Hey everybody!

Welcome to a year-end edition of the monthly net worth update. Which actually, is identical to the usual monthly net worth updates we do around here, where I share an update on my goal of total financial freedom. (I’ll be posting a full year-end summary in the coming weeks)

If you’re new here, I’m working and saving towards a roughly $1 million portfolio by age 37. So far, I’m 28 years old, with a new worth of… well you’ll have to read on to find out!

Life Update: December 2018

December seems to always be a busy time of year for everybody, me included.

I started the month in a pure panic about getting everybody’s Christmas gifts in order. I had a lot to do, both work-related and personal-related, before Lady Money Wizard and I left town for a few days in search of even more holiday cheer.

You see, Christmas in New York had always been on both of our bucket lists. And when an impulse buy accidentally left us with two tickets to the new Harry Potter play on Broadway, with the dates preset for mid-December, we decided to pull the trigger. (Harry Potter nerds, represent!)

So, one week into the month, we left Minnesota and flew to New York City. I’d visited The Big Apple once before as a teenager, when I spent two quick-paced days in the city, which both flew by faster than a New York minute. (Ba-dum-tss!) This go-round, we had five full days to work with, and I was excited to take in the city through the eyes of something resembling a fully functioning adult.

And five days we spent, although I can’t say they went by any slower. New York City is a frantic madhouse in the best way.

Over the course of our five day trip, we walked Central Park, visited holiday markets, ate delicious food, saw the Christmas light displays, ate more delicious food, haggled in Chinatown, ate even more delicious food, toured the 9/11 Memorial, explored Brooklyn, ordered a-few-too-many-drinks from more bars than any city should ever have, and finally saw the Broadway play that brought us in here in the first place. (Which was amazing, even for a total play-noobie like yours truly.)

Oh and of course, I wouldn’t be a good money blogger if I didn’t snap a pic of the New York Stock Exchange!

Overall though, New York is not my favorite place in the world. Most of the tourist attractions were so absolutely packed with people they weren’t all that enjoyable, and I found the highlights of the trip to be the rare escapes from the main attractions, like this empty park in Brooklyn where we enjoyed a skyline sunset.

I definitely left New York with an answer to a question I’ve long wondered. When it comes to vacations, there’s big city people and then there’s nature people. And maybe it’s because I live in a big city during the rest of the year, but I can now definitively say that my ideal trip is nature oriented, mixed with a small town or two.

Coincidentally, those nature vacations are also a whole lot cheaper than their big city counterparts, but we’ll get to the financial damage in a little bit.

After returning from New York, I was thrust back into mountains of work. Eventually, I spent Christmas with Lady Money Wizard’s family before heading down to Texas to visit my family for the end of December and into the New Year.

Net Worth Update – December 2018

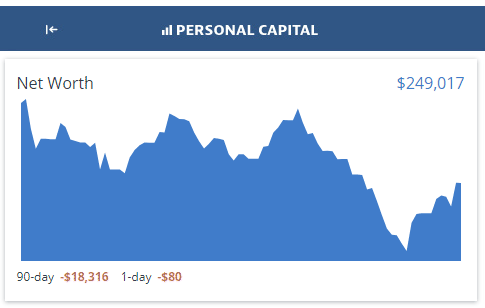

A noticeable dropoff to end December, plus a $5,000 or so uptick due solely to this update not being written until a few days through January.

Ouch. December was a brutal month in the market. The S&P 500 fell nearly 10% in one month, which is pretty nuts. The decline was enough to push the overall stock market into negative territory for the year, for the first time since 2008. Check out this graph of the S&P 500 from January 1 to December 31, 2018.

Overall, the stock market closed down roughly 6% for the 2018 year.

And obviously, my portfolio, which is concentrated almost entirely in stocks, took a beating on the month too, wiping out $14,000 of net worth in 31 days. (Technically, 35 days, since I’m writing this after the market’s Friday closing bell, heading into the first weekend of January.)

What do I think of all this? Well, it kinda comes with the territory, if we’re being honest. The market has returned 7% per year on average, since the early 1900s. But nobody’s saying that 7% percent has been a smooth ride. There’s been months, and even years, when the market is down double digits like it’s nothing.

For young people still in the accumulation stage, what separates the true wealth builders from the posers is an ability to ride out the waves, keep investing while everyone else is panicking, and coming out the other side even richer.

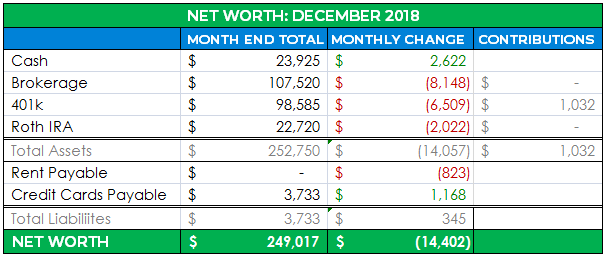

Cash: $23,925 (+$2,622)

To repeat a broken record from the past few months, my cash position has been steadily climbing ever since I decided to save up for the down payment on a rental property.

The unintended benefit is that I accidentally find myself in a good position if the market continues to decline. We’re not anywhere near true recession prices, like the 2008 days, but if prices fall another 20-30%, I’ll be tempted to abandoned my rental property plans and just pour cash into the market instead. Trying to “time the bottom” is not what I’m going for, but we’ll see.

Brokerage: $107,668 ($8,148)

A rough 7% drop in my brokerage account, which mirrors the nearly double digit drop in the overall market. My target brokerage breakdown remains:

- 50% in Vanguard’s Total Stock Market Index Fund.

- 30% in a mixture of Vanguard growth, value, and bond ETFs.

- 20% in individual stocks, back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

But with the big declines, it’s possible this position is out of whack. On the to-do list for next month, reevaluate my holdings and see if my current breakdown matches my target, and adjust accordingly.

401(k): $95,585 ($6,509)

The only reason this decline didn’t match my brokerage decline is thanks to $1,000 of automatic contributions and employer matching during the month. My 401k target remains:

- 50% in Large Cap US Stock Index Funds.

- 35% in Small Cap US Stock Index Funds.

- 15% in International Stock Index Funds.

Roth IRA: $22,720 ($2,022)

I still haven’t contributed to my Roth IRA in 2018, and this is just getting embarrassing.

You have until April 2019 to make 2018 Roth contributions, and I have no idea what’s holding me back. Procrastination mostly, I’d guess. I need to just pull the trigger, especially when I’ve got over $20K just sitting in my cash account.

It’s sort of interesting, and mostly disappointing, to see that the diversification benefits of this account aren’t really holding up. My Roth IRA is invested entirely in Vanguard’s REIT index fund, which tracks the real estate market, which hypothetically should act somewhat counter to the overall stock market.

Obviously, that wasn’t the case in December 2018, but it’s hard to analyze things in a one month vacuum.

Rent Payable: $0 ($823)

A rare $0, just because I’m writing this post in the first few days of January, so I’ve already paid up my $823 December obligation.

For the newer readers, I live in Minneapolis in a house with my girlfriend. This cost represents my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.)

Credit Cards Payable: $3,733 (+$1,168)

A whopper of a credit card bill, but that doesn’t tell the whole story. During the first days of the New Year, I put down a $1,500 deposit for a ski trip with friends, which I’ll get reimbursed within the next two months. I’ve also got a small amount of reimbursable work expenses on here, so let’s check out the true December spending report:

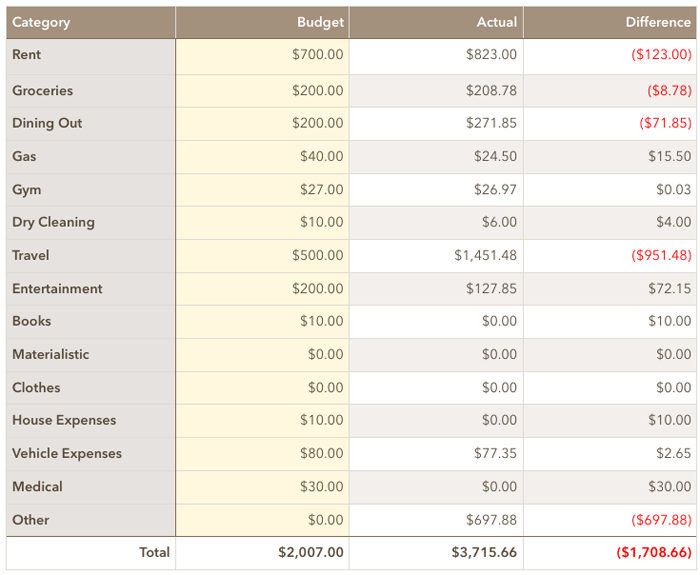

Total December Spending: $3,715.66

Whoa! The spending report doesn’t make things any prettier. Let’s find the culprits:

Groceries: $209

Pretty standard stuff here. Stay on the lookout for a detailed post about my grocery spending this month.

Dining Out: $272

Definitely a little over budget here. Between the travel and laziness, I defaulted to dinners out a little more than usual, including a $75 sushi splurge.

Travel: $1,451

Culprit. Found.

Protip: If you want to have a frugal vacation, DO NOT go to New York City.

Overall, I’d say we did it about as cheap as possible, staying at a cheap hostel and not going too nuts with the entertainment.

That said, a trip or two to the bars, complete with seventeen dollar cocktails, plus your average entree at a sit-down place running $35+, and this vacation added up quickly.

Quite the contrast to October’s $300-all-in trip to Zion National Park, which ironically, I found to be a better overall vacation anyway. Guess you don’t always get what you pay for, at least when it comes to vacations.

This bill also included a $250+ roundtrip flight to visit family in Texas over the holidays.

Other: $698

Second culprit found. Included in this category was $70 of pet medications and $600+ of Christmas gifts and donations for friends, family, and charities.

Strangely, or maybe not so strangely, I feel the least guilty about this category. Monetarily, I had a pretty fantastic year in 2018, so it felt good to give something back.

How was your December?

For most people, December is typically the spendiest month of the year. Hopefully, you didn’t throw caution to the wind quite like I did, although speaking from experience, I can’t say I’d blame you too much if you did.

Happy New Year, everyone! See you in a few days!

The market sure was a grinch this month! Oh well, better to let the market do what it does and focus on savings rate instead.

I share the same feelings as you when going to NYC. While it can be fun, I always find myself relieved when it’s time to head back home. My idea of a vacation is getting out of the big city!

Haha!

“How the Market Stole Christmas”

Hey money wizard, sound like your December was almost as expensive as mine! I went to ecuador for 8 days and even though its cheap when you are there it isn’t to get there!

Quick note on correleations. REITs and the total market have a .66 monthly correlation over the last decade so it should be expected to have them up or down in line with the broader market albeit to varying magnitudes reletive to stocks. REITS never can truly replace bonds from a diversification perspective in a portfolio but who wants lame old bonds.

How was Ecuador? Sounds awesome.

True about the correlation, I should probably reign in my expectations. Although 0.66 is still a lot less correlated than other options which get touted for their diversification benefits.

Ecuador was fantastic – finally learned to surf. Traveled to Montanita, Salinas, Guayaquil and Quito. Was with a local so it was even better. New Years party on the beach was pretty cool too.

Yeah totally less correlated but definitely still not a replacement for bonds but i think for someone like you who is all equity its better than being just international and US – its much less correlated than international to US. Interesting to note that the correlation drops to .26 on an annual basis. My take would be “when stocks are getting slaughtered in the short term – not a great diversifier but an ok diversifier on an annual basis.

Not sure if you have seen it before but this tool is sweet and totally free.

https://www.portfoliovisualizer.com/asset-class-correlations

That sounds awesome. Ecuador is on the bucket list, because the Galapagos are on the bucket list.

Thanks for the link!

Nice update Money Wizard!

Yeah, December was rough for us too. Our net worth jumped around like popcorn in a hot pan, but has since recovered considerably.

No problem though, volatility doesn’t bother me much. We still earn most of our income from dividends, which come in regardless of what the market is doing.

Thanks Mr. Tako! Definitely envious of your dividend position. Hope to get there one day!

Markets rise, markets fall, ’twas ever thus…

What’s your approach when it comes to geographic diversification of your portfolio?

When it comes to calculating net worth, I think your numbers will be accurate for now as (hopefully) the realisable price and recorded value of stocks will remain close at any given time. One issue I’m grappling with its how to reliably value illiquid assets, such as property, or retirement benefits, when calculating net worth. Do you have a preferred method for valuing your rental property once you’ve made a purchase?

Happy New Year.

HH

Outside of just calculating a property’s equity, I give my opinion on valuing illiquid assets in this post.

Happy New Year to you too!

Would you mind sharing what those individual stocks are that you’re still holding from your “I can beat the market” days? Thanks…

For those who have property taxes or kids (maybe other type expenses depending on where you live), we found a great stress free way to lighten the load is to have a separate account where we stash money each month for Christmas gifts($80-100/month) and property taxes ($50-70/month). Makes it much less stressful to pull money out of the bag in December or January and write checks or pay credit card bills when you have a chunk of change sitting there waiting. Weekly auto drafts make it easy to keep the amount each week low.

I like this strategy. We do something similar with our “home maintenance fund” which we use to pay for property taxes, insurance, and miscellaneous repairs.

Ever think of doing cost benefit analysis on moving out of individual stocks? Good lessons need repeating. But maybe putting them in your roth is better. Less worry, small gains off set by tax deduction, can be stretched out over multiple years. Just a thought.

I did one a while back and decided that it’d be better just to let it ride than to pay the capital gains involved in moving to an index fund. I’ve been meaning to double check that math though.

You’d think REITs would perform differently compared to the broad market, but really, broad REIT indexes perform like high dividend yield stock indexes. I started scaling back into the market in recent weeks and I’ve decided to start buying REITs for the first time only because I found this etf REZ which specializes in residential and medical REITs. I don’t think I need any more exposure to corporate america than through their stocks, especially given the retail apocalypse and it’s affect on REITs. Since I don’t own a home, I think residential REITs are a better option for me. I am also buying a small amount of IAU. Bonds, metals, commodities, and real estate not associated with the stocks you already own are the best ways to get diversification.

I have similar feelings towards international stocks as some REIT indexes. They just don’t seem worth the trouble when I could just buy a total US stock market index and call it a day. Bogle himself has said that investors don’t need to hold international stocks. I believe in ‘murica and don’t necessarily want to just invest in every country in the world regardless of their level of corruption, debt levels, or culture.

As a former NYC resident I will say that there are ways to enjoy the city cheaply – taking the free Staten Island ferry to see the Statue of Liberty vs. the official tour, walking over the Brooklyn Bridge and catching the skyline from the Williamsburg waterfront are both totally free. Instead of taking a harbor cruise you can take the ferry between Manhattan & Brooklyn for more like $7. As long as you don’t go up to the top of the WTC, Empire State Building or 30 Rock you’re saving tons 🙂 Plus there are plenty of $5 comedy shows, etc. I’m curious if you do a lot of “travel hacking” as part of your savings e.g. getting free points for airline & hotels?

Great update! For whatever reason, the one sentence on Zion really caught my eye. Cannot agree more with you comment on Zion National Park and that you don’t always get what you pay for in terms of vacation. While any vacation is great, it’s hard to justify expensive trips to nice resorts and high cost cities, when I’m just as happy (if not more happy) out exploring National Parks and Public Land.

I had a similar trip to Zion in 2016 (cheap flight to Vegas, cheap rental car to Zion and cheap air bnb). It was my favorite trip I’ve taken so far and I look forward to replicating it at other public hands across the US!