There I was, minding my own business yesterday when I got a notification. Something about a historic selloff.

I checked Yahoo Finance, and saw this:

Well, light my fire! Now that’s a headline!

A headline that will surely grab your attention. ESPECIALLY if you happen to have hundreds of thousands of dollars invested in the market.

As much as I believe in ignoring most of the market noise, I’m not sure I’d be able to call myself a proper personal finance blogger if I didn’t at least put some sort of effort into analyzing what the heck just happened.

So, here’s my 5 quick thoughts on all this noise.

1. “Worst” is a pretty clever word choice.

Anytime crazy things start happening in the world, whether its the financial world or otherwise, it’s worth reminding yourself that the media is mostly in the business of grabbing eyeballs.

So they’re more than slightly incentivized that make things sound historic…

And that’s what many news outlets are doing here, in a way.

Personally, I think the old timers who spent the latter half of their roaring 1920s standing in line at soup kitchens because 20% of the population was completely, utterly, out of a job, might have something to say about these last 6 days being the “worst” stock market crash ever.

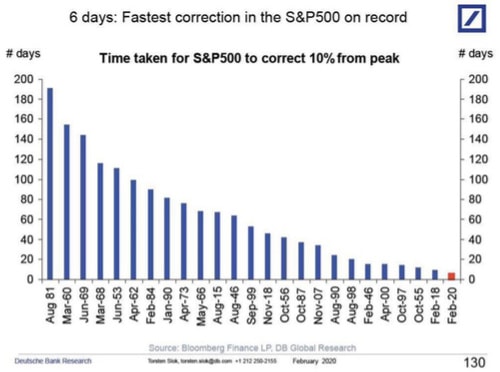

But facts are facts. And over the past week, the stock market dropped by 10% faster than it’s ever fallen by 10% in the history of… ever.

Wild stuff!

2. The underlying cause? ‘Ze Coronavirus.

Aye Corona!

(Why the beer company hasn’t capitalized on this with a clever marketing campaign yet, I’ll never know.)

It goes like this. The stock market is a complex bidding process, where buyers and sellers get matched up based mostly on the two opposing side’s opinions about the future.

Now, if everyone was like me and you, wisely investing our money for the 30+ year timeframe, the market would mostly keep a steady upward march.

But most of the money in the market isn’t like me and you. In fact, us piddly retirement savers are dwarfed by the ultra high net worth individuals, the business analysts looking for economic clues buried deep in company financial statements, and the day traders looking to make a quick buck on recent momentum.

And with the recent news about this Coronavirus spreading to California (they’re currently monitoring about 8,000 potential cases there) those analysts, day traders, and even some ultra high net worth investors are concerned.

The general sentiment is that all the fear about travel to China will be a big anchor dragging down the productivity of so many businesses reliant on the area. And if a true pandemic hits, and millions of people have to be quarantined, well… it’s gonna be hard for many businesses to continue their steady growth if half their customers are cooped up inside, and half their employees are working remotely.

3. This Coronavirus stuff is actually pretty terrifying.

Maybe I’ve just watched too many Walking Dead episodes, but I find biological concerns absolutely terrifying.

Why? Because they tend to spread via compounding.

And if compound interest is powerful enough to allow regular folks to become multimillionaires through saving essentially pennies a day, it seems like compounding could have equally unfathomable results when it comes to health and populations.

And I’m not the only one who’s a little concerned about this. In fact, I’ve been following this whole thing unplay on twitter for the last few months, (psst… follow MyMoneyWizard on Twitter if you don’t already!) and the people initially sounding the alarm on it were people whole a lot smarter than me. When folks like the brilliant multi-billionaire tech investor Naval Ravikant start getting seriously concerned, I pay attention.

The regular flu has a mortality rate around 0.05%. Swine flu had a mortality rate of just 0.02%. The Coronavirus appears to have a mortality rate anywhere from 2-15%.

If a 1% difference in investment fees can cause millions of dollars of change to future portfolio values, a 300 times higher death rate on an exponentially spreading virus sounds like a pretty big deal to me.

4. Governments seem to be downplaying this.

In China, it was like a modern day Chernobyl over there.

The communist government first denied there was any virus at all, but after thousands of clear infections, a local doctor blew the whistle on the cover up. He was quickly summoned to China’s Public Security Bureau and forced to sign a letter about making false comments.

A few days later, that 34 year-old doctor began showing symptoms and died of coronavirus, leading to massive public outrage. The Chinese government responded by claiming the doctor was still alive. When news agencies proved his death, the government decided to shut down the internet.

Sounds crazy, but even in the US, following 8,000 potential cases being monitored in California, the White House instructed leading health experts to avoid talking to the press.

“Dr. Anthony S. Fauci, one of the country’s leading experts on viruses and the director of the National Institute of Allergy and Infections Diseases, told associates that the White House had instructed him not to say anything else without clearance.”#covid19 https://t.co/J8k8L4CWzC

— Carl Quintanilla (@carlquintanilla) February 27, 2020

Historically, the stock market has done slightly better than average during election years, as the defending president presumably pulls every string he can to prop up the economy heading into the voting season.

I’d say censoring the country’s leading health experts could be an example of that. As would recent rumors that the Fed may cut interest rates in March. (Which usually props up the stock market.)

5. As usual, the best move is to stay the course.

Sorry for the anticlimactic ending.

But we’ve had double digit market corrections nearly every year for the past decade. So while the news of a modern day bubonic plague sure is headline worthy, we’re not exactly in uncharted territory.

S&P 500 corrections since 2009:

2010 -16.0%

2011 -19.4%

2015 -12.4%

2016 -13.3%

2018 -10.2%

2019 -19.8%No this is not the worst stock market correction since 2008 (yet)

— Ben Carlson (@awealthofcs) February 27, 2020

Investment is won through consistency, not mass hysteria.

Personally, I haven’t even checked my net worth yet. I’m sure it will be down significantly.

The question I have to ask myself as a 20-something with many years ahead of me (if the coronavirus doesn’t get me first!) is this… Do I believe the market will be in a better or worse spot 30 years from now?

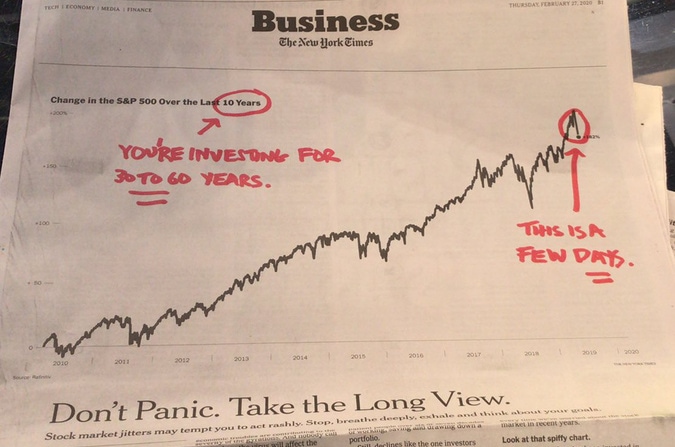

Kudos to The New York Times for being a rare news outlet to put things into perspective:

If things continue getting worse from here, well then:

- I hope everyone stays safe.

- At least I’ve been moving to a more conservative allocation following my 2021 recession prediction.

- Absolutely DO NOT SELL.

- It may present a fantastic buying opportunity on discount stocks during some of my higher earning years.

Stay smart. Stay safe. And don’t forget to wash your hands!

🙂

Related Articles:

As usual, I have really enjoyed your article Money Wizard. I think its important not to overstate the danger here because this is actually whats causing things like the current market swoon.

Is the Coronavirus scary? Sure, as in its a thought that brings anxiety to anyone. Why is it scary? Because everyone thinks that they will be the one to die from it. But so far, at least from the studies I have read the mortality rate is around 2%. So about 20x the mortality of the flu. Ok this seems scary again, but then we dig deeper. The mortality rate of healthy adults seems to be far lower 75 and people with seriously compromised immune systems is >10%. The combine mortality which is heavily skewed by the latter population is around 2%.

To throw some more mud in the water the mortality rate in Wuhan is around 4% but 2% elsewhere. Why is that? Did the virus suddenly become less serious as it left Wuhan. Doubtful. More likely some of the methods used to quarantine people there are leading to an increased mortality rate. But this increased mortality rate is surely skewing the worldwide numbers higher.

In summary, its an anxiety producing thought for sure. But we should all practice level headed-ness (just like in investing), wash our hands, cough in our elbows and live healthy, and at all costs try not to panic as the news seems to want you to.

All great points. The bigger concern IMO is whether we can trust any of the numbers at all. Considering the Chinese government was willing to pretend the virus didn’t exist and then pretend certain people weren’t dead, it’s hard to pin down the real situation.

Experts early on suspected China was under reporting the number of cases (and maybe even deaths) by a factor of 50, which over time has shown some truth. Couple that with the US seemingly going into “nothing to see here” mode and it’s tough to get a real read on anything. Things could either be a far bigger or far smaller deal than we think, and there’s no good way to tell as far as I can see.

You’re making very good point about the numbers. But lets say that things were much worse in the US, wouldn’t some journalist somewhere have reported on an increase in critically ill patients at their local hospital? I think that we can at least believe that individuals are free to share information. In any case, I think we are about to find out. There was some kind of issue with the test kits that was resolved yesterday. Lets see how things evolve in the next week.

For the record, I believe US numbers are accurate for what can be detected so far. I just don’t trust the numbers from less developed countries. (Both China’s dishonesty and other countries struggling with resources.)

It’s also worth noting that the virus doesn’t usually show symptoms for 3-4 weeks, and recovery/death takes an addition 3 weeks or so. So getting a true picture of the “current” situation is nearly impossible.

I think there is great validity in your observation; however, I am 61, self employed and I don’t HAVE 20 to 30 years. So not being critical, but sounding glib doesn’t help people my age group and those already retired. In addition, the trickle down effect is very real for me. I have bee a professional petsitter for 19 years. If people are afraid, and are losing money hand over fist, they DON’T TRAVEL, which means they don’t hire petsitters to take care of their pets. It is a rough time for everyone and I am hopeful things will turn around soon. Thank you for listening.

Respectfully,

Sharon

Good point Sharon. The important thing is sticking to different portfolio allocations depending on individual situations.

It sucks “losing” $15k in a matter of days. I am still contributing to my 401k but a bit hesitant to buy more index funds through my brokerage account although I would be buying them at a discount right now….

Hang in the Wizard, it is part of the journey!

Very reasonable post my dude. Some good thoughts. I’ve been continuing my normal buy in schedule. Might load up a lil extra on Monday if it dips again. Eric in 30 years prolly won’t be able to tell the difference but it’ll be a whoot and a holler now

Just my opinion but I think this all blows over in 3-4 months, maybe even sooner. New cases in China are already coming down and stabilizing. I expect worldwide cases to increase over the next week or two before seeing a similar plateau and, eventually, decline.

If you’re a healthy younger (under 50) person, I really don’t think you have much to worry about. A) you probably won’t even get it and B) the virus is mild in 80% of cases. The vast majority of deaths are older folks or those with compromised immune systems. That’s unfortunate, but the bulk of the population has little to worry about.

My bigger fear is the paranoia, panic and fear set in motion by the media and governments around the world (governments are most definitely NOT downplaying this, I strongly disagree with you on that point), drive the economy into recession. In the end, that’s what the market is pricing in and it may not be wrong. When all is said and done, the bigger tragedy may be economic as opposed to human.

Think about it. 80,000 cases in a country of 1.4 billion people and the entire world goes into a panic. BILLION, not million. Whether you believe the numbers or not (are they under-reported? probably), that’s a tiny fraction of China’s population. 3,000 cases in South Korea, a nation of 51 million people and a vastly smaller land area where the virus can spread easier. Still just a tiny fraction of the population. I think the concern, honestly, is overblown. Should we be vigilant and work on trying to limit its spread? Absolutely. But I think the all out panic and fear is uncalled for and doing more harm than good.

It’s a decent time to look to add to your portfolio, but understand that a recession (due to the virus concern accelerating some already softening economic signals) may be just around the corner and we may continue to go down before we start marching back up again.

To play devil’s advocate about the low number of cases… that’s true, but there’s currently 780 MILLION people under some form of quarantine in China. That’s an insane number. Not only is it half the entire country, but to also put it into perspective, that’s basically all of North America, Central America, and South America. Combined.

So while the total number of cases is low, the fact that ~10% of the world’s population can’t leave their house right now is probably a huge factor. Not sure whether that’s proof of how contagious the virus is or how much people are overreacting.

For me there are really 2 sides:

1/ the virus itself, bad bad and sincerely hope within a couple of months we have this “under control”

2/ economic repercussions……. This is for me a hole other ballgame. Once the Chinese market is ready to go back to work and receive our orders, we might all be in quarantine….this sets them back even further and we have no more to sell. I might pin this out a bit dark but actually I’ll be pilling up cash myself and see opportunities.

Love your blog. Big fan

Do you think it’s a good time to more a portion of my Vanguard Told Bond fund to buy some of the discounted Told Stock Market Fund?

I am in for the long hall just wanted to hear your opinion I am 43 years old so I got plenty of time.

Thanks Money Wizard

Up to you…

Historically, not trying to time the market and instead continuing to dollar cost average should yield the best results.

If you’re feeling risky, you can also read a few articles like this and make up your own strategy:

https://mymoneywizard.com/3-things-you-should-never-do-when-stocks-tanking/

https://mymoneywizard.com/recession-2021/

https://mymoneywizard.com/3-fund-portfolio/

*nothing here is investment advice. Just opinion.

Personally, at this time I like my more conservative allocation because of my shorter timeframe to early retirement, so I don’t plan on deploying any bonds/cash unless we see a real blood-in-the-streets recession. (Usually defined as two consecutive quarters of negative GDP growth and accompanied by 30-40% drop in stock prices.)

Ride the wave. Don’t sell. The market will bounce back again. Everyone should be a little more cautious in buying things we don’t really need. My friend is living in China now. They have SARS cases as well.