Hey Money Wizards!

Welcome to the September Net Worth Update!

Every month, I track my progress towards a goal of about $1 million in net worth. I’m hoping that amount will let me leave my white collar office job within the next four years.

The goal is early-retirement or hobby employment by age 35. I’m currently 31, and hopefully getting close!

Life Update: September 2021

The big life story of September was the honeymoon.

You might have remembered that in August we blew the budget on our wedding.

Come September, we’d long forgotten about those woes thanks to a little thing called, “Hawaii time.”

For the honeymoon, we flew to Kauai, which I’m told is the least populated of the different Hawaiian islands. Not that I’d know anything about that; this was my first time to America’s adopted chain of volcanic land.

But I do know that the place is absolute paradise. I think The Money Wizard could get used to a little island life…

Okay, now back to work!

Let’s check out the money…

Net Worth Update: September 2021

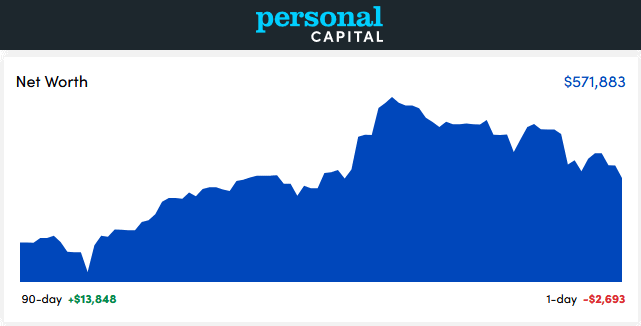

Nifty dashboard provided for free by Personal Capital

Nifty dashboard provided for free by Personal CapitalYes, yes… I know none of us can believe it in the money-printing-fueled perfect world that we’ve been living in, but, for the first time in 12 months, it is possible for the stock market to go down.

As my poor portfolio proved…

What caused this impossible-to-believe drop?

I have no idea, I was in Hawaii…

Boy, the Money Wizard sure is mailing it in this month.

What!? Now I’m getting heckled by my own italics?

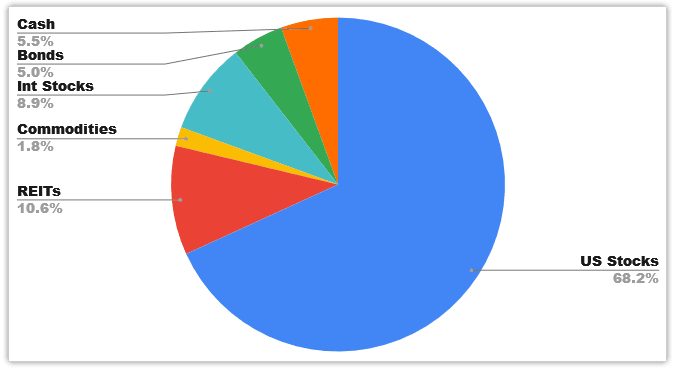

Fine, fine… at least I spent the time putting together this fancy chart about my current portfolio allocation.

Can I go back to Hawaii now?

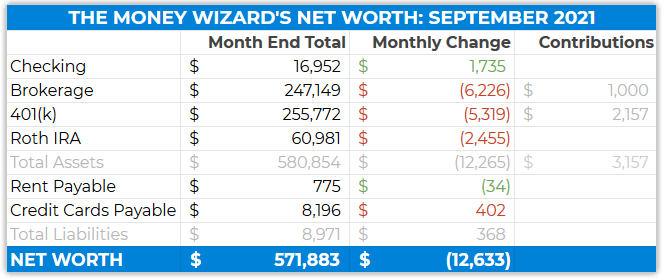

Checking Account: $16,952 (+$1,735)

Don’t get too comfortable, Mr. Checking Account. There’s still an enormous credit card bill you’ll have to pay since your owner was busy lazing it up and sipping Mai Tais on the beach all month.

Once that amount is sorted, maybe we can get to work putting you dollars into some more productive assets.

Brokerage: $247,149 ($6,226)

Luckily, the checking account did run it’s $1,000 automatic investing magic.

That’s thanks to to me recently setting up Vanguard’s auto-pilot investing settings. Definitely one of the best decisions I’ve made in a while.

Unfortunately, that $1,000 contribution only slightly offset some much bigger losses this month.

401(k): $255,772 ($5,319)

Another instance of those automatic investments working harder than their lazy owner can.

My 401k setting automatically invested another $2,000 this month, thanks to the 401(k) maxing I long-ago set up, plus the benefit of my 7% employer matching.

Roth IRA: $60,981 ($2,455)

It seems the REITs weren’t shielded from the overall market decline last month, so market movement brought this account down by a little over $2,000.

(This portfolio is about 75% of the VGSLX index fund and 25% VITAX index fund.)

Rent Payabale: $775 ($34)

On the plus, September is beautiful in Minnesota, and I don’t think we ran our heating or cooling once.

For newer readers, this rent payable is my half of the living arranagements, since we live in a Minneapolis home in Lady Money Wizard’s name. This total includes the mortgage, utilities, maintenance, etc.

Of course, we’re now 100% married, so it probably doesn’t make sense to be paying her rent anymore. Expect this category to change in the future once everything’s combined.

Credit Cards Payable: $8,196 (+$402)

Wowza…

I put all of Hawaii on the credit cards, and due to the way the billing cycle cutoff works, there’s even some of the over-budget wedding included in this category.

It’ll all get paid in full before any interest or fees hit, but it will still be nice to get this total back down to earth.

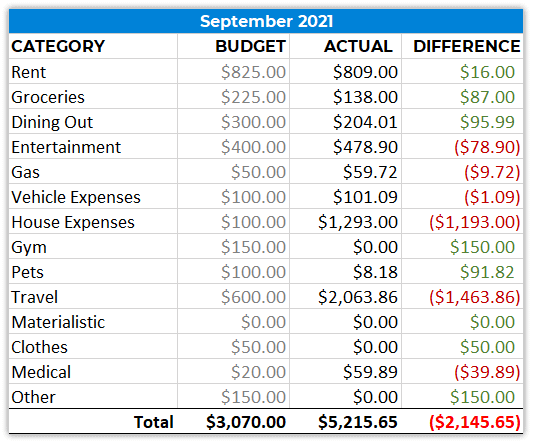

Total Spending: September 2021 ($5,216)

Ouch! Another month of red!

Travel: $2,064

Hawaii is amazing, but it sure isn’t cheap! This was entirely the 8-day Honeymoon in Hawaii.

House Expenses: $1,293

Adding insult to injury, we bought a new mattress, and we weren’t frugal about it.

We went the frugal bed-in-a-box route two years ago, with a mattress that cost $100 off Amazon. It was great… for about a year… and we’ve been waking up feeling like we’ve been run over by a truck ever since.

The last straw was when we stayed at a friend’s house and had the best night’s sleep in months… on an air mattress. Of all things.

Then the beds in Hawaii reaffirmed just how saggy, lumpy, and god-awful our mattress had become. We got home and drove straight to the showrooms.

The new mattress should be coming in a few days. Wish us luck. 😬

Entertainment: $478

An Oktoberfest or two, and then we stockpiled for some future house parties by spending way too much on high-end alcohol. Are we just trying to blow the budget?

Thankfully, we’d been pretty under budget for the first half of the year, and the spending should come back into the stratosphere for the rest of the year.

Readers, how was your September?

Hope you’re staying a little more on budget than I am!

Related Articles:

Beautiful pictures of Hawaii! Hopefully, this down month of September doesn’t cause a slippery slope, but it was a good time to buy some stocks at a discount. Hope you enjoyed your honeymoon Money Wizards!

At 31, I’m so impressed with your 401k balance. At what point did you start investing/maxing out the account?

Waimea is so cool! Took my mom for her birthday a few years back. Hope you had a great time!