What’s up wizards and witches!? Coming at ya live from quarantine!

If you’re new here, every month, I track and share my progress towards growing my net worth to roughly $1 million. What doesn’t happen every month? One of the craziest events in world history, which sent shock waves through the world economies, my portfolio, and all our of lives, too.

Let’s assess the damage…

Life Update: March 2020

I had to do a double take when I was putting this update together.

Apparently, my month started with my much anticipated guys’ ski trip to Salt Lake City, Utah.

I say apparently, because with everything that went down in March 2020, that ski trip feels like months, if not years ago.

My memory of the trip seems to exist in an alternate universe. A world where you can just hop on a plane, meet up with your buddies, and clink glasses while enjoying a world class ski resort? It sounds almost unbelievable. Especially while I sit here writing this in the total isolation of my home office, where I’m building on day 17 of home quarantine and nearly a week of state mandated shelter in place.

To be honest, I actually haven’t minded the quarantine. (My real life employer shut down our building midway through the month, and I’ve spent the rest of my days working out of my humble home office – a place that’s usually reserved as The Money Wizard world headquarters.)

A lot people seem to be really bent up about the quarantine. But if I’m being honest, I’ve actually kind of liked it!

I do feel bad for the small business affected by all this. And we could certainly focus on all the negatives for days, because there’s a lot.

But personally, I’m really trying to focus on the positives.

When else in history will we have a multi-week pause of real life?

If you can avoid the urge to binge watch netflix, it’s an unprecedented opportunity to catch up on to-do lists, work on your side hustle, and most importantly, stay healthy.

Since alone and outdoors is one of the best places you can be to combat the virus, one of my main entertainment sources has shifted to lots of runs outside. Plus walk after walk with The Money Pup, who’s not really sure what’s going on, but is pretty convinced he’s hit the jackpot with how often I’ve been home with him lately.

I’ve also gone full chef-it-up mode. Seems like every night, I’m devoting an hour or two to whipping up a dish that’s time intensive enough that I’d have avoided it in my busy, pre-quarantine life.

In a way, my days look pretty similar to how I imagined my ideal early retirement lifestyle. Who knew!?

Net Worth Update: March 2020 (hold me…)

This ain’t gonna be good. Since I’ve spent the last few days procrastinating and pretending I’m spending all of Bill Gates’ money, it’s probably time to just rip off the bandaid.

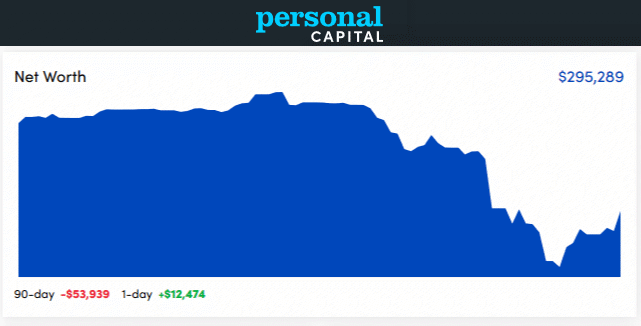

Let’s see what literally the worst start to a year in stock market history has done to my net worth:

Tracking from my free Personal Capital Dashboard

Tracking from my free Personal Capital DashboardOuch!

My portfolio is now back to May 2019 levels. While it never feels good to get set back nearly a year in your investing journey, I was honestly expecting a lot worse…

And there is some silver lining to all this. Michael Batnik posted this great analysis that shows the more the market falls, the more money you’ll probably make.

As long as the portfolio doesn’t get completely decimated, which mine hasn’t so far, and you’re young enough to ride it out, market crashes can actually be huge blessings in disguise.

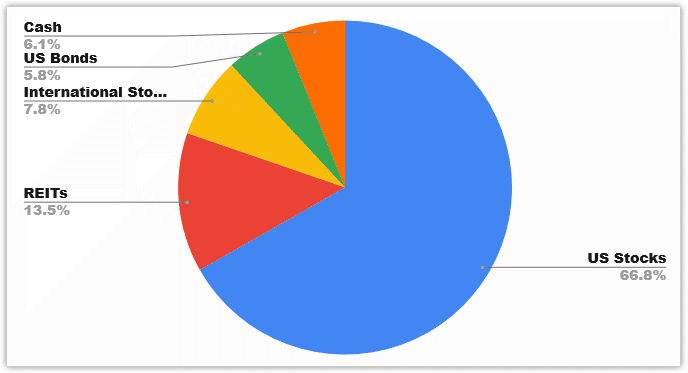

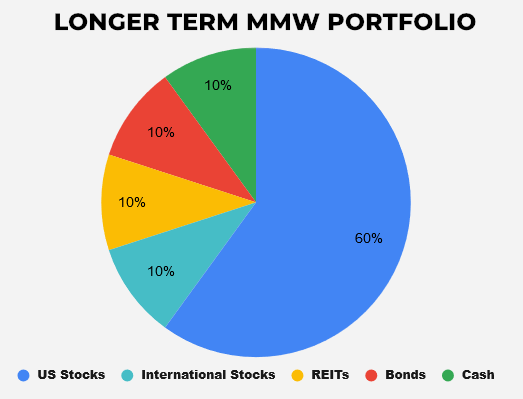

And my latest portfolio allocation:

For comparison, here’s my target allocation, back from when I pretty much called the current recession back in August: 😎

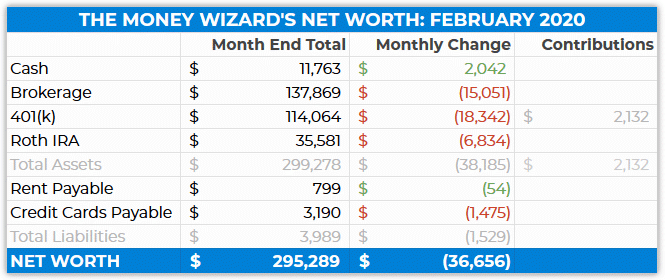

Cash: $11,763 (+$2,042)

The cash position keeps building as I keep living frugally. It’s times like these that the ability to live below your means really comes in handy, whether you’re using that cash to take advantage of falling stock prices or just building up some peace of mind.

Personally, I’m still working towards a 10% cash position. The market’s been brutal, but it still hasn’t hit the 35-40% drops indicative of a true recession, which would be enough to convince me to go a little cash lighter.

Brokerage: $137,869 ($15,051)

And I thought last month’s $10,000 drop was bad!

Here’s the thing though. The losses are only real if you sell.

And I ain’t selling…

401(k): $114,064 ($18,342)

It really helps ease the mental need to “take advantage” of the stock market knowing that my maxed out 401(k) continues to gobble up $2,000 of shares per month throughout this crash, which one day, whether that’s next week or next decade, will probably look like fantastic deals.

Roth IRA: $35,581 ($6,834)

After the monthly craziness, I did a mid-month analysis of my allocation and saw that the REITs in my Roth IRA were way over my 10% target.

So, I shifted $3,000 of my Roth IRA money, which was sitting in cash, towards International Stocks. (I went with VTIAX for the reasons I talked about in my new VTIAX vs. VFWAX post.)

I’m still over the 10% REIT target, so I may make another adjustment in April.

Rent Payable: $799 ($54)

Here in Minnesota, the weather’s finally getting nicer. FINALLY. Which also carries the bonus of cheaper utility bills.

For newer readers, I split a mortgage for a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $3,190 ($1,540)

Ignore the incorrect red in the table above. The credit cards saw a nice, green drop-off when I paid off some of the pre-paid group ski trip expenses.

(As a reminder, this amount gets paid off each month. There’s nothing more wealth destroying than paying credit card interest.)

Let’s take a closer look with the detailed spending report:

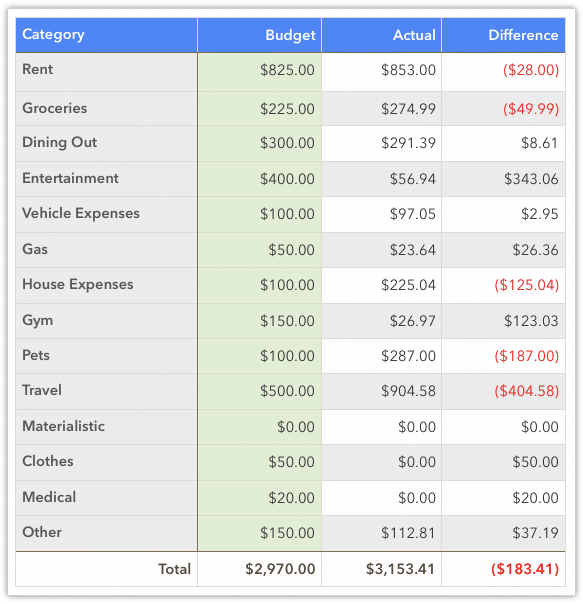

Total March Spending: $3,153

I actually expected this to be lower given the quarantine lifestyle. But I’d also forgotten the ski trip was even in this century, so that explains a lot.

Groceries: $275

My fridge and panty are now so stocked they might start putting Walmart to shame.

Dining Out: $291

Since I’m in a good spot financially, I’ve done my best to help support some of my favorite local small businesses, who I’m sure are struggling with these brutal times.

Lady Money Wizard and I have kept up our once or twice a week “dining out” habit, except given the situation, that obviously means to-go orders.

Entertainment: $57

It turns out that reading, writing, and playing board games is a whole lot cheaper than happy hour drinks, cross-town ubers, and sporting events.

Who knew!?

House Expenses: $225

We’ve found ourselves making all sorts of little tweaks to the house. I guess this might be the cabin fever setting in…

While it was pretty easy to ignore the wall’s splotchy paint job for the past few years, now that we’re spending 24 hours a day in here, I found myself buying a few gallons of new paint, a new armchair for the living room, a shoe rack for the entryway, some new shelves, etc.

Pets: $287

We snuck in a vet visit for The Money Pup, just before the lockdown. And then got our bi-annual reminder that vet visits are crazy expensive.

Travel: $904

Entirely the cost of the 5 day ski trip before the world shut down. Followed by another reminder that ski trips are crazy expensive.

How are you holding up?

Hopefully you’re doing okay during these crazy times. And hopefully, you did a little better at taking advantage of this money saving quarantine opportunity than I did.

Next month, I’m looking forward to seeing how much cash I can save. (While still doing my best to support the local businesses, when possible.)

Stay safe out there!

PS – During these wild times, tracking your spending and monitoring your portfolio allocation is even more important than ever. Personal Capital still has your back there. It’s the best free tool I’ve seen to monitor your investments.

Related Articles:

Money Wiz, thanks for the article. Wondering about your $11K in cash. With unemployment numbers through the roof and a true recession looming for Q2-Q3, are you concerned about the need to quickly build up cash equal to ~1 full year of expenses, with the possibility of being unemployed?

Not really.

My cash position is actually around $18K. The $11K is just the portion I haven’t done anything with yet. The rest of it is sitting in money market funds either in my brokerage or my Roth IRA account.

For me, $18K is well over 9 months of my bare bones living expenses, and over 6 months of my luxury spending budget. For a single guy in my situation, this is more than enough IMO. A couple caveats to that though:

-Knock on wood, but my job is pretty high security.

-I have zero debt.

-By working out the frugal muscle for years, I know I can live off less than $2K a month and it wouldn’t even be much of a sacrifice. If I really lost my job, you’d probably see my spending fall to $1,500/month or less.

-I’ve got another $17K in bonds that could be sold in a pinch.

-According to Google, unemployment benefits in Minnesota would total another $17,000 over 6 months.

-If all else fails, I could take a leap of faith and try to live off the earnings from this blog.

-If all else really, really fails I could plead my case to the landlord (my fiance) who might cut me some temporary slack on the rent. 😉

Emergency fund advice is very individual specific. I’ve never been big on huge emergency funds, but you’ve got to consider my perspective as a single guy with multiple income streams and a large asset base already. If I was a single parent with a big mortgage, I’d be stacking a whole lot more cash right now.

Awesome answer that really shows the financial resilience you’re already enjoying because of all of the decisions you’ve made. For this point:

-If all else fails, I could take a leap of faith and try to live off the earnings from this blog.

I remember you sharing at one point that you keep these earnings off to the side somewhere. Do you have any plans to publish them at some point? I’d be interested to read about how blogging income potentially plays into your FI dreams.

Thanks for the thoughtful reply, Money Wiz.

I work for a small business and there’s a better than 50% chance I’ll be out of a job by the end of April. So, my wife and I are very grateful for having an 8-month emergency fund. I too am getting a small taste of early retirement and it’s a mixed bag tbh. Probably need to stop consuming the news and put more time and attention into more enriching activities.

Sorry to hear that.

I was pretty addicted to the news at the start of this too, and I noticed myself getting pretty angry and stressed out. In the past few weeks, I’ve set a hard limit of no more than 30 minutes per day to catch up on the news. Highly recommended. I’ve spent the recovered time on more productive stuff that could actually improve my situation, and I’m definitely happier and more productive for it.

Can I ask how you export / extract the graphs and net worth graphic from Personal Capital? Are those screen snips or is there a way to export them?

Thanks

Jeff

They’re just screen snips.

If you find a way, let me know! Would definitely save me some time, haha!

It’s has been a crazy month! Glad to hear you’re doing okay and will be fine financially. I wish everyone would take this as a wake up call to get their acts together financially, but I doubt that’ll be the case. Guess we’ll always need wizards to learn from lol

Thanks Nathan. Stay safe out there.

Yes, this month sucks. But at the same time, I am not too worried as long as my health and income are okay. A long-term horizon is good for staying sane.

Also, I guess some people are worse off than me that are only down -9% this month.

Take care everyone!

In case anyone is interested in my March update: https://10yeartarget.com/financial-status-march-2020-the-shit-has-hit-the-fan/

Health > Wealth. Good outlook.

I just found your blog from Business Insider and I’m liking all the extra cooking you’re doing! The browned butter Cacio e Pepe looks delicious — and no wonder. It’s fresh pasta. Looking forward to more of your cooking adventures!

Welcome! Glad you like it, and see you around!

Indeed! I’m liking your grocery and food posts. Will you be going to Fincon this year? Maybe I will meet you in person in Long Beach?

I was surprised it wasn’t as bad as expected for me either. My net worth in down about 7% and 75% of my money is in stocks, i did have thee tailwind of getting my tax return and bonus and investing that into the chaos. I doubt i hit the actual bottom and i’m sure i have more to lose but i got my bonus and tax return on Friday the 20th and invested on the 23, so by dumb luck, hit the “most recent” bottom which compares to S&P December 2016 levels. The process i go through when investing into a crash is looking at what level the markets are at to see where i would have invested. If i could go back and invest 20 grand in December 2016, i absolutely would take that opportunity.

Glad you got out skiing, we have the best snow pack here in Calgary and i was excited for spring skiing. Looks like that won’t happen.

Your cooking looks great, i have been on the same trend of cooking 1-2hr meals for one person haha. something i would never have made time for a month ago.

I had a similar experience when checking our net worth this past week, we had very similar allocations, and had a similar loss. In the end it’s hard to plan for something like this that’s so unprecedented. You can try, but you don’t expect to see almost the entire economy shut down for months at a time. Crazy.

I’ve been furloughed from my full time day job for at least the month of April, maybe longer. Thankfully we still have our health insurance being 1/2 paid for even if we’re not getting the paycheck. We already had between 8-12 months of expenses saved in cash, so we’re not that worried about regular expenses. We’re finding that we spend a fraction of what we were spending, we basically are now only spending money on our mortgage and food. No gas, no eating out, no miscellaneous expenses. We just can’t get out and spend like we were.

All I know is I’m glad I went down the road of creating side income years ago and had a second fallback income to help us when the job went away. Now I just have to figure out how much extra we have so I can buy some for extra index funds while they’re on sale..

Looks like you’re dog walks are on a beautiful spot! Hope it keeps you sane. I’m teetering on the brink. Imma lose it man! This close. On the razor’s edge. Anyway, thanks for the transparency as always broski. Enjoy your Tuesday.. or is it Friday. They all seem the same.

I think you should examine your tone in future posts during the COVID-19 crisis. People in cities can’t necessarily get outside safely while maintaining social distancing. Millions of small businesses and self-employed people ARE struggling — not “may be struggling”. People have lost relatives and friends due to this virus. You sound a little out-of-touch with the level of suffering your readers and fellow humans at large are enduring.

It’s an absolutely awful situation. But I think the world has enough negativity right now, so I prefer to look for the positives.

Hey Mr Money Wizard,

Just curious on the large REIT position. Any thoughts on the long term outlook? I ask as it seems with this virus that companies may realize that office is not so much needed now that remote work is successful. That in turn less demand, same with social distancing with the retail space? Just curious if real estate still holds long term growth compared to S&P 500

Very possible. But a few counter points.

1) REITs are more than just office buildings. Take a look at Vanguard’s breakdown of VGSLX’s holdings. Office space is only 8%. It also includes things like residential real estate, health care facilities, storage units, etc. Thats the beauty of an index fund.

2) The thing is, the REIT position isn’t actually large. It’s about 10% of my net worth, which is actually kind of small. Its purpose in my portfolio is diversification. How I feel about its long term performance is irrelevant, since its job is to just be a different asset class.

3) Predicting anything long term is really, really hard. So who knows.