If you’ve followed the news at all, logged into twitter, or even just stepped outside from underneath a rock, you’ve no doubt heard about the ongoing government shutdown.

Today, the shutdown hits its 30th continuous day, which places this closure a full week longer than the second longest shutdown in government history.

The lock up has brought certain government functions to a halt, caused various national monuments to remain unopened, and even left national parks either closed or overrun with trash and vandals. It’s terrible.

But the topic that seems to be getting the most airtime is personal finance related: The sad story of the nearly 1 million government employees going without pay.

The situation, according to everybody, is getting dire. CNN reports there’s tens of thousands of government contractors out of work, over 380,000 furloughed Federal Employees, and another 420,000 working without pay.

The situation is getting so bad, Federal Employees are now lining up outside of food banks. This VICE report shows the devastation:

The video shares several firsthand accounts of how bad things can get:

I’m eating 1-2 meals a day, trying to make my food stretch as far I can make it go…”

I might have to talk to family, for [monetary] support…”

It’s like a nightmare that won’t end…”

I’m not too proud to ask for help during this time…”

First, a disclaimer:

It’s easy for me to write this article from the plush padding of my continued employment.

Since I started my career, I’ve never had to experience a month long gap in paycheck. And without question, if I was a TSA agent, air traffic controller, or any other one of the half million workers required to work without pay, I’d be piiiiisssed. (I think we have a name for being forced to work without pay, and I’m not thinking of volunteering…)

BUT, since everyone else seems to be weighing in with their opinions about the effects of a missed paycheck, I thought I’d throw in my two cents.

If one missed paycheck sends you to the food bank, you need to get your financial life together.

Funny enough, this couldn’t be more evident than in the previously linked VICE video, which I picked completely at random thanks to its position as Youtube’s #1 search result for “federal workers shut down.”

But when I did a double take, I saw the icing on the cake that so perfectly sums up the REAL issue at hand, the one nobody wants to talk about, far more succinctly than I ever could with the written word.

The key lies in the video’s poster child, whose portrait doubles as VICE’s featured thumbnail.

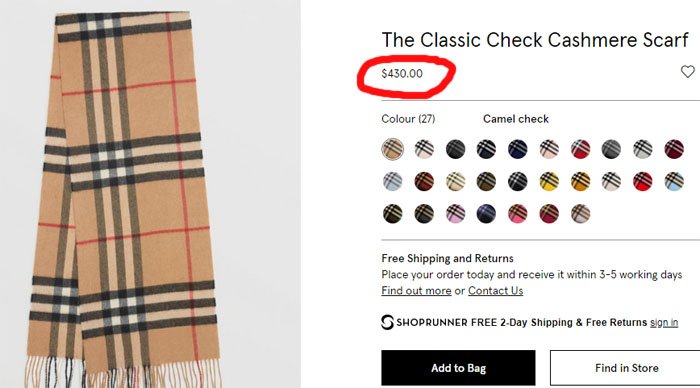

To the tune of emotion inducing piano music, she faces the camera and explains why she’s standing in line at the food bank after one missed paycheck… WHILE WEARING A $430 BURBERRY SCARF.

Maybe it’s a knock-off…

But then, in a one-two punch that would make Mike Tyson proud, the video immediately cuts to this guy, who explains that he’s been passing the time by binge watching a lot of Netflix. If the shutdown doesn’t end soon, he says, he may have to ask his family for support. Most likely of the monetary kind.

Did you see it though?

It’s the small logo above his heart, nearly camouflaged with the rest of his outfit. That’s the Mountain Hardware logo, a luxury brand name for outdoor gear. I only recognize it because I lusted for weeks over their ski jackets before finally deciding that $300 for a jacket was way more than I could reasonably afford.

Live within your means, or prepare for the consequences.

There’s nothing wrong with buying nice things. If you can afford it.

But these people, with their luxury goods and even louder complaints, clearly cannot.

The average Federal Employee earns 50% more than the private workforce. Unlike the private workforce, they also work a job that’s essentially immune from layoffs. According to federal legislation, the 380,000 furloughed employees are guaranteed backpay, and so will the 420,000 workers in the extremely unfortunate spot of working without pay.

In other words, the least that federal employees should do is build their financial lives responsibly enough to last a couple paychecks in the event of a shutdown.

I’m not the world’s biggest fan of emergency funds, but a few paychecks is well within the range of standard financial advice. If you instead choose to ignore that advice, and you decide you’ll sacrifice the foundation of your financial life in exchange for luxury scarves, jackets, or whatever else floats your boat, then you’ve assumed that risk.

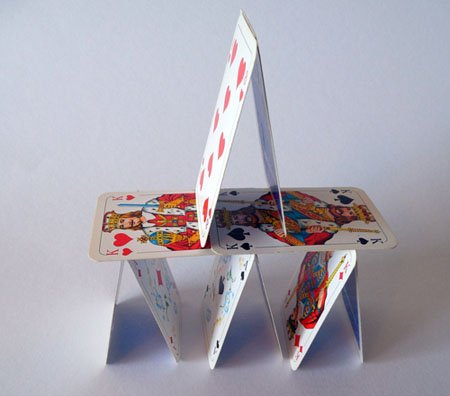

Do not choose to design your budget on a knife’s edge with steep drop offs to either side. All it takes is one change in the wind to get knocked off balance, and then the whole house of cards comes crashing down.

You want your financial picture to look like this:

Not this:

Always consider the possibilities

Until you’ve saved enough money to be completely financially independent, you need to be on high alert. Always be asking yourself what could go wrong, and plan according.

Whether that means an expanded network of contacts on speed dial, a part-time job to revert to, or a host of side hustles to cash in on, do not put yourself in a position of no options.

- When you’re a corporate worker, and there’s even a whiff of layoffs, you should immediately make arrangements for a plan B.

- If you’re a federal worker, and you’ll never get laid off, but the government has hinted at a shutdown every year for the past five years, bump up your emergency fund just to be safe.

- If you’re a federal contractor, and an openly anti-government dude gets elected into the White House, consider the possibility that your contract gets terminated.

The beauty of financial responsibility – negatives become positives

Here’s the best part about living a little differently than the masses. When you reject the idea of money being a temporary token to blow on stuff, and instead view it as a tool for eventually purchasing a lifetime of freedom, a few amazing things start to happen.

For one, you’ll start saving more money. Duh.

But the interesting part is how those savings impact not only your day to day life, but those rare events that everyone else calls “catastrophes.”

Consider these scenarios:

1) You’re a federal employee, and you get forced away from a work for a month or so.

If living paycheck to paycheck → Your house of cards comes crashing down, and you’re soon begging for food donations or shuffling to your family, hat in hand.

If saving aggressively for financial freedom → Knowing that backpay is coming, your furloughed situation is suddenly a free vacation, an opportunity to pick up a side hustle, or a chance to spend time with family.

2) You’re an index fund investor, and an economic crisis hits.

If living paycheck to paycheck → Stocks are tanking! With nothing in savings, you start to panic, and you do one of the 3 things you should never do.

If saving aggressively for financial freedom → Hey! Stocks are on sale. Looks like a great buying opportunity.

3) The big one… You get fired or laid off.

If living paycheck to paycheck → Total disaster. File for unemployment, and pray you can survive.

If saving aggressively for financial freedom → Chances are, you’ve already made serious progress towards your financial freedom number. It may not be ideal, but you’ve got months, or even more likely, years of living expenses already saved up. You take a break, reevaluate your position in life, and consider pursuing a dream or making other positive life changes.

Two Choices. Which do you take?

Look, I get it. Not everyone is going to be as obsessed with planning out their money the way most readers of this site are. And there’s a huge portion of the population living paycheck to paycheck.

That does not make that population dumb, stupid, or bad people. In most cases, it means they weren’t exposed to the right ideas, and then they got surprised by a situation they never expected.

But this shutdown should serve as a reminder for everyone. Because at the end of the day, we’re all given two choices with our financial lives.

Accidentally or not, we can design our lives as a high wire act, juggling mortgages and credit card bills while hoping our situation never encounters the slightest wind gust.

Or, we can build up our options for dealing with adversity, and ultimately, our options for reaching freedom.

I know which choice I’d rather take.

Related Articles:

The government shutdown is a perfect example for why financial independence is so important. I faced many “income interruptions” during my career and eventually I built up a financial fortress. Now, it’s a industrial strength fortress, and almost nothing could derail it.

Sadly, many government workers that don’t splurge on fancy brands are probably facing some serious financial hardship.

I can hardly believe that people will pay that much for a very ugly scarf!

Enjoyed this post. Coming from Australia, this is the first time I’ve ever heard of a government shut down, but it seems that people in the US look on it as being a normal thing.

It’s perfectly ridiculous. How can a government not be able to pay its workers??

I’d be mightily pissed off if I’d saved for ages, planned a trip to the US and things that I wanted to see were closed.

The guy in the video above is spending his time watching Netflix videos…hmm..isn’t that another clue to what his financial priorities were / are, In addition to his cool ski jacket??

Hello, MW.

Really like your blog. Have to point out what comes across as a lack of empathy or even prejudice. For instance, your “poster child” is a federal contractor who explained that she expects to adjust as this wasn’t “the end of the world.” Spending one’s money on a luxury scarf (even at full price) should not be any more shameful than a NY vacation.

You should review the CBO report (rather than Huffpost’s clickbait headline). Federal Government compensation (plus benefits) is at its highest for people with a high school degree – which only highlights the point that one of the world’s wealthiest economies allows people to pay employees less than a living wage.

And even if they were indeed cash strapped, there should be no shame in watching Netflix while waiting for the absurdity of a selfish government shutdown to end. Or standing in line at a pop-up food bank and speaking to draw attention to the absurdity of a shutdown.

Yes, living from paycheck to the other isn’t financially prudent. Even after the big holiday season. But the lesson here isn’t coming from today’s post.

TBH that scarf lady seems like she was actually kicking a**. She had a super positive attitude and even mentioned she was looking into substitute teaching and starting a small business.

You’re right though. My NY vacation was about 3 times as shameful as the luxury scarf purchase, and I really hope all readers would call me out if I did that while living paycheck to paycheck.

Hi Mr MoneyWizard,

Love the blog, have been reading it for a few months and I’ve found it very helpful. Unfortunately this post seem really out of line with the rest of your content. Making assumptions about people’s financial choices, and then criticizing them based on those assumptions seems pointless and mean. To do this to people who are going through financial hardships just seems needlessly cruel.

I enjoy seeing you criticize your own financial choices, and that has helped me get better at doing the same, but I’ve never seen you criticize the financial choices of others like this. I hope you reflect on my comment and this post and edit the post or take it down. But ultimately that’s your decision. I just wanted to provide my feedback since I really appreciate your blog otherwise I wouldn’t have taken the time to write this.

Hey there,

I appreciate the comment. I am a little confused by it though.

If I post about my own successes and failures on the blog as learning examples, as well as the successes of others (like the financial freedom spotlight or the recent feature on Orville Rogers) then doesn’t it

make sense to analyze the less rosy scenarios too, even if it’s not one of my personal self-criticisms? (Which I’ve done a lot of lately!) Or would you prefer all posts on the blog only be about me?

Buffett’s right hand man, Charlie Munger, says when he’s analyzing success, he always begins with obsessing over all the ways things can go wrong:

“Invert, always invert: Turn a situation or problem upside down. Look at it backward. What happens if all our plans go wrong? Where don’t we want to go, and how do you get there? Instead of looking for success, make a list of how to fail instead – through sloth, envy, resentment, self-pity, entitlement, all the mental habits of self-defeat. Avoid these qualities and you will succeed. Tell me where I’m going to die, that is, so I don’t go there.” -Charlie Munger

Thank you for your reply.

I don’t have an issue with posts about other people, but the analysis of the success or struggles of other should be based on reality not assumptions. Your previous posts you reference where you discuss other people, those people have themselves documented their reflections of how they reached their financial success. The analysis of the government workers had no such self reflection that you analyzed of how they ended up in these situations. The post has your assumptions of how they ended up in their financial situation, then you use your assumptions as a basis of the analysis of these people’s financial decision making.

I don’t quite see the connection in your use of the Charlie Munger quote. He is talking about how he personally approaches problems or situations and offering it as a glimpse into his thinking. I don’t think it’s telling us how to analyze or guess the financial decisions of people in a Vice video.

I don’t think I’m alone is my concern about this post and how you go about making your point in it.

While they wait in the food line, I hope each one is also handed a copy of the book ‘Automatic Millionaire’. Never read a “boringly” simple book that explains how the average person can systematically save, and accumulate wealth.

I’m really bummed by this negative twist in blog content. Some of my least favorite FI bloggers are those that sneer down their noses at others. It is a toxic pattern in the community as a whole. I agree with the previous comment sharing concern on this direction.

Never judge a man until you’ve walked a mile in his shoes. You don’t know the story lurking behind each of these faces. Elderly parents to care for? A special needs child? Student loan boat anchors? Recently divorced? Everyone has got a multitude of things that contribute to their financial story, but don’t fit neatly in an Excel cell.

How can someone with a $430 scarf and manages Cost benefit analysis for the gov’t have a cash flow problem?

Who told you these people didn’t budget, and save up for the designer items? I budget, and budget for extravagant items somethings, if I value them. I don’t agree with your assumptions without further information.

Other than that, good point to save up even for the things that can’t ever happen, like the government shutting down and missing two paychecks.

Money Wizard,

I love your blog but this post was really disappointing. I don’t think you can judge someone’s entire financial lifestyle by what they are wearing in one picture.

I live in Washington DC and many furloughed employees do have savings. Typically those of us with a high enough salary to begin with that we afford to save. The people this is really hurting are lower wage government employees and contract staff that work as cooks and janitors in federal buildings. These contractors will never get back pay. In terms of side hustles it’s hard to anticipate how long this will go. You could literally be called back any day and need to maintain that flexibility.

Would have loved to see a more positive spin, like how to save on a low income, financial resources for federal employees, or really anything that didn’t castsuch a judge mental light on people currently struggling.

Looking forward to your next post

A fed

Money Wizard,

I feel like you are taking a couple of blows for posting this topic. I don’t think it was a negative topic at all, nor do I feel that you made assumptions about anyone. Lack of budget planning and living paycheck to paycheck is a “taboo” topic much like weight management. We all know it needs to be done. No, it’s not fun to track either and make a plan to be within a weight range or a budget. Many people then just hope by not dealing with either, the problem will fix itself. And lord knows you bring up either topic, you are are going to hurt some feelings and some people are going to feel that you are being “negative” and start accusing you of not having empathy and that you don’t know what each individual circumstance is on why a person is overweight or why a person hasn’t been able to set aside anything from any paychecks. I applaud you for posting this. No, you aren’t being judgemental. You just posted a topic that many people don’t want to face the music with.

Keep posting, young sir!

I read the past twice as well as all of the other comments before pitching in myself.

I think that the message to always look out for obstacles to financial flexibility and avoid purchasing expensive items until one has financial failsafes / a backup plan in place is a good one.

Is judging a book by its cover the best way to elaborate on this message? Probably not, simply because one can’t necessarily tell from picture how valuable an item is or how it was acquired.

Is it alarming that many people appear to be one paycheck away from the foodbank? Undoubtedly, yes. Either they must be employed in jobs that are not really providing them with enough to live on or their finances are arranged in such a way that everything they are earning is being spent (leaving them no buffers or reserves for times of crisis). Will it always be easy to escape such a financial situation? No. However, I still think it’s legitimate to warn people against ‘choosing’ such an existence and urging them to do what they can to strengthen their finances. It’s not easy to hear but it’s certainly a message worth listening to.

HH

The ONLY truths are the following.

1. The 2 folks on the videos above are furloughed (assuming those aren’t doctored videos)

2. They don’t have enough money saved.

3. They are wearing wearing expensive – jacket/scarf

Everybody here is debating the negativity and positivity of the message the blog post.

Shouldn’t we be debating the merits of saving up and the challenges about the same, instead of assuming the intent of the messenger – be it MW or the fans commenting about the post?

I enjoyed the post. Sometimes the truth hurts. If you can’t eat because of one paycheck, something is wrong. Hopefully the people suffering will learn from this and put a few acorns away for a rainy day.

I’m a government employee who is working without a paycheck. I find standing in food lines to be rather ridiculous but that’s just me. I can live through quite a few presidential elections before my family would run out of money but understand not everyone has managed their money like we have. Also my wife just finished cancer treatment so we understand that everyone has to deal with different financial obligations in life. One thing that annoys me is that my held paychecks should be paid with interest because I could be investing them and making some money. I think your post is fine and find people to be too sensitive in the past few years.

In the USA, unless you or a dependent suffer from some type of physical or mental health issue that causes unavoidable financial issues, or you’ve recently went through a life crisis (e.g., messy divorce, legal issues or jail time, depression that leads to unemployment) that causes severe financial trauma, there is *never* an excuse to be living paycheck to paycheck to the point where you find yourself at a food bank in a short amount of time with no pay. Bottom line. Fact.

And yes I understand that some federal employees may be dealing with some of these other outstanding issues on top of the shutdown and I feel for them.

With that out of the way, I just want to say that there is a problem with “broke acceptance” in America…similar to fat acceptance. It’s almost like it’s cool to be broke….as if there is a brotherhood of people in the “struggle” against the “Man” who is keeping them broke. Even my well-off colleagues complain about how their next paycheck will have to go all to their credit card and bills because of the Man and the 1%’ers…after driving to work in their German cars. Broke shaming (or fat shaming) is never OK, but calling people out when they’re making stupid mistakes is fine. Otherwise, people will do Olympic quality mental gymnastics desperately trying to convince themselves that $500 car payments, $100k liberal arts degrees, and lease-to-own $1000 cell phones all while living paycheck to paycheck is OK. The nice grad student who fixed my bowl at Chipotle yesterday played on their iPhone Xs between serving food. She was nice, but she was also financially stupid. No wonder Apple is so successful if they’ve figured out how to get $1000 gadgets into the hands of people working for $9/hr.

America has been fine tuned into a consumption machine where we rent everything, own nothing, and marketing algorithms based on your search history, phone location history, and email message content has already determined what you should buy with your next 5 paychecks. If I have any empathy for these people living paycheck to paycheck, it’s because their basic “skip the latte” style “budgeting” is no defense for the way big banks and advertising companies mine our data to gently push us towards making purchases without us even realizing it. That battle was lost before it began. Algorithms put the president in office so it’s pretty easy to believe that algorithms are having a huge effect on spending habits. I think everyone underestimates the effects of algorithms and data mining on our spending habits.

Socially acceptable but toxic lifestyle decisions are the hardest bad habits to quit. Creating safe spaces around people who have made financially unhealthy lifestyles because “but you don’t know their story” can end up doing more hard than good. Unless their story involves a life changing crisis, their story does not matter and they are not a unique snow flake. Period. They made stupid decisions and now as a middle aged person they are at a food bank after a few weeks with no pay check. This also implies that they don’t even have credit cards to hold themselves over. I don’t support credit cards in general and only use them to keep my credit active…but I also have a couple credit cards for emergencies, emergencies as in to hold me over during the 2 days it would take to transfer money from my mutual funds to my checking account.

I once heard about a study that concluded that the success rate of quitting heroin is higher than quitting cigarettes. Why would this be? Because cigarettes are more socially acceptable than heroin. You can smoke cigarettes and not be a complete social outcast, and in some circles there will even be positive reinforcement towards smoking. But if you do heroin you’re a social outcast who needs to get their life together. In the US, being financially irresponsible and in debt is normal, socially acceptable, and can even strengthen social connections through bonding. If that is normal then I want to be weird.

/rant

Loved your comment Julian! I agree completely with everything you said. Up to the point that I would love to connect with you on a professional basis if this is ever possible. As a young grad starting my career, I feel like you would be an ideal mentor to me.

Money wizard, keep up your good work. I had recently discussed this same issue that you write about among my friends and they don’t seem to get it. I admire your bravery for positing this “controversial” article in this increasingly PC world that we sadly live in.

This is a well thought out and honest appraisal of what is really going on. The fat shaming analogy is spot on. Myself and a collegue were just talking yesterday about a very overweight 50 year old coworker who died of massive heart failure last week. She was loved by so many as she was a social worker at a cancer center, the turnout at her funeral was capacity. Were it depression or suicide it would likely be talked about as a cautionary tale for others to heed. The fact that her weight was almost certainly the primary contributor to her death is something that will never get more than a private whisper among those bold enough to speak of it. Its always ‘don’t judge unless you have walked in anyones shoes’. Well, this works for some instances, but the vast majority of the time with enough life experience under ones belt and good critical thinking skills the majority of your conclusions will have a strong basis in fact.

Your commentary on this automatic out is, I agree, taking out accountability at the knees. Compassion, understanding and a helping hand up are all to be considered, but if we were to go around giving the benefit of the doubt to everyone who is taking the low road we betray our life experience.

I personally avoid interactions with folks with neck tattoos, people who live in broken down sketchy RVs, groups of young men downtown at night, guys with big rebel flags on their pickups and smarmy rich folk. Perhaps they are fine, but its not worth my work filtering through it.

I thought it was a great post. I interpreted the point of it not as bashing people but making it clear that if missing one or two paychecks sends you to a food bank, something is seriously wrong in your financial life. It speaks to a bigger problem in the country where financial literacy is taboo and spending/consumption is encouraged.

I agree completely with Julian’s comment above. Sometimes, the truth hurts.

Hey Money wizard,

You seem to be taking a lot of flack for this post and as a longterm reader I must say people need to calm down. I dont think your post is out of line at all. Your point is if you are at the foodbank after 1-2 missed paychecks your financial life is not in great shape, that is a perfectly fair point. If you don’t have an emergency fund to fall back on or even enough of a credit buffer to pay for 2-4 weeks of groceries, you aren’t planning very far into the future.

I think it is really apparent when the one person says its his third shutdown, if you had this happen in the past and didn’t think to plan for it, what are you doing? Everyone has the capability to protect themselves minor financial hurdles and it isn’t that hard. If you work for the government plan ahead for a shutdown, if you work in a union that might strike, plan for it. If you work in a specialized area that might mean a long job search, maybe you need a bigger emergency fund.

There are circumstances outside of ones control and you don’t know everyone story but almost ANYONE can do things to improve their financial position.

Saying this post is in bad taste is like telling someone on a fitness blog that they shouldn’t say americans need to exercise more when 50% of the population is obese just because you don’t know someones individual situation and they might have a condition outside their control that makes them fat.

Good post and a sober reminder that you need to plan for the unexpected.

Hi MW,

I’m a big fan and love your site/blogs – it’s one of the main reasons I started up a Vanguard account last year! – but I have to agree with some of the comments here that this story didn’t strike the right chord.

The points you make about building financial resilience are spot on but I felt you could do that without presuming or judging people without knowing their full story. There could be a dozens of reasons why someone is not able to build up that emergency fund – reasons that are outside of their control rather than an active choice.

Anyway I just wanted to provide my feedback as I’m very supportive of what you’re doing with this blog and your updates.

To all of those so resistant to making some assumptions (‘judging’ as it were) without knowing the full story of someones situation or life I would say get real. We do it all day long, every day. Its how we navigate the world. If someone has a $300 jacket, just leave it at home when going to the food bank line after just a few weeks of no pay.To address the jacket directly, since everyone else wants to, I mountain climb and have Mountain Hardware gear. The odds of that ending up in the hands of someone randomly are so slim it is hard to explain, its almost boutique level gear.

But my main point is, that almost every person I know who has a hard luck story- of whom I know ‘their whole story’, are completely responsible for their long term woes. So its pretty easy to project that when I see what looks, walks and quacks like a duck day to day. You don’t always get it right, but I bet you do more than most of the time.

FYI, judges never know nor care about the full life history of the person before them. They make conclusions based on limited information as they have to.

This is a particularly relevant and appropriate post. Unfortunately, the truth cuts deep at times and people are not willing to see this post for what it is.

Love your blog, and keep up the good work.

I enjoyed this article until I scrolled down and read some of the comments. Wow people are sensitive.

Hi Money Wizard,

So I’ve been reading your blog for a while now. I’ve actually gone back and started from your first posting and have been slowly working my through the old posts while reading your new ones as well and all this time I have never commented on your blog. I have learned so much though so thank you. I feel though that after reading this post and all of the negative comments from people who didn’t understand the point of it, I had to speak up to give you some support.

First of all, Money Wizard was using this scenario as a teachable moment, not to berate or belittle anybody for their financial decisions. He even says that in his disclaimer at the beginning and end of the article. He was simply using this as a prime example of why an emergency fund or some form of investment is so essential for everyone. These workers missed ONE paycheck and are going to the foodbanks, selling their cars, and losing their mortgages. ONE!!!

By the way, food banks are for people who make like no money or are homeless, not for people who make pretty good money with great benefits who did not save any of it or have any kind of fallback option. How many homeless or starving people didn’t get food this last month because federal workers were going to the food banks? Just a thought.

As far as the picking out of the clothing that cost a lot of money, again he was simply using them as examples to make his point. We don’t have a clue as to how they got these expensive clothing. Maybe they got them as a gift? Maybe they got them online used or at good will? Maybe they did spend money on them that they barely had to begin with. WHO KNOWS, WHO CARES!!! THAT IS NOT THE POINT!!! The point was that there are SO many people who do live paycheck to paycheck and buy expensive things like this who then are in full on crisis mode when they lose their job or in this case, get laid off for a month. If you want to live that way, that is fine but as he was saying in his post, be prepared to face the challenges that can and will come when crisis hits. Again he is not directly attacking the workers in the video, just generalizing to people who live that way.

As the Money Wizard said, I by no means condone the shutdown or the fact that these federal workers have to make these kind of decisions. It’s not right and it’s not fair. But guess what, it happened anyways and it will probably happen again and it would be beneficial to them to try and make preparations for what is likely an inevitability. It sounds like victim blaming but it’s not. They are the victim of a situation that is not their fault. That doesn’t change the fact that they still have to deal with it regardless of where the fault lies. The real issue is that we’ve all be so heavily marketed to and constantly told our entire lives that the American dream requires expensive houses and clothing and cars rather than financial savings and responsibility.

Great post Money Wizard. Keep up the great work and don’t let people who didn’t get the point get you down.

Your post is spot on! On Jan. 6 CBS had a story of a federal worker who was “not going to be able to pay his rent this month”. First off, our first paycheck of January (yes, I am a federal employee) didn’t come out until Jan. 11, so this person who stated they couldn’t pay “their January rent” shows that they obviously spent too much money in December, or they live paycheck to paycheck and pay their rent on the 15th. Then on Jan. 15th (date may be wrong) CNN showed a story of 3 women, all holding babies on their laps (nice for a “oh please feel sorry for me” message) stating they “weren’t going to be able to feed their babies” (OMG, the poor “babies” are all going to starve!). Really? After missing ONE paycheck. You mean, the large bling bling rings and the modern large kitchen they were all sitting in made them not consider that jobs in America are not guaranteed? Your post is awesome. People are too sensitive and need to pull up their big girl and big boy pants.

Keep up the good work.

I thought the same thing when I saw all these stories on the news. I’m not doubting some people are left in a bad situation due to their life circumstances but also I think many have done it to themselves due to being irresponsible (as applies to a lot of people in general). From where I come from, I believe many of these workers make a decent paycheck and benefits. Poor money management on their part if they are sunk after not getting 1 or 2 paychecks.