a recovering market.

So it really just depends on what part of the market cycle we are in.

Worst case scenario I just hold out for another couple years as things recover. It’s worth reminding myself too that my original goal was age 37.

You are right, I was just thinking the other day how valuable it was to have a decent paying job right now. It’s allowing me to plow $1500 a month into dividend producing stocks and ETF’s. It will prove to be real asset in about 2 years time. Great post!

I really resonated with what you said in the the life update section this month:

“But a little more free time to take a break and make memories?”

I’m leaning more and more towards taking a retirement/career break next year rather than waiting until FI to do some of the things I haven’t been able to because of work. However, this market pullback is definitely making me re-consider. Hard not to think about buying investments hand over fist while everything is down, and I have a stable job….

Thanks for the update, and keep up the good work!

Travel: $3,579

Does it includes 2x round trip air ? Stay ? Meals ? Everything ?

I believe it was a bargain.

We used credit card points for our round trip flights, and one of the 12 friends had some timeshare points for the lodging. (We did buy flights from the island of Santorini)

So it was a serious bargain of a trip, although we were far from frugal once there.

Love your posts! And what a great vacation!

A bit random: what is your wife’s blog name again? I remember you mentioned her having her own money blog in an old post but it’s impossible to find now. I’d love to read her perspective. Thanks!

Hmm she’s actually never had a blog. In the past, we talked about her doing a guest post on here, but it never panned out.

Hey Money Wiz!

Great update and I’m happy to see you continue to not forego the good things in life on the way to FI. As a note since a lot of people see this blog, if the big jump in your net worth in the middle of your personal capital chart was due to double counting accounts I’ve had success emailing them from the support center and getting some help cleaning up the data.

Great tip, thanks!

Keep working. It’s good financially.. good for your health and good for your mind.

Trust me, I tried the retirement life for 3 months. I was bored, slept and ate too much.

You can work and travel .. and save money by working in a retirement job that is not about the money.