A few months ago, I was at the bar with a friend. (Remember those days?) Soon after, a friend-of-a-friend walked in, clearly in a fantastic mood.

Right away, this friend-of-a-friend, who’d I’d always heard through the grapevine was a loaded real estate developer, began an absolute bender of a spending-spree. We’re talking the highest shelf alcohol. Drinks for the entire bar! Art right off the walls!

It was a sight to see.

That’s when he leaned in and let us know why he was so happy.

Apparently, he’d been sitting on a piece of undeveloped real estate for the past few years. His partner was managing the lot for him, and he’d expected it to sell for a couple hundred thousand dollars.

Except his lot didn’t sell for a couple hundred thousand dollars. On this day, he learned his land had sold for $1.5 million.

The epiphany hit me like an ice bath. As we spoke about this guy’s $1.5 million dollar payday, cubicle workers at my job were stabbing each other in the back for the hopes of a 1% annual raise that totaled… a couple hundred bucks.

This is what the rich do better than anyone else. They choose to play the right game.

So, what game is that, exactly?

Welcome to the rare and exclusive world of seven figures…

First off, what does a 7 figure income mean?

The slang refers to the number of digits.

So, a seven figure salary means earning over $1,000,000 per year. To get specific, anything from $1,000,000 per year to $9,999,999 is a seven figure income.

(Eight figures means over $10,000,000, and six figures means $100,000 to 999,999.)

How Likely Are You to Earn Seven Figures?

I hate to be the shatterer of dreams, but… not very likely.

The 1% in America starts at an annual income of $328,551.

Yeah, even earning more than 99% of the population still isn’t enough. And to get extra depressing, you’re not even 1/3 of the way to seven figures!

This isn’t gonna be easy..

#FirstWorldProblems.

To make things even tougher, Reuters researched the topic and found that of the select few who do earn a 1% income, over half of those one percenters earn less than $500,000 a year.

In fact, 5 out of 6 one percenters earned less than a million dollars.

What’s that mean? Out of a total U.S. population of 327 million people, only 545K will crack the seven figure mark in any given year. That’s just 0.17% of the population!

For those following along with the math (I’m not… my puny 99 percenter brain busted out a calculator long ago) that means less than 1 out of every 600 people in the entire country will earn $1 million in a year.

I won’t lie to you. Those are some tough odds!

But let’s assume we were playing those odds. What would be the most likely way to earn seven digits in a year?

The 5 Most Common Seven Figure Jobs With a Degree

Truth be told, there’s not many degrees that earn seven figures. And even those few that do are much more likely to occasionally eclipse seven figures, rather than the relatively steady performance you see in most six figure positions.

And most importantly, absolutely zero degrees earn 7 figures out of the gate. In every case, you’ll have work your way up to these salaries.

But if you’re gonna swing for the fences, here are your best bets.

1. Enterprise Sales Account Executive (Earning potential: $1 million to $5 million+)

Enterprise sales reps make their living selling high dollar products to large businesses. Most commonly, these products are some sort of large scale business software or high cost medical devices. The biggest employers in this field are Microsoft, Oracle, IBM, AWS, Google Cloud, and a whole bunch of biotech companies you’ve probably never heard of before.

The key here is that the products being sold are so expensive that even small commissions add up to massive seven figure totals. If a sales rep can close a big deal that brings his employer millions of dollars in extra revenue per year, it’s absolutely worth it for that employer to pay him or her handsomely for it. Again and again.

Add to the fact that your earnings as an Enterprise Sales rep can be influenced by your general grit and hustle, and you’ve got a recipe for making serious bank.

How much bank? Well, Business Insider published a list of some of the top performing Enterprise Sales Reps, all earning $5 million to $6 million per year.

Enterprise Sales Path to Seven Figures:

- You’ll typically start as a Sales Development Rep for 6 months to 2 years. At this point, you’re working entirely for the salesmen higher up the chain. You’ll be making 100+ calls a day, every day, reading from a script in hopes of setting up meetings for your salespeople. (Average salary: $45K to $100K)

- If you prove a strong salesperson, the next progression in this career path is to begin selling directly to small and mid-sized businesses as a Small Business Account Executive (1-2+ years) or a Mid Market Account Executive (another 1-2+ years). Here, you’ll do less cold calling and more demos/customer management. (Average Salary: $100-300K)

- If you continue to show success in these stepping stones, you’re finally ready for the big leagues and may get promoted to Enterprise Account Executive. Here, you’ll be dealing exclusively with the top 100-1,000 largest companies in the world and paid accordingly. Total compensation of $1 million a year in this position is possible.

(If you’re curious about the medical sales field, here’s an interesting guest post on ThinkSaveRetire.com from a guy who started down the traditional enterprise sales path before venturing into his own medical device sales career. Last year, he earned $4 million as a 27 year old.)

2. Investment Banking or Private Equity Managing Director (Earning potential: $1 million+)

Working on Wall Street is probably the first job most people imagine when they think about seven figure careers. And while the introduction of passive investing strategies and Artificial Intelligence have definitely brought down salaries in this industry, Wall Street is still one of the most lucrative careers for those who can make it.

Investment bankers who can survive the borderline hazing culture of this career path (which usually includes extreme 80 hour workweeks, ruthlessly cutthroat competition, and a “produce or get fired” expectation) are likely to come out the other side with some of the highest earning potential of any career path.

Managing Directors of major investment banks (Goldman Sachs, JPMorgan Chase, Credit Suisse, Deutche Bank, etc.) or large Private Equity Firms typically earn a base salary anywhere from $400-600K, with year end bonuses that can range from almost nothing to multiple millions of dollars, depending on their division’s performance.

Investment Banking Path to Seven Figures

Investment banks are notorious for recruiting almost exclusively from prestigious Ivy League Universities. From there, you’ll need to prove yourself as an associate ($150-300K salary) for a 2-4 years before either getting laid off or promoted to Vice President. (Approximately $500K salary)

The next moves from VP would be to Director, which might get you close to seven figures but not quite there, followed by the holy grail of investment banking – Managing Director.

Typically, even the most rockstar of rockstars shouldn’t expect to hit managing director until they’ve been in the industry for at least a decade.

3. CEO or other C-Level Executive of a Large Company (Earning Potential: $1 million to $50 million+)

The “CEO” usually evokes visions of power, closing big deals, and… a huge salary.

For most CEOs of major companies, the stereotype is entirely accurate. According to a study from Harvard, The median CEO salary among the 3,000 largest companies is about $2.7 million per year,

The highest salaried CEOs in recent history?

- The Discovery Channel’s CEO David M. Zaslav ($129.4 million)

- Linde’s (a German industrial gas company) CEO Stephen F. Angel ($66.1 million)

- The Walt Disney Company’s CEO Robert Iger ($65.6 million)

Among the 500 largest companies, only 23 CEOs earned less than $5 million.

When you factor in “nonsalary” compensation such as stock options tied to performance goals, many CEOs earn even more. By that metric, Elon Musk’s infamous $2.2 billion compensation led the pack. Not bad for a company that hasn’t made any money!

And while CEOs obviously make the most, reaching any of the C-Levels at a large company should do the seven figure trick. This study found that even the fourth highest paid executive at the average billion dollar company earns $1.01 million a year.

C-Level Executive Path to Seven Figures

No beating around the bush here. The rise to C-Level Executive is as stereotypical “climbing the corporate ladder” as it gets.

Typically, you’re looking at a 20+ year career gutting it out with your fellow coworkers, playing the politics game, and hopefully, convincing the current management to like you enough to identify you in their succession plan.

It’s extremely rare to find a CEO, CFO, or similar role under the age of 40. And the rungs of middle management are lined with executive hopefuls who got passed up on the big promo, for one reason or another.

4. Corporate Lawyer, Big Law Partner, or High Profile Trial Attorney (Earnings Potential: $1 million to $10 million+)

While a disturbing number of lawyers don’t use their degrees at all, and many who do earn an average salary that’s dwarfed by many undergrads, lawyers who make it to the top of their fields can earn a ton of money.

At the absolute highest end of the spectrum are big-time trial attorneys. These are lawyers like Richard Scruggs or Joe Jamail, who each have an estimated net worth $1.7 billion dollars thanks to some high profile victories in court. (Richard Scruggs won a $246 billion settlement against Big Tobacco in 1998, and he’s also won cases against seedy asbestos companies, insurance companies, and pharmaceutical companies. Joe Jamail has tried over 500 cases, with his his biggest being a $10 billion dollar victory over Pennzoil.)

Next on the attorney earnings hierarchy would be equity partners of big law firms. Here’s an interesting list that shows some of the biggest law firms profit $4-6 million per partner, per year, so it makes sense partners at these firms earn salaries near that range.

And last (but certainly not least when we’re dealing with seven figure salaries!) are the head lawyers for major corporations. According to Business Insider, becoming the general counsel at a major company can pay anywhere from $1-10 million per year.

Lawyer Path to Seven Figures

Unfortunately, the odds are definitely not on your side for this career field.

You’ll mostly likely have to make it into a top law school, and then graduate at the top of your class. From there, as many as 40% of law school graduates can’t find a job related to law, which is a real problem if you’re also carrying the average law grad’s debt load of $120,000+.

5. Doctor owning a private practice. Or working insane hours. (Earning potential: $1 million)

While most doctors earn low six figures, some select few owning their own business can earn up to seven figures a year.

This is pretty rare in the medical field, and is mostly limited to surgeons and proceduralists who do more expensive, elective procedures. (Think plastic surgeons, orthopedic surgeons, spine surgeons, etc.)

Some other fields can reach these earnings IF they dedicate nearly all their waking hours to overtime and double shifts.

One interesting point about the statistics: Unlike nearly every other career on this list, you won’t see many, if any, doctors getting above the low seven figure mark ($1.0 to $1.2 million).

Doctor Path to Seven Figures

To become a doctor, you’re looking at a minimum of 11 to 18 years of post-high school education before you can even catch a whiff of the big bucks. From there, you’ll need to carefully select (and be accepted into) one of the highest paying specialties.

Then, if your goal is seven figures, you’re looking at additional risk and investment by purchasing or starting your own business.

All told, you’re looking at a nearly 20-year path filled with extremely long hours (and several chopping block filters) before you make it to seven figures.

A noble profession, but if it’s just the money you’re after, you’re probably better off devoting your time and effort to many of the other careers in this article.

The 4 Most Common Seven Figure Jobs Without a Degree

Of course, you don’t necessarily have to attend a $100,000/year business school or spend a decade studying to make seven figures. Here are the most common million dollar salaries that can be earned without a degree:

1. Professional Athlete

For those gifted with world-class genetics, making it to the pros is a surefire way to earn a seven figure salary.

Here’s a look at the average salaries for different professional sports:

- Average NBA Salary: $6.39 million

- League Minimum: $898,310

- Average MLB Salary: $4.36 million

- League Minimum: $560,000

- Average NHL Salary: $4 million

- League Minimum: $700,000

- Average NFL Salary: $2.7 million (with a median of “only” $860K)

- League Minimum: $480,000

2. Entertainer

Keeping the masses entertained is big business. If you make it to the top of this field, some serious coin awaits.

Actor:

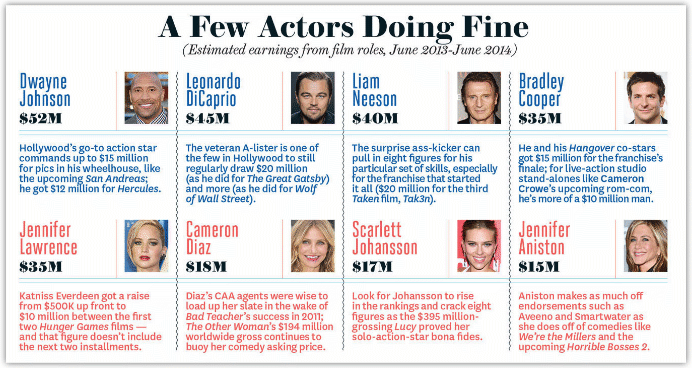

The “movie star” is still a solid seven figure earner. This report from the Hollywood Reporter had The Rock coming in at #1, with $52 million of earnings in one year.

In the world of movies though, there’s a huge discreprency between the stars and the average. The average Screen Actors Guild member earned just $52,000 a year, and the earnings of most co-stars are dwarfed by their star’s counterparts. (In one extreme example, Leonardo DiCaprio earned $25 million in Wolf of Wall Street, while Jonah Hill got paid just $60,000 to co-star.)

That said, actors have more options than just movies. TV actors can make bank too – all three main cast members of The Big Bang Theory famously earned $1 million an episode, which were the highest salaries of any actors on TV at the time.

Musician:

With musicians able to sell out basketball arenas at over $60 a seat, is it any surprise the highest paid musicians can easily clear $100 million a year?

The median performer on The Street’s list of highest paid musicians earned over $50 million a year. (Taylor Swift topped that list at $185 million in one year.)

Radio Host:

Radio might be labeled a “dying medium” but that hasn’t stopped these five highest paid radio hosts from earning a fortune on the way out:

- Howard Stern: $90 million a year

- Rush Limbaugh: $85 million a year

- Ryan Seacrest: $74 million a year

- Sean Hannity: $36 million a year

- Glenn Beck: $9 million a year

3. Youtuber, Influencer, or Blogger

Unlike traditional entertainers who have to be hand selected into stardom by movie producers, talent agents, and other gatekeepers, the internet has opened up a world of possibilities to anyone with a laptop, an internet connection, and a little bit of hustle.

Youtubers are the best example of this. With a selfie stick or a webcam, Youtube stars like Jenna Marbles (a former tanning salon employee who now posts comedy videos) Ryan Kaji (an 8 year old who opens toys) and PewDiePie (a video gamer) now earn millions of dollars a year.

I first realized the insane earning power these youtubers had when I heard that Shay Carl, a youtuber with millions of subscribers, had bought an entire ski resort. Apparently, he and other youtubers had just sold their production company to Disney for $500 million.

And then there’s the bloggers. While 99% of blogs make almost nothing, those at the top echelon can make magazine or newspaper style revenue, without the expenses.

In my corner of the internet, probably the most famous example of this is Michelle from MakingSenseOfCents.com. She famously earns $100,000 a month from her blog. (Unfortunately, MyMoneyWizard.com isn’t anywhere near the same ballpark. Yet? 🤞)

And then there’s the Instagram influencers. These folks can earn up to $100,000 per post.

4. Business Owner / Entrepreneur

And finally, the classic American dream.

Despite all the allure of movie stars, pro athletes, and wolfs of wall street, one fact remains:

The highest percentage of seven figure earners, across all fields, are business owners.

Why?

When you own a company, your earnings aren’t limited to a salary. No are they limited by what your boss thinks is “reasonable” or what your “tenure” would indicate.

Instead, your earnings are driven by just one thing: the amount of profits in your company.

This opens you up to the amazing power of leverage. There’s literally no limit to the potential profit from a company’s sales. If you grow large enough to hire employees, then you gain the leverage of their work, too.

In the case of many business owners, that might be seven figures. But it could also be eight figures. Or in the case of the world’s current richest person, twelve figures.

So if reading this list made you a little jealous, then it’s time to start a company and get to work!

Bonus: Any valuable degree is really a 7 figure degree. (Looking at the glass half full)

When reading a list like this, it’s easy to get a little unsatisfied with your current earnings. After all, everyone is happy with their salary… until they find out what their coworker makes.

But here’s the consolation prize for us mere mortals.

Even if you’re nowhere near seven figures (welcome to the club) your salary probably already has seven figure potential.

Even if you’re earning $50,000 per year, you can still earn a million dollars in around 20 years. That might not sound all that fast compared to The Rock’s massive earnings, but it’s still about half the length of the average human’s working career. And once you get to that million, if you play your cards right, that’s probably enough to give you complete freedom over your time, for the rest of your life.

Which is really what this whole game is about. Because in an ironic twist, the big benefit of these seven figure salaries isn’t the salary. It’s the freedom you can buy with it.

And that freedom is totally separated from how many figures of income you earn.

While a big salary can definitely speed up the process, there’s plenty of seven figure earners who still doom themselves to a lifetime of work. (Don’t believe me? How else do you explain Nicholas Cage making Ghost Rider?) Just as there are plenty of low wage earners who reach financial independence in a blink, like Jacob who found freedom on just $7,000 a year.

The main issue then, is keeping that million for yourself. And that, my fellow non-seven-figure earners, is totally possible for the vast majority of us, using the same simple strategies I’ve used to get about halfway there in my 20s.

At the end of the day, no matter what you earn, achieving financial freedom comes down to what we’ve always talked about – living below your means and making smart investment decisions.

That’s a strategy that can have you reach financial freedom in a couple years, or less. No seven figure salary in sight.

Do you enjoy my free blog? Share this article on your favorite social media or take advantage of free, awesome products like Personal Capital or Rakuten using this site’s affiliate links. (Like those two links!) Thanks for keeping this place alive!

Related Articles:

I never made that much but about a year after I retired a recruiter friend called me about a job working for a CEO I was familiar with for over a million a year. I told her thanks but no thanks, I did not need, or want a job, regardless of the pay. I had enough money. It might have been fun to check that box, but they pretty much want your every waking hour when the job pays that much.

Must have been tough to say no to an income like that. But then again, Freedom > Money. Otherwise, what’s the point of saving?

Way to stick to your guns!

I agree with the thoughts on the sales career + progression. It requires little/no school debt to start a career in sales. Then to have the ability to transfer into technology sales at an entry level point is critical.

The ability to earn as you move through the ranks plus the company perks (employee stock purchase plans) are how you build wealth quickly.

Sales is a very mentally challenging job but any of those listed above are going to be tough. I am a big fan of going into sales and increasing your earnings each year. Great share!

Thanks for a great as always blog. Just a FYI, the Personal Capital link is broken 😉

Thanks, especially for the heads up! Link should be fixed now.

Robert Kiyosaki says a job is no way to get rich. Who wants money if you have no time to enjoy it? That’s why building your own business and owning systems for passive income is the only way to go if one is to retire early enough to actually enjoy the wealth, even if it means being homeless for awhile while building your empire. I’m trying to build brands and collect royalties, solve problems real people have, get resourceful in ways most people don’t think is possible, etc. Look at Tatiana James who at 26 y/o makes 200k a month for just a few hours of work she enjoys every week. Or Millionare FastLane by MJ Demarco, or Alex Becker who claims to have billions in business assets in his 30s, or Jeff Burwick who flies on private jets and vacations permanently. Having a job is just incompatible with getting rich unless you want to get a stroke/heart attack working so hard, ignoring your family/health, only to look back with regrets – if you make it that far. I know because I’ve seen people in those 7-figure sales jobs. They’re not happy. Take the entry level to learn basic marketing and make your own product. If you fail, pivot and keep trying. The #1 regret of the dying is not living true to yourself. Working to someone else’s bidding sucks your soul and suppresses your creative spirit that could enable you to start your own idea. That’s why I quit my desk job, and am freelancing to get by while I build my business. Even though I’m not raking it in right now, I am literally so confident I’ll be able to retire well before I’m 40. BECAUSE I chose to ditch the “easy” option of having a boss tell me what to do. I’ve been following your blog for awhile and IDK if you’re aware of Cash Flow Quadrants by Kiyosaki or Millionare Fastlane but employee/or self-employed IMO isn’t recipe for fulfillment, monetarily or otherwise.

Honestly, just reading a list of this 7-figure professions makes me feel nauseous! If you have to make such dramatic sacrifices like never having free time, never spending time with your family or having fun, never being able to relax for a minute because your job is so stressful and competitive, all this just to earn 7 figures. Your life will go by so quickly, and you’ll probably have some money saved, but most of it spent to overcompensate for the lack of time. Then you will find out you have high blood pressure and high cholesterol and chances to live long and happy life with money you made are scarce.

I would rather make 5-6 figures and live below my means and know that I have time for a fun night out and time for my children and for health checkups. The paradox is more money you make, more money you spend. At the end of the day, those great people in your family and friend’s circle, consistent savings set aside and invested in Total Stock Market Fund, some money to have fun with and some free time to enjoy our lives is all we need! Otherwise, we live to work, not work to live.

That’s my philosophy!