Hey all!

Welcome to the first update of 2019! Doesn’t it feel like a big fresh start?

Maybe so, and maybe not. Because around here, we’re holding the popular format stable. Every month, I’ll share an update on my goal of total financial freedom. For me, that means working and saving towards a roughly $1 million portfolio by age 37.

So far, I’m 28 years old, with a net worth of… well, you’ll have to read on to find out!

Life Update: January 2019

Weighed down by a Christmas and New Year’s season hangover, I begrudgingly dragged myself back to work at the beginning of January.

Things weren’t so bad though, because lingering in the back of my mind was a soon-to-be trip down to Florida.

A January trip to Florida to visit extended family has become a bit of an annual traditional for Lady Money Wizard and I. We find ourselves some dirt cheap Spirit Airlines tickets (making sure to avoid the ridiculous passenger usage fee) and before we know it, we’re sitting seaside, munching on delicious jumbo shrimp and admiring a beautiful ocean sunset.

I’ve grown to really love beach trips. They’re surprisingly budget friendly (especially when you have the luxury of mooching a free place off somebody you know). But more so, they seem to inspire an appreciation for the simple things.

If you successfully dodge the beachside tourist trap and t-shirt shop, there’s nothing quite like an afternoon spent strolling through the sand, admiring the waves, or reading a good book in a beach chair.

It’s just so peaceful, and I find myself completely relaxed after a couple days. Not to mention, thawed out from Minnesota’s brutally cold winters.

Speaking of which, back in the Twin Cities, I took the opportunity of an unexpected snow storm to get tuned up for my favorite time of year. Ski season!!!

I had a blast reuniting with the snow and my ski gear, and I can’t wait for my two big annual ski trips in February and March of this year. Stay tuned in the coming months for updates from Jackson Hole, Wyoming and Big Sky, Montana!

Oh, and to close out the month, I cashed in a Groupon gift to one of the most unique activities I’ve ever done in my life… a flying trapeze class!

Net Worth Update: January 2019

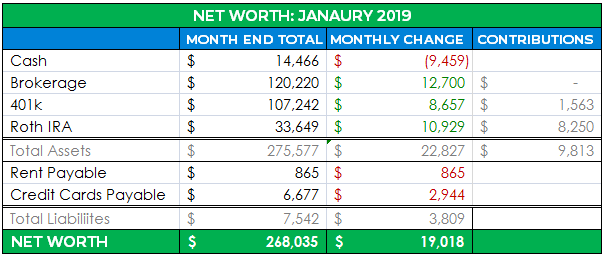

Detailed tracking from Personal Capital’s awesome dashboard.

Detailed tracking from Personal Capital’s awesome dashboard.And the details…

Talk about a month! After a brutal December to close out 2018, my portfolio swung the other way to start 2019. All in all, my portfolio grew $19,000 during January, or about 7.6% in one month.

As usual, this was pushed along by a noticeable rally in the stock market. The S&P 500 increased 7.9% over the same time period, one of the largest single month gains in over 30 years. Obviously, these gains dwarfed my own, relatively puny efforts at earning a salary and saving as much of it as I could.

Which brings up an interesting point. The fact these updates are beginning to be so heavily influenced by the movement of the markets is a sign of two things:

- The bananas crazy stock market volatility we’ve seen over the past few months.

- But perhaps more interesting, the start of something amazing – how your money can work so much harder than you can.

While I went to work every day in the month of January to stockpile cash, all those efforts were dwarfed by the years of hardcore grinding and saving that I’ve already done.

Because I had a mass of momentum behind me, and that mass can work a whole lot harder than I can. Seeing how my past effort continues to pay off is crazy motivating, and it inspires me to keep grinding and saving.

Cash: $14,466 ($9,459)

We have movement. I repeat… we have movement.

After sitting on a large cash pile for a year, I made two big moves in January:

- I plopped down $2,500 into my Roth IRA for the 2018 contributions.

- I moved another $6,000 into my Roth IRA to represent 2019 contributions. Sort of…

More on both of these in the Roth IRA section.

The last $1,200 is due to paying an unusually large credit card bill for a group ski trip, which my ski buddies will reimburse me for come February and March.

Brokerage: $120,220 (+$12,700)

Yes, a FIVE FIGURE swing from the market rally. Just goes to show you how stressing over monthly declines isn’t worth your effort.

Still on my to-do list: a spot-check to see whether my current holdings match my target allocation, which has historically been:

- 50% in Vanguard’s Total Stock Market Index Fund.

- 30% in a mixture of Vanguard growth, value, and bond ETFs.

- 20% in individual stocks, back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

401(k): $107,242 (+$8,657)

The 401k is back over six figures, thanks in part to the rare and elusive three paycheck month.

I wish every month was a three paycheck month…

No changes to my 401k target, which includes:

- 50% in Large Cap US Stock Index Funds.

- 35% in Small Cap US Stock Index Funds.

- 15% in International Stock Index Funds.

Roth IRA: $33,649 (+$10,929)

Yes, that’s $8,500 of contributions to the Roth in January. Go big or go home!

That $8,500 finally includes $2,500 worth of 2018 contributions into Vanguard’s REIT index fund. Yes, after dragging my feet for a whole year and failing one of last year’s resolutions, I finally contributed something to my Roth for the 2018 tax year.

Time for a party??

You’re allowed $5,500 of Roth contributions in 2018, and you have until April 2019 to make them. So, I’ll contribute the remaining $3,000 in February. My reasoning being that Vanguard doesn’t charge purchase fees on their mutual funds, so it diversifies my entrance risk a little bit. The only cost to this strategy is an opportunity cost of one month of missed returns. Which could be positive or negative, depending on the market.

This thought of opportunity costs reminded me of how much silent money I lost by waiting a year before making my 2018 Roth contributions, and suddenly I was struck with an epiphany.

With The Fed steadily raising interest rates over the past several quarters, certain savings accounts and money market accounts have begun offering surprisingly appealing rates of return. Usually, capturing those rates involves shopping around for a bank account paying more than a few cents of interest.

But Vanguard has index funds for everything these days, including Money Market funds. VFMXX is one such index fund, and it’s now paying out an attractive 2.32% interest rate.

Even better, using strategies that are way beyond the scope of this net worth update, Vanguard manages its share price to always be $1. This means that unlike a typical index fund, your investment value shouldn’t ever fluctuate. Instead, VFMXX and similar funds act nearly identical to a savings account or money market account.

For all those reasons, I decided to make a move in January and store all $6,000 of 2019 eligible Roth contributions in VFMXX.

Every month for the next six months, I’ll move $1,000 from VFMXX to the higher yielding (and slightly riskier) Vanguard REIT Index Fund. This basically reduces my entrance risk with a dollar cost strategy, while earning 2.32% on cash that otherwise wouldn’t have made a cent.

And if I do need that $6,000 for an unexpected emergency or even the fading rental property dream, I can always hack my Roth IRA.

Rent Payable: $865 (+$865)

The big increase is a lie due to timing of when I wrote December’s report.

For the newer readers, I live in Minneapolis in a house with my girlfriend. This cost represents my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.)

Credit Cards Payable: $6,677 (+$2,944)

Apparently, fronting the money for two vacations featuring 11 dudes partaking in one of the world’s most expensive hobbies isn’t cheap. And I’ve got the credit card bill to prove it.

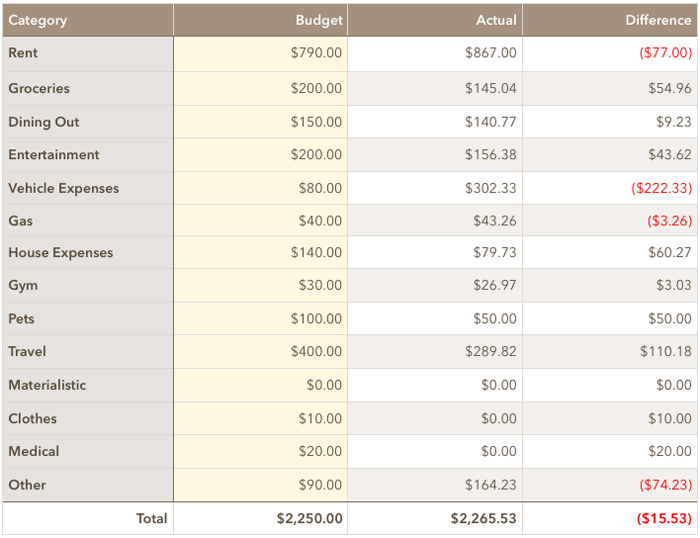

Let’s take a more accurate look at my spending in January:

Total January Spending: $2,265

Groceries: $145

Not bad, a little under budget here.

Dining Out: $141

Hey, I’m a little impressed with myself! I set out to spend less money dining out in 2019, and I don’t think I’ve had a monthly total this low in years.

Vehicle Expenses: $302

In the great state of Minnesota, you pay the government $225 a year for the privilege of owning a cheap Mazda 3.

I also paid my usual $77 for monthly car insurance.

Travel: $290

The previously mentioned extended weekend to Florida. It turns out, travel’s cheap when you have a free place to stay and borderline-free flights.

Pets: $50

My half of a dog sitter for The Money Pup. We found a relatively cheap one on Rover for the Florida trip.

Entertainment: $156

A night at the breweries, a day of local skiing, league fees for my upcoming Spring Softball season, and about $40 of drinks at a charity Gala event I was invited to.

Oh, and how could I forget, the free entertainment of the flying trapeze gift!

Other: $164

At the charity gala, I found myself with my very own auction number for the first time in my life. I gotta tell ya, raising that sign to the fast-paced bellows of a live auctioneer was quite the thrill. Maybe a little too much of a thrill, and I ended up donating a cool $100 to a good cause.

How was your start to the New Year?

A new year is a fresh slate, and a time to forget about the troubles of the past and instead take action on meeting your goals.

How did your 2019 start?

PS – For newer readers, if you want to easily track your net worth like I do, monitor your spending, and double check you’re not getting overcharged on fees, I can’t recommend Personal Capital enough.

Related Articles:

Whoops, just noticed two minor mistakes in the detailed net worth table.

1) I made $8,500 of Roth IRA contributions, not $8,250.

2) Looks like the total net worth in the table is off by $21. I’m guessing Personal Capital updated my Net Worth after I penned the detailed table, or I made a $21 typo in one of the categories.

Great January update!

Couple of questions:

1) Why do you put your Roth IRA contributions into Vanguard’s REIT index fund instead of the Total Stock Market fund like you do with your brokerage account?

2) Why are you putting money into VMFXX (Federal Money Market Fund) instead of VMRXX (Prime Money Market Fund)? It appears that VMRXX pays out at 2.56% interest rate compared to 2.34% that VMRXX pays out at.

Thanks!

1) Diversification. REITs are also taxed heavier than traditional index funds, so it makes sense to me to hold it in a tax protected account.

2) I plan on writing about this more in a dedicated post about holding cash. It’s personal preference, but over half of VMRXX is invested into foreign countries. If I’m look for an essentially risk-free asset, I trust the US more. Not worth the ~$10 difference in interest payments, IMO.

How on earth did you only spend $145 on groceries for an entire month?! I would love to read a blog post about it.

Got one almost finished about that! Check back in a week or two.

Obviously no hungry teenage boys at his house!!

What is the reason for the ‘fading’ rental property dream? Have you decided against that as an investment approach.

One point I’d make about your net worth is that as its so heavily in equities then it may be volitile (able to move down / up very quickly) but it’s also realistic. One issue that I have when looking at net worth which contains real estate assets is trying to be sure that ‘hope’ value hasn’t crept in. E.g. properties being valued at what the owner hopes to achieve instead of what buyers in the market are currently willing to pay.

HH

Cold feet I suppose, mixed with the realization of how horribly unhandy I am, and how little interest I have to learn.

I talk about it a bit in the home ownership update here:

https://mymoneywizard.com/year-in-review-2018-resolutions/

Credit Card expenses need to be curbed..and, hope you are earning cash/points for the CC expenses.

Well done! It’s always great to see when the investment gains start making a larger impact than your W-2 job itself. Means you must be doing something right 🙂

Are you still interested in getting a real estate property or are you less likely to do that now? I am saving up for one right now, though I keep going back and forth about whether I will actually ever pull the trigger on it, and if my money is just better off in the stock market. TBD, but just curious as to your situation and thoughts.

Hey, great article. I’m curious if you are you using VNQ or VGSIX? When do they pay dividends (I’m guessing quarterly).

I had some interest in this fund until I read this, wondering what your experience has been and whether this article has valid points:

http://stonybrooksecurities.com/vnq-dividend-reit-etf/

Thanks in advance

VNQ and VGSIX are the same. One is the ETF version and the other is the mutual fund. (See my ETF vs. Mutual Fund article)

About the article – meh… His concerns about the tax rate are common knowledge, and also the main reason I hold VGSIX in my tax-sheltered Roth. Because Roth’s grow and are withdrawn tax free, I’ll never pay a cent of the taxes he’s talking about.

His other major concern is its about liquidity in the options market, not the stock market. Options are, in my opinion, a speculative strategy that’s way too close to day trading for my comfort. So that doesn’t apply.

He’s also comparing VGSIX strictly to other stocks, which is a little misguided IMO since REITs are a totally different asset class.

I guess my main concern brought up by the article is the section titled “Does the VNQ Dividend Put it Over the Hump?”

I realize he’s talking about options but have you been able to notice the dividend is really 4% or more?

Yeah, the 4% quoted by Yahoo is probably a little too high as of today, but I’m not sure when that was originally written. Vanguard’s note on the dividend yield says this:

“Since Vanguard cannot know the taxability of the portfolio’s distributions during the year, unadjusted and adjusted effective yields are calculated.

The current unadjusted effective yield is 3.73% as of 12/31/2018, which is based on the full amount of REIT distributions (dividend income, as well as return of capital and capital gain).

The current adjusted effective yield is 2.45% as of 12/31/2018. The adjusted yield reflects a reduction in the income included in the yield based on the average return of capital and capital gain distributions received from the fund’s REIT investments for the past 2 calendar years.(These percentages are 25.16% for 2017 and 40.94% for 2016.)”

In a tax advantaged account, like a Roth, the unadjusted yield (3.7%) is more accurate. Held in a taxable account, the adjusted yield (2.5%) is more accurate. If you really want to get into the weeds, here’s a good Bogleheads thread about it.

Actually, the more I read that section of the guy’s article, the more I don’t know what he’s talking about. I’m not sure he does either.

He seems to be getting quarterly vs. annual dividends confused. Yahoo finance, Vanguard, and the SEC quote yields on an annual basis. He seems to expect VNQ to pay out 4% quarterly, which isn’t how dividends work. So, we’d expect the quarterly dividends to be about 1% a quarter, which is what his chart averages out to.

Also, this quote of his: “Sometimes the company makes a lot of money; sometimes it doesn’t. This is why the dividend payments are very inconsistent. This is also why we cannot trust what the dividend yield says because there is no knowing ahead of time when the REIT is going to do well or not.” Applies to dividend paying stocks and REITs equally. I’d argue REIT dividends are actually more stable than most companies, since rental payments are usually steadier than say, iPhone sales.

Really appreciate your thoughtful responses. I just sold a house and have some equity to play with. I want it decently liquid, but still want good returns. I use Ally bank and get 2.2% but am looking into REITs, crowdfunded real estate, Worthy Bonds, etc.

I am interested in having this fund in a Roth as you do, maybe in a taxable account, but still weighing my options. I’ve read all of your posts, and MMM’s, and have a comparable savings rate and am doing as much tax deferred stuff as possible, but still looking for the best thing to do in a taxable account.

Keep up the good work.

Quick question… can I fund an HSA account instead of a Roth Ira? I feel after a certain age, the HSA become a roth anyway and having an HSA could pay for any medical expenses in my old age. All of my HSA money is invested and I am only 28 years old. Thanks

You can fund both. In my correct order of investing your money post:

https://mymoneywizard.com/correct-order-investments/

I actually put the HSA before an IRA.

Sorry if you’ve answered this before, seeing that your 401k is not in a target retirement fund, do you recommend not investing in a target retirement fund for a 401k? I’m asking in terms of my Roth 401k that is already invested in a target retirement fund