Last month I sat down for my annual performance review, and I was in for a shock.

For the newer readers, I graduated in 2013 with a dual degree in economics and finance, and I now work a mundane office job in that field.

That said, on the income scale, my earnings started around “well-paid elementary school teacher” for a few years before jumping to “successful electrician” for the past several, all while staying far behind the “$250K investment banker” pay of some of my similarly degreed peers.

In fact, I’ve never even clipped the prized six-figure mark that seems to be the barometer for high-pay, at least in certain circles of society.

But that all changed last month, when my boss ended my performance appraisal with the following surprise.

“I know you recently put in for that promotion,” he started, with a dejected tone, “and starting today, you got it!” he finished.

I had to ask him to repeat what he just said.

When it finally sunk in, I nearly fell out of my chair.

The new position came with a big pay bump, and there was now no getting around it. I’d soon be firmly cemented as “well-paid.” No matter who you asked.

Exactly how well-paid? We’ll get to that.

Why I’m Not Lying About My Salary

Some close friends who know about the blog even suggested I ignore or hide the raise. They said earning six figures would make the blog “unrelatable” to many people.

But you know what? Screw that.

This blog has always been about documenting my journey to financial freedom. And that journey means being honest.

I could “round down” like a lot of other bloggers do, in a dishonest attempt to relate to the biggest audience possible. I could smudge my numbers or leave out key details along the way, so that I maintain the illusion of being in the middle of the bell curve. (In one famous instance, one personal finance blogger loved touting their “modest nonprofit salary” which some internet detectives discovered was… $225,000 a year.)

But I made a conscious decision that this blog wouldn’t be ran like a sell-out business when I turned down multiple offers to sell this site. Then I reinforced that decision when I decided not to bombard my readers with sponsored posts or endless display ads. (This website’s ad settings are literally on the lowest frequency possible, and I still worry that’s too much.)

So, I’m sharing the one HUGE detail that so many personal finance bloggers love to ignore, even if that means taking a risk.

And you know what else? I’m kind of proud of the promotions I’ve scored.

I started my career as a fresh-faced college graduate with an intentionally chosen degree, earning $50K a year. Since then, I’ve busted ass to consistently impress my bosses. I’ve spent nearly seven years gutting it out with the same company, even when tough times had me wanting to quit or jump ship. I’ve put in extra hours when needed. I’ve traveled across the country, often leaving my personal life behind far more than I’d prefer. And I’ve even navigated B.S. office politics time and time again.

From all those efforts (mixed with a little luck, of course) I’m proud to say that my salary has doubled in my first 6.5 years on the job.

Am I incredibly fortunate? You bet.

Am I going to hide from that fortune? Absolutely not.

So here it goes…

In 2020, I should make around $105,000.

Phew. That feels wild for me to even type.

Especially when I remember my starting salary, which was less than half that. Nobody in my family ever made that much. (That I know of…) And I always envisioned 6 figures as the “holy grail” of salaries.

In fact, when I originally set out to become financially independent by age 37, my calculations assumed I’d never make more than $75K or so.

So when I see that startling number, I realize that my strategic moves to increase my salary have actually paid off. Which I hope does one of three things:

- Gives people an honest view of my financial picture. The last thing I want to do is mislead anyone.

- Makes me more relatable to so many of my readers that I know make even more, including families with combined incomes that blow mine out of the water.

- Inspires people hoping to build up their earnings to keep chugging along, because it just might pay off.

Some people won’t have any reaction whatsoever to that number. Lady Money Wizard makes a fraction of my salary, but she loves her job and doesn’t envy my paper shuffling in the slightest.

Other people might see that number and wish they made more. If that’s you, I’d give you this word of encouragement. Your salary IS in your control, no matter how many people try to claim otherwise. While every career path is somewhat limited by certain averages, there’s nothing stopping you from playing the game a little more strategically, hopping to a higher paying position (or company), and if all else fails… jumping into a completely different field or starting a lucrative side hustle.

Remember, there’s two types of people in the world. People who look at something and immediately come up with reasons why they can’t, and people who look at something and immediately ask how they can. I’ve always strove to be the latter, and I think the world would be a better place if more people did too.

What does this mean for the blog?

Does my higher salary mean that all of my advice about money is now worthless?

I’d like to think not, but I guess only you can be the judge of that.

Personally, I think a much better barometer of someone’s financial situation is how much they spend, how much they save, and how they invest. Lots of high income people have financial situations that are total disasters. Being rich is not the same as being wealthy.

Hopefully, knowing exactly how much I’m bringing in makes it easier to compare your situation to mine, which I know a lot of readers of the Net Worth Updates enjoy doing.

If you make or save less, you might want to adjust your expectations for when you can reach financial freedom. If you make more, feel free to show me up. (Don’t forget to send me an email when you beat me to freedom!)

On that note, I plan on funneling the new raise into maxing out my 401(k) next year. Previously, I’d dialed back my 401k contributions to build up a cash pile, so that I could either invest in real estate or shift my portfolio towards more conservative cash/bonds. But with a higher salary, I now have the luxury of doing both.

Between maxing out my 401k, receiving my generous 7% employer match, maxing out my IRA, and continuing to avoid lifestyle inflation while I plow money into Vanguard index funds, I’m shooting to save $60,000 next year.

- 401k max: $19,500.

- Employer match: $7,000

- IRA max: $6,000

- After Tax Index Fund Contributions: $27,000

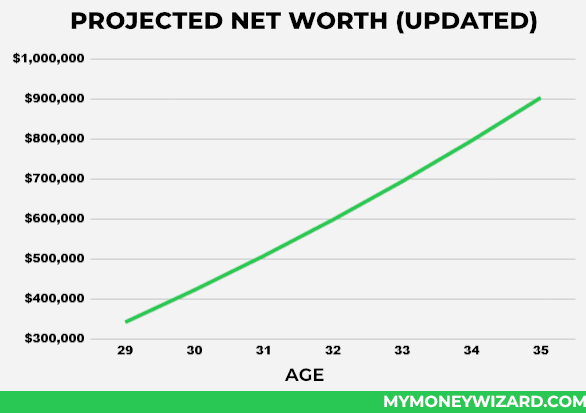

5-6 more years of saving at that pace means that I should definitely be able to accelerate my financial freedom goal, from my original target of age 37 (with $750,000 saved) to a new target of age 35 with closer to a million:

But do you even understand frugality anymore?

As someone who started this journey spending no more than $22,000 a year, I’d like to think I’m still in touch with what it takes to be frugal. But I’ve certainly increased my spending over the years. (Last year, I spent $34,000 while enjoying the first-world privilege of remodeling my kitchen, and this year I’m on pace for $29,000 or so.)

That said, unlike a lot of other personal finance bloggers, I don’t think frugality is the be all, end all metric to life. To pick on a peer… Mr. Money Mustache believes everyone would be happier splitting their own firewood and biking to work every day.

I disagree. I think frugality is a great start, but as I’ve always said, it’s just one level in the game of money.

To me, the game is much more interesting when you also try to maximize your earnings, build multiple income streams, and… brace yourself for this one… strategically spend your money to actually make you happier. (Hold the gasps!)

Would my $1,000 ski vacations have me laughed out of the room of most early retirement groups? Probably. But it’s hard to imagine a time when I’m happier, and those ski trips are some of my favorite memories.

Is cutting your expenses to the bone unbelievably powerful in achieving your financial dreams? You bet. But so is building up a side hustle, or dare I say… getting a promotion at work.

What do you think? Do I make too much to still run a down-to-earth blog about saving and investing money? Or do you wish more bloggers were honest about their earnings?

Related articles:

Congrats on the promotion, man! $105k is a number you should definitely be proud of, especially since you just graduated in 2013. Choosing the right field certainly helps, but no doubt you had to put in a lot of work to get the promotion. Excited to see how this turbo boosts your path to financial independence!

Thanks, Zach! I’m excited to see how it plays out with the financial freedom experiment too. Definitely ahead of schedule, although that’s mostly due to the wild market lately.

Congratulations! That is one awesome promotion! 🙂

One small suggestion for the blog. Now that you have your current large salary, I think that people will hone in on it – and as you suggested some will be dismissive. I think you could head that off by making a post about your salary progression throughout the years and your corresponding savings per year. Since you’ve already revealed this salary and your annual savings in the NW reports, this shouldn’t be too much of a shocker to disclose. 🙂

Enjoy that wine and cheese, life is short 🙂

That’s an awesome post idea, Handy Millennial. I’m definitely going to look into that.

Congrats! I’m very happy for you. Getting to $100k is not easy in my opinion. I would also add what you did, at a high level, to get promotions and pay increases along the way.

Congratulations! Good suggestions from Handy Millennial and Jay. I will say that as the salary increases, sometimes expenses increase as well. Do you plan on having kids? That may throw a monkey wrench into things….even when you’re past childcare expenses, there are school expenses, sports expenses…it’s enough to make $100K seem like “not enough”. It would be interesting to see how you manage things like that down the road.

I think it’s great that you are honest with your readers. A lot of us are in the same position.

Congratulations on the promotion Money Wizard.

And your honesty is much appreciated. Bold as you stated to compared to the blog but that’s the way to go, i believe !

Look forward to reading more.

Thanks!

Congrats on the promotion! I would imagine it’s well deserved 🙂

It seems we have had a very similar career path as I also dual majored in economics/finance and have slowly climbed the corporate ladder. I make just a touch under six figures, but I think I should cross that barrier early next year with a scheduled raise.

I appreciate the transparency as it’s certainly easier to save more rapidly with a high income, but your message of values based spending isn’t diluted because of that fact!

Team dual major! Congrats on your success so far too, I’ve enjoyed following your journey.

Thanks for sharing Money Wiz, and congrats. With the extra earnings, will you still continue to avoid VTSAX contributions until a downturn? I know you’re putting more into bonds, but that won’t yield 6% like VTSAX.

I’m going to stop and regroup at year-end and weigh my options.

My initial thought is to continue trying to build that 10% bond exposure that I’ve been aiming for. Getting there will actually be harder and harder to do though, since the maximum 401k contributions (which are all into stock market index funds) will shift the portfolio towards stocks.

Thanks for sharing. I remember making six figures before the oil went down hill and got laid off. Unfortunately when you hit 65, people just don’t want to hire you. I don’t look nor act my age and have years of knowledge to share and it is frustrating when you have to settle for a position paying 65% less than previously. Thankfully I had paid off everything except the house so things haven’t been too bad.

That is tough, but pat yourself on the back for being fiscally responsible and putting yourself in a position to weather the down years. Hang in there!

Congratulations on the promotion good sir!

Reading your history of employment I realized it mirrored my own almost down to a T. I graduated in 2013 with a degree in IT and started making $50,000 a year like yourself. Unlike you though I changed jobs twice and were making the same salary wise.

What your teaching about properly investing and saving for one’s future is something I could have used a few years ago when I first graduated. I probably would’ve prioritized paying down my student loan debt more but mistakes were made and learned from. Now my current focus is on paying down the rest of my student loan debt within the next couple of months then continuing to figure things out from there.

Thanks for your transparency as I’m sure it’s helping many of us learn to follow a better path!

Very similar, indeed. Sounds like you went the “play the field” route, which is an equally effective strategy for scoring raises. Congrats!

Congrats on the promotion! It’s great to see you not shy from discussing salary. You’ve clearly put in the effort to earn that salary and there should be any reason to hide it!

Thanks, Tony. A lot of bloggers do try to hide it for one reason or another, so I’m glad I can keep things open.

Congratulations! I don’t get why people would throw rocks now that you’ve cleared six-figures. Haters gonna hate, I guess. I hope you keep doing what you’re doing.

If I’ve learned one thing, it’s exactly what you said… haters gonna hate, indeed. Just gotta roll with it and surround yourself with people who celebrate success.

Fantastic Money Wiz!!!! I applaud you. My net worth matches your. I make what you do as an RN with overtime but being in Southern California and the taxes I can’t max out my TSP (government 401k) because I wouldn’t be able to pay extra on my mortgage. With the rate I am paying it down I should have it paid off in 3 years, I owe $129k. Was wondering if you can tell me, would it be wise to up my deductions on my W-2, which gives me more take home so I can then max out my TSP, because the amount of TSP that comes out is taken off the taxable income???? I know this would just be a suggestion…if anyone else out there has any suggestions, please let me know. I am as frugal as I can be. I want to retire in 3 years when I have my house paid off. Thanks in advance.

Working towards a paid off house in Southern California is no easy feat, congrats on your progress so far!

As for the tax specific question, that’s not my area of expertise and tough to answer without more info. I’d say find yourself a great CPA and run it by them.

“What do you think?”

>Congrats, look forward to reading about the next promotion. Just the start of good things to come.

NEVER apologise for success.

“Do I make too much to still run a down-to-earth blog about saving and investing money?”

>Yes and no. It’s down to the reader to take the factual information and decide how they’re going to react to it. It’s up to them to decide whether they are the type of people that are encouraged or discouraged by the success of others. As for being down-to-earth, some multimillionaires can be extremely down-to-earth whilst some people who are broke are away with the fairies (the amount of money one earns is not the only factor determining how down-to-earth one is). Does a higher salary move you further away from everyday reality for the average person? Yes, BUT I wouldn’t spend too much time worrying about it. As you said, this blog is about your financial journey. Would you be engaging in hand-wringing about relatability if your salary had gone downy ability I think not.

“Or do you wish more bloggers were honest about their earnings?”

>I like to see the numbers. If someone has a high salary and explains how they got there it increases one’s zone of awareness and show’s what’s possible. Without seeing the numbers nothing makes sense because there is no proper context for what people are doing and how they’re achieving it.

HH

Love your mindset, Hustle Hawk. Like you said, us bloggers can only put ourselves out there and hope to help people. People will react as they do, so there’s no sense worrying about it.

Congratulations on the raise! I’d be curious to know your salary progression as others have stated, and maybe your approach to getting promoted in the workplace. For example, when you put in for the promotion, what case did you make to prove your value to the company? Just curious!

Congrats again. I know I’m still interested and following along even with the higher salary because it’s your mindset and approach to money that’s helpful.

Great to hear! Hope to see you around!

I do like that idea for a post…

Congratulations on the promotion ! That is awesome to hear. Sadly most people don’t want to stay with a job past 2 years but job hop and wonder why they don’t seem to get ahead ! WTG

Job hopping can be a decent strategy for some, but you have to be careful not to wipe out all the work you’ve done building up a reputation for the past few years. Whatever new job you start at, you’ll be starting over at zero as far as future promotions. (Which can be worth it, if the pay raise is high enough.)

All about evaluating where you’re at in the game, and adjusting accordingly.

You da man!

Very much agree with your line “Your salary IS in your control, no matter how many people try to claim otherwise.” Long term it’s so much more sustainable to have more and cut less than to stay at the same salary and cut more. I’d rather make $20 more dollars a year than source free ketchup packets from fast food restaurants when no one’s looking. Now you can eat all the ketchup you want and still retire early!

Financial freedom AND ketchup. Can’t beat that! 😉

Congratulations! I’ve been reading your blog for the last few years now and am so excited about your new earning power! I also have a decent salary but I work in healthcare so climbing the corporate ladder isn’t the same. I have been wondering if I should change my career to something different, but my pay is just almost 100K (and should surpass that soon) and I don’t have to work more than 40 hours per week, don’t have a significant amount of being on call, and I have 5 weeks of vacation a year… so its hard to leave. But I always wonder, what if I can succeed in something else? I look forward to seeing how your new pay increase changes your lifestyle/money goals. Cheers

-Tiffany

Seattle, WA

I’m sure you could succeed in something else, but the million dollar question is do you want to? It sounds like you’ve got a great gig going.

Congrats on the raise! I want to be able to save as much after tax funds like you are doing!! Do you invest all that money or do you leave it in normal savings accounts?

Congrats on the promotions!!! I want to be able to save as much after tax funds like you are!! Do you invest that money or do you leave it in a regular savings account?

Great news and Congratulations on the promotion!! I’m a longtime reader and your transparency (i.e. suitcase stolen in San Fran post) are what make you relatable no matter your level of income. Great choice on picking full disclosure as it certainly took courage. I look forward to hearing about your future promotions…and corresponding raises to ultimately catch up with the investment bankers!

This is incredible! Hard work clearly paying off! Congrats on the new salary. Much deserved.

-Chris

Congratulations on your promotion! Very exciting and I think it’s awesome you continue to be so open! Love reading your posts.

That’s more than I made 6 years out (even accounting for inflation)! Great work!

Right now we’re in a weird financial situation that I never imagined happening… we are debt free including mortgage, maxing out our retirement savings, and making more money than we ever dreamed possible. Earlier this week I lost my (3 month old) apple pencil while out of town for work and I feel guilty for not feeling guilty… I can handle the $138 it costs to replace it no problem. Things have definitely been changing the further we move up the economic/wealth ladder. I remember having less money, but I suspect I will continue to lose touch if things go on like this.

I am frankly embarrassed about the amount of money we make. But also I really really like having a lot more income than we need.

On our blog we only talk in generalities– tax brackets, upper middle class/no longer upper middle class. We also have a lot of obnoxious posts about this new world, and we did a poll and some of our readers definitely (anonymously) feel bad about them, though most do not.

Congratulations on the promotion! Your increase in salary actually makes your blog more relatable to me. I have made over 6 figures since I graduated college with my master’s in 2012. However, my net worth is less than yours at about ~$315k. I did pay off $50k in student loans. So I am quite impressed that you were able to save and invest so much with such a low salary.

Congratulations! You earned it!

Now go out and avoid lifestyle inflation. 🙂

Well said. Lifestyle inflation (or rather avoiding it) is absolutely critical.

The quote from the above post:

“That said, unlike a lot of other personal finance bloggers, I don’t think frugality is the be all, end all metric to life. To pick on a peer… Mr. Money Mustache believes everyone would be happier splitting their own firewood and biking to work every day.”

Frugality isn’t a start. It’s not a metric. It’s the basis of the entire concept of FIRE . I personally define frugality as being able to consistently spend a lot less than your take-home pay. In my mind you need to be able to live comfortably and more importantly, HAPPILY off 50% or less of your take-home pay with the other 50+ % being invested. When you can do that consistently, month after month, year after year, with no feeling of hardship, then you’re onto a winner. For some, that will mean having to earn $250k a year, for others, $40k would be fine.

The reason that Money Wizard’s promotion is cause of celebration is that he is frugal, thus the $10k or $20k increase in his take-home pay is going to widen the gap between the amount he earns and the amount he spends thus reducing the time until he becomes financially independent and is able to retire early.

If however the $10k or $20k increase in his take-home pay was completely nullified by a $10k or $20k increase in his spending, then this blog post would be utterly meaningless and the promotion would do nothing more than give him a bit more responsibility and a bit more kudos amongst a very limited number of people.

Any article or blog post about increasing your income through promotions, multiple jobs, passive income or side gigs is only valuable to the extent to which you can avoid lifestyle inflation.

I’ve read too many posts and articles on the MMM forums over the years that feature things like this:

“Elizabeth White, an international development expert specializing in sub-Saharan Africa, was making $200,000 a year as a consultant when the economic crisis hit in 2008. Her consulting income disappeared, and she turned to a mix of consulting gigs, writing and speaking engagements. Now 65, Ms. White has burned through her retirement savings, but owns her home in Washington with a low-rate mortgage that she is close to paying off. She is holding off on filing for Social Security until she reaches the full retirement age of 66 this year.”

To me that’s borderline tragic and utterly stupid. She was making double what Money Wizard is now making (probably for a long time) and yet she’s basically got nothing to show for it in terms of savings and a comfortable retirement. Let’s not forget folks, there are a lot of people out there who are doing more than fine on the career/earnings front, and yet they’re nothing more than a financial trainwreck. This are the people who triple their salary in 10 years and somehow manage to triple their spending at the same time without ever realising it.

Way to go man, that is awesome and something to be hugely proud of! I have similarly just got a promotion this week after focusing on developing my skills toward that goal. I started on a grad salary of $60k in 2016 and next year expect to make $140k (although water down these numbers a little since I’m in Aus.) I’m still a fair way behind your net worth though so you’re probably on track to hit that FI freedom first!

I really enjoy reading your blog, you clearly put a lot of effort into it – keep up the great work!

Congrats on the promotion! Keep doing you; your honesty and frugality keeps you relatable. We all save and spend in different areas with the same end goal. As for ads and sponsored posts, earn that extra cash! You work hard to provide your audience educational material and entertainment for FREE. You deserve to get adequately paid for your consistent hard work. I will say if you decide to do a sponsored post, please keep it consistent with what you truly believe in. Your readers will take it to heart. Keep hustling! 🙂

Congrats sir! I respect the salary disclosure, it fits the theme of the blog might as well give the full picture (plus when giving net worth and expenses the income missing variable can be reasonably estimated anyway hah). I think colleagues should be more transparent with their pay to ensure fairness exists and people are being paid their worth or even for motivation. Employers don’t want that for a reason.

Well done Wizard! And I like your honesty. It is better to be transparent than not. You show that you have worked hard to earn your raise. That should be relatable and inspiring, not the opposite!

That is awesome, congrats!

I’ve been reading your blog from Australia for over a year now and often share your posts to the Barefoot Investor group here (it’s from an amazing book of the same name). While some things are a bit different here (eg. 401ks) the concept is the same.

You’re making a huge difference to people’s lives, good on you – keep up your fine work, and if I may make one small suggestion: celebrate your payrise with a epic bottle of wine or 3 🙂