Hey all!

Welcome to… another net worth update!

If you’re new here, every month I track and share my progress in growing my investment portfolio. Originally, my goal was a roughly $1 million portfolio and financial Independence by age 37. I’m ahead of schedule, so I recently updated that goal to age 35, because why not?

Life Update: October 2019

Where to start?

Well, the Money Meow’s already put on somewhere north of 2 pounds since we adopted him two months ago. He’s now moving from kitten-hood to cat-adolescence. I don’t even want to know what teenage cat angst is like…

Overall, he’s been a fun addition to the family. And since I just know everyone is dying to hear how he and The Money Pup are getting along, I’ll just leave this here:

Other than that, I’ll stop this section short.

Yep, we’re mixing up the usual format this month!

To find out why, we’ve got to travel back in time to last month, when I got the wild idea to spend as close to $0 as possible during the month of October. And so, I thought it’d make more sense to hit the rest of the month’s activities under an update of the no-spend challenge.

If you’re impatient, just scroll down to the spending summary at the bottom of this post. Otherwise, we’ll run through the finances first.

Net Worth: October 2019

Personal Capital unveiled a spiffy new logo this month. (Ignore the big spike in the middle, PC always seems to glitch for two days after I transfer money to Vanguard.)

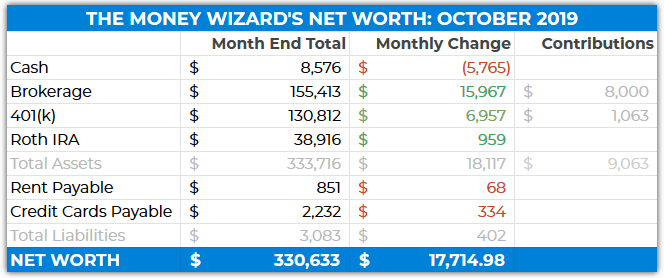

Personal Capital unveiled a spiffy new logo this month. (Ignore the big spike in the middle, PC always seems to glitch for two days after I transfer money to Vanguard.)And my detailed spreadsheet:

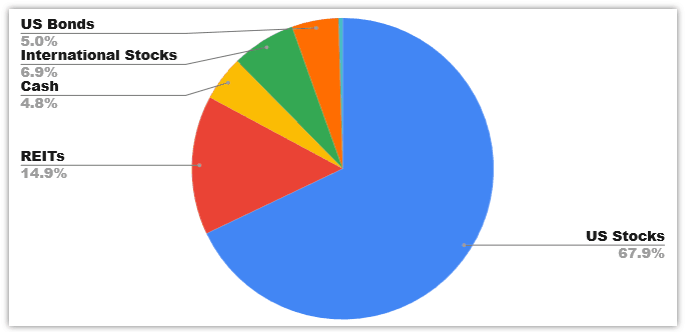

As you can see from the table, we had a few swings, so I though it’d be time for another allocation checkup. (Shout Out #2 to Personal Capital, whose free software turns this job from an hour long chore into one click of a button.)

Cash: $8,576 ($5,765)

My cash account crested $14,000 last month. Which sounds really cool, until you realize each dollar sitting in cash costs you at least 3% return that you could be earning elsewhere.

So, halfway through the month I transferred $8,000 from my checking account to my Vanguard account.

You’d expect that $8,000 withdrawal to cause an $8,000 decline in the total cash by the end of the month. But wait, my cash balance only dropped $5,700. That $2,300 difference is savings, yo!

Brokerage: $155,413 (+$15,967)

A nearly $16,000 monthly increase, half fueled by the $8,000 I transferred from my cash account and half fueled by continued market growth.

As part of my strategy to shift towards a more conservative portfolio in my crotchety old age, I used that $8,000 to buy Vanguard’s Total Bond Market Index Fund. This bumped US bonds from 3% to 5% of my portfolio, while bringing cash down from 8% to 5%.

I decided a few months back that I wanted bonds to make up 10% of my portfolio long term, so I think I’ll slowly but surely continue making these cash to bond transfers for the foreseeable future.

401(k): $130,812 (+$6,957)

Wow, the market really did go nuts this month. I only contributed $1,000 to my 401k in October, and yet the account’s value grew by nearly $7,000.

Roth IRA: $38,916 (+$959)

I maxed this out at the beginning of the year, so any monthly changes are just market changes.

My Roth is invested entirely into Vanguard’s REIT index fund, so this makes up nearly all of my 15% overall real estate exposure.

Rent Payable: $850 (+$67)

Ouch! A $70 increase since last month. Can you tell we turned the heat on in October?

I need to get on that energy audit that so many readers suggested a while back…

For newer readers, I share a house owned by my fiance. My rent payment to her includes my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month.)

Credit Cards Payable: $2,232 (+$334)

That number is all sorts of inaccurate this month, so I’ll defer to the spending report below.

As a reminder, this amount is just the balance that I always pay off in full each month. In the word’s of The Waterboy’s Mom, credit card interest is the devil!

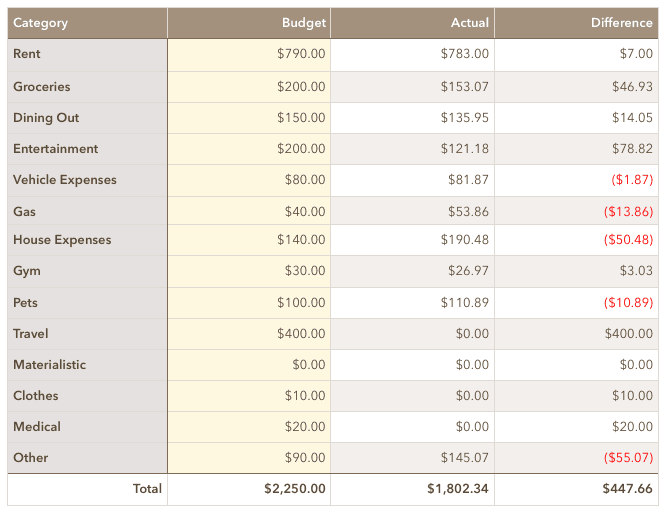

Update on the No Spend October Challenge: $1,802

Last month, I challenged myself to a “No-Spend October.”

To stay true to the name, I’d have to spend $0. Obviously, that’s impossible, so the real spirit of a no-spend month is to stop and ask yourself whether there’s a way to avoid paying for things you’d normally buy without a second thought.

It sounds a little crazy, but once you get into it, you realize it’s not nearly as bad as it sounds. (And as you can tell from my total spending, it’s okay to give yourself some flexibility. And definitely don’t beat yourself up over it…)

So, how’d it go?

Well, I stuck to the no-spend plan for a while. For the first few weeks of the month, I looked for cheap or free entertainment options. I replaced expensive distractions with some extra reading and writing for this blog, which as a nice side effect, means I’ve now got an awesome backlog of posts lined up for ya!

To hit the frugality from all angles, my go-to meals involved digging into the treasure trove of previously forgotten meals buried in the freezer. (December 2018 Chili – still delicious!)

But all in all, the wheels slowly started falling off. On the scale of frugality, the month ended as “slightly more frugal than usual” but certainly nowhere near “Wow, epic month, man!”

But hey, No Spend October wasn’t all for naught!

Despite my obvious overall fail, the challenge still helped me turn October into my cheapest month of the year. And I’ll definitely take the free $500 I saved!

Let’s see where exactly the wheels fell off:

Groceries: $153

Making a conscious effort to eat out less meant a few more groceries than usual, despite my best efforts to pillage the freezer for all its worth.

Dining Out: $136

Ended up taking Lady Money Wizard to a nice dinner or two during the month, since this whole “let’s spend $0 dollars” challenge was my wild hairball idea all along.

Entertainment: $121

Hey, it might be No Spend October, but it’s also October. So, lest I wanted to risk getting haunted by Halloween cousins of Ebeneezer Scrooge’s Christmas ghosts, I figured I needed to cough it up for the usual fall festivities.

That meant tickets to a Haunted Hayride (which was awesome) a costume party at the science museum (which was also awesome) and trips to the pumpkin patch and apple orchard (which were fully Money Pup approved):

Even better, an awesome friend and Money Wizard reader turned one of those pumpkins into The Money Pup’s spitting image!

How awesome is that???

House Expenses: $190

The big one here was a $160 visit from our every-other month maid. A little on the pricier side, but after running through three different cheaper companies and getting tired of dealing with the headaches, I’m willing to pay a somewhat luxury price for this luxury service.

A maid is definitely not in the spirit of No Spend October, but as I’ve explained before, this is one of, if not the only bit of lifestyle inflation I’ve succumbed to over the past 6 years, despite my salary nearly doubling in that time. I’ll take it overall.

Other than that, I also needed to make a $30 trip to the hardware store. For the life of me, I can’t even remember what I bought, which goes to show you how thrilling I find spending money on home expenses…

Pets: $111

$50 for The Money Pup’s meds and $50 for litter boxes for the Money Meow.

Other: $160

A bunch of random stuff here, including a big trip to the dry cleaner, bringing in snacks to an office event, a buying a random tank of gas for Lady Money Wizard, and of course, Halloween Candy.

Did you try No Spend October?

Would love to hear how your month went, either way!

PS – As you can see from all the reports I used in this post, I’m a massive fan of Personal Capital. For free, it lets you see all your accounts in one place. This means you can easily track your net worth, see your portfolio allocation in seconds, and best of all, avoid overpaying on fees.

Related Articles:

Well done! It’s insane how big the swings get when the market does well. The side effect of “failing” a no spend month usually means you end up spending a lot less than normal anyways! 🙂

So true about the swings. Cheers!

Wiz,

Love the updates, and keep them coming! Having enjoyed the boost in the market this past month myself, I particularly enjoyed seeing the growth in your brokerage. Here’s to more months like that. That said, it did raise a question.

In past posts, you’ve raved about investing in an HSA because of the huge tax benefits. It was due to your review and a bit of my own research, that I started making this move. It’s hard to turn down the Super IRA, right? However, it just dawned on me that you don’t have one in your portfolio. Any particular reason for this, or is it simply because you’re on an insurance plan that doesn’t offer one? After all, I only invest in mine because of the insurance plan I’m on at work. Being single with no family of my own yet, and a relatively healthy individual, I’ve opted for the higher deductible plan that is coupled with an HSA option at my work. Would love to just hear your follow up thoughts, and looking forward to future posts!

Best,

Matt

Yep, I just don’t have the option with the health insurance plans my employer provides. Otherwise I’d be all over it.

Money Pup pumpkin! Love it.

I did not try no spend October, but to be honest it sounds tempting to take on the challenge. But it will have to wait. With Christmas coming up it would be impossible to do it now (because it doesn’t have to be October,right?).

Perhaps I will try a no spend February or something. It could really boost my saving. Perhaps I could write down everything I almost purchased and transfer the value of those items into the savings.

Haha, thanks! And yes, you can do a No Spend Challenge in whatever month you like.

Damn. 18k in one month is amazing. Market did an up and up this month for sure. Set yourself up for a W big time man. Congrats!

Thanks, Eric!

Money Wiz- I thought you said you were done investing in the stock market as a result of the inverted yield curve and record highs? Did you move $8,000 cash into the stock market or a Vanguard money market? It seemed like you were wanting to stock pile cash until a potential downturn.

Check under the brokerage section. I put it into bonds.

I see- thanks for your response. You’re the man money wiz.

Any recommendations on where people can park money in a good brokerage firm?

Thank you for putting out so many quality contents moneywizard. Have a question. I have invested in vanguard funds. However, market is gonna crash in maybe another year. Now is all time high. Would it be better if i sell them all now, and then buy back when market crash?

NO! Do not do that. Never try to time the market