Although I can’t yet say that I’ve “Made It,” like one of those hot-shot, Shark Tank style entrepreneurs, as of a little over a week ago, I can now say this little website was on CNBC as a featured “Make It” story!

Pretty exciting stuff, and also pretty intimidating to see your life story end up as the top article on the front page of MSN and Yahoo, right underneath a photo of Donald Trump’s hair… oh and his face too.

Big regrets for not taking a screenshot of that one. Why do we never have a camera when we need it??

At this point, you’re probably either already familiar with my story or just came to this website from the CNBC article. That said, the reporter (Kathleen Elkins) did a great job weaving my incoherent ramblings into an entertaining crash course in early retirement, so check out the CNBC feature here!

As fun as being featured next to a presidential candidate The President is, I’m quickly learning the far more entertaining part of these mainstream articles is the hilarious, bizarre, and often downright angry comments from the readers.

Not only did I continue to learn new and interesting things about myself (the comments informed me that I’m obviously a compulsive gambler, that I live with my parents, and that having children somehow contractually binds you to financing a new minivan) but a pattern of comments representing some seriously misguided assumptions about early retirement emerged.

I was guilty of a few of these assumptions myself before I really started researching the realities of early financial freedom, so let’s debunk a few of these misconceptions:

1. “You Must Live Like a Hobo if You Save More Money Than Me.”

This was a common one. Here are a few direct quotes from the comments sections:

- “Even the welfare live better than his frugal lifestyle.”

- “Why save and live like a homeless pauper? Enjoy the fruits of your labor.”

- “He’s not a Money Wizard, he’s just a miser.”

- “Secrets [to saving $150,000]: 1. Be a miser. 2. Lie to others about your financial condition. 3. Be a jerk.”

Well that got out of hand in a hurry…

Obviously, all of these are incorrect. Anyone who follows my monthly Net Worth Updates knows that I live a ridiculously decadent lifestyle.

I travel almost every month, eat out multiple times per week, and rent a nice apartment that is probably way too big. In 2016 alone I’ve traveled to: Florida, New Orleans, Cape Cod, Canada, Montana, Wyoming, South Dakota, Wisconsin, ski trips to Utah and Lake Tahoe, and probably a few places that I’m forgetting right now.

But I automatically invest tons of money before my paycheck ever even hits my bank account, then work hard to keep the BS expenses low so I can invest even more of what’s left.

I’m not saying this to brag, I’m saying it to prove that by not wasting money on junk that isn’t important to you, anyone can free themselves to live a great lifestyle AND improve their finances in the process.

2. “$750,000 isn’t enough to retire on, because… inflation. Also because it’s not very much. PS – you’re gonna be poor.”

This is also incorrect. That $750,000 number is adjusted for inflation. To understand how, we need to break down the stock market a little bit.

Break down time!

A stock investment, at its core, is a claim in a real company, and it’s important to remember a company is not just a logo and a board of directors. Companies are made up of real assets, such as land and equipment, and companies make real earnings from the sale of real goods and services. Really.

When a company’s real estate increases due to inflation, the value of your stock eventually increases along with it. When prices inflate, companies adjust their prices higher, which allows earnings to also grow with inflation. Those earnings ultimately make their way to you, the investor, in the form of dividends and/or higher stock valuations.

Because of this, stocks are an excellent hedge against rising prices.

The stock market’s performance supports this. Historically, stocks have returned right around 11 percent since 1950, while inflation has been roughly 4 percent. So when you hear people referencing a 7% historical return on stocks, that’s the historical return of stocks after inflation.

So when I simplify predictions and assume a 7% return, any quoted numbers in the future have already been adjusted down to today’s dollars. Looking at it another way, if we assumed stock returns that included the effect of inflation (11%) I would say I’m planning on retiring with around $1.2 million future dollars.

Which is interesting, because I bet if I said my magic number was $1.2 million dollars, the amount of concerned commenters would sharply fall off. A million dollars just sounds like a lot.

Isn’t it fun to say? One Million Dollars.

Which brings me to sub point B)

- $750,000 is the inflation adjusted amount of money that I need to retire.

Using the 4% rule, this is a portfolio capable of spitting out $30K of today’s dollars per year. Based on my current expenses, I have somewhere around $10,000 of wiggle room built in there, which is pretty darn close to the USDA’s estimated annual cost of a child.

Yes, that number might increase a little bit with the addition of a spouse. But remember, this is 2016, and women are strong creatures fully capable of making and saving money as well. In reality, my girlfriend is probably an even better saver than I am, and she doesn’t buy into diamond rings or expensive weddings, so I like my chances.

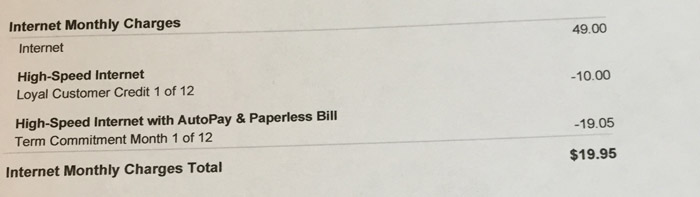

3) $10 internet Continues to Amaze

Not only did my $10 internet bill continue to prove more impressive than a $150,000 portfolio, but the allegations have now grown into me be a hard-nosed negotiator, who rips off his own girlfriend in the race towards early retirement:

While we’re at it, I’ve got a jump to conclusions mat for sale…

As our good friends at Adidas once said, impossible is nothing:

🙂

_____________________

Related Articles:

Hilarious that they suggested you were free loading off of your girlfriend hahaha. I think the idea of early retirement is mind boggling to people. Hopefully learning this new view point has changed them for the better even if they left you a nasty comment!

Yep, I’m encouraged that the message gets out either way.

For each wild comment about compulsive gambling or freeloading, I know there are just as many who are getting excited about financial responsibility. I’ve gotten plenty of those more positive emails too, and that’s the sort of truly awesome stuff that keeps me writing.

The idea of early retirement does seem scary and impossible to manage based on how the American lifestyle is all about spending money that we don’t have or just flat out shouldn’t spend. That’s why everyone is in debt and will probably work until the day they die. Just because someone like you can come in and show us that it’s very possible to successfully manage your finances in a way that lets you stop working well before the average American does not justify the hate that these guys are showing you. If you have haters, you’re doing something right. Keep it up!

Thanks Joe! Haters gonna hate, so it’s all good!

Whats the phrase, oh yeah, ‘haters gonna hate’. Sounds to me a lot of ignorant an/or jealous people. You do you and I for one, totally appreciate you and your site and wish you all the best! I have even begun passing you posts along to my 17 year son in hopes that he will garner some financial wisdom from the wizard, that is you! 🙂

It always amazes, yet saddens me when people see a person working hard and living life differently than the supposed norm, and how said people wan to tear them down, they should learn from the great Booker T Washington, “If you want to lift yourself up, lift up someone else” BOOM!! mic dropped walking off the stage….

Hahah, I like your style! Awesome to hear you’re sharing the posts too!

I love how it always comes back to the internet bill.

To be honest, I didn’t know how much I paid for internet before I looked it up today. My girlfriend and I share the bill just like you. I’m happy to find that she’s found a good deal – and I’m only paying $9 a month! The bill is $18 total.

Impossible is nothing.

Haha, I know right?

Careful posting that internet price here though… The Yahoo readers might see your comment and send some of my hate mail your way. 😉

Mad props to you sir on that internet price!

And I was thrilled to get mine down to $50!

Thanks TJ. Internet can be insane in certain areas of the country. My only advice there is that despite what the sales reps will try to tell you, these days even the slowest option is perfectly capable of youtube watching, streaming netflix, and even running a blog! 🙂

I am always so completely shocked when the comments section descends into chaos. Hello wild, wild west. My favorite are the angry trolls that can’t even formulate complete sentences when unleashing their rage. You have reduced them to telegraph like bullets of darkness and vitriol all by simply suggesting an alternative path might lay ahead.

On to the positive… Thank you for writing and inspiring others! I have enjoyed your story so much since you are closer to my own age than other FIRE bloggers and podcasters. It is refreshing to have a story that features slightly more normal living than some of the others. I love a good meal out during the middle of the work week, and occasionally like to hop on an airplane to some awesome unexplored part of our globe. Since joining this community of readers I’ve driven my monthly savings rate from 9.5% to 22%. I have gotten a handle on debt and have started to make each consumer world purchase with an eyebrow half raised and a health dose of forethought. Maybe this community is meant to stay small and quietly filled with awesome.

That is awesome to hear!! Very impressive jump in that saving’s rate of yours. Here’s some more motivation for you: just increasing from a 10% to 20% savings rate shaves off around 15 years from your working career. Congrats on your new retirement date!

I agree the message isn’t for everyone, but I’m not so sure this community was meant to stay small. We’re growing like crazy! In the past two months, we’ve averaged about 25 new email subscribers per day! It still blows my mind to watch.

Hey, hey 25 a day is awesome! I have sent the blog to a few friends and my sibling. One has gotten very into it and we regularly discuss. The other two haven’t yet taken the bait, but I am holding out hope that they’ll come round.

In my own recent calculations I estimated having shaved off 8 years from my retirement date. I like your figures better!

I started following you last month and I love what you write. I did not make your goal of retirement really young but I did manage it at 57. Net worth of $1.5M. Health care covered for life due to military retirement which also is indexed to inflation. Some things that helped me.

Both children got full academic scholarships to college. Read to and with your kids.

We bought land (paid cash) and raise cattle – great way to save on taxes.

Our hobbies save money. Fishing and hunting (we eat what we catch/kill).

Gardening, not only is our life full of beautiful flowers but we raise 50% of the fruit and vegetables we eat in a year. We also donated 850 lbs of top quality produce to the local food bank.

My lifestyle isn’t for everyone but there are as many ways to do what you are trying to do as there are people who try.

Rock on!

No you rock on! Always love hearing advice from the people who have been there and done that. Sounds like you’ve set up an awesome lifestyle for yourself, congrats!

Definitely looking forward to seeing your wisdom more in the comments!

C’mon we all know that screenshot of your bill is a fake. Haha, jk! ?

It’s sad how many people try to tear down a success story like yours, especially since you are giving free advice. I think Henry Ford said it best “whether you think you can, or think you can’t—you’re right”.

The bill is clearly photoshopped, haha!

Interesting comments from readers. I’m not that surprised. At least, I’ve read many of such comments on people’s stories.

Not matter what, you’re inspiration to many others to shape their personal finances.

Those responses were all ridiculous. Kudos to you for trying to respond with rational explanations. Sadly, I think that the folks who write such comments typically suffer from true believer syndrome, so the more evidence you show them, the less they are going to actually believe a word you say.

Terrific little post that summarizes some good points and congrats on the huge featured article. Sorry to hear about the negative comments on there, why must people always question everything they see in such a terrible manner. I see this time and time again when people seeking ER or FI get featured on national publications.

Glad I saw this on Rockstar Finance

Have a great day

Congrats on your feature! Being 27 and in a similar mindset, I read the CNBC article and thought “There is not reason I can’t have the same life.” Those comments are hilarious, but sad at the same time. I read a few and just had to stop. I’ve noticed over the years that people have a really hard time not projecting their situation and beliefs on others. Just because they aren’t frugal, can’t imagine your living situation, and would never dare try to keep expenses as low as possible, you are instantly wrong. If $750,000 is what you need to retire in your situation, than that is all that matters. You’ve found a way to make it work for you and it doesn’t seem like you project that approach and look down on others because they don’t follow your exact methodology. Each person’s story and situation are unique and I think they should be treated as such.

Bert, One of the Dividend Diplomats

Interesting blog. I don’t know if your $750K is enough not because I doubt your sustainable withdrawal assumptions, but because of the unexpected lifestyle creep and some unknowns about taxes, healthcare and economy. If you are planning to live on only $24K and your SWR is $30K, then, you have 20% cushion during the ‘good’ years that you can accumulate to tide over any unplanned surprises in expenses. But if you do plan to spend $30K inflation-adjusted in retirement, then your plan needs some cushion.

Thank you for your article. I too am on that path but our recent election may throw a damper on the health care options. Have you researched costs for a family for health care today? I am assuming you may go et married and possibly have a child or two? I hear health insurance has been hoping up by 7% per year. By the time you retire it could cost $3-4k per month?

What are your thoughts on that possibility?

Dear MW, Only those who are jealous and ignorant mock & cry foul at whatever you have accomplished. My own experience tells me that its very achievable with a hunger for financial knowledge, discipline and focus on a critical few financial goals. I am sure these jealous and ignorant ones are also drowning in debt because of their ill-advised choices and the company they keep…and repeating the same mistakes over and over – on a daily basis.

11 million Americans spent at least half their income on rent.

You don’t have to be homeless to retire early, but I doubt early retirement is even possible for those whose rent consumes half their income.

Jacob from Early Retirement Extreme lives off $7,000 a year in San Francisco. Nothing is impossible.

But yes, if you’re working an extremely low wage and spending a large portion of that on rent, you better be willing to make drastic changes to your situation if you want to retire early.

It is possible to retire on $750,000. It depends on the type of lifestyle one goes for.

Ben