To say October was a wild month could be the understatement of this blog’s history.

I started October trying to pack in all those wonderfully festive fall activities. I’ve raved before about just how much I love the fall season, and don’t worry… I’ll only rave a little more.

As the fall air’s growing chill asks you to cozy up, and the trees give off their last hurrah of color, I find myself wishing we could just turn every season into fall.

You all can take your beaches, flip flops, and scorching sun… give me some jeans, a sweater, and a warm apple cider any day! #PSL (just kidding…or am I?)

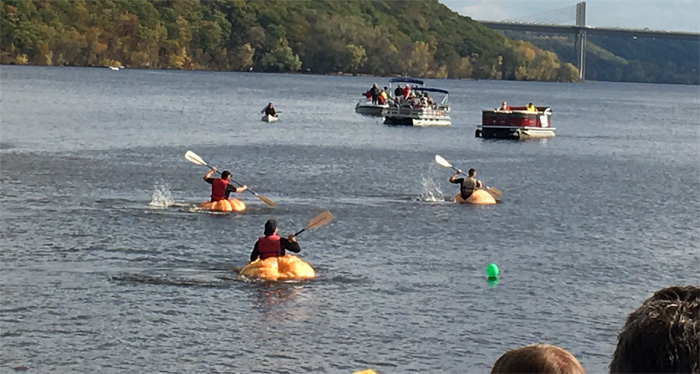

Highlights of this year’s season included more beautiful trees than I had time to photograph, and a local Fall Fest that saw some maniacs racing down the river in hollowed out GIANT PUMPKINS.

Although for some reason this year’s fall felt short. I’m not sure whether that’s because of the whirlwind going on in my life this October, or the fact I spent two weeks of the month traveling to California and Texas – two states known for their total lack of Fall.

In any case, around the second week of October I packed up my bags and headed to sunny California. It had been a while since Lady Money Wizard and I got away, and we were both looking forward to a week of relaxing.

Unfortunately, the world had other plans for that vacation of ours. You see, in the time since we planned our trip, the two of us made the tiny purchase of a whole freakin’ house, and the bank set our closing date to right after our trip.

To complicate matters, our original plans to visit Sonoma Wine Country literally went up in flames. Here was the hotel we planned on staying at:

Yeah… not happening.

Never deterred, our relaxing weekend turned into on the fly improvising, and our one-on-one getaway was frequently crashed by bankers requesting documents, realtors asking for signatures, and other bankers requesting more documents.

Nonetheless, we ended up staying with some friends in San Francisco, and we had an awesome time. With the help of our local friend, we passed on the Fisherman’s Wharf madness, drove right by all the tour buses taking selfies with the Golden Gate Bridge, and went barely off the beaten path to score an even better view of San Francisco’s most iconic landmark:

We sat on that secluded log and had a great time with friends for most of the day. It was an activity that didn’t cost us a penny, but was probably the highlight of the trip.

Less than a quarter of a mile away, tourists battled for parking spots and rushed to find their tour guides, who they paid upwards of $50 for the privilege of shouldering their bodies into an overcrowded bus. As we sat enjoying the silence, we couldn’t help but chuckle at how the tourist traps are almost never worth it, and the best things in life are consistently free.

Having worn out our welcome with our friends, we headed down to Monteray, California for a day. We meandered the rocky coastline by bike, and only fended off about 3,000 phone calls from bankers and realtors during our stay.

But it didn’t matter how many missed calls we had, the scenery wasn’t any less incredible:

The next day, we worked our way back to San Francisco. I hopped on a midnight plane, grabbed a couple hours of sleep, then hopped on a still-dark-outside-flight to Dallas for FinCon 2017 – the blogger’s conference so crazy it will get its own entire post next week.

I stayed in Dallas for 5 days, hopped on another midnight flight, squeaked out a couple more hours of sleep, then headed to the bank for an early morning house closing, right before the very last day of October.

We closed just in time to set up two lawn chairs in the house’s empty living room, and start handing out candy to our first ever trick-or-treaters.

Could there be a more fitting end to this wild month?

Net Worth Update: October 2017

And the detailed breakdown:

To the details!

Cash: $11,243 (+$501)

It’s nice to see the cash inching upwards, which should be helpful as I continue to shop for a rental property investment in 2018.

Brokerage: $105,836 (+$1,842)

No contributions this month, but the brokerage account increased about 1.8% during October due to market changes.

My breakdown remains:

- $54,500 invested with Vanguard’s Total Stock Market Index Fund (Related: How to Choose a Vanguard Index Fund)

- $51,000 invested in a mixture of Vanguard ETFs, with a few stocks back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

401(k): $77,413 (+$3,694)

$2,300 of automatic contributions (including employer matching) with about $1,300 in capital gains from market movement.

After a slow start to the year, I’m still contributing over $800 per paycheck, so that I make sure to max out my 401K in 2017.

Roth IRA: $18,262 (-$185)

STILL NO CONTRIBUTIONS THIS MONTH. Shaking my head…

Even though I announced my plans to max out my IRA during the 2017 tax year (and you should too!) I keep dragging my feet on this.

I think I’ll take a reader’s suggestion and set up automatic transfers to my Roth IRA with Vanguard. (Thanks Saver Steph!) I’m obviously dragging my feet too much otherwise.

Rent Payable: $715 (+$14)

The very last month of apartment rent before moving over to the house!!

Credit Cards Payable: $3,004 (-$255)

The credit card number is always a little over inflated, because I include the total outstanding balance on all credit cards. Even though I never pay a cent of interest, the way the timing of the billing cycles works out, this number usually equals about a month and a half of spending.

Which is why I started included these detailed spending reports:

Total October Spending: $2,289

Not my worst month ever (I’m looking at you, September 2017) but not my best either. Some of the major categories:

- Dining Out – $215

- With the stress of the move and half our apartment packed away, we defaulted back to a little more eating out than the budget.

- Travel – $510

- California sure ain’t cheap. This damage could have been at lot worse if we didn’t have the help of the Chase Sapphire Reserveto give us free flights, and I didn’t cash in some hotel points to find a place that wasn’t burned to the ground.

- Entertainment – $39

- A few trips to the breweries, a redbox, and the fall fest featuring GIANT PUMPKIN BOATS.

- Clothes – $255

- After nearly 5 years, I had to replace all my dress pants for work. 🙁 Here’s to hoping this set lasts me through early retirement. 😀

- Other – $256

- Mostly dog related spending, plus a few Christmas gifts for friends and family.

And that’s a wrap on the craziness of October!

By the way, if you’re not already tracking your own spending, I can say from experience it’s probably the easiest way to start taking control of your money. I highly recommend Personal Capital, which will track everything for you automatically. If you prefer to be a little more OCD, you can always track it manually using this underrated iPhone app.

Readers, how was your October?

Related Articles:

Grew up near the fires. All my friends and family were okay in the end. Some has to evacuate though. Trip to SF looked like a lot of fun brohammer. Glad you knew about the fires before your trip and not during your vacation. That would been bad.

Glad to hear everyone is okay. Definitely a scary situation there.

We actually had moved our stay to a different hotel in Sonoma for a while. Eventually I learned that new hotel had been labeled an evacuation crises center, and when I heard how hard rooms and beds were to come by, I figured two out of town idiots who were just there for the wine tasting could give up our room for one of the 2,000+ families without homes, or any number of the rescue workers trying to contain the fires. Definitely a sad situation, and I hope they’re able to recover the best they can.

Awesome pics from California. A few years ago I went biking across the golden gate, into Socilito, and back into Golden Gate Park. It’s always great to go off the beaten path.

Another solid month of network gains. Keep it up!

Thanks Gary, I’d wanted to check out Sausalito but just didn’t have time.

On the early retirement bucketlist is a multi-week drive from Seattle, through Portland, and all the way down Highway 1. Hopefully then I’ll have time to check out everything!

Good photos and way to keep on the accountability track with commitment to FIRE 🙂 … feel free to follow and comment at CPO too …. from the the far side of the planet … CPO 🙂

Thanks Michael, I’ll check it out.

Thanks for the shout-out!

Per your own advise, it’s nice having transfers automated, and seeing your various accounts grow 🙂

Regarding your CC’s, have you thought about changing the due dates to make them all coincide with each other, or for a different due date? I changed mine to manage them better, and help me better see per month charges (my bill is due on the 2nd each month). It’s definitely helped out my budgeting and it’s better than having some middle-of-the-month bill. Then I always see what money I have left over and transfer it to my Ally account….which just went up to 1.25% last week! Cha-Ching!!!

Good call, although I’ve *mostly* got that part under control. My due date is near the beginning of the month for all cards.

But even with corresponding due dates, the nature of credit cards means charges incurred under one billing cycle aren’t due until 30 days after the close of said billing cycle.

You gotta bet I’m taking that free loan from the credit card companies! So whenever I look at my “amount due” it almost always covers 50+ days of spending.

An increase of over $17,000 in the past 90 days (based on that Personal Capital snapshot) is impressive by any means – thanks for the update! I’ll be interested in watching your progress over time 🙂

Thanks! Those 90 day changes continue to blow my mind.

Like a lot of progress, in the moment it feels like not much is happening. Then you zoom out to a longer period, and the results are crazy!

Do you make any money from this website and are any numbers priced in to your NW month over month?

Hey TK, the site makes a little bit of money, but I keep it all in a separate account. It doesn’t get included in my savings rates, net worth updates, or budgets. My plan is to reinvest it all back into the site, and hopefully keep growing the message. I talk about that more in my FinCon recap:

https://mymoneywizard.com/what-i-learned-from-fincon/

Your doing a remarkable job and you will get there. If its any motivation for you here are my numbers:

Age 33 (turn 34 in Jan)

Brokerage account: 400,000

My IRA 127,000

Wife IRA 135,000

Savings: 90,000 bank account

Principal residence owned free and clear $400,000. Extra half acre lot owned next door: $45,000

Real estate holdings to flip owned free and clear. Value upon completion:

Property 1: 140,000

Property 2: 129,900

Property 3: 138,000

Property 4: 110,000

Wow, Jancsi, you’re killing it! Owning 5 properties free and clear plus a hefty liquid brokerage account at 33 is incredible.

What’s been your strategy? Especially for paying off those real estate flips? I’d be really interested to hear!