Disclosure #2: (Blame the laywers…) Nothing on this website should be considered financial advice. I’m just a guy spouting his opinions. Make sure to do your own due diligence prior to making any investment decisions.

Earthquakes rarely “just happen.”

Sure, the exact moment often surprises the scientific community. But the early signs are there, nonetheless.

Tectonic plates start moving in certain patterns. Animals begin displaying unusual behavior. And seismic measurements begin picking up almost imperceptible rumblings.

While these signs might not be able to predict an earthquake down to the exact date and time, these factors do give a pretty good indication of the probability of a quake hitting a certain area.

And when it comes to the earthquakes in the financial world, we might have just had our “birds fleeing the trees moment.”

At the risk of being one of those chicken-littles, this post will take a look into:

- Why so many people (me included) are more than a little concerned about the latest economic developments. (One in particular…)

- What I plan to do about it.

- What you should do about.

Since you might not have the desire to read 2,200 words about the economy (who can blame you?) feel free jump around using this table of contents:

What’s a Yield Curve Inversion? And Why Should We Care?

We’re gonna simplify things for a second, but just roll with it.

In a normal economic environment, investors look for higher returns the longer an investment’s “lock up” period.

That’s a neat financial concept that professors like to boast about, but nobody needs so much as a textbook to understand.

- If my friend Brad tells me he needs to borrow $10 and he’ll pay me back in a week, I’d think about it. (Depending on how much I like Brad…)

- If Brad asks for that same $10, but instead says he’ll pay me back in a decade, I start to seriously wonder what the chances are that our paths ever cross a decade from now, let alone whether Brad even remembers to pay up.

Now say I have two options for an investment. Consider these investments something like a fixed bond, or a Certificate of Deposit at a bank (where you’d pay a premium for withdrawing your money early).

Which would you rather put your money into?

- Option A) An investment that lasts two years and pays 3% per year.

- Option B) An investment that lasts 10 years and pays 2% per year.

In a normal economic world, you’d choose option A every day of the week, and twice on Sunday.

Why? It’s just like your deadbeat friend Brad asking for a 10 year loan – If your money is locked up for 8 years longer, you want higher annual returns to compensate you for all the crazy stuff that could happen over a 10 year time-frame.

With Option B, your money is not only locked up for longer, but you’re earning 1% less per year, too.

So, what type of economic world would we be living in if investors across the board considered options A & B to be equal?

That would mean investors were really, REALLY concerned about the upcoming two years. So much so that they’d be willing to lose money (relatively) to avoid dealing with the short term entirely.

That’s a simplified example of what’s called a “yield curve inversion.”

And it just happened…

Why you should care about the recent yield curve inversion

Economists measure a true yield curve inversion by comparing the returns on government bonds.

This serves as a pretty good indicator of overall investor sentiment, since the exact yield on bonds comes from a complex bidding process of all interested bond investors.

Investors first started showing their anxiety about the short term back in May, when the 3 month government bonds were paying more than 10 year government bonds for the first time since 2007.

Why is this concerning? Well, you might recognize the year 2007 as “that year right before S#!T hit the fan” in 2008.

But one data point isn’t all that reliable, which is why I take more stock in the research pointed out in this great post by my new blogging buddy from FatTailedAndHappy.com.

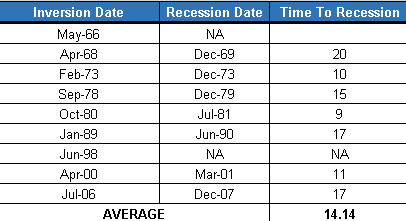

He found that an inversion between the 10 year/3 month yield curve has led to a recession 7 out of the last 9 times it’s ever happened. (With an average time from yield curve inversion to full-blown recession of 14.1 months)

This is pretty crazy. The inverted yield curve is the sort of Upside Down world that would make Stranger Things proud.

Then, just this week, the Upside Down world deepened. The yield curve between the 2 year government bonds and 10 year government bonds inverted too.

While the 3 month vs. 10 year metric is the preferred recession-metric among economists, the 2 year vs. 10 year metric is the metric preferred among bond traders.

And when those guys start panicking, that panic tends to spread to them and their friends. (Aka the guys actually moving money around and whose millions of combined actions drive the markets themselves.)

Why a recession would not be a surprise

This shouldn’t come as a shock to anyone.

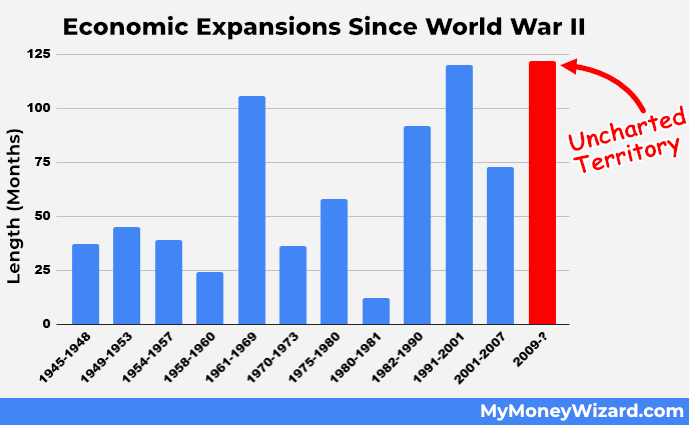

Right now, we’re in the middle of the longest economic expansion in history. (Or should I say, near the end? At least if the metrics are right…)

Seriously, that’s not an exaggerated statement. The economic expansion since 2009 is literally the longest on record, or at least dating back to World War II. (123+ months long – roughly a quarter of a year longer than the decade long expansion prior to the bursting of the dot com bubble in 2001.)

While it might be nice to imagine the good times lasting forever, that’s just not the way the business cycle usually works.

Things expand and things contract, and right now we’re sitting on a decade of unrestrained growth.

So this is a guarantee? Time to live in a cave for the next 14.1 months?

Well, no.

Using an analogy from the world of cheap plastic toys, this yield curve inversion is sort of like the Magic 8 Ball.

Dear Magic 8 Ball: Do we expect a significant stock market correction before 2021?

Magic 8 Ball: All signs point to yes.

Okay, that’s a silly analogy, but it’s actually not a bad way to think about this situation.

Because we know any “leading economic indicator” or back-tested metric should be taken with a healthy shot of skepticism and maybe a grain of salt on the side.

With the stock market, you can cherry pick any set of data to prove just about anything. (Hence the reason for all those “Amazing stock picking system JUST DISCOVERED! Buy now!” nonsense programs you see advertised.)

And yet, just like the Magic 8 Ball, even if we think the whole thing might be nothing more than hocus-pocus, we still can’t help but stop and think for a second. Or knock on the nearest piece of wood, even if we feel a little silly while doing it.

My take on it all

Personally, yield curve inversions are actually the one market predicting metric that I personally believe in the most. As do a lot of esteemed economists.

I also think these things tend to become self-fulfilling prophecies.

Because as I type this, there’s lots of other investors like myself, who see the yield curve inversion and start wondering if it’s finally time to build up a little larger cash base than they otherwise would.

I’m guessing there’s also businesses executives who see the same yield curve inversion and wonder whether it’s time to rewrite the annual business plan with a lean towards safety.

As those dominoes tip over across an economy of 350 million people, an economic downturn creates itself.

All that said, I’m just one guy. And economists make an entire career of being wrong all the time.

So, can I offer you a grain of salt with that prediction?

How I plan to prepare for a potential market correction

In light of the news about the inverted yield curve, I thought it’d be a good time to dust off Personal Capital and take a good hard look at where my portfolio is, and where I want to be.

I had to ask myself some hard questions, like:

- How would I feel if my portfolio dropped 40% overnight? Reworded to make that number a little more real – how would I feel if the $315,000 net worth I’ve posted about building for the last several years plunged to $190,000 from one monthly net worth update to the next?

- Do I have a backup plan if my manager marched into my office with a cardboard box in tow, and told me the company had to make some difficult decisions because of The Tough Economy?

- How confident would I be investing when the whole world is panicked?

My current allocation

As I write this, my net worth has already fallen around $10,000 this month (~3%) and my allocation across my investment accounts is roughly:

Then again, I also currently hold another ~$10,000 of cash in my checking account. So, my total allocation is actually:

- US Stocks: 67%

- International Stocks: 6%

- Real Estate (REITs): 15%

- Cash: 8%

- US Bonds: 3%

- International Bonds: 0.3%

And of course, there’s always the wildcard of a modest 5 figures of MyMoneyWizard.com profits, sitting in a separate business account. I never include this in my net worth updates, because I intend to reinvest that money back into growing this site. But if things got wild enough, and/or a recession presented too many juicy investment opportunities, I could always divert some of those earnings towards stocks or real estate investment.

How I feel about my current allocation

Well, my total stock allocation is about 73.5%. (Plus 15% of REITs which are more correlated with the stock market than the “real estate” part of their heading may suggest.)

Realistically, if another 2008 hit and stocks took a 40% beating, my net worth would probably stay over $200,000.

(Personally, I think the chances of a stock market correction being as quick and drastic as 2008 is unlikely. 2008 was unlike anything the market had seen in nearly 100 years. The chances that happens again just 10 years later seems slim. I’d argue people who do expect that are suffering from the Recency Bias phenomenon.)

In any case, a nearly $100K drop in net worth would sting, big time. But, it’s not as quite bad as I expected. Overall I feel relatively comfortable with this, especially given the possibility that I’m wrong with my prediction and those stocks keep going up.

Plus, I’ve accidentally built up a $25,000 cash position back from the days when I was seriously searching for a rental property. Although it doesn’t look like that real estate dream will pan out due to a lack of attractive deals in my area, it’s nice to have lucked myself into a somewhat more conservative asset allocation.

My surprise finding from this exercise?

The amount of comfort this cash position brings me, given my risk tolerance and the current economic environment.

In light of this, I’ve decided I will probably continue to pause my after-tax stock market contributions and continue to build up a cash position until either the yield curve or the stock market corrects itself.

My revised mid-to-long term allocation

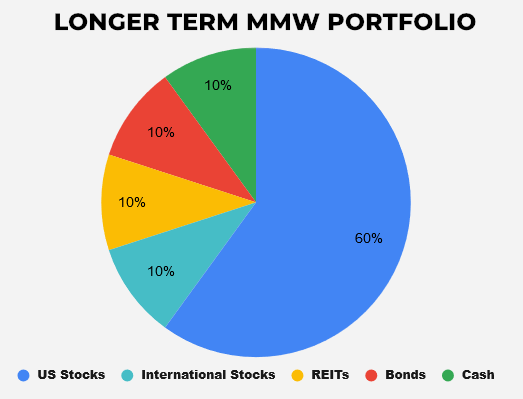

Longer term, I think an allocation of…

…makes a lot of sense given my current position.

A few random notes on this strategy:

- I’m not stopping investing in the stock market completely, because my ~$1,000 per month of 401k contributions are still being dollar-cost averaged into the US/International stock market. (At an 80/20 contribution ratio)

- I like the “diversification of contributions” between my automatic 401k contributions mixed with a conservative after-tax strategy.

- It’s interesting that when you live frugally and save $30-40,000 a year, you can actually change your risk exposure just by adjusting your contributions. Most people cannot do this because their savings are too small, and instead their only option is to buy and sell investments (and usually incur taxes).

How You Should Plan for a Potential Market Correction

The above is just my approach. My answer would be completely different if I was in a different stage of the journey.

- If I was younger and just starting out, I’d probably blindly invest everything in the market – simply because I wouldn’t have that much to lose. I’d prioritize building up my net worth quickly over the potential risks of a more aggressive allocation.

- If I was older or had more to protect, I’d probably be way more conservative. I would probably actively buy and sell positions to get to a set allocation.

In either case, it’s worth noting that from a wealth building perspective, stock market corrections and recessions aren’t to be feared.

Played right, they can actually be one of the best wealth building opportunities you may ever come across.

Personally, a huge reason I was able to hit the headline-grabbing accomplishment of $100,000 of net worth by age 25 stems back to the discounted stocks I invested in through the trenches of the 2008 recession.

That said, dark-cloud predictions like an inverted yield curve are the perfect time to re-evaluate your risk tolerance.

And I mean, REALLY evaluate.

It’s easy to tell yourself that you’re going to stick out a recession.

It’s a whole different ballgame to actually stick out a recession when the portfolio you’ve worked so hard to build for years is slashed by 40% in value overnight. And the job you’ve spent so much time complaining about suddenly looks like a lifesaver in the wake of 20% of your coworkers getting laid off, yourself possibly included.

You want to pack that umbrella BEFORE it starts raining. Because if you play it right, the blue skies will only be that much sweeter.

Related Articles:

back tested metric.

great term without sounding pretentious.

couple typos, your content is great and i am no grammer cop but tuning that up would be a good ROI.

being able to plow seed during dark economic cycles equates to working several more years than you actually did.

off topic:

my take on money at 53 and why it is such a trigger for folks is this: most people work to generate a paycheck even if they like/love their work. when a significant amount of their net worth vaporizes its is as if years of their time did so. who would not have rather had 3-4 months a year off to do as they wish instead of working all those beautiful days away. same as when we pay for things we fundamentally disagree with in society. if we feel it an unfair allocation its as if we have given that area of society or that project weeks of our lives we could have done something else with. its as if they have stolen our time, of which we have so little of here.

i work in oncology and a while a ago i heard this: ‘for the cancer patient, their currency is time’. funny how after 25 years in something you can still have a moment that creates a new clarity for yourself.

Great point. In theory paper losses sound like they’d just be paper. In reality, you think back to how long it took you to build that position, and it feels like stolen time.

Greg, your grammar is the one that could use a tune-up.

I’ve been having similar thoughts given the economic headwinds. Right now I’m comfortable with my allocation (roughly 85% stocks and 15% cash/bonds) but if the market keeps heading higher by year end I may move a bit more over to bonds (in the 401k to avoid taxes!). Need to be ready to pounce on discounted stocks or real estate if the chance comes! Also as you said, it can’t hurt to have that prepped just in case the worst happens and your job is scrapped.

Nice, and good point about tax efficient allocation!

Love this! Thanks for sharing your thoughts on this highly relevant topic. I’m 26 and pretty early on in my career so I’ve been trying not to pay *too much attention to the swings and predictions.

FYI the hyperlink to FatTailedAndHappy.com doesn’t work!

Thanks for the heads up! Hyperlink should be fixed now.

I’m in a similar age and money position as you are, 28 with almost a $250,000 net worth, do you think it’s too drastic to start shifting that money which is heavily invested in vtsax to a money market account? Then when the recession hits reinvest? Or just leave it and let dollar cost averaging do it’s thing?

For my taste, that’s too much like trying to time the market. Historically it doesn’t work out for most people who try it, because there’s no way to know when the recession will hit and when the right time to reinvest is, either.

I was just wondering why wouldn’t you sell now till the market hasn’t crashed yet and then buy after the correction ?

Thanks

Time in the market, not timing the market. There’s no way to predict when the crash will essentially happen. Studies show that portfolios fare better by continuing to invest than if you invested all your money at the height of every business cycle.

Yep, what Jennifer said. Technically, most studies would show I’m probably doing the “wrong” thing by even adjusting my contributions. But for me, it’s a risk tolerance thing, compounded by my plans to “retire” in 6 years or so.

Since I’ve already got more than I’ll need my allocation is conservative with only about 45% in stocks. I’d love to see a major market crash. I could buy a lot of cheap equities if it fell far enough, or maybe just sit where I am. I’m good either way.

Nice. If I was already set, I’d definitely have a much more conservative long term allocation.

I am 51, married and wife works and has her own work related investments. I am on LTD, which means my 60% disability checks are not being invested since April. I have approximately 600k in 401k with an 80/20 stock split. We don’t have much left to pay off on our mortgage and car loans and are comfortable with our outside of 401k investments. My Q: with no contributions going into my 401k until I find another job, should I maybe move my 80/20 split to something more conservative, as I will be losing possibly 40% and won’t be buying at discount when the market re-corrects (due to no contributions)? If that makes sense? I would welcome anyone’s feedback and TY for your continued insight into financial freedom.

Great post. I too think we’re headed into a recession, although I believe it will be relatively mild. We’ve had a decade-long expansion and are overdue for a downturn. While our economy is in pretty good shape right now, the rest of the world has been weakening for some time and it’s only a matter of time before the US gets caught up in that. I think the yield curve is a reliable predictor and all the people on Wall Street trying to dismiss it and explain it away this week are just putting their heads in the sand and saying/writing what they want to hear in order to feel good.

I may be wrong, but I think the chances of a recession in the next 1-2 years are greater than not having one. It’s good to prepare now and really think about what you want to do, if anything.

Agreed, my thoughts exactly.

With the student loan drag and other such factors, I could definitely see this recession being more of a mild, slow contraction rather than an overnight panic/overreaction like 2008. It seems like a 40% slash like 2008 is unlikely, if for no other reason than that’s only happened once in most people’s lifetimes.

I would’ve agreed that a correction like 2008 isn’t likely to happen soon until I saw the 20% drop in December 2018 essentially over nothing (hawkish fed). If the market will drop 20% over nothing, then what’s going to happen when the economy actually turns? I tend to agree with people that technically, our economy is doing well (although it’s fueled by a deficit) and that the inversion is due in part to negative rates in other countries driving investors to US treasuries. That said, I don’t think we we’ll be able to insulate ourselves from the world economy. Either way, this recession is going to be interesting. I don’t think inflation will fall much if at all, and rather we could see some stagflation. I don’t think unemployment will skyrocket as much as in 2008 and instead I think there will be very high under-employment where people are doing side jobs or working multiple part time jobs in the gig economy. Also, given that income inequality has increased since the last recession, the lower income half of the US is less prepared for a recession this time around so I think that even if we don’t have another “great” recession, the political fallout will be worse than 2008 and we could see more extreme political ideas becoming more mainstream.

True, and to play devils advocate to my comment to Brain just above… I’ve seen some interesting research that predicts a sort of amplifying effect of any stock market activity due to the prevalence of index fund investing today.

So, like most things economics/finance, who knows! Just gotta judge your risk tolerance and plan accordingly.

Here’s a nice video about the yield curve inversion:

https://youtu.be/h_eVEv4N6WA

Looks like a nice intro, thanks for sharing. His comments at the end are why I’m not completely stopping all investments into the market. And also why I’m not selling any investments to try to actively time the market.

But I disagree with his advice. To say we’re “no more likely for a recession today than yesterday” ignores the fact that many, many investors make decisions based off yield curve inversions, whether that inversion is a legit predictor or not.

There’s certainly a real case to be made to continue investing/dollar cost averaging through any yield curve inversions. But I think it’s dangerous to completely brush off the inversion, because at the least people should take the opportunity to really think about their risk tolerance.

Great post and very interesting approach. My take on investing is you can do whatever the heck you want and also whatever you have the stomach for. The volatility is defo making me uneasy (peasy?). You ever watch the dudemer Graham Stephan on YouTube? He has a video called “How to Beat The Stock Market in 2019” that’s all about time in the market being better than timing the market. It compares perfect timing to immediate investment and shows that they’re actually a lot closer than you’d think over five years or more. The data is from Chuck Schawb, so of course they want your money right away, but approach seems sound. He’s a real brohammer that Graham. Worth the watch.

Anyway, hope your Tuesday is majestic and memorable.

Yep, I’m familiar with Mr. Graham. I like his style. He occasionally references my posts and sends some traffic my way.

Noice! Any plans for the YouTubes in the future? Be a guest on the Graham Stephan show?!?

I have been reading about the inversion for months in a newsletter i pay for. The newsletter thinks the fears are overblown of an impending stock market crash. They give several reasons, but the one that struck me as most understood (by me) is that we are nowhere near a “euphoria” stage, where everyone is buying stocks. My criteria – when the locker room at my gym is full of people giving each other stock tips it is time to rethink any aggressive positions in equities. So far that has been infallible. Call it the “stink” index.

Hmm, well I guess this didn’t age too well. Hopefully you’re weathering the storm. Might be some good buying opportunities soon and at least all markets recover eventually so not end of the world.

Pablo, who are you responding to?

Not to brag, but I’d say my recession by 2021 prediction is looking pretty dead-on right now. 😎

Whoops, not sure why but somehow thought some of your comments in your article.

I guess I should have read more carefully… One of your comments above mentioned it would be a slow contraction but that didn’t take into account of unexpected variables such as the coronavirus.

Anyway, to be fair, you are pretty close on the timeline since its 2020 but not 2021 but you were probably speaking in general. Recession in mid-2020 I think with everything shutting down. Still a good read.

Curious how you are doing with the current market turmoil? I predicted a correction in February earlier (but I didn’t take into account the virus either) but looks like I was only half right since it ended up being way worse than I thought.