Drumroll… please…

No seriously, can we make this a really cool, dramatic intro?

Maybe dim the lights a little. Throw on some spooky music. And would it kill you to get a fog machine and an acrobat or two?

Because today, I’m debuting a concept that I’ve wanted to publish since I first stated this blog. But until now, unfortunately, I’d just never gotten around to it.

Why? Mostly because the dreamed up project was no small task. It required detailed tracking of every single cent I’ve spent over the course of 365 days, with zero lapses in record-keeping during that time.

But now, thanks to some high-tech and not-so-high-tech advances in the budgeting department, namely Personal Capital and my numbers spreadsheet, I’m finally able to make this silly dream a reality.

So, behold…

The Money Wizard’s Complete Annual Spending Report – The 2018 Edition

After all that hype, let’s get a little anticlimactic…

This year, preparing the “mammoth” report was actually a total cakewalk. Thanks to the two previously mentioned tools, all I had to do was tally up the monthly spending reports that I include in each month’s Net Worth Update.

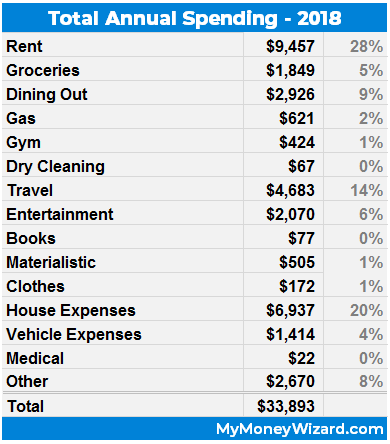

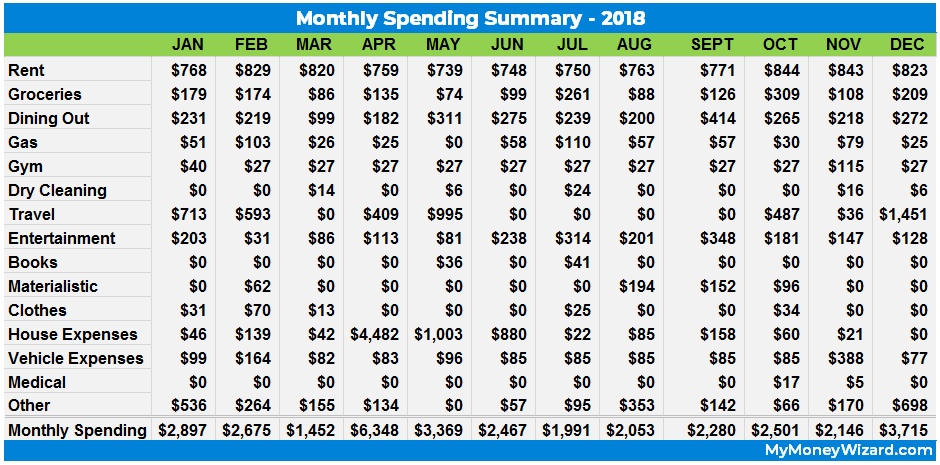

Which is exactly what I’ve done below. So, let’s see what we can learn from my whole year, summarized in two tables for your convenience:

Perhaps you’d like a little more monthly detail? In the words of the iPhone, there’s an app… err… chart for that.

Total Annual Spending: $33,893

Dang! That’s a whole lot higher than the $22-24,000 spending world I lived in for the first 4-5 years out of college. What happened?

Let’s dig through my notes, category by category.

Rent: $9,457 (28% of total annual spending)

In October 2017, Lady Money Wizard closed on a house in her name. Since I’m not a deadbeat, I offered to pay for my half of everything.

The end result was a monthly “rent” payment of roughly $700, which covered my half of the mortgage, insurance, property taxes, internet, one of those $50/mo home appliance repair services, trash service, and internet bill.

This $700 figure also included my half ($150 per month) towards our home maintenance fund. We plan to use this maintenance money in the event a tree crashes through the side of our house, letting us star in our very own Farmers Insurance commercial. (Or more likely, in the event our roof ever needs regular repair, the water heater needs replacing, etc.)

The remaining monthly fluctuation above $700 is my half of the heating, cooling, and water utilities. As you can tell from the monthly chart, utility prices tend to peak during the winter months for us Minnesotans.

Groceries: $1,849 (5%)

Most of this was spent at Aldi, which I’m convinced drops the final bill by about 15-20%, especially compared to some of the fancier grocery stores.

Dinning Out: $2,926 (9%)

I did a poor job staying on track with my goal of cutting down on lunches out during the workweek. I also defaulted to take out quite often, in addition to Lady Money Wizard and I’s weekly-or-so dinner dates.

(If anyone has tips to avoid the constant sushi temptation, I’m all ears…)

Gas: $621 (2%)

After trading in my gas guzzling dinosaur burner (an old pickup truck) for a more reasonable Mazda 3 in late 2017, my gas prices dropped considerably this year. Hooray for 30-40 mpg!

Gym: $424 (1%)

My health insurance includes a benefit of reduced pricing on gym membership. So, I pay $27 a month for access to a nice health club.

Towards the end of the year, I also dropped $88 on two discounted Groupons for a 10-session boxing class, in hopes of spicing up the gym life.

Dry Cleaning: $67 (0%)

One of the best purchases I ever made was a set of machine-wash friendly, anti-wrinkle dress shirts from Banana Republic. (Like this one)

They allowed me to completely eliminate dry cleaning my work shirts from the budget, and these days, I only dry clean the occasional dress pants and rare suit.

Travel: $4,683 (14%)

In 2018, my trips included 6 days in Costa Rica, a long weekend at Zion National Park, 5 days in New York City, two summer get-a-ways to a cabin with friends/family, and two ski trips to Colorado. Plus a few flights to visit family in Texas, which don’t really count considering Momma Wizard never accepts payment for her delicious home cooking.

I kept travel costs down by redeeming hundreds, if not thousands of dollars worth of credit card and travel rewards points during the year.

That said, this total looked a whole lot better before the New York City trip, and its nearly $1,500 price tag, dropped a bomb on this category during the final month of the year.

Entertainment: $2,070 (6%)

This is the catch-all category for the livin’-it-up spending that happens outside of vacation days.

In 2018, the main line items here included drinks with friends, non-dinner dates with Lady Money Wizard, concert tickets, and entrance fees to state parks, bicycle rallies, ski hills, and softball leagues.

Books: $77 (0%)

If I was really frugal, I’d get all my books from the library. But what can I say, my ever-growing bookshelf is my favorite piece of “art” in the house.

As it stands, most are purchased for $1 from the local thrift store. And considering this category rounds down to zero anyway, I’m not too worried.

Materialistic: $505 (1%)

Bought some new ski gloves, ski poles, and sunglasses. I also scored a deal on a Playstation 3 and 42″ TV off craigslist, which I barely ended up using.

Clothes: $172 (1%)

A few random sweaters, work shirts, and socks.

House Expenses: $6,937 (20%)

A ha! The big culprit.

We remodeled our kitchen this year, and surprise surprise, that costs quite a bit of money. We cut costs wherever we could, and the end result is amazing, but nonetheless, I still found myself spending about $6,000 in materials and contractor fees.

The other $900 includes those miscellaneous Home Depot and Lowe’s trips that new home owners find themselves making all the time. Lawn equipment, paint, new light bulbs… the list could go on and on.

Vehicle Expenses: $1,414 (4%)

Insurance at around $80 a month for the Mazda 3 is my main cost. This also includes oil changes and the $300 mistake of losing one of those super-fancy (and way-too-expensive) key fobs.

Medical: $22 (0%)

My medical insurance automatically gets deducted from my paycheck, so it’s not something I track. If I did, that would add about about $60 a month to this total. My employer also funds $1,000 in a FSA at the beginning of the year, which I use to pay for various appointments during the year.

Besides that, the $22 total is a testament to what a good year I had when it comes to the stuff that really matters. Good health is more important than wealth, so I can’t even begin to express how fortunate I feel that this number is as low as it is.

Other: $2,670 (8%)

As the name implies, this is the catch-all for everything I’m too lazy to sort into a group. Usually, the costs here are vet checkups and medication for The Money Pup and The Cash Cat. Christmas gifts and donations made up another significant portion of this.

Total 2018 Savings: $36,253

The most important number…

In 2018, I saved $22,800 cash (the difference between my annual take home pay and my annual spending) plus another $13,400 of 401(k) contributions and employer matching.

2018 Savings Rate: 52%

Not bad, but I can do a lot better.

In the past, I’ve hit a savings rate of well over 60%. This year, my savings rate fell because of the kitchen remodel and a little bit of creep in lifestyle.

To be honest, I’m a little disappointed. The kitchen remodel was obviously a serious headwind to fight against, and without it, I’d have passed the 60% mark. But, even adjusting for that, I still spent more money this year than I ever have in my life.

That said, things are still on track. At a minimum, a 50% savings rate essentially “buys” me one year of freedom for each year worked.

But what if I defer that year of freedom for a few years, and invest that 50% savings while I wait?

Then, the years of freedom continue to grow. And when it’s time to retire early, that one year of freedom will have grown into 2… 3… or more.

This compounding effect is why, as Mr. Money Mustache explains (using a concept borrowed from Early Retirement Extreme), a 50% rate all but ensures you’ll retire in 17 years. Assuming you start with nothing.

And if you’ve given yourself say, a $250,000 head start, well then… retiring in less than 10 years doesn’t sound so crazy after all…

By the way, if you want to compare your own savings, (and I know you do!) I calculate my savings rate as savings divided by take home pay, and I count employer contributions as both income and savings. In other words, the formula is as follows:

(Annual Savings + 401k contributions + Employer Matching) / (Annual Take Home Pay + 401k Contributions + Employer Matching)

Room for improvement?

When I look back on the year’s total, I have to ask myself. Am I living as a frugal miser (like I’m usually accused of) or actually a ridiculous life of total luxury?

I see a ton of fat in those annual totals. In fact, if I was taking this race a little more seriously, rather than casually cruising through and enjoying the ride like I did in 2018, I see four minor adjustments that could reduce my annual spending by 33%:

- Eight trips in a year is pretty high. A little more selectivity could shave $2,000+ off the yearly travel budget.

- Obviously, if I was shooting for hardcore frugality, I wouldn’t have dropped $6,000 on a kitchen remodel just because I’m spoiled.

- There’s easily $1,000 of fat in the dining out budget…

- The dog and the cat accounted for nearly $2,000 of the “other spending”

Boom, just like that, over $10,000 found. That would bring the average spending down to less than $2,000 a month.

IMO, this level of spending is certainly attainable for anyone who’s dedicated enough. And actually, just typing that out gave me some serious motivation heading into the New Year.

Hmmm, Anything You’re Not Telling Us?

Not really. That’s my finances, with 100% transparency, and probably way more detail than you ever cared to know.

As I look back on areas where this report could fall short, I can really only think up three possibilities:

- My work covers my cell phone bill, so that’s not included.

- None of Lady Money Wizard’s cash flow, nor the equity in “our” house is included. If we ever combined finances, that would definitely change the picture a bit.

- This online diary of mine has grown more popular than my wildest dreams, and with that comes an unexpected source of modest income. All website earnings and savings are kept in a separate account and not included in any of the spending or net worth updates.

PS – If any sleuthing readers are wondering why I’m claiming I saved $23K cash and yet my net worth updates only show my savings account increasing by $17K year over year, I’ve tracked down the culprit. During the year I fronted $3K for a group ski condo, which my ski buddies will reimburse me for in March 2019, and I also contributed $3K to my 2017 Roth IRA at the beginning of 2018. (Counted as 2017 saving)

Final Thoughts

What do you think? How do you compare? Am I a Money Wizard or a Frugal Fraud?

Let me know!

And I’d love to hear if any readers out there tracked their spending during the year!

Related Articles:

This was the first year I tracked every penny I spent – It came out to just under $25K, which was under budget and lower than 2017 (based on available data that I had). I was very happy with that. Throughout the year it makes a difference as you keep your emotions in check and ask yourself, “do I really need to buy that?”

The three areas where I was over budget were groceries, eating out and the miscellaneous/other. What does that tell me? Stop eating so much! 😂 Seriously, it’s something I hope to cut back on this year — both for better savings rate and better health.

Nice to see you had a savings rate over 50%. I get that your slightly disappointed given your goals, but if this is an average to below average year as far as spending and saving, you’re on a pretty darn good track!

No need to beat yourself up over the higher than usual spending on the year. Most seemed to either make your life easier, or were spent on experiences. It’s important to value those on the journey to your big goal (especially when you can afford it) since tomorrow is not guaranteed!

Given your situation and how you are way ahead of the game, I can’t imagine you’ll look back 5 years from now wishing you skipped some of those vacations!

We eat sushi a lot (even one of the kids loves it now), but most of the time it’s at home. Maybe I need to put together a post on how to make DIY sushi?

Nice work for the year. You are not invited to the Frugality Olympics, but for a normal human you’re killing it. I wouldn’t tighten your belt much more than you have.

Great post & thanks for sharing the gritty details

Congrats on a great 2018 Mr. Money Wizard! A 52% savings rate is nothing to feel bad about. If that was 10 or 15% you might want to worry, but 52% isn’t bad.

Hell, we spent twice as much as you did in 2018 (but this does include 4 people). Granted, now that we’re financially independent we’re no longer in “save” mode like we used to be.

For dining out, old tricks work well. Both my husband and I have a separate account for dining out and entertainment budgets. If there’s not enough money in my account, I can’t eat out at work. If between the two accounts we can’t afford sushi, we don’t eat it. Something similar could be done with having a shared account just for entertainment/eating out or withdrawing cash and only paying with cash while eating out. It’s hard to overspend when the money simply isn’t there, even if the scarcity is artificial.

$80/month for car insurance??! I need to move to your state.

It’s $202/month in Michigan.

What kind of car do you drive?

Can you tell me how much your mrs money wizard paid for her house? Are you living in a caravan? or house prices in the US so low? Would be a dream for me to only pay $1400 a month for ALL my house expenses.

https://mymoneywizard.com/i-sort-of-bought-a-first-house/