At this point, regular readers have probably noticed that the Money Wizard blog has been eerily quiet these past few weeks.

In part, that’s because I’ve been busy getting my life together as we start the new year, both in my career and on a personal level. (Those resolutions are no joke!)

But more so, it’s hard to publish a regularly scheduled post when a bunch of random message board users are blowing up the stock market, right in front of your eyes.

For anyone who’s paid attention to the financial headlines lately, I’m talking about that better than reality-TV soap opera currently playing out on Wall Street.

I’ll call it the “wallstreetbets vs. Wall Street Battle Royale” taking place in Gamestop Stadium.

How A Random Internet Forum Broke Wall Street

Well, the cliff note version is this:

- The reddit forum r/wallstreetbets decided to “raid” Gamestop stock.

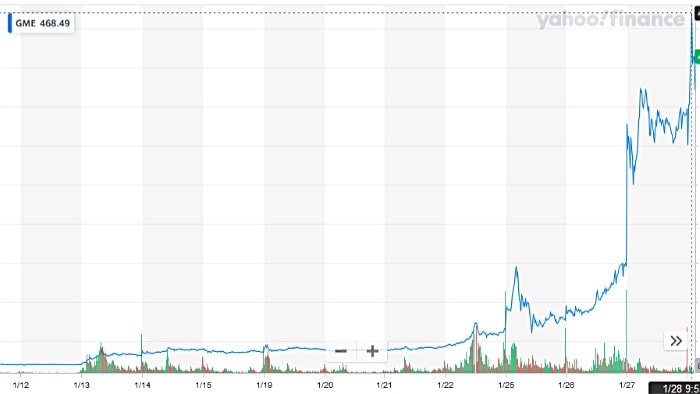

- In a matter of days, their organized buying pushed the price up from around $12 per share to over $400 per share. (In the stock market world, price changes of 1-2% are pretty headline grabbing. Gamestop, fueled by WallStreetBets, rose by about 3,600% in a week!!!)

- This was all very, very bad news Melvin Capital, a $13 billion dollar hedge fund that happened to be short 140% of all the available Gamestop stock in the world. (How can a company be selling more shares than even exist in the world? We’ll get to that…)

- As Gamestop stock price rose, the hedge fund almost goes bankrupt. (They would have, if not for an emergency injection of cash from a notable venture capital firm.)

- And finally, the world blinks and wonders wtf just happend? And wtf does it mean that a message board just nearly broke the stock market?

Let’s take a look!

What actually happened

Our saga starts where all epic odysseys begin… on the Reddit message boards.

r/WallStreetBets, to be specific.

Until this point, I knew r/wallstreetbets as that place where hopeless day traders bragged about their casino-like winnings while foolishly gambling in the stock market. And much more often, their life shattering losses, like this dude who brags about losing $217,000 in a year. (A common occurrence on these message boards, surprisingly.)

But earlier this month, something interesting happened. A wallstreetbets user posted a surprisingly solid technical analysis of a potential stock trade.

His thesis? Melvin Capital, a $13 billion hedge fund, was recklessly “short” Gamestop stock. In other words, Melvin Capital was betting the farm that Gamestop stock prices would go down in the near future.

In fact, Melvin was so aggressively short that they had actually borrowed money to get even more short than humanly possible. Melvin’s total short position was 140% of all outstanding Gamestop stock.

Yes, you read that right. Of the roughly 70 million Gamestop shares available for trading in the stock market, Melvin Capital was so confident that the stock price would go down that, in a basic sense, they were responsible for selling 98 million of them to whoever would buy them, at any price.

Because of their “short” position, if Gamestop stock price declined, Melvin Capital would make a fortune. If Gamestop stock goes up…?

Well, let’s find out…

The Reddit Raid

Enter a mass pilling on of Gamestop stock purchases from the ~4.5 million wallstreetbets users.

Since the stock market is, as the name implies, a market, any demand for any stock pushes its price up. When a company like Melvin Capital is “short” every single available share and then some, they’re basically saying they will sell Gamestop stock at any price, no matter what.

Since Melvin has created a situation where there’s almost no shares available to trade, any demand only increases the price of stock that much faster.

(Imagine how fast a TV would increase in price if there were only a handful of TVs for sale and 4.5 million people wanting to buy them!)

The rest is history. With an amount of money that usually wouldn’t make the stock market blink, wallstreetbets and their users, mostly armed with hoodies and robinhood apps on their iPhones, sent the price of Gamestop spiraling to outer space.

People first started noticing when the price rose 100% in a day, from $20 to $40. A few days later, the price was over $100. Then $200, and eventually, $483… less than 48 hours later.

Facing bankruptcy, the insanity ended with Melvin Capital getting a $3 billion psuedo-bailout from their venture capital friends and then promptly closing out their short position in Gamestop.

And here’s where things get even crazier.

Along the way, certain investing platforms (cough… Robinhood… cough…) actually froze all trades in and out of Gamestop stock. And even crazier, there’s some reports of Robinhood actually selling people’s Gamestop stock for them, without their permission.

Just minutes later, the price of Gamestop plummeted from over $500 to around $100, both through forced selling and as any remaining wallstreetbet traders realized the game was up and it was time to sell.

Time will tell how that move holds up in court…

Occupy Wall Street goes digital?

To be honest, I’ve gotta hand it to those crazy redditors.

Look, I’m not at all a fan of treating the stock market as a casino.

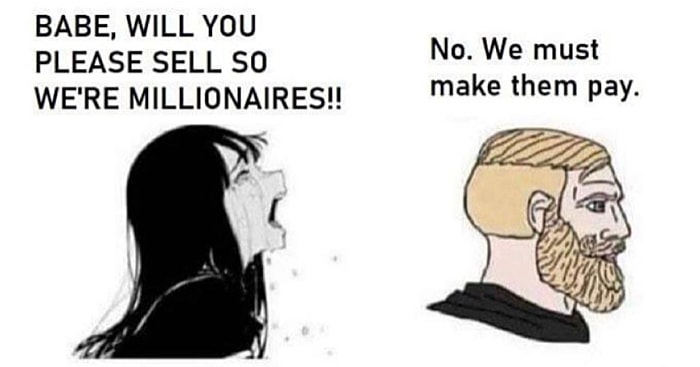

But underlying the whole sentiment of the wallstreetbets “short squeeze” on Melvin Capital is a Occupy Wall Street-style revolution against the system. Many redditors joined the trade not even because they hoped to get rich, but solely to punish Melvin Capital for making such an irresponsible short trade.

And the amazing part? It worked.

Melvin Capital nearly went bankrupt, and the world is now reconsidering what on earth to do with the stock market, overly leveraged investment firms, and over enthusiastic wallstreetbets users.

If the goal is to spark change, that’s sure a whole lot more effective than pitching a tent in New York City.

But isn’t that insider trading?

Not really. As brilliant investor Chamath Palihapitiya explains on this brutal CNBC interview, Wall Street managers do the same thing all the time. They just call them “idea dinners” and they’re hosted at private residences, but the result is the same – a group of powerful investors agrees on which stocks to throw their money into, in hopes of pushing the price up and making money.

(CNBC still hasn’t published the full interview, unfortunately. Chamath just went off, and it was gold…)

They do this behind closed doors. How is r/wallstreetbets doing the same thing in an open forum any worse?

Will this lead to regulatory change?

Maybe. Possibly. Who knows?

Regulators will argue that stock market regulations exist not only to stem off fraud and cheating, but also to protect greedy traders from themselves. And they’ve got a point… can you imagine getting into Gamestop at $500 per share and seeing the price cascade to less than $100 per share in a matter of minutes?

On the other side, wallstreetbetters are already searching through Robinhood’s terms of service (and other stock market exchanges that halted or actually sold users’ Gamestop shares) for any class action lawsuit waivers, in preparation for legal war.

And you thought 2021 was supposed to be the year when everything returned to normal…

Cough it up! Did The Money Wizard make a big Wall Street Bet on Gamestop?

Haha, no… definitely not.

Call me old school, but I remember the days of the 2008 crash and how brutal it is when quick trades and euphoria, completely removed from any underlying business fundamentals, comes crashing to a halt.

And I’ve read enough books about the 2001 dot-com crash, when investors lost 70-80% of their wealth after piling into a stock because, “Well, my neighbor just made a fortune in this one, and I don’t want to miss out!”

Those games rarely end well for those involved.

But they sure are fun to watch from the sidelines!

Related Articles:

Excellent writeup. I stayed out, but I know a lot of friends who were up huge yesterday and then got locked out (or sold out). Worth noting that they also ran up Kodak, Nokia, BB, and even paper Silver with SLV. The SLV run did help me in all fairness but I was in those well before the push ;). Today is the day for the GME shorts to come due, so I would expect a huge fall after today.

I think it is fantastic – Those Wall Street Bastardos have been ripping of Retail for years and making millions and billions

Nobody feels sorry for the hedge fund, except the investors involved with Melvin. While the rebels of Reddit stuck it to the empire, it exposed Robinhood as aligning with the empire by shutting down trading of GameStop and other stocks. The Robinhood platform just raised the flag it may censor free trading in similar fashion to Twitter and Facebook censoring posts it doesn’t like or go against their agenda.

Yes, pretty hilarious that Robinhood claims their mission statement as “democratizing finance for the average investor” but when push comes to shove… they screw over the little guy in favor of the hedge funds.

What’s Buffett’s quote about it taking 20 years to build reputation and just minutes to ruin it? Robinhood could be a case study for that!

People used to always ask for my thoughts on Robinhood and my default answer was “No” even though I couldn’t quite put my finger on why. Now we know…

And 2021 was supposed to be the year where the madness stopped…Boy were we wrong. You’re right, it really was fun to watch from the sidelines and see some underdogs take Wall Street to the cleaners!

“People are comparing it to the “French Revolution of finance.” But if Robinhood is acting at the hedge funds’ behest, it’d be as if, at the last minute, the king made a deal with Robespierre. And then together they slaughtered the French peasants.” The Atlantic

There is a lot of Nihilism out there in America right now. This is just the latest example.

Good post!

Haha – yes, definitely avoid the hype – generally by the time you hear of the hype, it’s a risky time to buy in. I learned my lesson in December 2017, when I pulled $2,500 from my index funds (my early investing days – this was literally ~40% of my money at that point) to drop into bitcoin, which was hitting its all-time-high at the time and there was lots of excitement. Bitcoin’s price then proceeded to drop – my investment dropped down to $1,400 in a matter of days. Ouch. I then bounced this money around to various cryptos (paying fees each time), which all ended up losing value – my lowest recorded crypto balance was $309 in Jan 2019, just over two years after my initial investment. Double ouch.

My current crypto balance is ~$1,200 (I locked in some of the bitcoin earnings rather than continuing to ride it up – for fear of another huge drop) – a far cry from my original $2,500 investment, and an even further cry from the value it would have been if I left it untouched in my index funds – I estimate the value would now be ~$3,830… Triple ouch.

“Be fearful when others are greedy!!!”

Lesson learned, and thankfully while I was (am) young and before I had a bigger portfolio. There were undoubtedly people who invested a huge portion of their life savings into bitcoin in Dec 2017 or in Gamestop on Weds who are feeling a much worse feeling than “ouch”…

So true. Better to learn those lessons early!

Wiz….I hope everything is ok with you, LMW, and the Money Pup (and the $$ cat). From a distance, it looks like Minneapolis is going through a difficult time. Maybe its time to consider a tax-free state (back to Texas); its worked so far for Tom Brady!

I like to play devil’s advocate and think this was never about getting revenge on the hedge funds. Think of the Capitol Hill riots… All it takes is one person with big intentions to stir up the public and cause chaos, while the one person sits back and reap the rewards (meanwhile many in the process are hurt and killed in the process)