Last month, an astute reader pointed out this true, albiet depressing, reality:

Are you concerned at all that your current net worth is smaller now than it was 6 months ago? (and that’s even without factoring in the really high inflation!) For a month or even a few months that would be ok, but half a year is not a trivial amount of time, and doesn’t it make it feel at least a bit demotivating – like all that saving and investing is just going nowhere?

I read the comment and thought, “Surely, it’s been a rough couple of months… but 6 months without any progress? That’s gotta be an exaggeration.”

So I dug back into my net worth archives, and sure enough… He’s right!

When Matt wrote that comment at the end of February, my net worth was sitting at $571K. Six month earlier, all the way back in August, my net worth was $585K!

Meaning that after months and months and thousand of dollars, I was $13,000 poorer!

(Even last month’s $599K hasn’t topped October’s high of $615K.)

What’s a Money Wizard to do?

I saved and saved and all I got was this lousy t-shirt.

After this sad reality, I dug further into the numbers. (Apparently, I’m a glutton for punishment.)

Each month over those past six months, I added $3,157 to my investment portfolio as a mix between my 401k contributions and my $1,000 automatic brokerage investments.

And then, in January, I even doubled down with a $6,000 investment into my Roth IRA portfolio!

Doing some quick math, that means I invested about $25,000 over the course of six months.

What did I get for all that disciplined savings?

A wealthy lifestyle? An immediate early retirement? A portfolio that left me filthy rich?

Nope. Nope. And Nope.

I saved $25,000 for six months, and all I got was $13,000 poorer!

When you put it that way, it’s awfully depressing!

What does this mean?

Time to throw in the towel? Give up investing completely or abandon the strategy?

Not exactly.

Here’s the important footnote…

6 months is a BLIP in the scheme of stock market investing.

The stock market is a volatile investment vehicle. You’ve probably seen that disclaimer if you’ve ever transferred cash into a brokerage account.

What the lawyers are trying to tell you is that you can lose money. And what I’m trying to tell you (and myself!) is that you can definitely lose money temporarily.

Especially if you zoom in too closely when you’re measuring your returns.

The right (and wrong) way to measure market returns

You might remember my article about what’s REALLY the average stock market return.

In that article, I took a look at the historical returns of the stock market, using time periods ranging anywhere from 10 to 30 years.

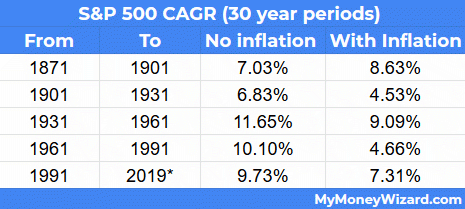

Using a 30 year time period, the trend was pretty obvious. The market basically always went up, at a nice, comfortable pace of around 5-10 percent for each period:

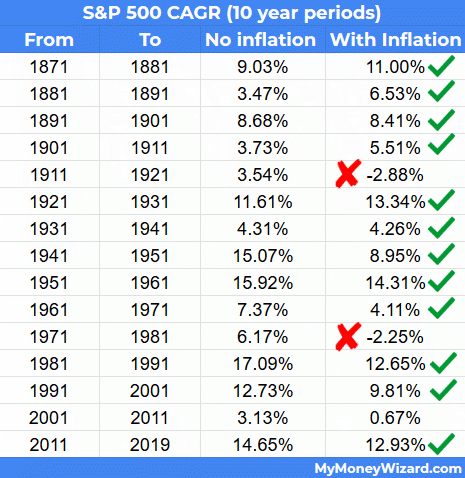

But when I shortened the time period to 10 years, the trend became fuzzier. We started to see more volatility, including our first periods with losses!

I didn’t dare shorten the time period any further, because I knew that below 10 years, the volatility gets wild enough that you start to lose the general trend as the sample size becomes nearly too small to be relevant.

Naturally, this means that measuring returns on a monthly basis, or even 6-month, is sure to drive us mad! Even while the general trend continues to be positive. (Despite some money bloggers insistence on publishing monthly net worth updates. Who would do that!?)

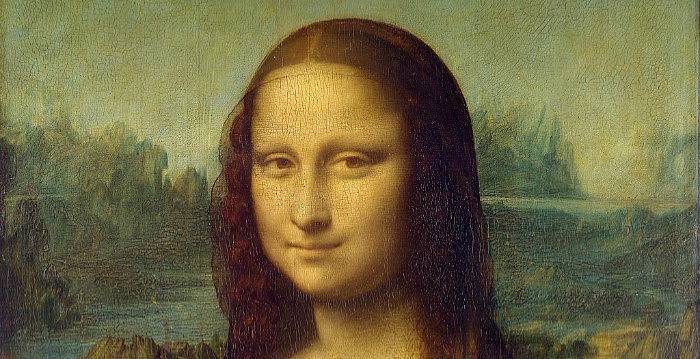

I equate this to looking at a picture or painting.

In order to appreciate the beauty, you have to take a step back.

If you get a little too close, you start to see the cracks and imperfections. That doesn’t mean it’s any less of a beautiful painting, it just means you’re standing a little too close.

And if you get way too close, you’ll start to have no idea what you’re even looking at.

You see that pixelated, blurry mess? That’s kind of like evaluating your stock portfolio on a monthly basis.

But there’s a silver lining!

All that said, it’s worth mentioning that even if your portfolio looks smaller after a set time period, it’s not like you went nowhere.

You still made progress. You’re just standing too close to see it.

Consider my six month net worth debacle. Even though my update said I’d lost $13,000, did I really?

Each month, for those past 6 months, I kept investing. I was buying more and more shares of stock, and doing so at cheaper and cheaper prices!

I was building my base.

If, or I should say… when, the market recovers, I’ve now got even more assets to set me up for life.

It’s like building a fire. You go out and collect kindling. Twigs, branches, leaves. Whatever it takes.

You do this for days on end, and it feels like you’ve gone nowhere.

In fact, if you start to think about it, you might start realizing how much time you’ve lost. You were picking up twigs, when you could have been doing something else. (You might have even heard from your friends about a better strategy for building a fire!)

You might start questioning if all this was worth it…

Except one day, you light the match. The twigs catch. And in a matter of minutes, you don’t just have a little smoke or a little fire. You’ve got a blazing inferno.

And the reason? You spent time building that base.

When everything else seemed hopeless and pointless, you just closed your eyes and kept building.

It’s kinda like that…

Related Articles:

Love the picture and fire building references Money Wiz. You’re a good man.

Thanks, Nate!

**slow clap**

Haha, thanks J$

Well you’re not the only one. Two years ago I moved the bulk of my 401k into a safe account to avoid taking some bigger losses and even that one has taken a small hit over the last 6 months. Not as much as my Vanguard though. I’m just hoping that before we truly need them the course will be righted and don’t focus on it too much at this point. Great article!

+1 for the ‘blazing inferno’ analogy – like it!

As we’re inherently unable to see the future we can only look to the past for potential cles of what we face. As you’ve stated, for equities in general the longer term trend has always been up and to the right.

Tbh one has to scratch around quite hard for a market that doesn’t fit that pattern and even then it’s only the Japanese market, from peak to trough, that looks like it might require more than a single human lifespan.

We don’t talk about Japan 🙈 no, no, no!

I actually have lots of thoughts about Japan. Maybe a future post?

This was spot on. Thank you.

I’m down nearly a quarter of a million during that same six month period. It happens, no worries. It might go down a good bit more before it starts going up again. But up it will go.

Ouch, but good perspective!

Roots grow downward and establish the base of the tree..preparing the tree to grow taller in the future. Yeah, some leaves and branches fall off once in while, but there’s no point in counting those fallen leaves or twigs and plucking them often…as long as flowers/fruits/vegetables continue to grow on the tree.

As I read your post all I could think over and over was ‘you are buying more stock but at cheaper prices, that will pay bigger down the road’.

I’m fine with a downturn, just means most things get cheaper which will earn more when the upturn comes back.

Beautifully said! Have faith in the stock market!

Stay for the long course.

I wonder when inflation starts to reflect in equity prices

I think you need to change the title to say you are now “poorer than 1 year ago”, not just 6 months, haha.

Where is the April Net Worth update? Afraid to look at your investments after the market plunged further?

Haha, this comment was the final straw that motivated me out of my procrastination. It’s here!

https://mymoneywizard.com/net-worth-update-april-2022/