When I first started investing money, one of the most exciting ideas was the concept that every dollar I saved could be worth so much more money in the future.

But exactly how much more?

I thought it’d be fun to find out.

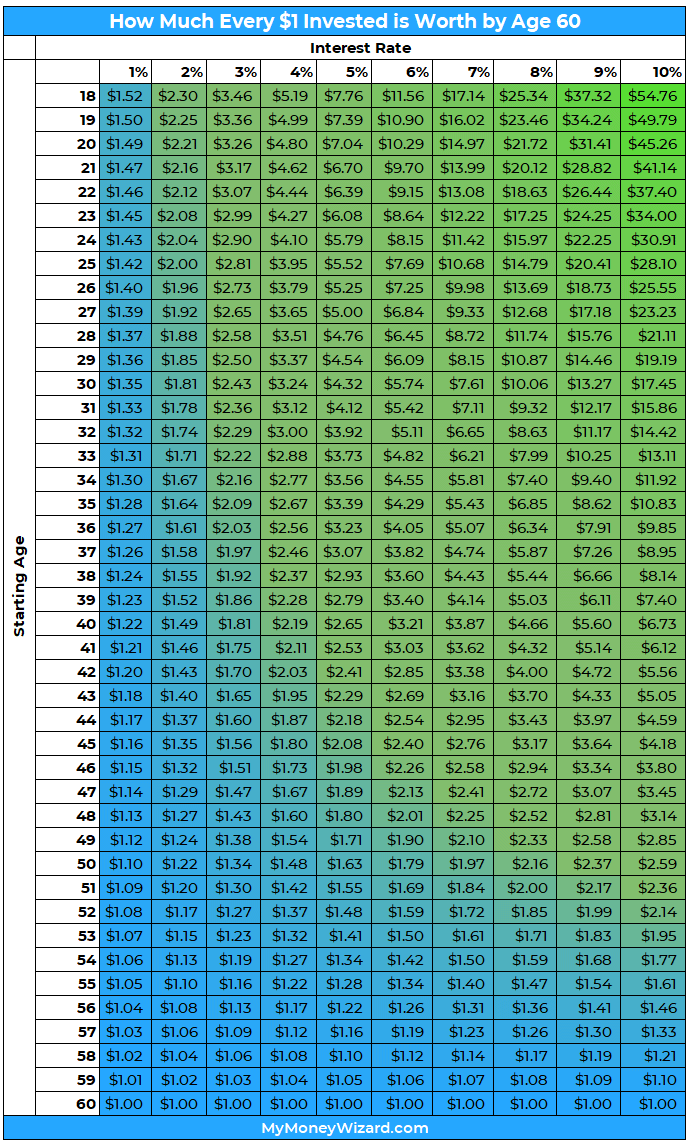

For some #ThursdayMotivation (is that a thing?) I ran some calculations to show how much every $1 you invest could be worth in the future. That “future” is yourself by age 60, since it’s a nice round number and also the standard age of retirement in the United States.

The result shines all sorts of insights on how important it is to start saving money early, and just how rich we could all be if we decided to do so.

So BEHOLD, the massive, fascinating chart:

How to Read This Chart

The chart is pretty straightforward. As the title promises, it shows how much every $1 you save (and invest!) will be worth by age 60.

So suppose you’re an 18 year old and you save $1 in your bank account, earning just 1% for the next 32 years. That $1 will grow to $1.52 by age 60!

Of course, if you instead choose to into the stock market an earn average returns of 7%, every $1 you invest at age 18 will be worth an astounding $17.14 by age 60!

Things to Consider

Obviously, the interest rate you earn makes a huge difference. So, which one is realistic?

Well, here’s some stats to help you out:

- High Yield Savings Account: About 1% these days

- Low Risk Bonds: usually anywhere from 1-3%

- Average Stock Market Return: 7% (after inflation!) based on the last 140 years of market data. (See my study on average stock market returns here.)

5 Key Takeaways:

Obviously, this chart has TONS of implications. Here are my five main takeaways:

1. The earlier the better!

A young person who makes the wise decision to invest has a HUGE advantage. Consider this example.

- If a 23 year old college grad chooses to invests their money in the stock market and earns 7%, every $1 they invest will be worth $12.22.

- What if that same college grad decides investing is for the geezers and instead chooses to wait a decade before investing? Every dollar they invest at age 33 will be worth HALF as much in the future. (Only $6.21 instead of $12.22) Even if they earn the exact same return.

2. Stuff actually costs more when you’re younger.

Put another way, if you buy an $8 brewski with the bros at age 21 instead of investing it the stock market (something even The Money Wizard did many-a-times, by the way) that $8 beer actually costs your 60-year-old self $111.92!

If you really want to cringe, consider the example of a 23-year-old new grad who buys himself a new $20,000 car. That’s really a $244,400 car!

Toyota Camry today or Ferrari tomorrow? The choice is yours…

3. Time is usually more important than your rate of return.

Take another look at the chart. A brilliant 52-year-old investor capable of earning 10% per year will under perform a 25-year-old earning just 2% per year.

Put another way, the world’s best Wall Street investors at age 52 don’t stand a chance against a 25-year-old with a high interest checking account…

Let that sink in. And let it be a lesson to anyone who’s worried about investing at the wrong time and possibly earning a lower rate of return. Many times, waiting to invest is far, far worse!

4. No wonder investors get more conservative as they near retirement

The closer most people get to retirement, the more they shift their portfolio to a higher percentage of less risky (and lower returning) investment choices.

The standard reason given for this is that people on the verge of retirement want to protect what they’ve already saved, so they move into more conservative investment choices, like cash and bonds instead of stocks. That’s definitely a good idea, and there’s a lot of truth to that statement.

But the chart also shows something less intuitive. The older you get, the less your rate of return impacts your future portfolio values.

When you’re in your 20s, the difference between holding cash on the sidelines and jumping into the market can mean the difference between $21.72 for your future self versus $1.49 for your future self. But when you’re 55? That difference is whittled down to just $1.50 vs. $1.05.

5. There’s no time like the present!

The wrong takeaway for a chart like this is to get bummed about missed opportunity.

Longing for the past doesn’t get us anywhere. Hindsight is always 20/20.

Look at the chart again. There’s literally no better return profile for you or me than wherever we’re sitting today.

Time to get investing!

What do you think about the chart?

Do you find these sort of visualizations as motivating as I do? Let me know, spread the word on social media, or show some love!

PS – You can always support the blog by taking advantage of awesome awesome products like Personal Capital or Rakuten using this site’s affiliate links. (Like those two links!) Thanks for keeping this place alive!

Related Articles:

This is super helpful to show my kids. Some are out of school but I still have younger ones at home, chomping at the bit to get a job. This chart will be useful to help them with their spending and saving choices.

Yes, definitely inspiring for youngsters! They’ve got such an amazing opportunity!

I get your point, but I wonder of this leads to a miserly mindset, certainly if taken too far. A lot of the spending in my youth went to waste, but much of it also let to good times and special memories. “Camry now for Ferrari tomorrow,” well you need to drive something. The Camry now is ok, what hurts is the Ferrari today when you can’t really afford it. $1 today $1.52 – the $1 today is often the better choice. Once we are older and wealthier, we forget how precious that $1 was and how sorely needed for current expenses (take a look at your first paycheck). Invest now, then also leave yourself some guilt-free play money.

Agreed. It’s all about balance!

This has always been one of my favorite concepts. As a young finance professional, it is easy to see that sacrificing now can make a huge impact on future savings.

Thanks for sharing!

Knowing the true importance of this I started for my newborn daughter who is now just turned 4. Was difficult but my future retired self will be even more content.

Figures almost always start at 18 but I would live to see the sort of compounding from birth upwards.

Birth is even crazier! At 7%, every $1 saved in a newborn’s name is worth $57.95 when they reach age 60.

Thank you so much for your really quick reply.

Wow, 3 times as much as from starting at 18! that’s enormous.

I have to show this to my 15 year old nephew who is taking an interest to investing.

This is exactly why I started investing for my daughter from the day she was born.

I love this article, I’m going to show it to everyone I know!’

#ThursdayMotivation it is, Sean, ha. Watch you start that as a trend on Twitter.

It’s crazy how big of a difference a couple percentage points in yearly returns make over the long run. Starting at age 18, 1% yearly return at 18 will be $1.52 by 60 while a 10% return will be $55 or so. Although the 10% yearly return is 10x the 1% yearly return, the end result is 36 times better!

So many of us think “we need to make 100% returns this year” in order to be rich but consistent long-term results work just as well and it has even less risk than trying to make 100% returns. 10% compounded return over the next 8-9 years is actually incredulously powerful. Small returns make big differences over the long term. The key is to have big returns over the long term but so many will fail trying.

This is awesome! Thanks for sharing.

I love that a lot of comments focus on starting young, but I also noticed that $1 invested at age 51 become $2 by age 60 with an 8% ROI. I hear a lot of people lamenting that it is too late to invest because they didn’t start young. But, I say, the moral of the story is that it is never too late – or too early!

Plus, this chart also shows how valuable a Roth IRA is to the younger generation. Put $1 in when you’re 18 and have over $17 in TAX FREE money when you’re 60! Love it!

Cheers!

Nice chart. Time matters more than returns if you start investing early enough. You chart shows that.