Hey Money Wizards,

Welcome to the newest update!

As you probably know by now, every month I track my updated Net Worth, so that I can hopefully leave my office job in the next few years. I’m currently 32 with a goal of a million bucks within the next three years, so let’s see the progress!

Life Update: May 2022

The biggest news of May was that we traveled to Vancouver Island, Canada for a round-2 attempt at some wedding travel that previously got canned thanks to COVID.

Why Vancouver Island?

The whales!

Can you even believe that picture!?

I was lucky enough to snap that while on our Orca Tour, which was definitely one of the most majestic experiences I’ve ever had.

Outside of the wildlife watching, it was nearly a week exploring the beautiful Canadian island. We went with another couple of long-time friends, who we had a blast with. Plus, our travel quirks didn’t end any lifelong friendships, so that’s a bonus!

Otherwise, May was mostly uneventful, which I’ll chalk up as a win these days.

I can’t remember if I updated you all, but Lady Money Wizard started a new job a few months back, and she’s loving it so far. Financially, it came with a modest 5-10% pay raise, which honestly took a back seat compared to the quality of life improvements. (The much more important factor!)

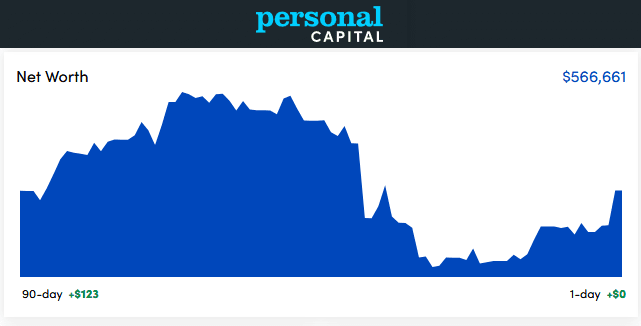

Net Worth Update: May 2022

Hey, a pleasant surprise!

After last month’s blood bath, I was expecting the downward trend to continue. But strangely, the market recovered in May, to the tune of a couple percentage points.

This helped my portfolio increase by about $8K:

The biggest market news was that the Fed raised interest rates by 0.50% in May. For those of you who weren’t required to sit through multiple economics classes to earn a degree, the Fed raising interest rates has the impact of driving down asset prices, most notably risky stock market investments.

(This makes more logical sense than your economics professor tried to make it out. Put simply, if you can earn a higher rate for doing nothing… meaning investing the safest asset on earth, aka government bonds… those risky tech stocks become a little less attractive.)

So why didn’t prices fall in May? In a classic case of the stock market being the goofy thing that it is, everyone already expected the interest rate hike and its corresponding crushing of the stock market. So long story short, the May interest rate impact was seen, just a month earlier, in April.

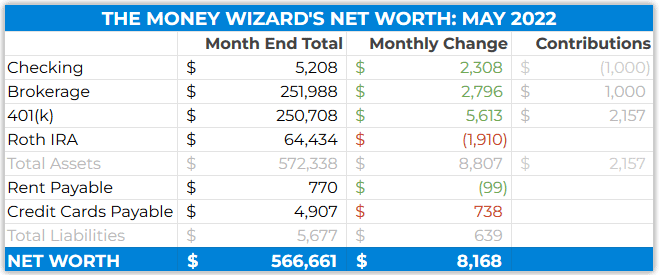

Checking: $5,208 (+$2,308)

I got some big Venmo payments from our traveling buddies for the reservations I fronted.

As is standard these days, I also automatically invested $1,000 from my checking account to my Vanguard account.

Brokerage: $251,988 (+$2,796)

The first month in a while that this one is green. The slight market relief helped the brokerage account, which remains invested almost entirely in total stock market index funds.

401(k): $250,708 (+$5,613)

No changes here. Still maxing out the 401k to enjoy those sweet, sweet tax savings.

Roth IRA: $64,434 ($1,910)

Real estate was the worst performing asset in May, so it’s no surprise that my Roth, which includes mostly Vanguard Real Estate REITs, was down on the month.

Rent Payable: $770 ($99)

The weather here in Minneapolis is absolutely beautiful this time of year. So, May was filled with far less heating/cooling and far more open windows.

For newer readers, I split our house’s mortgage with my wife in Minneapolis, Minneosta. This number represents my half of the mortgage plus utilities and other random maintenance expenses.

Credit Cards Payable: $4,907 ($738)

My I-O-The Bank stayed high, since we put a lot of travel costs on the credit card.

As a reminder, I always pay this off in full, because credit card interest is the devil.

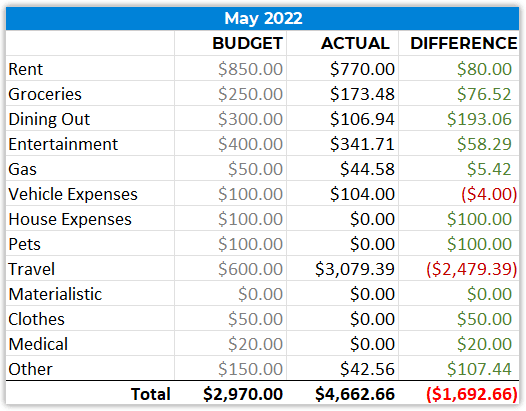

Total Spending May 2022: $4,623

Travel: $3,079

The big one this month. This was entirely the trip to Vancouver Island.

As an expense, travel has definitely crept up, but that’s mostly because Lady Money Wizard and I are no longer splitting the bill, so I report all these costs myself. Nothing to get worried about.

Entertainment: $342

The biggest line item here was registering for a 50-mile bike rally, then realizing my only bike, a mountain bike, probably wouldn’t cut it for a 50-mile bike rally. So, I rented a nice road bike for the day, then finished off with some celebratory beers.

We also hit up a Minnesota Twins game, a Minnesota United game, and even a concert. Thank goodness for summer!

Groceries: $173

I actually have no idea how this is so low. I went to the grocery store the other day and only bought a stick of butter, hamburger buns, and strawberries, and somehow to bill was $17.

That said, here’s a protip: spending $3,000 on travel helps cut back the grocery bill. Although maybe that’s not the desired effect…

Final Thoughts

It feels good to be writing for this website again. I may not be as punctual as the past, but I still very much appreciate all of you who have stuck with this journey for so long.

I hope you all have been fantastic, and I hope you’re riding out this wild 2022 economy that we’re all experiencing!

PS – Want to track your net worth like this? Personal Capital’s free net worth tracker is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Have you done a post about your drawdown strategy in early retirement? I’m curious with your mix of brokerage/IRA/401K how you plan on building the funds until you reach $1M (which I think is still your goal) and how you plan on withdrawing that until you’re able to access the full amount at 59.5. If you’ve already done this, please point me in that direction. Thanks!

I wrote this post:

My new life plan to “retire” at 35 and still hit $4 million in net worth.

The alternative would be using Roth IRA Conversion ladders to access the retirement accounts before age 59.5. I talk about those in this article:

My 401(k) is bursting at the seams. Now what? 6 unusual alternatives.

Hey Money Wizard! Thanks for all your great articles. I’ve learned a lot from reading your blog.

I’m curious if you’re planning to do a 2021 spending overview? I’m always interested in how personal saving rates change over the years. Cheers!

Thanks for the feedback! I never know if people are interested in those.

I’ve got all the data for a spending overview, so it’s definitely something I can put together if there’s interest.

I would say there is interest. I’d be another.

Thanks for letting me know!

Same here! I always looked forward to it – I would still be interested

I’m interested in a spending overview. We are 65, he’s retired and I’m on leave of absence (probably short-term).

Thanks,

Shelley

Where’s the June update?

He’s been a little behind on updates, so probably not for another week or more. I know he’s writing on another blog, but I miss those 1-2 posts he would do a month other than the Net Worth Update.

Haha, yeah, with the stock market down so much, instead of retiring early he now needs a second source of income with his other blog.

Just published!

Net Worth Update: June 202 (and most of July)

Are you still doing this blog or have you given up?

He gave up I believe. Probably doing a travel blog now. With poor timely updates I won’t follow anymore. I really enjoyed these updates but if he doesn’t have the time why should I.

Agreed. The whole point of these blogs is the journey. The ups and the downs. If you quit when the market goes down then you really don’t believe everything you preached for the last however many years.

I agree. I need to do a better job keeping this thing updated, especially since there’s so much interesting stuff to talk about with the market turmoil.

I’ll do my best to make that happen. I’ve been at this site for 7 years now… there might be some hiccups in consistency along the way, but I can promise it’s not going anywhere.

Have not given up! Check out the June update… I talk all about this.

not fun writing a FIRE blog when the stock market isn’t cooperating is it?

Lol, I get that it’s a bad look. Have just been busy with life and other projects. Fear not though, the blog’s not dying. A new net worth udpate is coming today, actually!