What’s the magic moment when compound interest goes crazy? And why does it happen?

When I was writing the recent article about my teenage stock market investments, I think I found the answer.

It’s all about turning your portfolio into a money printing machine.

Warren Buffett does this. I (accidentally) did it. And you can definitely do it, too.

That magic moment when your portfolio turns into a money printing machine

While I was writing that article about my teenage investment choices, what struck me the most was not how naive I was in my younger years. (That part’s obvious… I don’t need another reminder to know that truth!)

No, the surprising part was that even though most of my investments were… to put it politely… lackluster at best, most have still reached that magical point where they’ve returned my initial investment and are now returning pure profit.

Literally printing money.

To see this in action, take my investment in Eli Lily. About 10 years ago, I scraped together $2,000 and bought shares in this pharmaceutical company. After a few years, the stock price had risen to $4,000.

This sounds like boring math, but it’s not. It’s actually a super special moment in your investing journey. The stock market had completely returned my initial investment.

What’s that mean? It means every new dollar that investment earns is now 100% profit. Brand new money being added to my portfolio, literally created out of thin air.

This is when compound interest starts to go nuts.

Over the next few years, the stock price of those Eli Lily shares continued to rise. Today, they’re now worth $7,000. With the help of the stock’s dividend payouts, that $2,000 I put to work so many years ago has now earned me over $9,000.

That’s a total return over 450%.

This is how truly astounding, bananas-crazy compound wealth building happens.

How Warren Buffett Doubles His Money

If we want to see how crazy this example can get on a long enough time horizon, just look at Warren Buffett. He’s made an entire career out of this effect.

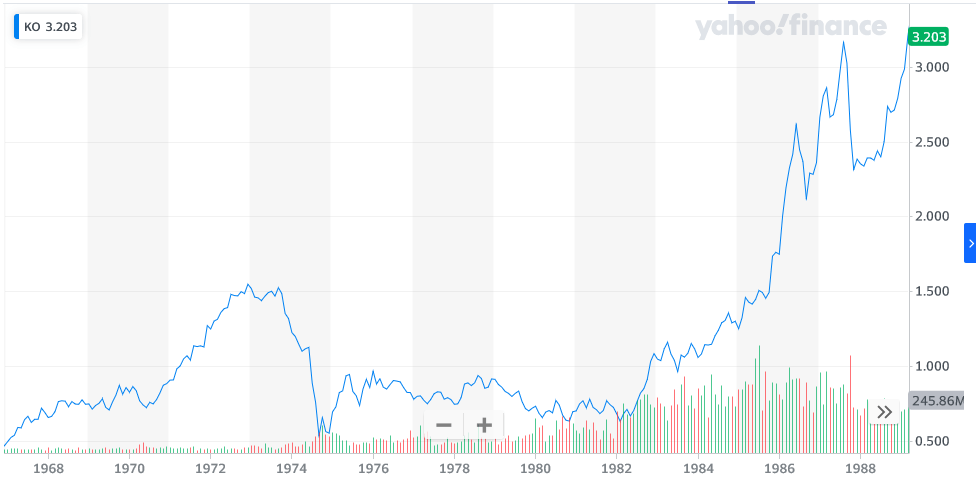

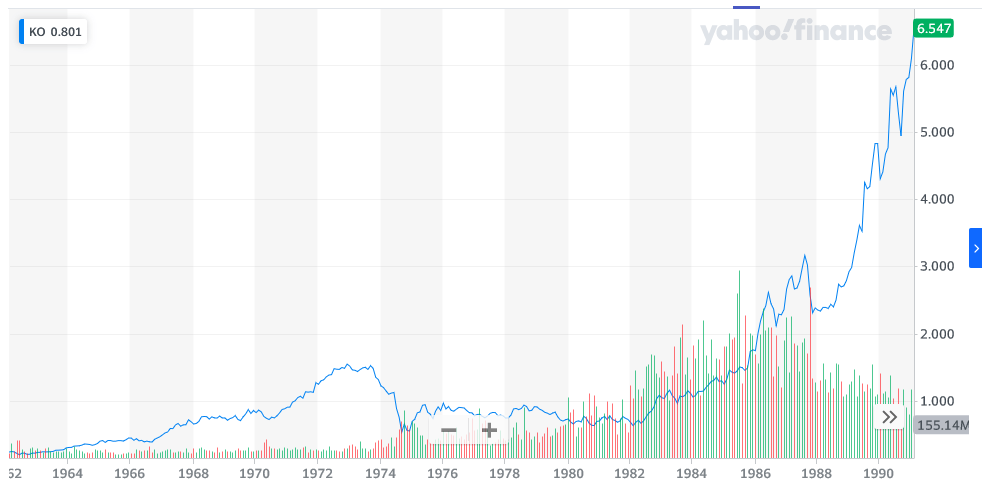

In 1988, Warren Buffett bought tons of Coca Cola stock at a price of $3.24 cents a share:

Three year’s later, Coke’s stock price had doubled. In other words, Buffett had earned back his entire investment, and everything thereafter was pure profit.

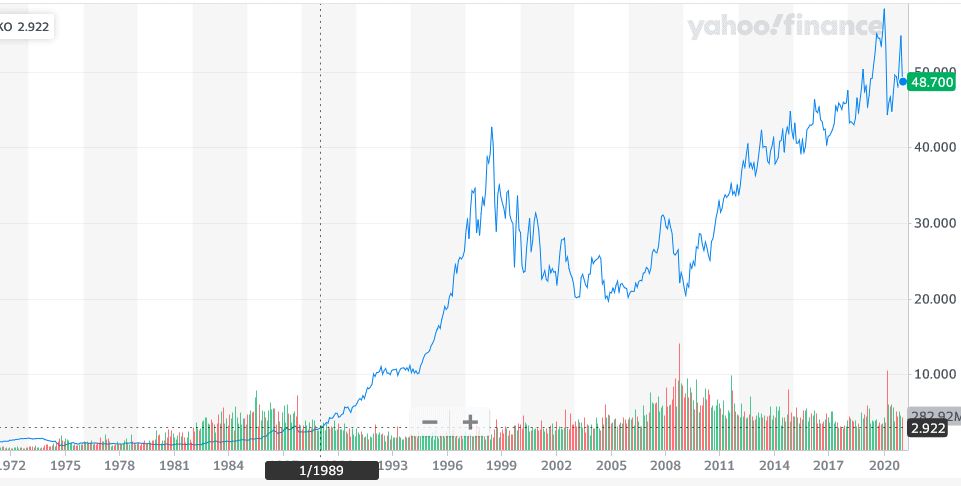

Since then, Coke’s stock price has increased roughly 1,750%, and no… that’s not a typo. On top of that, the company now pays a $1.64 dividend per share every single year.

A $1.64 dividend on a stock he bought for $3.24 means that Buffett’s earning an astounding 50.6% return on his initial investment every single year. Put another way, he’s doubling his money every two years.

This is why Buffett famously says he doesn’t care about daily changes in the price of the stock market. Why would he? If your investments had long since repaid the money you risked and were now printing a 50% return every single year (for doing nothing), would you care if someone said that the selling price of your money printing machine had changed by a dollar or two?

Of course not. You’ve never gonna sell. You’ll just keep collecting all your free money.

This same arithmetic works for pretty much of all Buffett’s investments.

In 1972, Buffett bought See’s Candy for $25 million. At the time, the company was making about $2 million of profit per year.

It took about 12 years for those $2 million dollars of annual profits to pay back his initial $25 million dollar investment.

But now, the business is a total cash cow for Buffett. Last year, See’s Candy earned about $80 million in profit – that’s over 300% return on his initial investment in one single year.

It’s all about assets and time.

The great news is that we don’t have to be the world’s greatest investor to benefit from this phenomenon. I mean, if teenage money wizard lucked his way into this, I think the rest of us will do just fine.

That’s because these stories aren’t some freaky or unusual occurrence. These sort of wild exponential returns are nothing more than a natural, predictable side effect of investing your money into productive assets.

Sure, being Warren Buffett and hitting a home run with Coca Cola stock (or being young Money Wizard and lucking into Eli Lily before a massive market recovery) will certainly help speed up the process, but the rules of exponential growth all but ensure this will happen to most every stock market investment, eventually.

With enough time and patience, nearly every investment you hold can turn into a money printing machine. And that’s when the compound interest starts to go crazy.

Do you enjoy my free blog? Share it on your favorite social media! You can also help support the site by taking advantage of awesome free financial software or my favorite cash back portal using this site’s affiliate links.

Related Articles:

Awesome post Money Wiz. I’m a big Warren Buffett fan and I like the way you shared about how this principle fits with his favorite holding period being forever, and not minding day-to-day fluctuations in share price.

Take or leave this, but one thing that I had trouble following in the post the way you wrote about your Eli Lilly stock acquisition. I know it’s used as an illustration and is not the point of the article, but the first sentence sharing you bought $2,000 worth of shares doesn’t include the number of shares or the share price, just the amount. So later when you talk about percentage increases and dividend payouts it is harder to see the increase in action. With the WB examples you talk just about share price so it’s easier to conceptualize.

Fair point. The total investment was just easier to find, since teenage money wizard didn’t keep the best records. 🙂

Your posts are generally fairly good, but this one misses the mark completely. You’re trying to say that the average investor can do what arguably the greatest investor of all time has done? Come on.

Buffett’s an extreme example, and no… the average investor isn’t going to grow their portfolio to $90 billion dollars. Sad to say…

But with enough patience I do believe everyone can get in a position where their portfolios are bringing in astronomical returns relative to what they initially invested. That’s the exact engine that drives compound growth, and the whole point of the article.

I find it inspiring to look at Buffett’s case. Sure, for you and I that won’t mean growing our portfolio by a few billion a year. But the average investor can still enter that same tail end of the exponential curve and see their portfolio $100,000+ in an average market year. That’s powerful stuff.

Warren B is an investing giant but I will never

understand why he dumped his investments in DAL and LUV. Great companies return to profitability in time and he lost billions there due to cv19 not because of the company’s performance. If he is a long time investor he broke his golden rules and they ate coming back.

Money Wiz… I love all your articles. But on this one I feel the title felt a little clickbaity (double your money in two years). No biggie though… one average article in a 100 good ones is still a good deal to me.

It’s true, I bought a few of these money printing machines about 20 years ago and they continue to spit out a very significant portion of my initial investment every year.

I have no intention of selling just because the stock market wiggles a little bit. These are compounders, and will continue to compound and spit off cash for years to come.

IMHO this is the difference between owning a stock and owning a business. Stock owners are looking for a greater fool from which to derive a gain. The owner of a business profits from the business itself.