Hey Money Wizards,

One quarter down, three to go!

I’m approaching age 32, which means we’re about T-Minus three years until I leave my office job at age 35. Hopefully!

Let’s check in on the progress…

Life Update: March 2022

Ski season entered full swing in March.

I started the month with a ski trip to Northern Idaho, before ending the month with a trip to Park City, Utah.

There’s something so rejuvenating about the mountains. As I get closer and closer to the early retirement finish line, I can feel those mountains calling me in.

Here’s to a future where I don’t need to use “vacation time” to enjoy my favorite hobbies!

Net Worth Update: March 2022

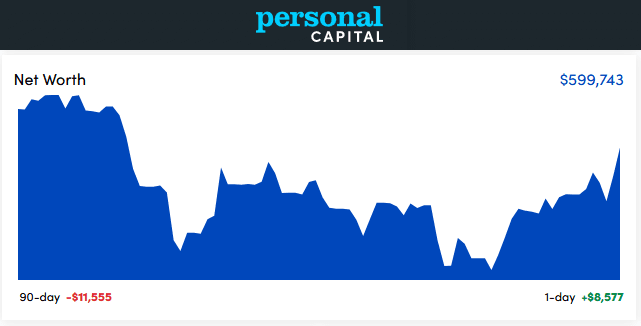

While I was skiing, the portfolio made a modest recovery…

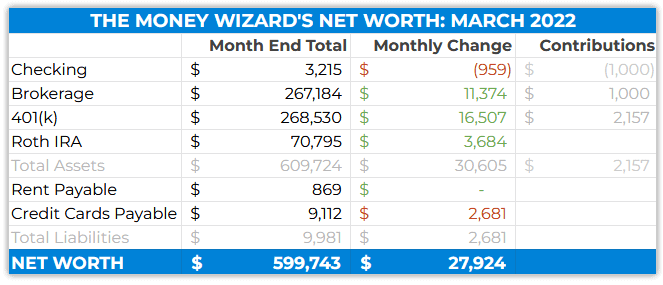

And the detailed table:

After last months’ $23,000 loss, this month bounced back with $28,000 in gains. Although as one reader pointed out, I still haven’t recovered from highs of nearly half a year ago!

I’ll share some thoughts on that in an upcoming post, but the cliff notes version? I’ve gotta constantly remind myself that a few months is a blip in my overall financial goals.

Monthly measurement is far too much of a microscope, and as hard as it can be, you have to zoom out and measure the market in years and decades.

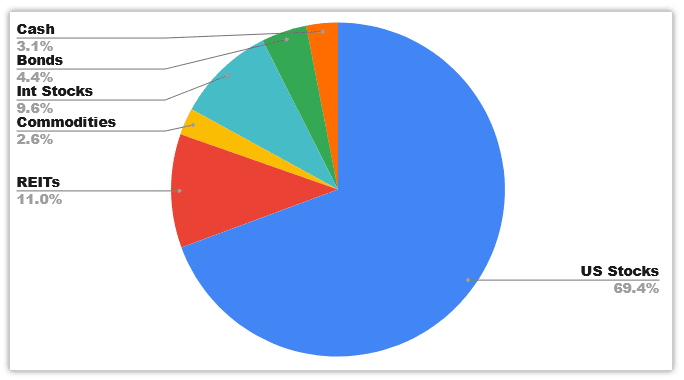

Portfolio Allocation

Checking Account: $3,215 ($959)

Another reason I like doing these net worth updates is that they help me stay on top of things whenever I notice abnormalities. Like, say, $3K in a checking account with $9K worth of credit card payments due…

It turns out I’d forgotten to submit a mountain of receipts for my work’s health FSA account. And not a trivial amount, either! Well over $2,000 that needs reimbursement.

The rest of the shortfall will be made up when friends pay me back for some of the ski trip expenses.

Brokerage: $267,184 (+$11,374)

I made my automatic $1K contribution, and the rest is just market movement.

401(k): $268,530 (+$16,507)

Similar story here, with my automatic paycheck contributions plus employer matching, with the rest being market changes.

It is fun to watch the neck and neck race between the brokerage account totals and the 401(k) totals.

Roth IRA: $70,795 (+$3,684)

I maxed out my Roth at the beginning of the year, so this was mostly recovery to the account’s real estate index funds and international index funds.

Rent Payable: $869 ($0)

I’m not quite sure how this total landed exactly the same as the prior month, but hooray for coincidence.

For newer readers, I share a house that was purchased by my now-wife. This number is my half of the mortgage, utilities, and a couple hundred dollars a month that we throw into a “home maintenance fund” to help prep for any big projects.

Credit Cards Payable: $9,112 (+$2,681)

It just keeps going up…

Luckily, most of the cause was fronting some expenses for a group ski trip and the reimbursable medical expenses.

But make no mistake about it… unfortunately, I spent March spending cash like it was going out of style. Let’s look at the damage.

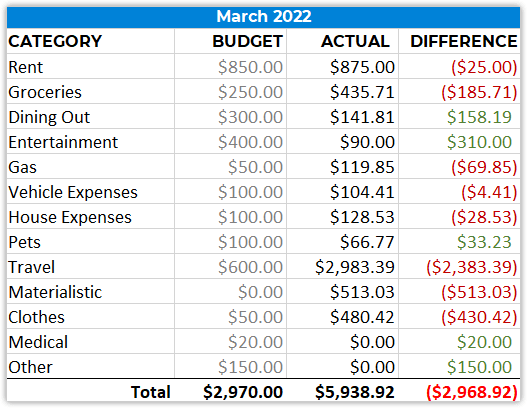

Total Spending March 2022: $5,939

Wowza… I haven’t spent this much since getting married in August and going on a honeymoon.

I knew skiing was expensive ever since I saw Tom Brady, Kim Kardashian, and Kanye West at the same resort as me. (Most people would be excited by this, but frugal young money wizard just started stressing for his wallet!)

Travel: $2,983

We went a little overboard this month with two different ski trips, plus a cabin trip. Making up for lost COVID time!

Materialistic: $513

To really double down on the skiing damage, I bought a new set of skis. I guess I’m losing my frugality in old age.

Clothes: $480

A coat and some winter clothes for Lady Money Wizard.

Groceries: $435

Even worse when you consider I was out of town for nearly a third of the month! Hooray, inflation.

A Closing Note

I’d like to share a thought that I probably haven’t done a good enough job highlighting over the last few years.

I’m fully aware that as a money blogger whose readership (I think) enjoys following my monetary progress, these net worth updates can come across a little money-obsessed.

When you’re writing articles hyper-focused on wealth while people halfway around the world are getting bombed out of their homes (and even people in your own country are struggling with economic realities) it’s not always the best look.

So it’s worth a reminder, for myself more than anything, that there’s definitely things in life more important than money.

At the end of the day, money is a tool. I personally want that tool to write my story for you all, and hopefully make a small dent among all the chaos and help some people along the way.

That said, although this blog might not make it obvious, money isn’t actually everything.

Our worth is not our net worth. If we have a roof over our head, people who care about us, and country where we’re free, we’re already the richest 1%.

PS – Want to track your net worth like this? Personal Capital’s free net worth tracker is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Awesome post – following the journey.

Similar age, 31 with a similar goal of FIRE’ing by age 35.

Current NW of $350k with a goal of $1.5M by 35. Always good to se other bloggers on the journey.

One area of investing I’ve changed over the last few months, is taking advantage of what I believe was overselling in tech stocks like META and Paypal. I’ve redirected capital from Index/ETF funds into single stocks for the next 12-24 months to take advantage.

I completely agree you can’t time the market, and I am a big believer in stable broad based low cost ETF’s – am I silly doing this? I’ve done the research on the fundamentals and it’s within my level of risk tolerance.

Have you looked at single stocks recently?

Cheers,

MeTheMillennial

I’m curious to know what strategies you are using to go from $350k by 31 to $1.5M by 35 (in 4 yrs)? Would definitely like to know your plan on achieving this tremendous goal by 35.

me too!

Sure – my stretch goal is $1.5M, best to aim high!

5 years to get there;

A. Initial balance $350k

B.Monthly additional contributions between brokerage and pension – $6,000

C. Assuming yearly compound interest growth of 12% gets me to about $1.1million – im hoping to divert extra lump sums as I go (e.g. bonus etc.) to get me close to my goal

*I know 12% growth rate is quite high – but I’ve recently diverted a substantial amount of my capital from index funds into, in my opinion, oversold stocks like META, PAYPAL, JD.COM, Shopify etc. So I think this is quite achievable. This is obviously a riskier approach but I believe in the fundamentals of these companies at their current valuations.

If I don’t get to the $1.5M mark, I hope to get mightily close trying.

*B I save upwards of 70% of my income

Ambitious, a challenge, yet still possible – just like all good goals should be. Good luck, and hope to meet you at the finish line!

What skis did you end up with? I recently bought some ARV 96’s for a pretty good price on Evo, much more enjoyable than rentals!

Nice, that is a good price on the ARVs.

I grabbed some DPS Koala 103s. Hoping for something a little wider than my 85s for the deeper days. Now fingers crossed that it actually snows!

me too!

Tip regarding groceries. I can never remember prices, so I finally made a spreadsheet logging the $/oz of all of my most common purchases. Rather than auto-buy what I normally purchase, I buy what is on sale/discounted. Wow is it revealing. Some low cost items double in price, but one generally doesn’t notice since they are relatively low cost. But there is almost always an alternate item that is on sale or discounted. Is x beef really worth 2x the cost of y beef??? The relative cost of items is very revealing. [side note – if you are a gardener, the $/oz really shows what you should be growing] Thus I have cut my personal grocery inflation rate substantially. Also, i hate dealing with coupons, but finally sat down and figured out how to use the digital coupons at my favorite store, and can now review them quickly and add them to my account in minutes. Paying attention to sales & coupons is really worth the effort. I’ve seen 1/3 deductions off my grocery bill without really sacrificing choice. Mostly it is about being flexible. A specialty item one wants will be on sale, just not maybe this week.

How firm are you on quitting your job when you get to your number…from what I gather in reading, it’s $1mil? I do like how conservative you are to not include crypto and your property equity (shared with spouse).

Do you have a recommendation of what percentage of your net worth should be in a retirement account (401k, Roth IRA, etc.)? Is there a $ amount or X factor amount of annual spending achieved in your retirement account that you would recommend slowing down contributions to your retirement accounts? In effect giving up the tax benefits to enjoy that money now instead of having “too much” in retirement that you wouldn’t be able to effectively spend.