Yesterday, I made a bombshell announcement on the heels of Tesla’s bombshell bitcoin announcement. That’s a lot of bombshells?

Anyway, as the dust cleared, one shocking truth emerged…

The Money Wizard had changed his portfolio allocation. Cryptocurrencies now made up a not-insignificant 7-8% of his portfolio. Even wilder, the nut admitted he was doubling down on this risky asset class, with a goal allocation of 10% crypto by the end of the year!

If you’ve been reading this blog for any length of time, you might have a similar thought to long-time reader Jamie, who left me this comment:

Hi Money Wiz,

Long time reader and appreciate all the analysis you’ve given over the years.

However, I can’t help but notice that you seem to be going against all the advice you’ve previously been giving, just because something new and shiny has come along.

Do you not think this sort of thing is exactly what you have previously said to avoid at all costs?

Thanks

Jamie

In other words…

“WTF Money Wizard?!? Are you some kind of hypocrite? Or have you just lost your mind!?!?”

It’s a tough but fair question, and I’ve gotta give Jamie props for wording it so politely. (Truthfully, I was prepared for lots of comments along the lines of my harsher translation, which I think could be totally justified.)

On first glance, it does seem totally hypocritical for me to spend years recommending a slow and steady investment strategy, and then dive deeply into something as new and risky as cryptocurrency.

As I typed out the justification for my actions, I saw the response growing far larger than the tiny little comment box could contain.

I realized not only would this one need its own dedicated post, but I’d also truly appreciate your thoughts on whether I’ve completely lost my marbles.

The Main Rules of a My Money Wizard Investing Strategy

Over the ~250 articles sitting in this blog’s archives, you can really boil down my incoherent ramblings into a couple of basic rules that I think anyone can use to become a rock star investor:

- Live well below your means so you can invest a LOT of money.

- Choose low cost, passively managed index funds instead of trying to pick individual stocks or actively managed hedge funds.

- No short term trading.

- Buy and hold for a long, long time.

- Pick a portfolio allocation and stick to it.

At first glance, it’s hard to see how cryptocurrency might fit into these rules. And that’s exactly why I avoided the space for years. (Despite briefly considering a $1,000 gamble on bitcoin 10 years ago, when I read about it on some random message board but decided it was way too overpriced at $100 per coin… a $500,000 mistake that still sorta haunts me to this day…)

But the more I thought about it, the more I realized that investing a small amount in cryptocurrency could actually be a Money Wizard-friendly investing strategy… IF I went about it in a certain way.

Let’s run through each of the 5 rules and see how it applies to my recent cryptocurrency investments.

1. Live below your means so you can invest a lot of money.

So far, so good…

The only reason I’m even considering getting risky with 10% of my portfolio is because I’ve been living so far below my means, and investing so much more than I originally planned when I started this blog, that I’m actually ahead of schedule for my age 35 retirement goals.

This realization hit me when I ran the numbers at the start of last year and realized I might actually be saving too much money.

Whaaa, whaaaa… first world problems to the max.

At that time, I set a new budget that included an extra $6,000 a year in spending.

Then COVID hit, and I failed to even get close to spending that!

The result, as anyone who’s been following my net worth updates knows full-well, is that I’ve had way too much cash sitting around. This has really been bothering me, since it’s totally contradictory to my thoughts on keeping as small of an emergency fund as possible.

As I always say, investing in something is better than investing in nothing. So in the corporate jargon speak of Tesla’s annual report, I decided to “provide more flexibility” to “maximize my returns on cash” by investing a little extra into crypto.

2. Choose low cost index funds over high priced funds or individual stocks.

The second main rule of Money Wizard investing doesn’t sound like it applies to crypto at all, but I’d argue it actually does… IF you use a certain strategy.

By purchasing an amount of Bitcoin/Ethereum/other smaller coins in a proportion equal to their relative size, you can actually build yourself a DIY index fund of the entire cryptocurrency space.

Even better, aside from the initial wire transfer fees and brokerage fees (which admittedly, are pretty high right now) the ongoing costs of holding crypto in a hardware wallet like a Trezor or Ledger are literally $0. Forever.

That’s an expense ratio that even Vanguard can’t beat!

3. No short term trading

If The Money Wizard announced that he was going “r/wallstreetbets” on the crypto space with a 50% portfolio gamble that he planned on cashing out “once it hit the top” then I would fully expect every one of you to take me behind the barn and put me out of my misery.

4. Buy and hold!

Warren Buffett says his favorite holding period is forever, and that’s how long I hope to hold my cryptocurrencies.

If I’m a long-retired 65-year-old and we’re all using bitcoin to buy our flying solar-powered cars and virtual reality simulations, well then I hope my 10% cypto allocation was a worthwhile hedge for that scenario.

5. Pick a portfolio allocation and stick to it

Obviously, this is where the wheels fall off a bit.

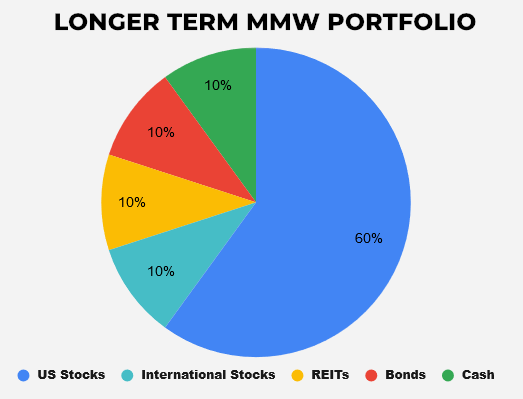

Back in August 2019 when I was worried about a recession, I decided on this long term allocation:

But the question I never prepared for – What happens if there’s a new asset class entirely?

There’s not really an investing textbook for that scenario. For hundreds of years, the world has had the same handful of mainstream investments.

What to do, what to do…

Am forbidden from investing in something new and promising?

The only solution I could come up with is carving out a portion from other risky assets like stocks. At least that way, my overall “risk” breakdown remains somewhat similar, while still capturing a new space.

What do you think? Has The Money Wizard lost his marbles?

I’d truly like to hear your thoughts and opinions on this one. Don’t hold back!

I’ve been sharing my thoughts and goals on here for years, so you guys know me better than just about anyone.

If you feel like you need to save me from myself, please let me know!

Related Articles:

I think right now, Bitcoin can be classified as an Alternative. Bitcoin as a store of value should be no different than gold, and could become the gold standard. So I don’t think you are off your rocker. I applaud you for taking the risk to do so.

Thanks, AR. That’s how I view it as well. It’s shown a use-case similar to gold, but also has the upside of some high-growth tech stocks. A pretty attractive combination, IMO.

I don’t think investing in areas that drive latest trends is hypocrisy, especially when investing a small amount. It’s actually being prudent. Cryptos are here to stay. People incorrectly assume Cryptos will replace Fiat currency. No they won’t. I invested $1500 in a few cryptos (Bitcoin, Ethereum included), and today its up by 100%.

Thanks for the comment, MM. Interesting comment about cryptos and fiat both existing in the future – how do you see that playing out? (I don’t disagree, just interested in your perspective.)

The day cryptos can be used directly to buy precious metals like Gold, and Diamonds without having to convert it to a Fiat currency, it may begin to replace fiat currency as a compelling alternative. I doubt that will happen anytime soon. At present, it’s the means to an end…ie., it’s an investment vehicle to make money…AND it derives its value based on supply and demand, and only when its converted to a Central-bank approved fiat currency based on the brokerage’s exchange rate. As long as it needs to be ‘converted’ to conduct any monetary transaction (buy or sell), it will coexist with fiat currencies. My humble opinion…

The other scenario is when the countries with a central bank also launch their own respective national crypto currencies that is also accepted as an alternative form of money similar to their own national fiat currency to conduct trade or monetary transactions with that country. China and the EU are racing ahead to create their own national crypto currency alongside Yuan and Euro respectively. An ulterior motive cannot be ruled out there.

Definitely appreciate your transparency and rational on this front. How exactly did you invest in crypto? Thanks…

Check out my “How to Invest in Bitcoin” article:

https://mymoneywizard.com/how-to-invest-in-bitcoin/

Great read! Very relatable. Let me first say, I know little on this topic… but I’m worried about all the hype over the past month or two. It’s why I’ve sold a few times to maintain my 3-5% allocation. And historically, cryptos have tanked every few years by up to 80%. But, who knows… will the never sell strategy work similar to stocks? No idea… Let’s keep hoping that Elon keeps tweeting…

Nothing wrong with maintaining your allocation! Thanks for the comment.

Honestly crypto seems a lot like gambling to me. I understand your aversion to individual stocks, but if you are getting bored I think long term you would do much better with a good stock picking service and putting about 15% of your funds into high growth small and micro-caps (buy and hold of course) then you will with Crypto (and it would probably be more fun for you). Just look at a chart of the value of bitcoin over time, and then think about the fundamentals that it promises and the inherent contradictions of those fundamentals.

Can anything that fluctuates the way Bitcoin does be a store of value? When its supply is artificially maintained can it be considered reliable? When so few merchants use it as a method of payment and you don’t know what its value will be from one day to the next (by wildly fluctuating margins) can it be considered a currency? You might as well start gambling on FOREX as buy bitcoin… at least with stocks you can evaluate good companies and bad. Outperforming the market isn’t as hard as conventional wisdom suggests as a small investor… its just that most retail investors are really bad at investing, and the big investors have a hard time playing in the areas of the market that are most profitable. The reason that Warren Buffet keeps underperforming the market these days is he has too much money! You and I do not have that problem.

All valid questions, and all valid points. Thanks for the input, Matthew.

I am curious as to where the new 7-8% allocation is coming from? Are you reducing your equity, cash, bond, etc? positions? Taking a 1% of total assets position in bitcoin is a no-brainer, and a smart asymmetrical bet. Either it will be worth nothing – and you have only lost 1% of your current assets, or it will be worth a lot of money and you’ll look like a genius. Allocating 10% seem extreme, Especially since you have not laid out a cogent thesis for the investment – IMO.

Only about 1-2% is new. I originally invested about 1-2% of my net worth back when I wrote my “How to Invest in Bitcoin” article back in the Summer. The rally increased that position to about 5% of my wealth. And then in the past month I contributed what amounted to another 1-2% of my net worth, after I finally understood how smart contracts, NFTs, decentralized finance, etc. work and the implications of that technology. (Plus the news of it going more mainstream, which was always one of my big concerns with it.)

So short answer – all my crypto investments are coming from extra cash flow, mostly side hustles like this website. I’m not selling or reducing any other positions to fund it. That’d be a mistake IMO.

Haha – I didn’t bat a lash at your increased 10% goal allocation in cryptocurrencies. Frankly, it’s clear you are well ahead of your overall financial targets, are sitting on a ton of cash, and this seems right in line with your post on Mark Cuban where he suggests 10% towards Hail Mary type investments – like Bitcoin!

I will suggest that if you do wish to build a “cryptocurrency index fund” – to buy uncorrelated coins. Etherium and Bitcoin (and many others) are closely correlated and so would be, for instance, similar to buying a bunch of tech stocks – not exactly a diversified index fund!

Great point, Mike, especially about uncorrelated coins. That’s tough though; much like international stocks vs. domestic stocks, this whole space is very correlated.

I’d also argue that Ethereum and Bitcoin are less correlated than most people realize; they each have different use cases. Bitcoin is trying to become a store of value/currency while Ethereum is a blockchain used for the creation of smart contracts and decentralized finance. I’d argue it’s like comparing a Gold ETF (Bitcoin) to an index fund of tech Stocks (Ethereum).

Of course, this is mostly my speculation which is why a market-weighted basket of a bunch of coins seems like the safest route!

If the circumstances change – then every intelligent person has the right to change their opinion.

Your doing the right thing for YOUR INVESTMENTS – don’t start running your portfolio to suit other

people’s risk strategy !!

Appreciate it, James!

Interested to see if you’ll add the bitcoin portfolio to your net worth updates? If it is a buy/hold type investment, would be quite intriguing to see how it performs vs your current portfolio.

For now, I don’t plan on it unfortunately. Even though I’d love to in the interest of transparency, I’ve been told that doing so puts you at too much risk for hacking.

Luckily, omitting it doesn’t change things too much. My crypto buys are funded with this website’s earnings, which I keep in a separate account anyway.

There’s also some benefit to not including it, mainly in mentally preparing in case the stuff goes to zero. If I encourage readers to assume they’ll lose every dollar they invest into Bitcoin, then it’s probably wise that I do the same.

I wouldn’t go more than 8-10 % of my portfolio in bitcoin or precious metals, but that’s just me.

I think I agree. Although I consider gold most similar to cash (it’s different obviously because it fluctuates in price, so I wouldn’t save up for a down payment through gold or anything like that) but if your goal is having “dry powder” available to weather market downturns, they’re both pretty similar on that front.

Hi Money Wiz,

I’m a long-time reader and often find myself referring back to some of your posts when I’m advising others on the correct order for investing, etc. I think that taking a small portion of your overall portfolio and allocating it to riskier investments is prudent, since we all know it’s tails that drive the greatest proportion of long-term growth. But I have two questions…

First, if you own broad index funds, I presume that there are companies included in those funds which hold crypto (see Tesla), so wouldn’t your 10% allocation actually understate the proportion of your total portfolio that is “exposed” to crypto?

Second, if you’re willing to consider holding ultra-volatile assets such as crypto, are you soon going to begin thinking about investing in art, sport cards, sneakers, or other collectibles?

Funny you mention that. I have a collection of old trading cards that I was recently shocked to learn is worth a small fortune, apparently. For sentimental reasons, I’m not sure I could ever sell, but it sure is wild that these things might truly be considered assets in my portfolio.

And yes, you’re right about the index funds. That gets tough to track though. For example, all businesses in the S&P500 own real estate (office space, etc.) but it’s near impossible to calculate that value in my portfolio. Personal Capital does the best job I’ve seen at calculating these things, but in general this gets down to splitting hairs that probably don’t matter for the big picture, IMO.

I think you’re onto something. Since the OCC issued the letter below crypto will eventually become more mainstream.

https://www.occ.gov/topics/charters-and-licensing/interpretations-and-actions/2020/int1170.pdf

Yeah, that sort of mainstream discussion was a big hurdle in my mind. I wasn’t really willing to go above 1% when there was still a question whether crypto was a fad experiment for tech geeks or something the world may take seriously.

With news like what you posted plus others (Paypal, Mastercard, Tesla, the Fed talking about a digital dollar, etc.) that was some of the mainstream acceptance I was waiting for before increasing to a higher allocation.

No, you have not lost your marbles. As long as it is a very small part of your portfolio (maybe 5% or less) that you are speculating with and can afford to lose. That being said, the way we are spending in Washington will eventually cause the dollar to lose value, and this is a hedge against that – if not for growth, simply for store of value. Just like we should be investing some of our portfolio in international stocks, we should also not have it all in US dollars – hence Bitcoin.

Crypto will certainly explode if/when more business start to park money in it. But for them, if crypto implodes – it’s a write-off. Not the same for us mortal beings.

MW, you are certainly working you way up Maslow’s hierarchy of needs. Consider some other options with your “play” money. Think of ways support local needs. Something like what MMM did when he purchased a commercial building to create a business incubator. Provide seed money/invest in a local business. A bonus would be something your kids could eventually be involved in (running/managing/as an employee). Low-cost housing for entrepreneurs – provide low cost housing for a limited time to support start-ups, then they move on an make room for the next entrepreneur. Granted it is hard to find local/smaller entrepreneurs to invest in, maybe this is a business idea in itself.

I don’t have anywhere near as much play money as Mr. Money Mustache, but this is a great comment that’s really got me thinking! Hopefully this site continues to grow, which would continue to increase the number of interesting experiments I could take on. (And write about!)

Well actually, I do think there are some benefits to a potential write-off for us mortal beings. It’s something I hadn’t really considered, because obviously I want my investments to grow, but I have a lot of individual stocks sitting around from my last financial advisor, and they all have such gains it just isn’t prudent to sell. But taking a short or long-term loss would offset those gains and allow me to shift away from my individual stock exposure. So, there is actually a decent reason for some investors in my position to consider the downside risk there as well.

Well, since you asked, here are my thoughts. Basically the same thing I said to my daughter the other day.

You appear to be a smart, thoughtful person with a solid plan for growing your net worth. You want to toss some fraction of that into crypto, be my guest. However, what you are doing with that money is not investing. You are speculating. There’s a difference.

Bitcoin, Ether, etc. do not generate revenues through sales or service. They do not represent material assets. They do not pay dividends or interest. Nor do they have industrial or other uses, such as gold and silver. They change value based solely on supply and demand – no NAV or book value. The intrinsic value is zero. You are hoping, therefore, that other people will continue to speculate with you.

I, too, believe blockchain technology is here to stay, but not in its current form. The current ones are too slow and expensive to carry the load. My bet is on some form of blockchain 2.0 that is faster and more powerful. Something banks and nations can use as an actual digital currency. But it will not become “money” as such until you can pay taxes with it.

BTW, I have dabbled in crypto as a fun little diversion, and each time exited with a nice profit. I consider myself fortunate, and the money I put in I could have lost without losing any sleep.

Best of luck!

Jeff

True, Ben Graham would be appalled if he saw my use of the term “investment” in these past few articles.

But I’ll play devil’s advocate and say they do have some intrinsic value. Maybe not in the same way you can find a business’s intrinsic value through a DCF analysis, but there is definitely some value to a system capable of storing the entire world’s currency cheaply, efficiently, and safely. That’s not even getting into smart contracts, defi, NFTs, etc. which is where I think the true “industrial use” is currently happening. (And has potential to disrupt the entire banking, insurance, art, and collectibles industries.)

But we also agree. My bet is on Ethereum 2.0. 🙂

Just out of curiosity, would you consider gold to be speculative?

Appreciate the feedback!

Hello Mr. $$ Wizard,

At the end of the day, you can do whatever you want.

I read your blogs and have recommended them to a lot of my friends.

In your case, I felt you experimented with cryptocurrency with the spare money that you were willing to lose entirely without affecting your retirement plans.

I think this is what Mark Cuban had recommended for the people to do with anything novel.

While you said that you may have potentially lost a lot of money not doing it soon, and I understand your frustration. Unfortunately, this is not based on your advice of low-cost ETFs, rather trying to pick the needle from the haystack.

Secondly, there is no way to time the market every time. I am not against crypto or the underlying blockchain, but the insane peaks and lows attached with bitcoin. Also, I believe in the power of democracy and the existing currency, rather than a bunch of clandestine groups that are way too uncomfortable to come out.

However, I do very much appreciate your honesty and candor. You haven’t lost any credibility, but actually, I trust you even more that you seek to improve yourself by inviting criticism.

I am glad that you have put yourself in a position to experiment with investing strategies, but I wish you take FOMO into consideration. I just want you to succeed, and even if one person were to copy your success it is one less family out of poverty.

Thank you for all your honest posts. I am very grateful for what you are doing for a lot of us.

Thanks for the feedback, Sid!

Speaking as one millennial with FOMO to another, this sounds like a case of FOMO to me! *In interests of disclosure I also have a small amount of crypto.

I don’t think ETH is ripe for investment at the moment until the future operation of the protocol is settled (sharding, proof of stake and ultimate stock to flow ratio questions still need to be answered).

I used to think BTC was a bubble, maybe it still is, but I think it’s slowly being seen as ‘digital gold’. Greater general awareness, institutional adoption and regulatory permissiveness are positive developments for those holding BTC. Because of this philosopher’s stone-like transformation, I think that your BTC investment will probably come good.

I don’t think you’re being a hypocrite, you’re just being human. It’s not like you bought the crypto in secret or pretended you were doing one thing whilst doing another. If the crypto investment continues to moon it’ll give your portfolio a boost. In an apocalypse scenario (value goes to zero) at least you’ve limited the exposure to 10% – even being on the wrong side of 30 you have time to recover from the apocalypse scenario ;-P

As a long time reader I look forward to hearing how the crypto play turns out.

Happy Hodling!

HH

Thanks HH, always appreciate your thoughts!

Hi Money Wizard,

I didn’t give any thought to you investing in Bitcoin. I’d like to share with you my thoughts. The way I think of Bitcoin, is that it’s a new asset category. I’m super proud to tell you that my husband and I are Bitcoin/Crypto mining. A bit (pun intended) different than the process you may be investing in it, but still we are both investing in it. To me, I believe that we are expanding our investment portfolio and diversifying it further. For example, some people invest in stocks and real estate, in my opinion, two different asset categories. Certainly a socially acceptable way to diversify investments. My husband and I live well below our means, we contribute way more than the 15% general rule in the traditional investments (which fit the social norm of investing). So I see nothing wrong in adding to that portfolio with something else. I’ll go to bat for anyone who gets put down for that! It could be a wrong decision, but Bitcoin could also be the way of the future.

Very interesting, Melissa. I’ve heard that mining Bitcoin today without specialized equipment costs more in electricity than the rewards are worth. Have you run into that?

Hi Money Wizard! No, I have not run into that issue. I would agree that there’s special equipment needed. The everyday desktop computer or laptop would not be able to cut it.

Wizzard what ratio of Ethereum and Bitcoin did you plan on buying? 50/50? Curious on how to approach.

Thanks

I prefer closer to their market caps, in order to keep with the index fund approach. Right now that’s about 75% Bitcoin, 15% Ethereum, 10% everything else.

Hi Money Wiz,

Appreciate the full article response!

All very good points and agree with most others that the fact you are transparent about the change is what matters most for the blog as a whole. So no, I wouldn’t call you a hypocrite. I guess I’d call you…adaptable.

Your integrity is still well and truly in tact. Looking forward to further updates.

Thanks

Jamie

Appreciate your response Jamie, and thanks again for the great question!

Having a moon shot bet isn’t being a hypocrite. Google does it all the time by allocating a small percentage of their money towards moon shot bets (remember Google glass?). Most won’t work but if some does, then get ready to get the bucket out to collect all of the money that will fall from the sky.

I am a firm believer that cryptocurrencies are the ways of the future. I can be monumentally wrong so time will tell.

Love the analogy to Google’s gambles. Really interesting way to look at it!

It’s great to see so many other money-minded folks open to and already invested in bitcoin/crypto. I have a mining rig set up, DCA into bitcoin daily with Swan Bitcoin (highly recommend), buy the bitcoin dips, and yield farm new defi launches (has been higher risk than my tolerance). I have a high level of confidence in crypto, especially bitcoin, and especially with the hyperinflation of fiat currency. However, I still I think the key is to only put in what we can afford to lose. If it fails, it will suck but it won’t change my life; if the value multiplies by 10x or 100x, that amount will change my life (high risk, high reward).