Hey Money Wizards!

I know I’ve been a bit MIA lately, publishing an all time low of just two posts in August.

But fear not! For those of you still hanging around, know that I’ve built up a BIG backlog of posts. Fresh off the longest vacation of my entire working career, I’m fully recharged and super excited to get the ball rolling, the wand waving, and the posts updating around here.

And it all starts with the latest net worth update!

As you probably know, every month I share my progress towards to a ~1 million dollar portfolio. I’m currently 30 years old and just hit a neat milestone along the way, so let’s check it out!

Life Update: August 2020

August was definitely marked by my longest vacation ever.

While I’m usually the type for a quick weekend getaway, after cancelling of our wedding, honeymoon, and a few other trips due to COVID, I found myself with a nice first world problem – way too much vacation time.

So, Lady Money Wizard and I carefully selected 10 days off and spun the globe for anywhere in the world. Except more accurately, we randomly picked whatever 10 days were available, and then looked at our limited options for a road trip near Minnesota.

As it turns out, Minnesota is a pretty landlocked state when it comes to tourist attracts. Thanks, Iowa…

We eventually narrowed down our choices to the Upper Peninsula, Michigan, aka that mysterious top-left part of the glove that I’ve personally never heard of anyone actually traveling to.

So we packed up the car and got to driving. And… we were pleasantly surprised to find a beautiful part of the country! (Even if finding a place to stay or a meal to eat can be a serious challenge at times…)

The blue giant that is Lake Superior looms over this rocky shoreline to the North, while the beaches of Lake Michigan sit to the South. We kayaked through rock formations and hiked our way to hidden beaches, which were all surprisingly impressive.

Eventually we stepped into the time machine known as Mackinac Island. Back in 1898, this quaint little place never bothered to legalize the horseless carriage, so to this day the island allows no cars. And I gotta say, Mr. Money Mustache and his car-less utopia might be onto something.

Life without the constant roar of diesel engines was so peaceful that I felt like I could sit around all day and melt my problems away. And that’s pretty much what I did.

By the end of my longest vacation ever, I felt recharged and ready to rock. I’m actually excited to refocus on my goals, get back to work, and make things happen!

Net Worth: August 2020

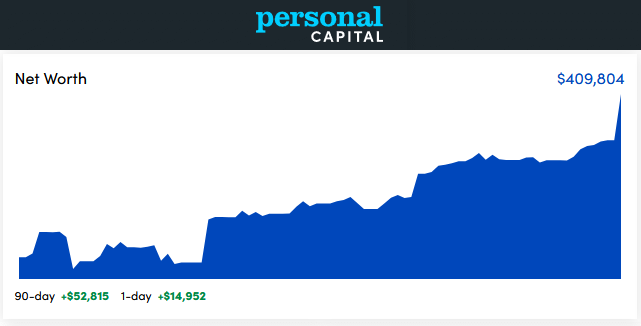

Last month I noticed that if the growth continues, my net worth will pass the $400,000 milestone. Did I make it???

Success!

I still don’t understand how this market growth is possible considering we’re in the middle of what’s supposed to be one of the most economically devastating crises in history.

If I put on my total-speculation hat, I wonder if this crisis might not ever hit the market as much as we expect? These days, nearly 20% of the S&P 500 is made up of Facebook, Netflix, Amazon, and Google. If anything, those companies have benefited from the pandemic.

While it’s tragic that 20+ million Americans are out of work, it seems the group hit hardest by that is your average waitress, barber, artist, and lower wage worker. For better or worse, that group missing their rent payment doesn’t seem to have the economic ripple effect that 2008’s defaulting middle class home owners had on the rest of the financial markets.

Either my hypothesis is correct or the economic devastation will eventually catch up with the economy. Either way, it just goes to show you that trying to outsmart the market can be a costly mistake. Which only makes steady, consistent contributions even more important.

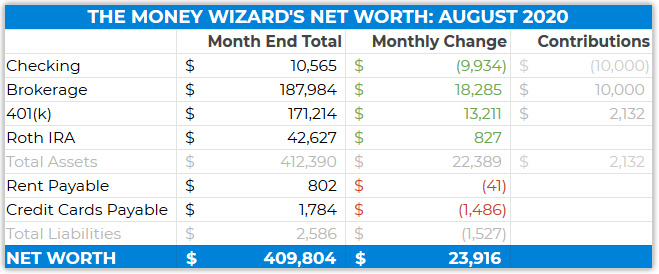

I moved some cash around this month, so let’s dive in.

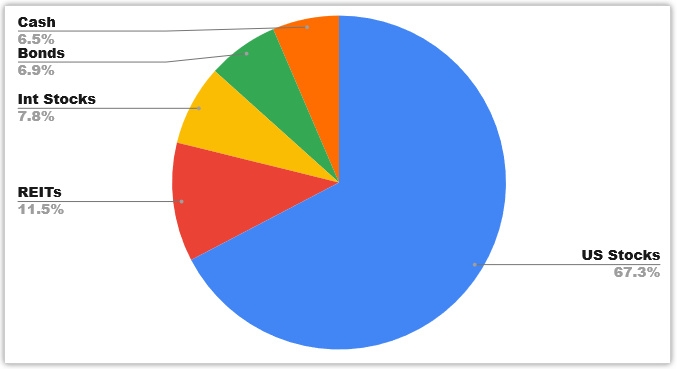

Portfolio Allocation: August 2020

The big change is I dropped my cash percentage from around 9% last month to 6.5% this month, while I increased my bond exposure from from 5% to 7%.

Checking Account: $10,565 ($9,934)

With the checking account getting way larger than the small emergency fund that I prefer, I decided to transfer a big chunk of that cash ($10,000) to something more productive.

In this case, I moved all that money to bonds so I could get closer to my 10% bond target.

Brokerage: $187,984 (+$18,285)

A $10,000 increase from my bond transfer and $8,000 from market gains.

This is still mostly made up of:

- Vanguard Total Stock Market Index Fund (VTSAX): $123,000

- Vanguard Total Bond Market Index Fund (VBTLX): $28,000 (Yes, $10,000 more than last month!)

- Vanguard Money Market Fund (VMFXX): $14,000

With the rest being some individual stocks back from the days I thought I was Warren Buffett. (Sadly, it turns out, I’m not.)

401(k): $171,214 (+$13,211)

My $1,600 monthly contributions to my 401k are still broken up as so:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

I also get a decent match to these contributions from my employer.

Roth IRA: $42,627 (+$827)

I maxed out my Roth IRA at the beginning of the year, so this is just market movement to the following accounts:

- Vanguard REIT Index (VGSLX): $36K

- Vanguard Total International Index (VTIAX): $6K

Rent Payable: $802 ($41)

Nothing too exciting here. The $41 drop is because the weather’s already started cooling off in Minnesota, so the electricity bill fell.

For newer readers, I split a mortgage for a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $1,784 ($1,486)

In yet another case of The Money Wizard being not-so-wizardly, last month I somehow managed to pay my credit card bill twice in the same month.

Seriously, I have no idea how I did that. From what I gather, I paid my bill. Then I forgot that I paid it, and paid it again. So now my bill is artificially low, despite an expensive vacation.

Oh well, I guess there’s worse financial mistakes to make.

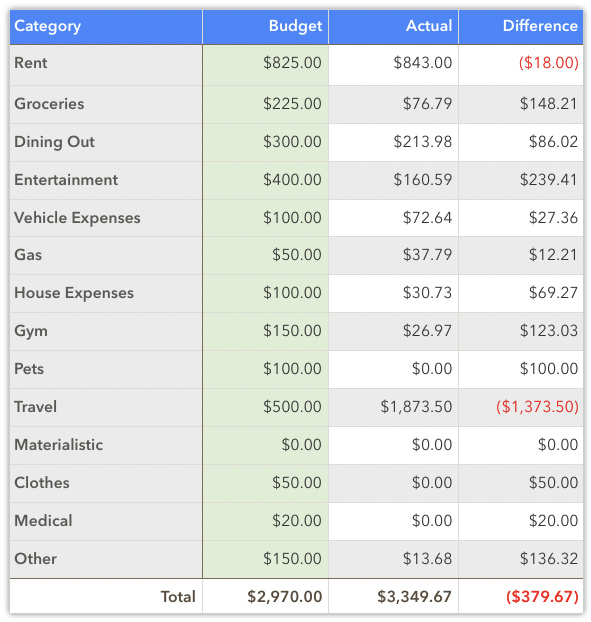

Total August Spending: $3,350

I’m okay with blowing the budget a bit this month, especially since my spending has been quarantine low all summer.

Entertainment: $160

We visited the Minnesota State Fair, socially-distanced drive through style!

Because if there’s anything more gluttonous than fried cheese, mini donuts, and foot-long corn dogs, it’s eating all those things in your car.

Vehicle Expenses: $72

Boring old car insurance.

Travel: $1,874

I guess I shouldn’t be surprised that the longest vacation I’ve ever taken was also one of the most expensive, but I still was.

Other: $14

I’ve recently become addicted to reading books on my Kindle, mostly because highlighting and exporting notes is such an efficient way to retain what I’ve read. So I went on a kindle shopping spree that was much cheaper than you’d expect for the double-digit number of books that I bought, mostly thanks to some Amazon promotions.

How was your August?

I always love hearing from you all. Stay tuned for a more consistent posting schedule in September!

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Glad to see that you enjoyed da UP! We were just up there a few weeks ago; we hit Mackinac as well as Tahquamenon and the Soo (where I went to college). I grew up in the northern lower peninsula, so we go up that way at least once a year.

Very cool! Tahquamenon was the one place we had to cut from the itinerary that I really wished we could have made.

Can you explain the Vanguard Money Market Fund in more detail? I noted an expense ratio of 0.11% in my Vanguard account, with a return that seems to be less than that….wouldn’t investing money in VMFXX result in a negative return? Unless I’m doing the math wrong. Thanks for all your insight into the markets!

Maybe so. When I first put that money into VMFXX the return was over 2%. Lots of changes since then with COVID, stimulus, etc. so I should probably take another look. Thanks for the heads up!

If/when you do, can you report back? I want to make sure this isn’t something I’m just missing in my calc’s or if it really is negative return 🙁

Cheers

Ohh wow. I visited Mackinac Island in August as well. I meant if seen the Money Wizard without even realizing!

Haha! Maybe so!

For Personal Capital and similar products to work you must give them access to all of your financial accounts. One company has the data to access to all of your financial assets. Doesn’t that concern you?

I talk about this in the “Is Personal Capital Safe?” section of my Personal Capital vs. Mint article:

https://mymoneywizard.com/personal-capital-vs-mint/#Round_7_Is_Personal_Capital_Safe_Is_Mint_Safe

I just noticed I’m about to reach $400k in all of my savings/retirement accounts, which was super exciting. My husband didn’t think it was so exciting. Oh well.

Definitely exciting! Either that or I’m just a huge money nerd. 😉

Would you ever consider putting some money into crypto? People are using it as a substitute option for gold and silver.

Yes, and I have. I don’t include it in NW updates for security reasons. And I’m taking Mark Cuban’s advice and counting any crypto investments as already lost.

https://mymoneywizard.com/how-to-invest-in-bitcoin/

Congrats on hitting the $400k mark! The big blue lake and Mackinac Island look amazing.

What are your thoughts on real estate investment? Specifically in the pros/cons of using an IRA withdrawal as a means of downpayment for a first/investment property. Typically the stock market annual return rate is quoted 6-7%, but I also hear it taught that between appreciation, passive income, and tax benefits real estate can net closer to 12% annually.

Would you ever take money from stocks/bonds and use it to invest in real estate? I realize REITS are a form of real estate investment, but it’s not quite the same as owning a property.

Curious as to your thoughts!

Hey MW! I started a Roth IRA for myself (maxing that each year) and will start one for my wife soon. After that I’ll open another brokerage account (with Vanguard, obvs!) so I can keep investing more than the Roth limit. My question for you is: how did YOU determine what funds to buy for each account? Your Brokerage is made up of VTSAX, VBTLX and VMFXX, while your Roth is made up of VGSLX and VTIAX and your 401(k) is made up of a few different funds. How did you decide which funds to use for which account? Feel free to reply with a link to another blog if you’ve already answered that question elsewhere. Thanks!

Hi! Long time reader.

I was looking at your account distribution and the Brokerage vs 401k levels sparked a thought. If I recall, you max your Roth IRA and 401k annually and any remaining funds goes into brokerage amongst other spots.

I recently learned my Employer’s 401k plan offers something called a “Roth In-Plan Conversion”. Essentially you contribute after tax dollars and immediately contact your fund manager (Fidelity, Vangaurd, etc) and direct them to convert the funds into Roth. You do need to pay tax on any gains but those will be negligible if you don’t allow much time to pass.

Besides the obvious benefit these contributions are forever tax sheltered, there are a couple other hidden perks.

1) No income limits (Roth IRA has an income cap)

2) Annual contribution is not part of the $19.5K pre-tax / roth 401k contributions

3) Allows you to contribute far more than the $6K Roth IRA limitation

My 401k provider indicated select 401k plans offer this benefit and the plan may limit the number of conversions annually. I don’t think this perk is widely known and curious if you knew about it? Does your plan offer such an incentive? Are you saving in brokerage to have funds available before hitting normal retirement age?

Thanks!