How does the saying go, something about a Merry New Year and a Happy Christmas?

Statistically, there’s a 50/50 chance that you’re new here. If so, welcome! It’s time for a monthly Net Worth Report, where I reveal every detail of the taboo subject of my own finances…

Despite the retail marketing machine’s best efforts to convince us that the holidays are all about spending as much money as possible on pieces of plastic, to me the holidays are really about spending time, not money, on the people we care about.

And on the front, December began with a bang. The girlfriend and I started the month with a trip to Denver, Colorado. We like to return to my former home-of-two-years around the holidays, and it is becoming a bit of an annual tradition for us.

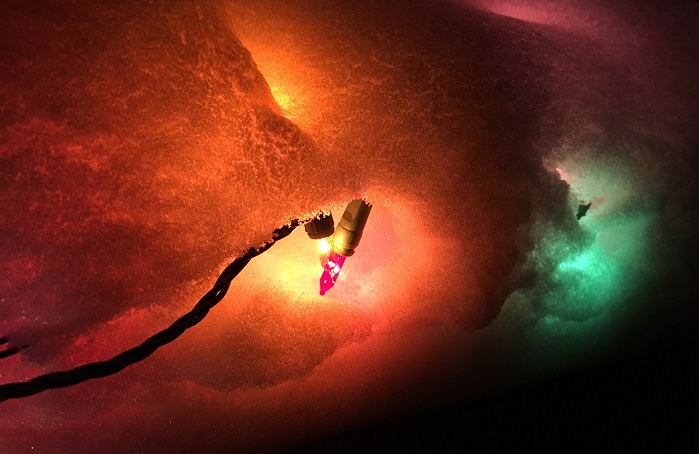

Denver truly has some underrated Christmas charm, I mean just look at these decorations!

We explored the familiar city, reliving old memories and finding new spots. I finally cashed in a 2 year old giftcard to a cooking class, and I surprised myself by whipping up this gem.

And for all the snowy, chilly nights in the Denver city, you’re always a few hours and a short drive from a sunny day illuminating some beautiful scenery. On this trip, we decided to sidetrack to El Dorado Canyon State Park, about 30 minutes north of the city.

The park is known partly for its incredible vista views and, unbeknownst, to me, mostly as a rock climbing mecca. Which means I first marveled at sights like this:

The was absolutely shocked by sights like this (click and zoom in for a surprise):

I can be a bit of an adrenaline junkie. Roller coasters are my idea of a great time, the bigger and faster the better, and I’ve been known to drop in on some ski terrain that’s far steeper and more challenging than my ability level. My bucket list is even rounded out by sky diving and race car driving.

But it only took one look at these tiny dots of humans before my palms started sweating profusely.

Nope, nope, nope. Respect to them, but no way.

Back in Minneapolis, I did my best to enjoy the winter weather. The cold and the snow really can be beautiful in its own way, especially during the holiday season. Plus, it makes for a great excuse for a toasty fire.

I then headed to my original home of Texas, where I took a relaxing week off work and spent time with my family and friends.

A perfect holiday.

December 2016 Net Worth Update

On the finance front, I passed $150,000!!!

My Forbes and Business Insider pieces had wonderfully complimentary headlines exclaiming “26 year old nearly saves $150,000.” To be honest, that nearly was taunting me.

“So close,” it said, “but not quite…”

A new car purchase and a brief moment of stock market panic later, and I was back down to $140,000 and wondering how long that little adverb would keep taunting me.

Not long, apparently. Reaching $100,000 took me 25 years, while saving another $50,000 took just about one more. Hey thanks, compound interest.

Cash Savings: $8,111 (+$4,918)

Wowza! ‘Tis the season, as my cash savings were bolstered by three factors:

- During the second half of the month, I temporarily dropped my 401K contributions from over 25% of my paycheck to around 10% in order to make sure I have the liquidity to kill that damn car loan ASAP.

- I started living pretty frugally, in order to make sure I have the liquidity to kill that damn car loan ASAP. I’m really not a fan of this whole debt thing, so I spent a lot more time in the kitchen cooking my own dinners and less time paying people to bring food to me.

- Holiday bonuses! I got an nice, unexpected year-end bonus at work.

Vanguard: $60,437 (+$1,290)

This stock market is crazy! I keep thinking it will come crashing down, even hoping so that I can buy some discounted stock, and it just keeps flying upward.

At the end of the month my allocations looked like this:

- Vanguard Total Stock Market Index Fund (VTSAX) – $47,000

- (Roth IRA) Vanguard REIT Index Fund (VGSLX) – $13,000

No contributions to these accounts this month, so the $1,300 increase was all market changes. December does mean year end dividends, of which the two funds spit out about $550 worth.

In 2017, I’m hoping to more regularly contribute to both of these funds.

Merrill Lynch: $45,919 (+$1,694)

Just more market changes here. The idea that your money can silently work away and create more money never ceases to fascinate me, and is a big reason for my initial interest in investing.

401K: $48,219 (+$3,054)

I was surprised to see this rise so much faster than then other two funds, since I adjusted my automatic 401K contributions downward during the second half of the month in order to build up some cash to kill the car loan.

The index funds that the 401K is invested in does have more exposure to small cap and international markets, and it looks like these two asset classes had a slightly better month than the larger US based stocks I’m otherwise mostly invested in.

Rent Payable: $690 (+$2)

Still proudly renting an apartment, and the rent is set through the summer. Right now though, it’s COLD, which means a slight increase in the heating bill.

Credit Cards Payable: $3,840 (+$2,024)

At first glance, this looks like I went on a wild spending bender compared to the previous few months. In reality, December was a pretty frugal month. My credit card bill is artificially high right now for two reasons:

- My friends and I are taking a surprisingly cheap ski trip to Whistler soon, but I was still the guy left holding the bag and fronting $1,400 for 8 people’s hotel rooms. I know they’re good for the money; I just don’t want to have to bust any kneecaps on this, the day of my daughter’s wedding…

- I signed up for the awesome credit card deal that is the Chase Sapphire Reserve, and I got hit with the $450 annual fee. A small price to pay for over $2,000 in rewards.

Auto Loan: $7,500 (+$0)

That loan is just sitting there, looming, with the first payment not due until March. Jokes on the loan though, I’m quickly saving up enough cash to give that thing a swift blindsided knockout, before any interest is due.

Year In Review

Here’s a chart showing my (almost) complete year’s progress, which you may recognize from my New Year’s Resolution post.

Who ever said little changes can’t add up to something big?

Looking at the chart, I still can’t quite wrap my mind around the power of saving.

At no point in the past year did I feel I was “sacrificing” anything to build up my net worth. Yet a bunch of small, consistent decisions added up to a big surge of growth – probably over $40,000 if we had data on the whole year.

And the most amazing part? I’m not doing anything special, really. I skipped a $5 coffee here, ignored the giftshop there, and resisted the temptation to upgrade my life just because I “deserve” something.

Probably the biggest contributor to the growth, a big automatic contribution to my 401K every paycheck, happens before I ever even get my paycheck, which makes the whole savings process totally autopilot.

If I can save like this, anyone can. Sure, we all have different numbers, and I’m sure there’s just as many people laughing at my puny net worth as there are impressed by the number. The point is, consistency is key.

My biggest takeaway from the graph? Small decisions really can add up to something huge.

Happy New Year Everyone!

________________________

Related Posts:

Hey congratulations man! To me that’s a very impressive number; much more than my own! Just wanted to make my first comment and say how much I enjoy reading your blog. I’m 31 with a different situation but definitely working toward being debt free (student loans) and increasing my net worth.

You are much more humble and down to earth than other financial writers. THAT is why I keep coming back. Thanks for sharing and stepping out to let everyone know that they can do it too; even me. God bless sir!

Tyler, thanks so much for the compliment man. Really means a lot to me.

Good luck crushing those loans, and hope to see you around!

I feel the same way out my net worth. I don’t feel like I’m trying that hard because the money for my 401k and HSA comes out of my paycheck directly before I really can experience it. Congrats on hitting that 150k mark and good luck in 2017!

Automatic savings are definitely a cheat code in the will power category. Good luck to you too Julie!

Congrats on passing $150,000! You can Forbes and BI to take out nearly now 😉 It’s so nice to have someone close to my age working towards these kinds of goals. It’s very inspiring and motivating. Happy New year!

Haha, maybe I’ll have to submit a letter to the editor. 😉

Really awesome to hear you’re enjoying the site.

Another motivating net worth post. Keep it up!

I’m excited to increase my 401k and automatic savings plan once debt free in a few months.

Enjoy that $300 travel credit and other perks with the CSR, definently worth the annual fee!

Thanks! Good luck on your debt crushing goals, and keep me updated! You’ll be amazed by your savings once you’re free.

The only thing I thought you were missing on this site was the Sapphire Reserve. Glad you jumped aboard before the sign up bonus bumps back down to 50K. Also, I am always the guy who volunteers to front the bill on a trip with friends, quick way to rack up- significant travel points, especially on the reserve. Great post man!

The travel points are definitely a nice bonus to the friendly loan. And yep, the Sapphire Reserve is definitely awesome. Here’s my full review in case you missed it.

Congrats on breaking $150k. I’m 27 and just broke 50k after depositing my year end bonus. I paid off $34k of student loans in the first 4 years after graduating, so considering that, I think I’ve done pretty well.

$50K at 27 with no student loans is nothing to sneeze at. Congrats! Looks to me like you’re killing it. Keep it up!

I wish I had your drive to save like that when I was your age. I can’t wait to save my first $100k! I “think* if I keep at it I will hit my first $50k in 2017. Trying hard… thanks for the blog – its very informative and motivating!

Glad you’re enjoying the site, and congrats! That $50K will be doubled before you know it!

Congrats! Very exciting. Can I ask what you ended up spending in total for 2016? I believe you were targeting about $22k all-in for the year. Did the final number end up around there?

I haven’t reconciled all my spending for the year yet, but from what I see so far, I would guess it ended right around $23-24,000.

Congrats on the $150K! Remind me what car you went with! I’m moving to Colorado and will need to pick up some wheels…sounds like you went used which I’m leaving towards doing the same

Thanks!

I got a new Mazda 3 Hatchback. There’s a post coming early next week that will discuss all the details.

Congratulations on breaking $150k! It’s amazing how compound interest works.

As they say, it’s the first $100k that’s the hardest, the rest will come by so far thanks to compound interest!

Slow and steady…. nah, let’s say quick and steady. Congrats MMW! I agree about the stock market. How much longer is this upswing going to last?

Haha, thanks CoupleofCents. Quick and steady… I like that approach.

Good to see you here, and hope to see you around some more!

Great progress! Keep pumping as much as you can into your 401k and other investment accounts. Max out your 401k. Open a traditional IRA and a Roth IRA and max those out too if you can. Anything remaining? Invest that too!

At your age, you have time on your side in a big way. By the time you’re 40, you’ll be realizing huge investment returns.