When I was a kid, I used to love those “Choose Your Own Ending” books.

In the books, the plot would occasionally branch off, and you as the reader were asked to make a decisions for the main character. Different decisions had you flipping to different pages to continue the story.

The beauty of the books was how your decisions had huge consequences. Sometimes your choices led your main character to a horrid fate, but choose wisely, and you were usually given a happy ending.

When it comes to saving money for financial independence, we’re all on a real life “choose your own ending” story.

Let’s get to page flipping:

Path 1: No Retirement

You decide to skip college or accidentally get a degree that doesn’t pay. You work entry level jobs, and not surprisingly, money is tight.

Unfazed, you try living like a millionaire on your $30,000 a year salary. Most likely, one of those pro football playing millionaires you watch every week.

Like your NFL idols, you make some poor life choices, and before you know it you have more children than you can support, and maybe you’ve even committed a crime or two.

Your millionaire impersonation hasn’t quite worked out, and you’re stuck in a financial trap. To escape, you soon spend your free time consuming, watching TV, and drinking alcohol, rather than putting in extra hours, learning, or side hustling.

You repeat this process for the next 50 years.

By age 70, you realize that in all that TV watching, you forgot to save any money.

You probably won’t ever be able to retire.

Age 66: The Typical Baby Boomer

You go to college for four years, and get a nice starting salary at Globocorp.

You’re left with a little bit of student loans, but on the whole, money is not tight. In fact, you’ve never had this much money in your life!

To go with your new career, you get yourself a fancy new car. You soon marry your soulmate, spending $30,000 on the wedding. After the wedding, the two of you combine finances, saving up for the downpayment on a nice $450,000 starter home. Kids arrive, and you trade in your dated 7-year-old car for a new SUV. Hey, those babies need legroom!

Now that saving for the big stuff is out of the way, you’re finally able to focus on your finances.

You start saving 10% of your income like the “experts” recommend. Unfortunately though, you’re not seeing much money in your accounts, or any of the supposedly amazing effects of compound interest, which is discouraging.

You conclude wealthy portfolios and early retirements are only for successful entrepreneurs, real estate moguls, and trust fund beneficiaries. Great for those people, but this is the real world.

You’ll keep saving where you can, then retire when your body gives out at 66. Hopefully social security will still be around to help.

Age 55: “Early” Financial Independence

Like your typical baby booming friends, you go to college for four years and get a nice starting salary at Globocorp.

You’re a real go getter though. Through a ton of extra hours and a little bit of luck, you quickly leapfrog your peers on the corporate ladder.

With your success comes a higher salary, and you feel a responsibility to learn about money. You soon realize the incredible power of compound interest, and how rich you could be if you put your money to work for you.

You invest much more than the average, which isn’t hard to do because you’re making so much.

Without really trying, you contribute heavily to your 401k each year, contribute a little bit to an IRA here and there, and even dabble in the stock market during those few years between paying off your car and upgrading to the next one with more horsepower.

You keep climbing that corporate ladder for 30 years. The whole time, compound interest silently works away, and by age 55, you realize your $20-30,000 of accidental savings each year has compounded into $2-3 million dollars.

Hey, this is right in line with how much the “experts” said you needed to retire!

Burnt out from years of the corporate grind, and tired of not spending enough time enjoying life, you shock all your baby booming friends by retiring “early” at age 55.

Age 40 or Bust: The Laser Focused WTF Early Retirement

You follow the tried and true advice to get a college degree that pays. Your research checks out, and you too get a job at Globocorp with a decent starting salary.

Although not a total go-getter (you believe in having a life outside of work) you make the most of your hours in the office, churn out quality work products, and strategically play the office politics game, even if you recognize it for the B.S. that it is.

You score a couple promotions and find yourself making good money, and if not, you switch companies until you do. Plus, since your life isn’t dedicated to the corporate world, you have time to learn, improve, and eventually build your own nuclear triad of income.

You not only understand the incredible power of compound interest, but also tax savings. So you max out your 401k and IRA religiously. You realize that chasing the latest and greatest is a never ending battle against hedonic adaptation, and you strategically save your spending only for those things that make you truly happy.

You recognize that diamond rings and $32,000 weddings are a marketing scam, and instead you use that money for the downpayment on a house costing half as much as the bankers said you could afford. You save for a cheap car to buy in cash, and then hold onto it forever. And most importantly, you work ferociously to cut frivolous spending to the bone, which leaves you with an incredible life for around $20,000 a year.

In 15 years, your habit of saving roughly $30,000 a year leaves you with a portfolio approaching a million dollars. Your friends tell you to tough it out for another $10 million dollars or so, but you understand the 4% rule, so you politely nod and ignore. You know some more numbers on a screen won’t actually change your life much anyway.

You soon do the impossible; retiring before you’re 40 to a life of total freedom.

Everyone assumes you’re a billionaire.

Choose Your Path to Financial Independence

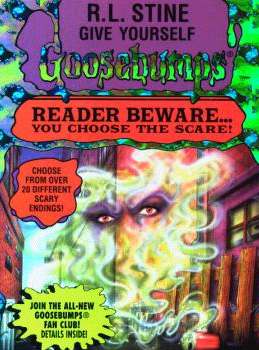

Much like those old R.L. Stein Goosebumps novels, you’re free to choose your ending.

- Age Infinity – Never retire.

- Age 62 – A Retirement Dictated by Social Security

- Age 55 – Early Financial Independence

- In your 30s – The Laser Focused WTF Early Retirement

Unfortunately, most people take the easy way out. Last year, when the Economic Policy Institute announced that “Nearly half of families have no retirement savings at all,” we were faced with an unfortunate truth: most people don’t save a dime.

An equally large group attempts to do the right thing, but they’re sidetracked by poor financial advice, billions of dollars in marketing efforts, and an ever-increasing hedonic treadmill.

And a few brave souls plan an early exit at age 55, although most of these people become too addicted to the money to ever break the chains.

Which leaves us one final option. “Early Retirement” as the internet likes to call it. Or as I like to call it, “dominating the money game until it taps out to complete and total freedom.”

In my humble opinion, this path is the best balance between eliminating all the waste, while still experiencing a few joys that actually cost money.

By saving at least 50% of my income, I hope to reach complete financial independence by age 37.

Which path do you choose?

Related Articles:

Mr. Wizard, I was in between paths 3 and 4 choosing to leave Globocorp at the age of 48 and transition to part time lower paying work in a new field for the personal satisfaction it provides. Tom

Great post! Its kinda funny cause i can identify lots of those people from among my colleagues. I likely am in between 3-4 but i see a lot of my colleagues in the #2 path. They make good money in a good field but have very nice cars and very expensive homes. Its not worth it to me, i would rather have a good lifestyle now and less stuff and early retirement than a good lifestyle, lots of stuff and a standard retirement.

“An equally large group attempts to do the right thing, but they’re sidetracked by poor financial advice, billions of dollars in marketing efforts, and an ever-increasing hedonic treadmill.”

This is the group of people that I’m both fascinated by and feel sorry for. Particularly those that fall prey to poor financial advice – far too much of that in the Middle East. If someone is being swayed by the marketing dollars of its stuck on the hedonistic treadmill it can be hard to get off (especially if this means refusing to pay ‘keeping up with the Jones and rejecting the lessor many others seem to be following).

Why is it that the standard advice of saving 10% of post-tax income seems to have been so readily accepted – when saving aggressively in the early years and letting compounding do the work is a far easier way to build wealth?

HH

I was 38 when I reached financial independence. Life is pretty good now, and I don’t have any real money worries.

Yes, I was laser-focused (as you put it) on saving and investing, but I loved every minute of it! While it didn’t start out that way, I really came to love investing.

I am most likely in the age 55 retirement group because of how dumb I have been to this point. Thankfully I am not too stuck on the hedonic treadmill, though. If that was still the case, I likely wouldn’t ever retire. I would likely have to have my brain transferred into a robot that I make payments on to be able to afford the payments I was making on my payments.

Hopefully my mindset change from consumer to producer of content will help change my ending of my money story!

I’m with you on the goal of saving at least 50% of my income. I’ve been able to do it for a couple months now and have found I’m just as happy as when I was spending a lot more money!

It’s all about finding that balance and by figuring that out now, we set ourselves up for that WTF Early Retirement!

I’m aiming to join the rockstars and squeak in just before my 40th birthday!

I enjoy following your postings but was surprised to see on your recent post on the right hand side a link to “Smart Investing” and it went directly to “New Bitcoin” set to take over and it’s $9,410 cheaper. For someone promoting investing for their future retirement, which I thing is great, investing in any cyber currency is extremely high risk.

Just my two cents. I do enjoy reading your posts and past them on to my kids.

Hey Larry,

The internal money wizard links are bold with green text. The links with blue triangles on the top right corner are advertisements.

I’m not a fan of crypto investing. Unfortunately though, the ad links are controlled by a third party, and I don’t have any say in their content.

The whole ads experiment is still very much a work in progress, so I appreciate your feedback!

Definitely trying to go down somewhere in between the age 55 and age 40 mark. If I put in a bit more effort to maxing out my retirement accounts, and investing a little more every year, hopefully I will be on track to retire early just like you are.