Hey all!

It’s beginning to look a looot liiiike…. no, not Christmas yet… Another net worth update!

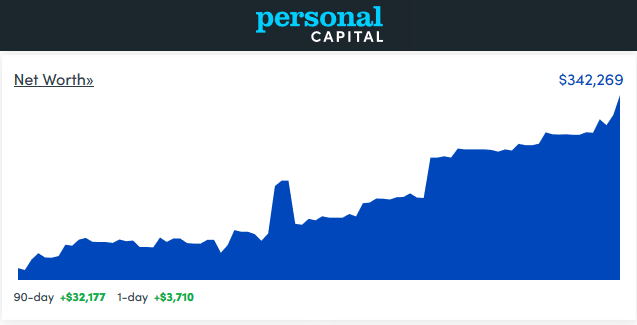

Every month, I track and share my progress towards growing my net worth to roughly $1 million. The goal? Financial freedom by age 35. I’m currently 29 with a few hundred thousand to go, so let’s check in on the progress.

Life Update: November 2019

In November, I got a double dose of my favorite holiday!

That’s because I flew down to Texas for Thanksgiving with my family at the beginning of November, then hung around in Minnesota to visit Lady Money Wizard’s family on the actual holiday.

I’m sure you’re familiar with all the Turkey stuffing (and stomach stuffing) that goes along with the big day, so I’ll spare you the details.

But I will stop and tip my cap to Thanksgiving, one of the last holidays standing against the onslaught of consumer culture. While Christmas lost the battle to gift giving obligations decades ago, Thanksgiving has managed to stay pure and true to its roots. Any holiday that’s all about good times with friends and family, without any of the social pressure, is a day I can get behind.

In other family news, The Money Pup and The Money Meow continued their bromance:

And on the business side of things, I got surprised at work with a big time promotion! Well la-dee-da for you, Money Wiz…

But the important part? The big time promotion comes with a big time pay bump! All the ramifications of this exciting news is far too much to discuss during a short intro to a net worth update, so keep your eyes peeled later this week for an entire post about what this all means.

Oh yes, I’ll be sharing more details than ever, so get your gossip cans ready!

Since there’s another post coming out in a day or two, we’ll keep this one short and instead jump right into the dollar dollar bills, ya’ll.

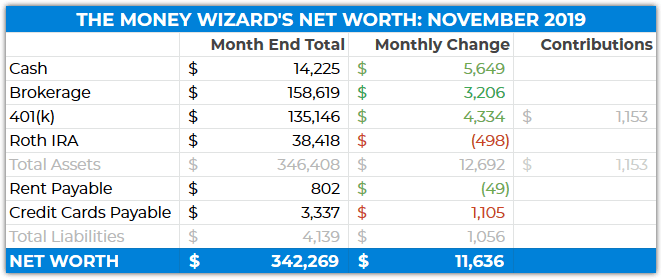

Net Worth Update: November 2019

Cash: $14,225 (+$5,649)

Wow! That’s a nice monthly change!

While trying to track down the cause of the unexpected cash growth, I uncovered one of my favorite surprises of the year – a three paycheck month!

I get paid every other week, which means through the grace of the calendar, there’s one or two months every year where the stars align, and I get paid not once… not twice… but thrice over a given 5 week period.

I could get used to this…

Brokerage: $158,619 (+$3,206)

Not quite as wild as last month’s $16,000 gain. Then again, I didn’t actually contribute anything to the brokerage account this month. Instead, the growth in my portfolio was aaall market gainzzz, thanks to yet another +3% month in the stock market.

I’m feeling like a broken record, but I’m still asking myself how long this onward and upward rally can last.

With my cash portfolio sneakily climbing over $10K again, I’ll look to make make yet another cash to bond transfer next month, as part of my longer term plan to get my bond allocation up to 10% of my portfolio.

For newer readers, this part of my portfolio consists almost entirely of Vanguard index funds (VTSAX if I’m being specific) mixed with a few leftover individual stocks, back from the days when I was young and naive and thought I’d be the next Warren Buffett.

401(k): $135,146 (+$4,334)

You’ll notice the growth of my 401k outpaced the growth of my brokerage account by a little over $1,000. You’ll also notice I contributed a little over $1,000 to the 401k this month, as part of my paycheck’s automatic contributions plus employer matching.

That’s detective work, yo! Call me Sherlock Holmes…

One interesting quirk I noticed this month – despite the three paycheck month, my 401k hasn’t yet registered the contributions from that third paycheck yet. I’m guessing this is just an issue of timing, and next month I’ll get an early head start on growing the 401k further. In any case, that’s something I’ll want to keep an eye on.

(As a completely random side rant, it always shocks me the number of people who devote 40+ hours a week to a job, then refuse to spend the 15 minutes a month to make sure their hard earned paycheck is accurate. I know it’s a chore, but if you’re gonna prioritize one chore, making sure you’re getting paid seems like a worthwhile one.

I know of way too many people who have found issues with their paychecks, and for some reason, those issues never seem to work out in the employees favor… )

Roth IRA: $34,418 ($498)

It’s almost the start of the new year, and you know what that means!? Another opportunity to max out the IRA.

In 2020, the IRS held the IRA contribution limit steady at $6,000 per year. So personally, I plan on setting aside $6,000 of my cash in January 2020 so I can get this out of the way early, and then let my money grow for the entire year.

Rent Payable: $802 ($49)

Absolutely no clue why this went down so much compared to last month. It was noticeably colder in November than October, so I’d expect the heating bill to be a lot higher.

Gah, I hate the constant mystery of utility costs.

For newer readers, I share a house owned by my fiance. My rent payment to her includes my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month.)

Credit Cards Payable: $3,337 (+$1,105)

A big jump up in credit card usage this month, which is partially to be expected since November wasn’t going to be as frugal as No Spend October.

Then again, there’s always some weird reimbursable work expenses on the card, so let’s see exactly what was going on:

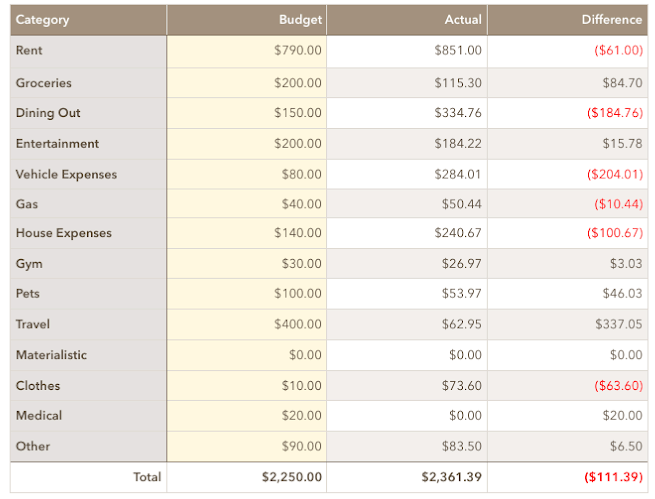

November 2019 Spending: $2,361

I had a bit of a relapse after No Spend October, although honestly, I expected this total to be way worse. Only $111 over budget feels like I dodged a bullet after the way I was slinging around the credit card this month.

Dining Out: $335

Wham! This was partly from a celebratory dinner with Lady Money Wizard to clink glasses over my newfound promotion, and partially because that Thai food spot down the street is just so delicious…

Entertainment: $184

I’d like to say there were all sorts of cool events and concerts that made up this month’s entertainment spending, but the truth is that this total included a few trips to the breweries, some more trips to the breweries, and then to really mix things up, a few trips to the cocktail bars with friends.

Vehicle Expenses: $284

Including $200 of vehicle registration to drive my cheap Mazda 3 on Minnesota roads. (Another reason why Minnesota is the 15th most expensive state in the US)

Pets: $54

The Money Pup got a little too excited on his walk, got something in his eye, and had to make a $100 visit to the Vet, which I split with Lady Money Wizard.

Travel: $63

I used airline miles to fly to Texas for Thanksgiving, but did take a couple of Ubers to get there.

Then, I booked out 3-4 different round trip flights all the way through June 2020, which used even more miles and credit card points. Pretty awesome to be flying for almost free – redeeming miles still runs about $5 per flight because of the TSA fee.

Travel through June 2020 that I’m jumping-out-of-my-skin-excited about?

- Skiing in Whitefish, Montana and Salt Lake City, Utah (twice!)

- Sedona, Arizona

- Vancouver Island, British Columbia

Clothes: $73

My one Black Friday splurge – my favorite jeans (shout to Gap Selvedge!) went on sale. They’re literally the only jeans I own, and are actually an awesome staple to a frugal wardrobe. But living in Minnesota means I wear them so much that I have to re-stock once a year or so.

Other: $84

Just picking up a few Christmas gifts for friends and family.

How was your November?

Do you agree Thanksgiving > Christmas? Did you manage to avoid most of the Black Friday madness, or did you score an epic deal that threw you over budget like me?

Happy Holidays!

Related Articles:

Totally agree that Thanksgiving > Christmas

Team Thanksgiving!

Congrats on the promo! I’ve found my net worth has been rising much faster since my last promotion earlier this year, so I’m sure something similar will happen for you 🙂

Vehicle registration was $200!? Those fees are easily one of my least favorite parts about owning a car.

Thanks Young FIRE Knight. And congrats to you too!

Congratulations on your promotion and raise! I’m wondering if utilities were lower due to traveling and not being home. I’m glad to hear your pup is ok.

Hmm, interesting thought, but Lady Money Wizard was home the whole time.

The Money Pup says thanks!

This is great! Congrats on the promotion. Do your monthly updates include net worth Lady Money Wizard? Or do you keep track of cash flow and investments separately? I ask as we are considering marriage but currently keep everything separate.

Thanks, Jared!

The Net Worth Updates are just me. For now we still keep everything separate; we haven’t decided what to do after the wedding. What are your thoughts?

That’s super impressive! I’m 30 and in a similar stage as you. In terms of combining finances, I am currently thinking shared goals and maybe one joint bank account makes sense, but overall leaning toward two separate financial management “systems”, although our values are aligned for the most part. Glad to discuss in further detail or maybe we can start an email thread given this is more private in nature than some financial topics, but regardless enjoy reading your blog!

Sedona is great!! I recommend sitting through the time share sales pitch for an hour or so & taking a free helicopter ride around. Fascinating and inspiring way to see the area 🙂

Helicopter ride!? Where do I find more info? Is that part of the timeshare pitch?

Love the updates and congrats on the promotion! I recently got back from my honeymoon and met a wonderful couple there from Vancouver Island, British Columbia! We can’t wait to visit! Maybe include a snow and skiing report after your trips! Have a great month!

Where did you honeymoon? It must have been pretty nice if people were leaving Vancouver Island to go there! Congrats!

Beautiful St Lucia! We never wanted to leave to come home to cold temps. Might be a good goal for us to work towards!

Congrats! I had a great raise as well thankfully this year and have saved 100% of every single new paycheck thanks to us living on my wife’s income. I commented before with this idea of combining income as a couple and living on the salary of whoever makes less, it has worked so well for us, and I’m cheering you on to retirement as fast as possible! Each couple is unique, so maybe it’s not perfect for your situation, but if possible I think your combined net worth would be ridiculous really quickly. Thanks for the great content and keep kicking butt Money Wizard! Happy Holidays!

Thanks so much, Bray! I really appreciate the comment and well wishes. Congrats on your raise, too! Pretty hard to beat a 100% savings rate! 😉

Just got back from Sedona and Grand Canyon with my Lady Money Wizard equivalent. Would happily share trails, restaurants, etc. if desired. It’s a FANTASTIC spot. I’m 28 with rental properties so would also be open to syncing up and discussing investment strategies. Thanks for the great monthly posts!

Andrew

For sure! Would love to hear about your suggestions!

We do not have thanksgiving in my country, so I’m looking forward to Christmas. But Black Friday, Black Friday Week, Cyber Monday and all that we have for some reason…

I know what I am going to purchase as Christmas gifts and that was the only thing I was looking for. I didn’t find any deals, so did not buy a single thing.

But a great month financially, received a work bonus so I could same some additional money. But still held some back in the regular account due to Christmas expences.

You can read about it here: https://10yeartarget.com/november-2019/

Congrats on the bonus!

Congrats on the raise dude! The world is your oyster!

Thanks, Eric!

Congratulations on your raise. Perhaps you should go to Thailand on your honeymoon we did. When you pay out right your credit card bills each month do you use your money from your paychecks or other money coming in from investments? We are thinking of opening a brokerage account after we max out our 401k and IRA’s. We worry about not having enough savings we are 14 years before mandatory retirement unless my husband can work to 67-68. Thank you for all your advice. Look into South East Asia for your honeymoon you can’t go wrong. It is so affordable and beautiful.

Thailand is actually the leading contender right now!

I use the cash from my checking account, so it would technically be money from my paychecks. I don’t want to ever spend any of my investment returns because that kills the compounding effects.

What is your view on debt? I have about $8500 in student loan, about 5k saved from a second job, 2k in stash app. Should I just pay it off or put the money in a roth ira?

I tackle dilemmas like that in this popular post:

https://mymoneywizard.com/correct-order-investments/

Hope it helps!

Thank you. A very informative post for person deciding if they should tackle debt or invest first

Congratulations on your promotion! Always find your blog so entertaining to read – do have a read through mine and share any feedback you may have http://www.investwithebele.com