Step aside, early retirees. Orville Rogers has your retirement goals dwarfed. And he’s not even trying.

You see, I’ve talked a lot on this blog about hypotheticals. A couple million here, a few decades there.

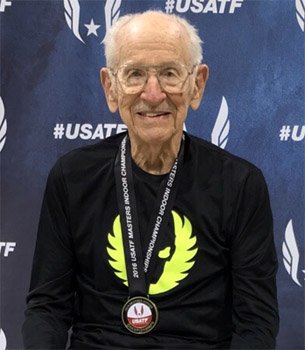

Then there’s Orville Rogers. He’s a former airplane pilot who, at age 60, was forced to retire due to the airline’s policy. Since then, he’s stayed retired for another 40 years.

He’s now 100 years old. And aside from having the most classic 100-year-old’s name ever, Orville’s portfolio is now worth over $5 million dollars.

Orville’s Secret to Investing is Good News for You and Me

When TIME Money asked for his secret to investing, Orville replied:

The key to success in any investment is periodic investments over a long time.”

For Orville, this meant self-educating himself on investing. As a pilot, he used his downtime while traveling to read The Wall Street Journal and Forbes. Eventually, he worked up the courage to open his first investment account at age 35.

From there, Orville continued his steady investments, although he admits he didn’t live a particularly frugal lifestyle. Instead, he spent without concern, and donated heavily to his church and various other causes.

Nonetheless, just before the 1980s, Orville pulled the plug on his working career. Since then, he’s spent the next 40 years happily enjoying life, and his portfolio continues to compound higher and higher into the millions.

When I read Orville’s story, I get absolutely pumped. For three reasons:

1. He didn’t actually start very early.

For one, there’s nothing unattainable about his timeline.

Orville started investing at age 35. That’s an age when I hope to have nearly a million dollars saved and at least one foot out of the working door.

And before I sound like I’m giving him a hard time, let’s give credit where credit’s due. When he started investing in 1952, the 401k wouldn’t be invented for another 25 years, and he was still a half-century away from widespread internet usage.

2. He wasn’t all that frugal. And he didn’t invest very much.

As impressive as this article’s headline is, $5 million after 65 years in the market actually hints that he probably invested less than you think.

So I had to ask… How much would you have to invest from age 35 to 100 to end up with $5 million dollars?

Well, we can start by using an S&P 500 returns calculator to track historical returns. From 1953 to 2018 (Orville’s exact time frame) the stock market earned 7.2% per year, including dividends and adjusting for inflation. Plug those results into a financial calculator, and voila!

With a 65-year time frame and 7.2% annual returns, Orville only needed to invest $3,996 per year to reach his $5 million portfolio.

(Yes, he may invested more or less in any given year, front loaded his investments during his working career, or stopped investing at retirement. But if you’re looking to replicate his success, the formula is right there.)

And this sounds about right. A few months ago, I ran some numbers and realized that I’d probably hit age 60 with a couple million, even if I never invested another dollar.

And if I kept up my current rate of investing $30,000+ per year until Orville’s age 60 retirement date? I’d probably start retirement with around $6 million dollars.

From there, my portfolio could spit out a whopping $230,000 of income each year, assuming a 4% withdrawal.

Even if I somehow managed to blow through that level of spending for 40 years straight, the portfolio could still grow to… $9-15 million dollars by age 100 in the average retirement scenario. (Adjusted for inflation!) And if the market was especially kind? History shows that in a best case scenario, my portfolio could hit $86 million at age 100!!!

The above chart shows the growth of my current portfolio projected over different time periods throughout history, if I followed Orville’s path. (If you’re interested in the tool I used to run these scenarios, check out cfiresim.com)

3. His life still sounds pretty awesome

If we’re honest, the toughest part of his story might be his age. And even that’s looking more and more promising for folks like you and me.

- The Society of Actuaries just published some research that shows that for a couple age 65 today, there’s a 50% chance one of the two will live to age 93.

- Latest estimates show 1 in 3 babies born today will live to their 100th birthday.

- And even the UK’s Office for National Statistic’s calculator estimates a 28 year old male (like yours truly) has an average life expectancy of 88 years old. With a 1 in 4 chance of reaching age 98.

“Buuut Money Wizard, who wants to live to be that old? No sense in living that long if you can’t enjoy life anymore…”

Oh really?

Did I mention ‘ole Orville is an avid runner, and he just shattered the world record time in his age group? At age 100, the dude’s still driving his bright red 2013 Camaro, and probably living it up so much in his retirement community that he puts your college days to shame.

We Live in the Best Time in History to Make Money

When I see stories like this, I get really freakin’ inspired.

If Orville could pull this off by reading a few magazine articles during a time when the internet was lifetimes away, what’s our excuse?

We now live in an era where we can type some stuff into a machine, and it immediately spits out answers from the brightest minds in history. We don’t have to slog ourselves to the library or hope to catch the day’s paper to better ourselves. Instead, we iterally carry all of mankind’s knowledge in our pocket.

Plus, that same intelligence-boosting tool can also make us richer. With the gig economy, it’s a cakewalk for anyone to earn an extra $10K a year if they want to. Can it get any better?

Well, actually, it can.

Statistically, if you’re reading this website, there’s a 50% chance you’re under the age of 35. In which case, you’ve got a serious head start on Orville and his $5 million-dollar portfolio.

So, what are you going to do with it?

Related Articles:

Great article. It definitely pumps me up knowing it’s not too late for me. As a 28 year old in the army, I also spend my free time reading Forbes, business insider and blogging my debt free journey on my militarydebtfree instagram page. I look forward to starting my portfolio next year and build a legacy for my future children just like Orville has done.

Yep, never too late!

Very inspiring post! I’ve been a long time reader of your blog and enjoy the motivating real life anecdotes of you and the people you highlight like Orville. I turned 30 this year and have aggressively been paying down student loan and credit card debt. Like Orville I work for an airline (flight attendant, not pilot though) and use my airline’s generous profit sharing program to contribute to a 401k and max out my HSA. Next year I plan on opening a Roth IRA with the money I would have been paying student loans with.

One question I have is regarding steady/periodic investments: does this mean to put more money in, say, an index fund you already have or start a completely new account?

Thanks for your time!

Usually it’s the former. Traditional “dollar-cost averaging” means contributing set amounts towards an asset on fixed schedule. So if you held $50K in VTSAX, you’d simply put another $500 (or whatever amount you could afford) into the fund each month.

Amazing!!!

Thanks!

A very positive and uplifting post MoneyWizard! Loved it!

Although I don’t fully agree that all mankind’s knowledge in our pocket. There’s plenty of information that can only be found in newspapers or in books that you need to slog down to the library for (or pay for). Some of the most important knowledge in human history has never been publicly published. These things, like industrial secrets are very real.

That said, there’s plenty of general information that’s free online. In that sense, I agree.

Get with the times, old man Tako! Your phone can play audiobooks now. 😉

I agree with Mr. Tako. I have read stuff in books that I couldn’t find in online. That includes old newspaper articles. In ancient times, like Greece, elderly storytellers were very important because they lived to see what happened. 1st hand knowledge is still very important.

That being said, I did like hearing about a 100 year old man still out there running and with $5 mil in the bank. Very inspiring.

Thanks,

Miriam

No more excuses for not saving & investing money, however old one is. Period.

Excuses are deadly. Just do it, Nike style.

Hey Mr. Money Wizard, hello from Brazil. I have been reading your blog for quite a bit now and want to congratulate you on giving these anecdotes and sharing inspirational stories like Orville’s. I’m myself working on my early retirement and trying to save up to 50% of my income so I can no longer live for work after my 40th birthday. I’m 26 now…

All the best for you and keep on the good work!

ps: Went to the twin cities last year to visit friends and have to say I loved the cities… Not to mention I love the winter time too so perfect place! Now I want to go back during the state fair so I can have a big bulk of sweet martha’s cookies!

Best of luck,

Gabriel

Kudos to you for making the trek to Minneapolis in the winter! I can’t even get my friends from Texas to come visit when it’s cold.

Thanks for the kind words. Keep working at that savings rate and you’ll be at early retirement before you know it! (But it’s okay to budget for some Sweet Martha’s cookies, too. ;))

What if I am 47 and have not made a start? Too late?

Better late than never!