Crisp, cool air… fading leaves… me suddenly panicking about where the summer went…

Yep, we’re officially heading towards Fall.

Welcome to the… September edition of my monthly Net Worth update? Yep, we’re definitely heading towards Fall.

If you’re new here, every month I share my progress towards a goal of nearly $1 million and an early retirement by age 37. If you feel like time traveling, check out the net worth updates page where I keep all the entries since April 2016. PLUS some napkin notes from even before then.

I started September off with a belly, I mean a bang, by indulging in the week-long gorge fest that is the Minnesota State Fair.

By average daily attendance, it’s the largest state fair in the United States. By pounds added to a waistline, it’s a runaway winner.

Between buckets of French fries, bags exploding with mini donuts, and anything and everything fried and then put on a stick, “the great Minnesota get together,” sure knows how to cook. Or maybe they just fry…

You’ll have to go back to last year’s August update if you want to see the world’s fattest hog, but rest assured, this year didn’t disappoint. I bought some discounted tickets and got to stuffing my face.

I also played a mean game of skee ball, which to my surprise, was not rigged by the carnies. I actually walked away with a prize! I promptly gave the new toy to The Money Pup, who posed for an adorable photo right before he decided to rip the poor bear’s eyeballs out.

I soon worked off the food hangover by gratefully accepting an invitation to retreat to a friend’s lake cabin.

I enjoy living in the city, but I’d be a huge liar if I didn’t admit how jealous I am of people who get to see beautiful, unobstructed views of the night sky. While at the lake, I tried to capture a photo of the silent beauty for you loyal readers, but my camera’s terrible quality photo was too embarrassing to post here.

It looked something like this:

In the city, I can hardly open my windows at night unless I want to be startled awake at 3 AM by a blaring siren and maybe a gunshot or two. But here in Minnesota’s northern woods, I can let the windows rip and still sleep like a baby.

It begs the question, how much are we sacrificing our sleep, and ultimately our health, to live near our careers?

Here’s to reaching financial independence, and being able to live wherever we want. With or without a job.

The rest of the month was much less eventful. I mostly kept to my routine of work-gym-dinner-repeat, with a few weekend date nights thrown in between.

OH, and we bought a house.

?

More on that shocking development over the next month. Stay tuned!

Net Worth Update: September 2017

And the detailed breakdown:

The market must have really gone mad, because September 2017 will go down as one of my least frugal months EVER.

To the details…

Cash: $10,742 (+$2,668)

Cash went up because I haven’t had to pay the piper yet; September’s redonkulous credit card bill is going to be a serious cash drag on next month’s cash growth, to say the least.

Readers of my emergency fund article would be fair to call me a bit of a hypocrite for carrying this much cash. Mostly this is money saved up for the downpayment on a potential rental property within the next year or so.

Brokerage: $103,994 (+$2,590)

No contributions this month, but the account increased thanks to a little percentage shift up in the market.

At month end, my brokerage account included:

- $53,500 invested with Vanguard’s Total Stock Market Index Fund. (Related: How to Choose a Vanguard Index Fund)

- $50,400 in a mixture of Vanguard ETFs, with a few individual stocks back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

401(k): $73,719 (+$4,176)

$2,300 of automatic contributions and employer matching, and an almost equal increase from market movement.

After a slow start to the year, I’m still contributing almost 30% of my take home pay so that I make sure I max out my 401K in 2017.

Roth IRA: $18,447 (-$92)

No contributions this month. Investing $5,500 sometime between now and April 2018 (the cutoff date for 2017 eligible Roth IRA contributions) is still a goal of mine. Each month I seem to comment about how I should take a little from my huge cash stash and place it here, and each month I drag my feet. Anyone want to give me a nice scolding in the comments section below?

My Roth is invested entirely in Vanguard’s REIT index fund. I like this allocation, since I otherwise have no exposure to real estate and do not own a house.

Rent Payable: $701 (-$18)

This number includes my utilities. The crisp fall air meant more open windows, which saved a little bit on the air conditioning bill. Even if that brilliant idea was brought back to reality by a 3 AM wake up from city noises.

Credit Cards Payable: $3,259 (+$1,498)

Here’s where the insanity of spending starts to rear its ugly head.

As usual, this number is a little over inflated due to some work expenses that I’ll get reimbursed for. But there’s no way around it, I spent a ton of money this month! Let’s check out the details:

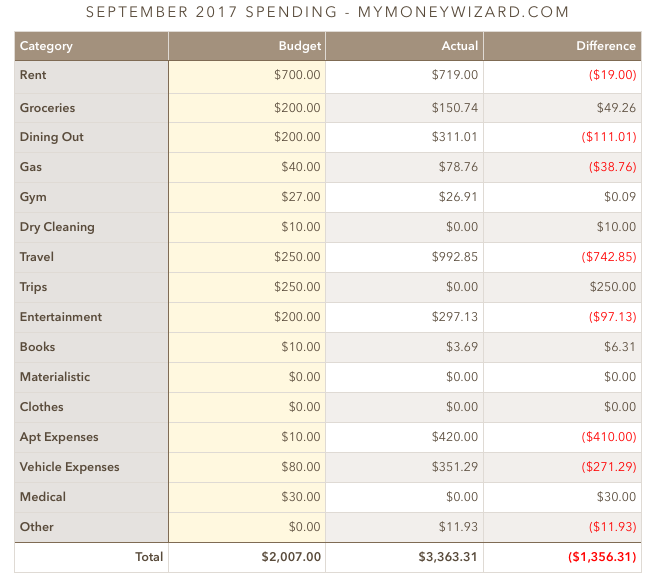

Total September Spending: $3,363

After two rock solid months of saving about 70% of my take home pay, I fell off the wagon hard in September.

In my defense, I had a few unusual expenses:

- The $992 of travel includes $550 of reservations for a group ski trip next year. My real share of this bill is only $135.

- That big travel number also includes $400-ish dollars that I prepaid for a December vacation.

- I was taking a leisurely drive down the highway, when out of nowhere a huge rock flew off a semi and shattered my new car’s window. A $260 windshield replacement later and I was just glad nobody got hurt

- Having an offer accepted on a house (is this real life?) meant $420 spent on an home inspection.

With those weak excuses out of the way, here are some of the other categories worth highlighting:

- Dining out – $311

- Ouch… fell off the wagon on my New Year’s Resolution to bring my lunch to work more. I also played host to some family who visited Minnesota during the month. Hopefully I should get this back on track next month.

- Entertainment – $297

- Also higher than usual (seeing a trend this month?) Major expenses included the previously mentioned state fair, an AWESOME food truck fest, an epic game of mini golf, and lots of trips to the breweries just because family was visiting. And definitely NOT just because I wanted a nice delicious cold one. 😉

- Vehicle Expenses – $351

- $77 of car insurance, a $9 car wash, and the dreaded $266 windshield replacement.

If you’re not already tracking your own spending, I can say from experience it’s probably the easiest way to start taking control of your spending. I recommend my new most underrated iphone app, or if you want an even easier and automated experience, personal capital.

Readers, how was your September?

So MMW had a girlfriend and now he bought the house, how are the haters gonna hate now?

Congratulations on becoming a homeowner.

Haha thanks, although it’d be a lot more accurate to say she bought the house, which I’m sure the haters will go nuts over.

Yay for buying a house! It’s been a big summer for house purchases in the FIRE community, I’ve noticed. 🙂 It does suck because buying a home incurs all kinds of sneaky little bills that you try to plan for, but they always come by surprise. We’ve been in our home for a year and I’m grateful we had a huge cash buffer when we purchased it.

Shouldn’t your windshield be covered by car insurance?

I feel your pain, I got a nail in my tire and had a hefty fee to replace it ($360). Apparently, I have the most expensive tires ever!

Apparently it was a $25 per year option that I overlooked. I’ll be adding it ASAP.

At $25/year, I’m not even sure how that’s profitable underwriting for the insurance company… If you have one windshield accident every 10 years, you’re coming out ahead. Everyone I know has had at least one replacement/repair on their vehicles, so it seems like one of the rare smart bets in insurance.

Per your own recommendations in your June article regarding setting your saving on auto, you could just set up those $450/month reoccurring transfers to your Roth account…then just add the $100 whenever to hit the max.

I’ve started doing this, and it’s been great. I’ve got all my incoming/outgoing transfers in sync so I don’t accidentally fall short.

Congrats on the house! I’ve been looking around for something, but the prices are ridiculous out here in SoCal.

I like the idea!

What is the matter with you not maxing out your Roth IRA! Quit spending so much money on fried cookies and beer 😉

Just kidding you got time. You could pay off the credit card and max out the IRA in one shot. Being a little cash poor always helps to control spending.

Congrats on the house. Look forward to hearing more about it.

haha, thanks Grant!

You bought a house!! Didnt see that one coming so soon. I almost feel like you should have consulted with us first before buying the house. LOL. jk congrats on buying the house. I look forward to reading more on this.

Haha, I know! It felt a little wrong not having you all along for the ride. Don’t worry though, I’ll be sharing all the details soon.

These are definitely my favourite articles you post on the blog, where we get to pick your brain and see where your money goes! 😉 Would love to see an article on how you budget when travelling!

Thanks for the feedback Zackery!

One day I’d like to write my own piece, but in the meantime, Business Insider and Uproxx both interviewed me about saving money on travel:

http://www.businessinsider.com/millennial-super-saver-shares-7-best-tips-for-traveling-on-a-budget-2017-5

http://uproxx.com/life/money-wizard-travel-saving-tips/

From what I’ve read, front loading a roth IRA results in a greater return than consistent contributions throughout the year. By waiting till the end of the year to make your contributions, you have really missed out on a whopping one dollar increase in the stock price and and a little over a two dollars of distributions during the year (yes this is for the ETF, but I would assume the index experienced a similar total return).

That makes sense – all else being equal, we want our money invested. The earlier we invest, the longer our investments have to compound.

Hello Money Wizard. I’m tryyng to compare the increases of amount of your Vanguard investments. Comparing your Aug vs Sept. it seems it went up by 1,100. (Correct me if I’m wrong). It looked like it grew around 2%?

That sounds right. And based on the stock charts, it looks like VTSAX increased from $61.96 per share to $63.05 per share during the month, or about 1.8%.

Nice update money-wizard! You may have overspent a little because of travel, but in the grand total of the year I bet you jave well over 50% savings.

Hello Money Wizard!

how is composed the other half of your investment portfolio “a mixture of Vanguard ETF”?

Congratulations for your blog!…..inspiring!

Hey Luca, I should add more detail to that section. Here is what I wrote all the way back in May 2016 about the makeup of that ETF portfolio:

-35% in Vanguard ETFs which track the overall stock market

-25% in individual dividend paying companies

-15% in government and corporate bond ETFs

-10% in International ETFs which track the international and emerging stock markets

-10% in cash

-5% in ridiculous and foolishly speculative companies. Not surprisingly, some of these have TANKED since I invested…

The make up has changed a little since then, but that’s the gist of it. The specific Vanguard ETFs are VTV and VUG.

Thanks for the fast reply. What do you think about the following portfolio composition?

S&P 500 (DR)-ucits -VG 50%

FTSE Developed Europe (DR)-ucits -VG 40%

FTSE Emerging (DR)-ucits -VG Emerging Markets 10%

Here in Europe we can’t buy directly from Vanguard. These are the FTE we can buy on the Amsterdam Stock Exchange!

Have a nice weekend

Hi MMW I like your blog and the information is very helpful.

I was just wondering looking at your Monthly income/Cash if you would be eligible for Roth IRA based on the IRA income limits or Am I misreading your net worth Report ?

Despite the few minor bumps in the road, not a bad month. Congrats on passing the $200K Net Worth.

Looking forward to your house purchase post!

Your doing great at 27!

Keep up the great work.

Dom