Hey Money Wizards,

It’s time for the second net worth update of 2022!

I’ll keep my usual intro short – I’m trying to leave my office job by age 35 with around a $1 million portfolio.

I’m currently 31, so let’s check on the progress!

Life Update: February 2022

The big event of February was a week-long escape from Minnesota to Florida to visit family.

Palm trees, warm weather, and lots of sunshine. What’s not to love!?

We even grabbed some kayaks and paddled the mangroves. What an experience!

Once back in Minnesota, I succumbed to the travel bug and quickly booked multiple ski trips for March. To adventure!

Net Worth Update: February 2022

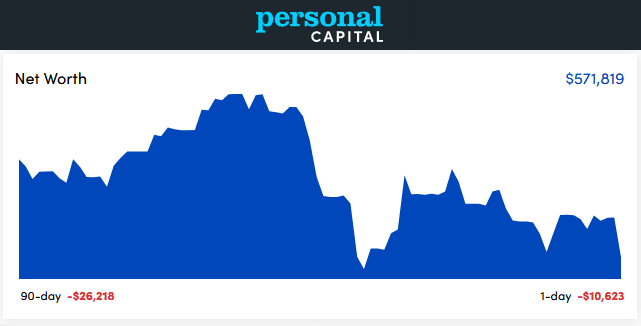

As far as the portfolio, it moved forcefully down and to the right:

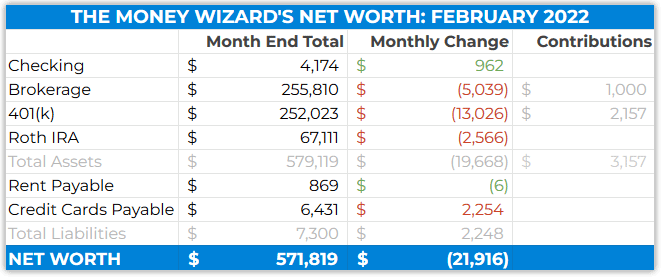

And the detailed spreadsheet that I keep:

I described January as a brutal month in the market, and February was even more brutal!

It’s mostly due to Putin invading Ukraine, which has the markets in a tailspin.

I’d be more concerned with the drop to my portfolio if I wasn’t saving so aggressively. But when you’re actively buying over $30,000 worth of stocks per year, then big market corrections like this just mean you’re getting a better deal.

Hopefully, by the time I’m ready to slow my roll on the money stacking and transition more to an early retirement setup, buying those stocks at cheaper prices will put me in an even better position. Fingers crossed!

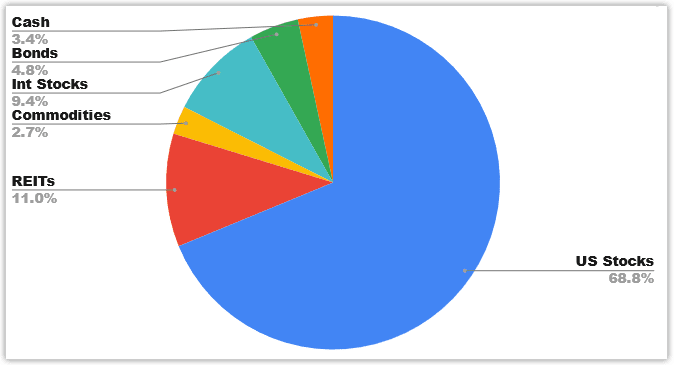

Portfolio Allocation

Checking Account: $4,174 (+$926)

I did my usual $1,000 transfer from here to my brokerage, thanks to my 3 minute automatic investing strategy.

Otherwise, not a lot of action here.

Brokerage: $255,810 ($5,039)

Actually not quite as terrible of a drop as I expected, considering the state of things.

401(k): $252,023 ($13,026)

The second month in a row that my 401(k) dropped exactly $13,000.

It makes sense that the 401(k) dropped so much more than the brokerage, because my 401k has a higher percentage of international stocks. Considering the invasion going on in Eastern Europe, it’s not surprising that international stocks will get hammered for a while.

BUT, I hold those international funds because even though I know they are riskier, my timeline for 401(k) money is so much longer. So hopefully, things sort themselves out when I’m ready to dip into this fund in 25-30 more years.

Roth IRA: $67,111 ($2,556)

Also has a higher percentage of international stocks. Although the biggest holding is Vanguard’s Real Estate Index Fund, which held up much better and helped cushion the blow.

Rent Payable: $869 ($6)

For newer readers, I share a house that was purchased by my now-wife. This number is my half of the mortgage, utilities, and a couple hundred dollars a month that we throw into a “home maintenance fund” to help prep for any big projects.

Credit Cards Payable: $6,431 (+$2,254)

The credit card went up a bunch because of the previously mentioned travel bug, and the spending spree of future trips that I booked.

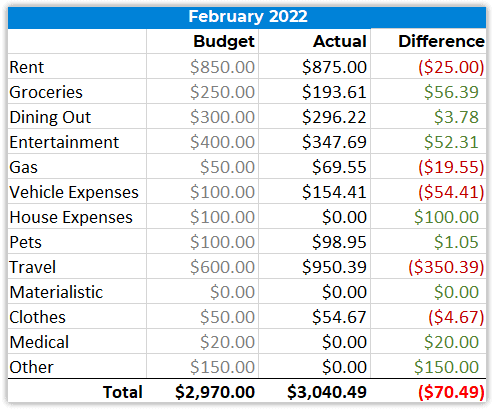

For February, the actual spending was:

Total Spending February 2022: $3,040

Entertainment: $348

This category is ticking upwards because as a married couple, it now usually includes both of our tickets.

In February, that included a winter beer tasting, one day at a local ski hill, and a couple trips to bars, distilleries, and breweries before dinner.

Travel: $950

Even with a free place to stay (family) the Florida trip made an impact, thanks to $500 worth of flights and an equal amount of vacation spending once there.

Again, this now includes both mine and Lady Money Wizard’s flight and spending costs, since we’re slowly but surely combining finances.

Vehicle Expense: $155

Included an extra $55 this month, since my annual Triple A membership kicked in.

Come to think of it, I’m pretty sure my car insurance includes roadside assistance, so I’m not really sure what I’m paying for here…

How was your February?

Hope you’re keeping your head up in a down market!

Remember, the more prices fall, the better deal you’re getting on your current investments!

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Tough month. But I like that sliver of commodities in your net worth! Huge right now!

That’s what they’re there for! Nice to see some bit of diversification working.

Were you down in St. Pete/Clearwater doing the kayak tour of the mangroves? I just did that a few weeks ago. It’s so much fun!

Yep, definitely an amazing little ecosystem!

That 1 day change 💀👀 – just another day in the stock market. Never a dull moment – as you said, everything’s on sale at the moment. Fill your boots 😛

Happy sale shopping 😁

HH

Haha, it looks worse than it really was, since a lot of times Personal Capital updates in a bulk whenever I got a while without logging in.

Crazy times. Quick note that made me chuckle:

“As far as the portfolio, it moved forcefully down and to the left”

I don’t think charts go left very often, I believe you mean down and to the right haha.

Stu

Ha, thanks for the catch!

Is a ski trip to CO on the travel list?

Idaho and Salt Lake City right now, but I may try to sneak in another to Colorado before the season is over.

When you said you buy 30,000 worth of stocks per year do you buy individual stocks or is it a fund? What do you buy through?

https://mymoneywizard.com/should-you-trade-individual-stocks/

Do you do any travel hacking with credit card rewards? Check out travelmiles101.com. I haven’t paid for a flight in a long time! Also, definitely consider cancelling one of your roadside assistance plans. I also realized I had doubled up on that.

I spent the latter half of 2020 and much of 2021 saving for a house down payment, and was also involved in a company sale mid-2021 that, while I received a modest earn out, resulted in me leaving that job (with a severance). I spent summer 2021 underemployed – keeping that down payment and earn out money in cash (in case it took a long while to find a suitable new job – I’m supporting a family of four), PAINFULLY watching the markets rise, but investing only partially.

I landed a fantastic new job in late 2021 and am closing on a house next week which cost significantly less than I had saved for. Along with my severance, I managed to freelance my way between jobs – not having to touch any of my saved cash (very fortunate!). I’ve been sitting on waaay too much cash, so I’ve been pouring money into the markets, maxing out things left and right for 2021 and 2022 – this stock market crash feels like a second chance for me!

Are you concerned at all that your current net worth is smaller now than it was 6 months ago? (and that’s even without factoring in the really high inflation!) For a month or even a few months that would be ok, but half a year is not a trivial amount of time, and doesn’t it make it feel at least a bit demotivating – like all that saving and investing is just going nowhere?