Welcome to the first update of the new year!

A fresh start!

Before we get into all the juicy details, you know I’ve gotta share the spiel!

Every month I track my progress to a goal net worth of around $1 million, and hopefully… an early exit from my white collar office job. I’m currently 30 and hoping to retire by age 35. Let’s see the latest progress.

*As always, I am not an expert or financial advisor, so nothing on this site should be considered financial advice. These are just like, my opinions, man. Always do you own research, and always abide by The Dude.

Life Update: January 2020

You know times are getting tough when your winter vacation is to… Iowa?

Haha, I kid! I kid! (Are the Iowans still here?)

In all seriousness, Lady Money Wizard and I found an awesome cabin in Decorah, IA.

It was an easy sell, since apparently that little small town happens to have one of the best breweries in the country. (Toppling Goliath, for any fans out there!)

We had a great time and were mostly shocked at the price of life in small town Iowa. Filet Mignon dinner for $20 bucks? Winery tasting for $6 a bottle???

For anyone who’s really fed up with the rat race, I think I’ve got your answer. Just move to Iowa! You might not have to work another day in your life.

It’s always nice to know you’ve got options!

Back in Minnesota, winter was in full swing, so we did winter stuff. Snow shoeing, frigid dog walks, tending to our broken furnace, you know… the usual. 🙂

Otherwise, there’s not a whole lot to discuss, so we’ll jump right into the numbers.

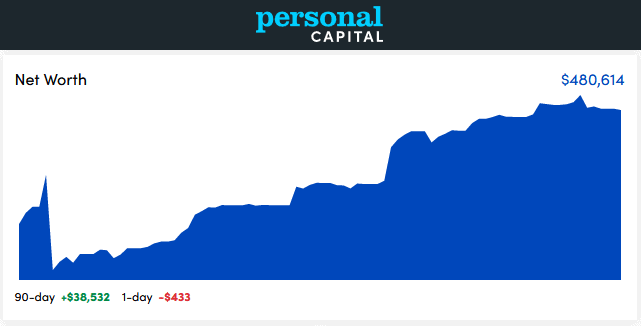

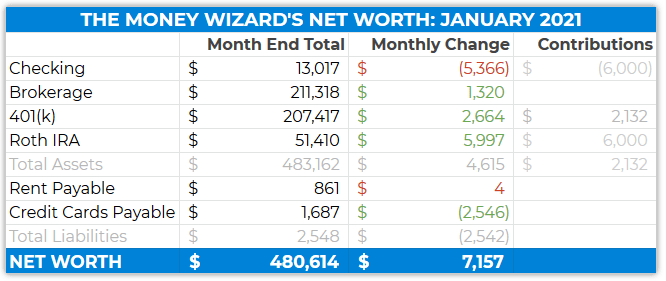

Net Worth Update: January 2021

In case your eyes have a tendency to glaze over at the sight of a spreadsheet (we’ve all been there) the net worth went up a modest 1.5% over the month, which totals about $7K given the size of my portfolio.

That’s an amount that the hardcore gamblers on r/wallstreetbets wouldn’t bat an eye over, but I’ll still take it.

Plus, we’re still inching oh-so-close to the half-a-millionaire mark! One of these days!

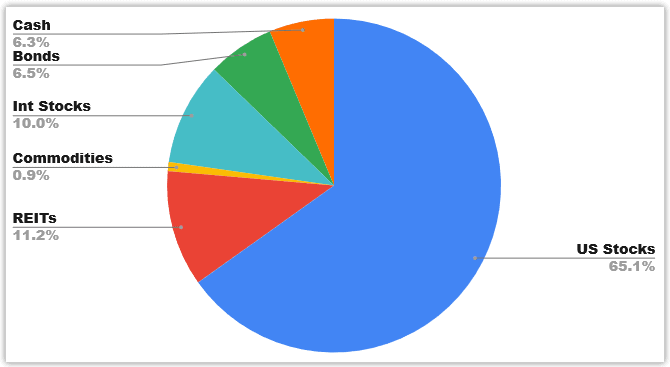

Portfolio Allocation: January 2021

Ohhh, how oddly satisfying that the international stock exposure hit exactly 10%? I’d previously said that was my long term goal, which just makes the happy accident even better. Of course, it was helped along by some portfolio changes that I’ll talk about below…

Checking Account: $13,017 ($5,366)

The big news is that a new year means a new chance to max out retirement accounts.

And for the first time since forever, I finally didn’t drag my feet on this one! In January, I transferred the full IRS-allowed $6,000 from my checking account into my Roth IRA.

Brokerage: $211,318 (+$1,320)

No contributions this month, so this was just market movement. This segment of the portfolio mirrored the S&P500 pretty closely (both went up by about half a percent) which makes sense considering the vast majority of this portfolio is S&P 500 index funds.

To get specific, the brokerage account is roughly:

- Vanguard Total Stock Market Index Fund (VTSAX): $136,000

- Vanguard Total Bond Market Index Fund (VBTLX): $28,000

- Vanguard Money Market Fund (VMFXX): $14,000

- Gold & Silver ETFs: $4,000

The only portion I’m not super excited about lately is the VMFXX Money Market fund. A reader pointed out that with The Fed slashing interest rates, this fund no longer pays the 1-2% it used to and instead is much closer to 0%. And he’s right. With an expense ratio of 0.11%, if interest rates don’t change in the near future, I’m likely losing a few pennies on this investment each year.

Oh well. I consider the main purpose of that investment to be diversification – mainly some ammo in case the market tanks and I need to deploy cash to scoop up bargain investments.

And if that never happens? Well then having a $14,000 emergency fund isn’t the worst thing in the world, even though I think they’re overrated.

401(k) : $207,417 (+$2,664)

I max out my 401(k) each year. With no changes in the IRS rules in 2021 (that maximum is still $19,500 per year) my monthly contributions won’t change this year.

Those contributions are still broken down like this:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $51,410 (+$5,997)

Finally, I did it! I didn’t wait half a year before maxing out the Roth IRA!

In previous years, I’d transfer the money to the Roth and then slowly dollar cost average into REITs or International Stocks.

This year, in the spirit of YOLO’ing wallstreetbets style, I threw the whole $6,000 right into Vanguard’s International Stock Market fund.

That might sound a little crazy, but it will give me an extra few months of compound interest to get to work. Plus, a lot of research shows that lump sum investing rather than a slow deployment (if you have the cash) usually outperforms anyway.

So, the Roth now has:

- Vanguard REIT Index Fund (VGSLX): $38,500

- Vanguard International Stock Index Fund (VTIAX): $13,000

PS – here’s why I like VTIAX more than VFWAX.

Rent Payable: $861 (+$4)

Nothing exciting here. Still splitting the mortgage on a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $1,687 ($2,546)

Always a lagging indicator, as we’re about to see…

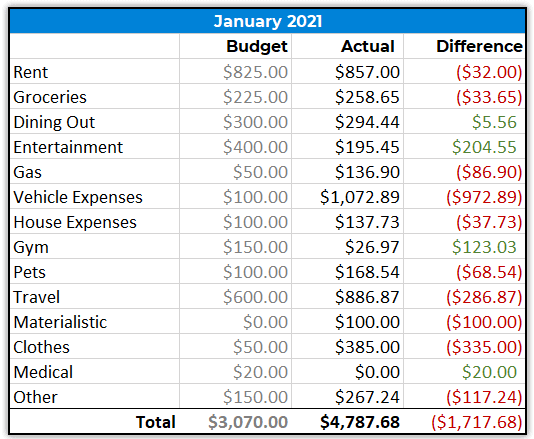

Total January Spending: $4,787

^^My actual face when I tallied up this month’s spending.

I think this is the hardest I’ve ever blown the budget!

So. Much. Red. Almost every category is a bloodbath!

PS – If you want that spending tracker spreadsheet for yourself, don’t forget to sign up for my email list. I’ll be releasing it soon!

Rent: $857

Winter is always more expensive here because of heating costs. So far so good…

Groceries: $258

I got sick of people breathing their COVID-breath down my neck at the grocery store, so I started dabbling in Amazon grocery delivery.

My amateur research says it’s about 10-20% pricier than bargain stores like Aldi, but still definitely something I could get used to. (Especially at a time when I spend my whole grocery trip wondering if the guy who thinks 1.5 feet equals 6 feet uses the same logic for the rest of his life.)

Dining Out: $295

One of the only below-budget categories, and by a whopping $5, haha! Not looking great…

Entertainment: $195

Mostly spluring on some board games. #COVIDLife

Gas: $137

Higher than usual because of the trip to Iowa.

Vehicle Expenses: $1,073

Aaand the big one. Doing a little unnecessary winter driving, your boy Money Wizard found a nice, slick patch of ice and slid The Mazda 3 right into another car. Whoops!

Nothing a $1,000 deductible can’t fix…

Clothes: $385

Here’s how this happened.

Lady Money Wizard, looking at my raggedy shirt that’s starting to resemble swiss cheese more than respectable clothing: “You need new clothes…”

Money Wizard, oblivious to the problem: “No way! I just went clothes shopping! Look at all these new clothes!”

Lady Money Wizard: “You bought all those 6 years ago…”

Money Wizard: “That’s not true, I just got these in 2015!”

… Also Money Wizard: “So maybe I need some new clothes…”

Readers, how was your start to 2021?

Hope it was a little more controlled than mine!

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Thanks for the article, money wiz. My one question was why you had $14K in a Vanguard MM with $13K in your checking, and you addressed it in the article. Much appreciated.

Glad it helped!

This is exactly my same question as well. It seems like that’s a $27k emergency fund which based on your thoughts in the past seems extremely high. Why not just leave $15k in Vanguard and have like $3k in a checking account? Much less cash and you can invest the $9k right now to put to work. I am struggling with the same issue so curious to hear your mindset.

Yep that’s exactly what I’m planning on doing. Hoping to get the checking account down to around $3-5K and investing the difference. Once I do that, I’ll take a second look at how I feel about the $14K in the money market.

I’ve moved all cash into USDC into a crypto bank earning 10%. There’s no point holding cash in the legacy system.

Iowa cabin looks nice! Any thoughts on a 457 plan? (if eligible, after maxing out a 401k)

Is this something that’s available to regular people somehow? I always thought this was only available to high level officers in companies.

That’s correct but with my nonprofit only having ~20 people it wasn’t too hard to become a “high level officer” haha I’m just not sure if it’s worth utilizing over a brokerage account for saving/investing money that could be used for early retirement.

457b plans are (usually) incredible because they let you withdraw your contributions whenever you want, penalty free. If it’s a non-government 457, you have to be careful though because sometimes they’re technically owned by the employer.

Someone asked about these in this month’s reader mailbag, so look out for a more in depth answer this month.

Yea, not that I think my company would go bankrupt but that’s one of the downsides I saw. If they did, it’s possible I could never see that money. I was also a little concerned about not being able to roll it over easily if I left the company. I’ll have to think about it more. Thanks for your input and look forward to the mailbag!

Holy crap! I spent less than MMW in a month?!? Maybe the first time ever. Love your updates. I’m about 2 years behind you in terms of assets/NW but I love reading your updates. Gives me inspiration/motivation. Sorry about the car. Keep up the good work.

Haha, awesome to hear! Challenge accepted for next month though!

Oooh a challenge. I like that. If I hit my budget PERFECTLY, I’ll be looking at ~$2,500. That’s about as little as I can reasonably spend. I see you around $2,000 sometimes. I wish!

Haha – my wife and I have had that same clothes conversation many times…

I always look forward to your updates. One quick question: 401k balance is pre tax amount, right?

Yes, I have a traditional 401(k) so my withdrawals will eventually be taxed.

Thank you for the quick reply. I look forward to the next blog.

Congrats on still increasing your net worth even though your budget was off this month. That’s a great start to the year with good momentum!

Yes, maybe the hardcore gamblers at wallstreetbets will scoff at it but that’s ok, ha. As long as we become millionaires in 10 years, everything is completely fine.

Thanks, David!

Hey Wizard! Long time reader!

I’ve been thinking the etf HIPS for an emergency fund since it pays a dividend and looks like an alternative to a money market account. Maybe that’s an option for you?

Thanks for the tip, but that ETF’s expense ratio is 1.27%, which I think is way too high. An equivalent fund at Vanguard like VEIPX only charges a 0.28% expense ratio. On significant funds of money, a 1% difference can add up to thousands of dollars.

Greetings Money Wizard. I recently learned something troubling about tax treatment of gold and silver ETFs (which I also own). Unlike other securities where the profits from sale are taxed as long term capital gains, precious metals are taxed as collectibles at 28%. Also, you will receive an additional statement which reports the TAXABLE activity in the ETF. In my case, the statement doesn’t arrive until March and hence, delays my tax filing. Personally, armed with this new knowledge, I plan to dump my gold and silver ETFs this calendar year to avoid this headache in the future. This can be avoided by keeping precious metals in a ROTH or traditional IRA.

https://finance.zacks.com/gold-etf-taxation-7670.html

Thanks again, and keep up the good work!

Great info…much appreciated!!!

VERY interesting. Thanks for the info!

Look into digitized crypto tokens tracking gold. Benefits 1) security tax treatment 2) potential to earn interest

Hey Wizard! Thanks for your post again! Though unrelated to this page, how do you plan to tap on your 401k and roth without penalty and without much tax impact? If you have already talked about your plan to tap them early (before 59.5) , please share me those articles.

Thanks,

Sharan

Sorry to hear about the car sliding around. Glad to hear you’re okay!

Maybe it was explained in another article and I missed it: How do you plan to pay for healthcare/medical expenses once you’re retired? One reason some people remain working FT is because of the exorbitant cost of medical care. Obviously it’s great if you’re healthy and plan to remain that way, but even the simplest things like annual doctor visits and teeth cleanings add up without coverage.

I know a lot of early retirees were getting decent, really cheap plans on Obamacare. I haven’t kept up with the politics of it all, so I’m not sure if that’s something they’re still taking advantage of.

Personally, at this point I’d probably just budget an extra $1K a month for buying health insurance on the private market. Expensive? Definitely, but not a total deal breaker.

Hi MMW!

What’s your thoughts on Vanguards STAR fund(VGSTX)? I am dumping my annual Roth contribution into this fund.