Hey everyone!

Welcome to the end of 2019’s first quarter. If I were a big publicly traded company, I’d release a massive quarterly report with all sorts of numbers and jargon to bore you to death.

But since I’m just a guy, we’ll stick to our usual monthly net worth update. Around here, that means reviewing my spending, saving, and investing progress. The end goal? A roughly $1 million portfolio and a complete and total exit from the rat race.

Life Update: March 2019

What happened in March? Hmm, let’s jog the memory…

For starters, the month began in an entirely different state. And I don’t mean a spiritual or mental one either, I’m talking about an actual state! That’s because I’d departed on the big annual ski trip, where me and 7 old college friends got together for nearly a whole week of skiing.

Regular readers will know how much I look forward to this trip every year, since I can’t help but mention it in the 3-4 monthly updates leading up to the real deal.

This one took place in a destination I’d never personally been. Big Sky, Montana:

The eight of us spent the next four days skiing as hard as our slightly out of shape legs could possibly handle. I had a fantastic time catching up with old friends and exploring a new part of the country.

When I returned, I was greeted by this blind beauty:

She’s a miniature toy poodle that we regularly petsit through Rover. She weighs a total of four pounds, and I find this absolutely tiny furball pretty adorable, even as she blindly bounces from wall to wall like an Eufy Robovac.

She’s become a regular visitor in the Money Wizard Castle, and at this rate could be the honorary fifth member of the family. Even as I type this out, nearly 30 days later, she’s currently curled up on my lap. And while that sounds like quite the lengthy commitment, she’s a breeze to care for, and the $30 a day she brings will certainly help offset the cost of the big ski trip.

Speaking of which, to close out the month, I was entirely prepared to pack away the gear and say good-bye to the 2019 ski season for good. And just as I was, work called to let me know I was taking an unexpected trip to Salt Lake City. So of course, I did what any reasonable addict would do. I parlayed the work-sponsored flight into one last extended ski weekend.

With the travel budget sufficiently blown, it wasn’t long before I found myself in a shared dorm room in a rustic ski lodge at the base of Alta, Utah. There, I met lots of other enthusiastic skiers, and enjoyed one of the most unexpectedly awesome trips of the year.

We’ll assess the damage a little later in the spending report. But first, let’s take a look at the investment progress:

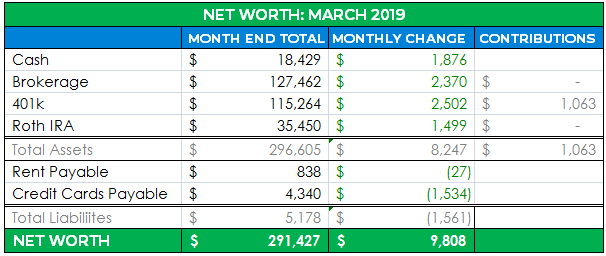

Net Worth Update: March 2019

And the details:

All green! Nearly five figures of growth!

Which is surprising, all travel considered.

Cash: $18,429 (+$1,876)

I finally got paid for my deposit on the large guy’s ski trip, which helped out the cash account quite a bit.

I’m still fighting an internal struggle between building up this cash balance high enough to afford a downpayment on a rental house, or instead abandoning the goal in favor of more passive investments. Stay tuned.

Brokerage: $127,462 (+$2,370)

Using the S&P 500 as a benchmark, the market grew 1.8% during March. My portfolio mirrored that pretty closely, which makes sense when you look at my brokerage account breakdown. It’s roughly:

- 70% Vanguard Large Cap Index Funds (65% is the VTSAX fund and 35% is Vanguard’s VUG and VTV etfs.)

- 20% Individual Stocks back from the when I was young and dumb and thought I could beat the market

- 10% Bond Index Funds (66% in Vanguard VBTLX and 34% in Vanguard’s BSV etf.)

Not exactly my perfect allocation, but imperfect investing is better than not investing at all.

401(k): $107,242 (+$2,502)

Roughly $1,000 of my contributions and employer matching, with another $1,500 of market returns.

Last month I realized that my current allocation is slightly off from my desired allocation. This month… I did nothing about it. (You’ll see that’s a general trend in this update…)

In the coming months, when I spend more time working and less time skiing, I’ll do some buying and selling to get back to my desired 401(k) allocation of:

- 50% Large Cap US Stock Index Funds.

- 35% Small Cap US Stock Index Funds.

- 15% International Stock Index Funds.

Roth IRA: $35,450 (+$1,499)

You might remember that I maxed our my Roth IRA earlier in the year. Initially, all $6,000 sat in a Vanguard money market fund, earning a tiny bit of interest. The plan was to convert that $6,000 into Vanguard’s REIT index fund, $1,000 at a time.

I followed through with that plan for the first two months of the year, but dropped the ball in March.

The actual process is insanely easy, and I could have it done before I finish typing this sentence. So I have no excuse. Nonetheless, my excuse is that I got busy and lazy. I’ll make up for it in the early days of April.

Maybe.

Rent Payable: $838 ($27)

It’s FINALLY warming up in Minnesota. So the heating bill returned from outer space and back down to earth, for a welcomed change. This should get significantly better in April, too.

For the newer readers, I live in Minneapolis in a house with my girlfriend. This cost represents my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.)

Credit Cards Payable: $4,340 ($1,534)

Still inflated thanks to a few straggling expenses from the group ski trip, plus reimbursable work expenses from the work trip.

Let’s assess the real damage via my spending report:

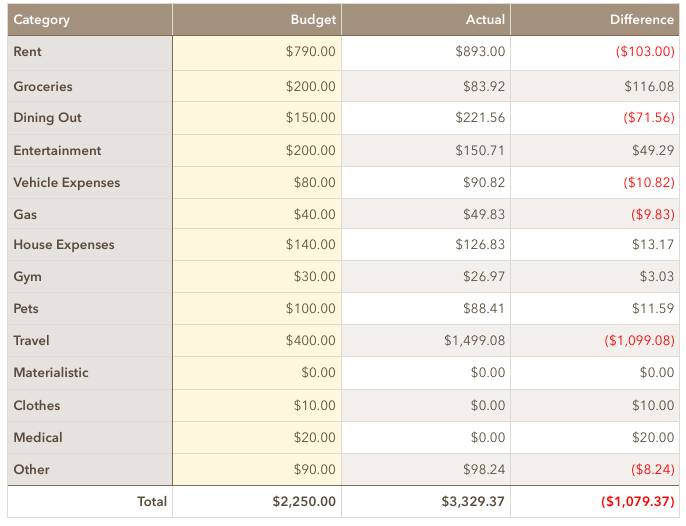

Total March Spending: $3,329

OUCH! Not a frugal month! I repeat, not a frugal month at all!!!

I already know the culprit, but let’s get detailed:

Groceries: $84

I usually spend less than $35 a week on groceries. This month was even lower, thanks to all the travel. That said, we’ll soon see the travel is about to make up for those “savings”…

Dining Out: $222

Blew the budget here, probably because it’s just so easy to come back from a trip and drag your feet on getting a meal plan together.

Entertainment: $151

I got a little alcoholic with my entertainment of choice this month. I’ve recently gotten into mixed cocktails, which is cool because it’s fun, and not cool because it’s ridiculously expensive.

All it took was three nights out with friends/Lady Money Wizard to hit a $150 monthly bar tab.

Vehicle Expenses: $91

The usual car insurance, plus a car wash.

House Expenses: $127

For whatever reason, this was one of those months where we had to replace a bunch of stuff around the house.

The glamorous purchases included a broken wall mirror, some replacement parts for the Eufy, lost cell phone chargers, a new light for the front porch, and whole bunch of other stuff that was so thrilling to buy I can’t even remember right now.

Pets: $88

Headed to Costco to re-up the dog and the cat food.

Travel: $1,499

Found the culprit!

Skiing is about the most expensive hobby ever, and even trying to split costs and keep it frugal, there’s no escaping the painful bill. The five day trip to Big Sky totaled $1,000, and the weekend getaway to Alta/Snowbird ran $500.

How was your March?

Hopefully it was a little more frugal than mine. Either way, share it in the comments!

PS – If you haven’t jumped on the bandwagon yet, I’m still obsessed with Personal Capital. Personal Capital will automatically track your spending, double check your portfolio allocation, and add up your entire net worth in one place.

Related Articles:

Money Wizard, really enjoy your articles. As an avid skier who sadly moved away from the mountains for the time being, how in the world did you do 5 days in Big sky for $1000 and a weekend at Alta/Snowbird for $500? Did this include flights?

Keep up the good work!

Haha, well technically I only skied 4 days in Big Sky with two travel days on both sides. In any case, I cashed in points/miles for the Big Sky flights. I also bought the Mountain Collective Pass which brought down my lift ticket cost to about $50 a day when you consider all three ski trips I took this year. Rental car and lodging were split 8 ways, which obviously helps a ton.

Alta/Snowbird my only cost was lodging and a shuttle to get there. The hotel I stayed at included breakfast and dinner, so I just skipped lunch to ski more.

I wrote an article a while back about how to do frugal ski trips.

I love the comment about the internal struggle between down payment for rental property versus pumping that straight into passive investments.

I currently have a rental property (house hack) and struggle between property number 2 and index funds.

I have to constantly remind myself that these are good problems to have and both lead to a solid future. For me, it depends on work load plus upside in my area.

Great article as always!

Thanks! Yea, the workload is what concerns me, since even finding a competent property manager can be work in itself. Keep me updated on your own internal struggle.

How’s the house hack worked out for you?

I will keep you in the loop.

It has worked out great! The money saved is great + learning new skill sets and how to handle to situations is a great teacher.

It was a good amount of work and some headaches to start but I think that’s home ownership. Similar to your rehab project, nothing goes as planned 😉

Keep up the great work!

Well done this month. Don’t fret about being indecisive when it comes to what investment your stockpile of cash will be deploy to. If you have a good problem on your hands, too much cash!

Keep it up!

Thanks, definitely a good problem to have…

Really enjoy reading these each month as always. Ski trip looks legendary! Wanted to do you a solid, looks like the Roth IRA category got doubled up in your detailed account break down, should this one: Roth IRA: $838 ($27) – be Rent Payable?

Fixed the typo. Thanks for the solid!

HI Money Wizard,

Another great post I look forward to each month. In fact, I am secretly competing with you (so far: your winning!! )

A few Questions for you:

1) In your brokerage account, will you ever add any more money to it or will you just let it ride?

2) In your brokerage account, do you have a set allocation of Stocks and Bonds? If so, how will you re-balance without getting a tax hit?

Thanks!

Makers

Nothing wrong with a little friendly competition!

1) Haha, I wondered how long it would take somebody to notice that I haven’t contributed anything to the brokerage in a few years. Contributions have been on hold due to the internal debate about buying a rental property. But once I make a decision there, I will start maxing out the 401k again and add any extra money to the brokerage.

2) I don’t have a set allocation within the brokerage, although I probably should. Ideally I’d have a set allocation across all accounts, since it’s important to look at your portfolio allocation as one complete picture. The best way to keep up with this while minimizing taxes, IMO, is to correct any imbalances by buying more of the underrepresented asset (as opposed to selling the over-represented one and taking the capital gains tax hit).

Big Sky and Alta are two of the best! I’m jealous, I did not get a trip up this year, but it is insanely fun to ski with a group of like minded ski animals. And you did it frugally, or at least as frugally as skiing allows. Great post.

Thanks Steve. Between Big Sky, Alta, and Jackson Hole, it’s gonna take an early retirement to ever top this year of skiing!

Are you paying off your credit card balance in full each month or accumulating a little debt (but still manaeagable per your asseets)

ALWAYS pay it off in full every single month. Credit card debt is an absolute nightmare that should be avoided at all costs.

Hi Money Wizard! With a couple of kids our spending is definitely than yours ($4860 in March), but our dividend income ($11,161) more than covered the expenses.

More details here: https://www.mrtakoescapes.com/march-2019-dividend-income-and-expenses/

It’s been a pretty stellar Q1 after a pretty rotten December. Can’t complain! 🙂

Wow! $11k+ in dividends – that’s amazing!

Hey MW, do you use personal capital to track you credit card spending or just your overall net worth? Personal doesn’t seem to work that well when it comes to budgeting and tracking expenses…. especially if splitting a card charge amongst others. I really wish they would improve upon these 2 features as it would make it a much more complete system.

I’d say I use PC to double check my credit card spending. I use a numbers spreadsheet on my iPhone to track my day to day spending.

Personal Capital is more of an investment tracker than a budgeter. Mint edges out Personal Capital for budgeting, but the downside is their investment tracking is garbage.

https://mymoneywizard.com/personal-capital-vs-mint/

Nice work! Something I really focus on is how to reduce my “fixed” expenses versus my variable expenses. That’s really where I find the most lifestyle creep to occur. For example, several months back I became a caretaker in my apartment building and was able to reduce my “fixed” rent from $1000/month to $50/month while leaving in South Minneapolis. Tough to beat that!

What is the goal with your cash account? I see the value fluctuates but rises over time. Do you want to maintain it a certain amount or invest money from this account when it reaches a certain amount?

It’s in limbo right now. In the past, I’ve kept as little in cash as possible so that everything could be invested in the stock market earning money. Then I started building up my cash savings with the goal of putting a downpayment down on a rental house. Now I’ve got cold feet.