It’s that time of year, folks…

That time when the gym gets crowded, cigarette sales take a couple-day sales hit, and that guy who hasn’t so much as picked up a book in three years starts imagining what life will be like when he can woo the women off their feet with his newly fluent French language skills.

Yes, we’re talking New Year’s resolutions.

And I’m all for them. In fact, I’m such a fanboy of the tradition that I’ve publicly posted mine on this blog for the past two years straight. (2019 resolutions here, 2018 here.) My success has been hit or miss, to put it kindly, so at least me and the aspiring French-speaking Rico Suave have that in common…

In fact, I had an astounding 40% failure rate on my 2018 resolutions, so I don’t have very big shoes to fill when it comes to passing this year’s test.

Alright, enough intro. Time for me to look into a year-long mirror. Wish me luck!

Checking up on last year’s resolutions – huge success or glorious failure?

In case you forgot since I mentioned it a few sentences ago, to kick off last year, I shared 8 New Year’s Resolutions of varying difficulty. Those resolutions were…

1. Spend less than $27,000 during the year – fail.

Rewind a bit. In 2018, I went a little hog-wild with the budget and accidentally spent $33,893. Upon closer analysis, the real culprit was over $6,000 worth of kitchen-remodeling, so I figured that I’d have this resolution in the bag during 2019.

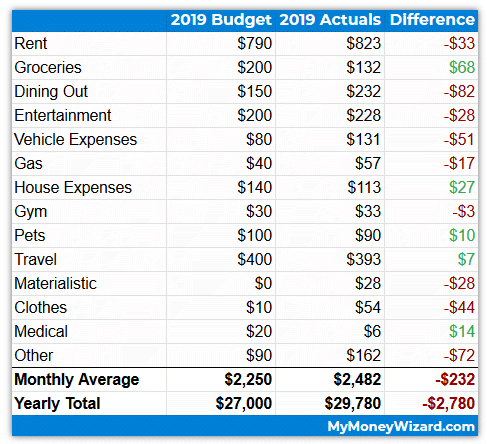

I slapped together a budget of $2,250 a month and mentally prepared to avoid any major home remodeling project. I felt like I could taste the success already.

Aaaand then I blew budget by a couple grand.

Here’s how it shook out, from a monthly average:

If you’re still curious, you can read all about it in my 2019 spending report.

2. Save over $40,000 (including employer matching) – success!

Despite spending a little more than expected, I still managed to hit this goal, thanks to over $29,000 of after-tax savings plus over $10,000 of 401k contributions/employer matching.

3. Grow My Money Wizard by 50% – fail.

After 81% growth in MyMoneyWizard.com readership in 2018, traffic growth in 2019 dropped slightly to about 20% year-over-year.

Obviously, that’s a little short of my 50% goal, but I’m not too bummed out about this one.

The site continues to grow and continues to surpass my wildest expectations. For the first time ever, we even topped a pretty epic milestone – 1 million yearly visitors!

How can I possibly be disappointed with a mind-blowing number like that?

And to be fair, I definitely dialed back the time spent on the blog this year. I reduced the posting frequency to a much more sustainable long-term goal of 1 epic post per week. (In previous years, I was churning out a ferocious pace of 2-3 lengthy posts per week. It didn’t take long before I did the math and realized that writing a 15-page college essay every 7 days was a one-way ticket to Burnout Town.)

To some extent, I also fell victim to the dreaded Shiny Object Sydrome – the idea that something better is just around the corner, even when something already fantastic is sitting right under your nose.

For example, I devoted an entire month of free time to a side business that never took off. I also spent at least 100 hours on two separate website ideas before sputtering out and losing steam, before I ever saw any results. Two of those projects I’m officially declaring dead; the third has still has potential, so we’ll see where that goes.

Plus, in 2019 I definitely devoted more of my free time towards my career. Extra hours that had previously gone towards building this site were instead spent working towards a promotion. The shift paid off with a promotion in November, but I really do hope to be able to focus more on the blog in 2020.

4. Read 15 books in 2019 – success!

In 2018, I was really disappointed to fall off the reading bandwagon and only muster 9 books all year.

In 2019, I’m proud to say I stuck with this goal and read 17 books.

Stay tuned for a post detailing my biggest takeaways from all those books.

5. No phone on the nightstand – HUGE FAIL.

Crazy… this resolution sounded like the easiest and ended up being the hardest. Those phones are addicting!

I really enjoy winding down at night by mindlessly swiping and surfing through my phone. Unfortunately, this seems to always spiral out of control, and I inevitably spend hours doing who-knows-what until late in the morning. It’s negatively impacting my sleep and sabotaging my reading goals, so I’ll be rolling over this resolution to 2020.

6. Stay consistent with weekend meal plans and gym plans. – success!

I think this one was helped along because I had a partner on this goal. Lady Money Wizard and I consistently spent Sundays or Mondays planning out what we’d be eating and when we’d be working out. Because of this, I’m proud to say that I feel like I’m in my best shape since college.

7. Max out my Roth IRA before the year is over – success!

I invested $1,000 a month for the first few months of the year, until all $6,000 of my Roth was fully invested by mid-year. Sure, I missed a month or two, but I eventually got there. And it’s a whole lot better than my procrastination from years prior.

8. One interesting date with Lady Money Wizard per month – success!

I could have done a better job tracking this, but we definitely did some interesting stuff last year. Between cabin staycations, all-you-can-drink beer fests, cooking classes, and even flying through the air on circus-like trapezes, I’m happy that even though we’re on track to be married, we’re doing a great job avoiding turning into the dreaded boring married couple.

Final Resolution Score: 5 out of 8… not horrible!

So there you have it:

- 1 huge fail

- 1 not-really-a-fail

- 1 legitimate fail

- and 5 successes!

For a total success rate of 63% in 2019. A percentage that is… the exact same as 2018! Haha!

I will give myself credit for actually checking in on my goals this year. At times, I literally opened up last year’s posts, and I was often shocked to realize I’d completely forgotten about certain goals. A swift kick in the pants and a stern self-pep-talk later, and I was back on track.

Without Further Ado – My 9 Resolutions in 2020

Now, the fun part of the post – the part full of hopes, dreams, and aspirations.

In the past, these resolutions have been mostly financial. But as I get older, and dare I say wiser, I’m trying to take a more balanced approach to life.

So this year, I’ll focus on making resolutions in life’s big three categories:

- Financial

- Health and Habits

- Relationships

And not necessarily in that order.

Financial Resolutions:

1. Save approximately $55,000, including employer matching. (For a total savings rate over 60%.)

In a shift from last year, I’m putting the total savings number & percentage first, rather then the usual spending target. That shift is sort of symbolic of my outlook on 2020.

In the past, I’ve been focused on spending as little as possible. But in 2020, I’m actually loosening up the frugality for the first time in 7 years. The focus will be on stuff that buys time, improves health, or creates a memorable experience.

The key will lie in still saving more money than ever before. I’ll also need to keep the savings rate in check and stay focused on the long-term goal: financial freedom.

To get specific, I’m shooting for a total savings target of nearly $55,000, which includes:

- $19,500 maxed out into my 401k

- $7,000 of employer 401k matching

- $6,000 maxed out into my Roth IRA

- $22,000+ of after tax savings into index funds

2. Spend less than $3,000 a month. ($36,000 of spending in 2020)

If I fail this target, you’ll know I’ve really flown off the rails. This is a full $550 more than my average monthly spending last year.

But I am trying to strategically spend more money, after all. So we’ll see how this experiment goes.

See also: Will spending an extra $500 a month actually improve my life? How I’m building my 2020 budget.

Health and Habits Resolutions:

3. No phone on the night stand.

Aka, sleep more.

Thanks to my nighttime phone addiction, I’m guessing I only slept an average of 5-7 hours per night last year. That’s just stupid, and bad for my health, too.

If Jeff Bezos can find the time to sleep a consistent 8 hours every night while running Amazon.com, a chump like me has no excuse.

Last year, I was shocked how hard this habit was to break, so I may have to resort to desperate measures. Arnold Schwarzenegger says he keeps his bedroom electronics free, so I might have to terminate the cell phone from mine.

If I have to, I’ll buy an old fashioned alarm clock and charge the phone elsewhere.

4. Keep a consistent workout log.

I’ll stop short of the generic “work out more” and instead revert to the tried and method for improving anything: keep a journal.

I always tout the benefits of tracking your spending, which is why I shouldn’t have been surprised when my new running coach immediately set up a workout journal for me. (Her method was a day-by-day google spreadsheet, which I’m finding is working really well.)

5. Keep a daily time journal.

I developed this idea when I was struggling with procrastination, and the results absolutely amazed me.

When I actually do it, the process works like this:

Anywhere from 1-3 times per workday, I make sure to pause and reflect back on how I’ve used the past few hours. Then, I write down what I spent my time doing.

It doesn’t have to be too obsessive – hour or half-hour increments is fine.

It turns out, looking back on a day filled with “10:00-10:30 AM – chatted with coworkers. 10:30-11:00 AM – surfed the internet” is extremely hard to face. And much like tracking your spending, simply knowing you’re recording things makes you more mindful of them.

And by “more mindful” I mean you’ll be cranking out your to-do list like a CEO boss. Seriously, this strategy turned me into an efficiency machine.

And since time is even more valuable than money, this seems like a no-brainer.

6. Read 24 books in 2020.

Last year, I read 16 books through August. By December, I’d read 17.

Safe to say, I fell off the wagon a bit…

(For the record, I blame the nightly cell phone here too.)

In 2020 I hope to keep up the pace of 2 books per month.

To do so, I’m enlisting some help.

Last year, I took advantage of free audiobooks through the local library. Unfortunately, I was bumming off a friend’s account, so I had some weird limits on the number of books I could read, and several books took months to become available.

This year, I’ll keep with the usual paperbacks, supplement with the library’s audiobooks, and I may even splurge on Amazon’s audible.

7. Eat more salads

Throughout my life, I’ve mostly been a hardcore carnivore. When there’s a plate or menu in front of me, I’ve usually avoided the greens at all costs.

In 2019, I’m proud that I definitely stepped up my veggie game. Lady Money Wizard and I started sneaking salads into our regular meal planning. At restaurants, I’d sometimes pass up on those delicious looking pasta dishes and grab a salad instead.

And the craziest part? I seemed to develop a taste for vegetables! At times, I experienced something I long thought was impossible: a craving for a salad.

I hope to build on this in 2020. Since good resolutions are specific, I’ll quantify this goal. In 2020, I’ll try to bring or buy a salad on 50% of my workdays.

Wish me luck!

Relationship Resolutions:

8. Find more like-minded people

Not surprisingly, secretly running a blog about leaving the workforce 30 years earlier than the average person can make you feel a little secluded.

Next year, I’d like to find some more like-minded people. I’m actually not sure about my action plan for this one, which probably isn’t a great start. I’m also a little leery of the potential time commitment.

But nonetheless, I’d like to reach out some of my fellow bloggers/financial freedom seekers and see where it goes. Who knows, maybe this means a ticket to FinCon 2020?

9. Get happily married.

In 2019, I got happily engaged. In 2020, I’d like to take things to the next level. 🙂

Building Your 2020 Resolutions

Hope you’ve got some exciting resolutions in place for the new decade. Don’t forget about wealth, health, and life!

Remember, according to the resolution experts (who knew there was such a thing??) you want those resolutions to be:

- Specific

- Public

- Ambitious but attainable

- Written down

Good luck!

Related articles:

Awesome resolutions Money Wiz! Congratulations on hitting more than last year, I really resonate with lthe time blocking and no phone on the night stand ones. If you’re looking to kill a couple birds with one stone, I think you could hit the workout journal and the time blocking pretty easily with the Full Focus Planner from Michael Hyatt. I’ve been using it for a couple years and it’s got a solid combo of Quarterly, weekly, and daily time and goal tracking. Finally, I want to say thank you. Your posts showing up in my inbox every Monday finally inspired me to launch by blog and commit to writing a post a week. So far mostly so good. If you’ve written it down somewhere, I’d be interested to hear how you stay on track to produce at least one post per week.

Nice work on your resolutions! So many people make resolutions but don’t have a post mortem on what worked and what didn’t.

I’ll have to steal the fun dates idea for 2020.

Thanks for an interesting read!

5 out of 8 is better than I did! Although all I did as far as make resolutions for 2019 was comment on your post last year lol. Probably would’ve made more progress had I made a note of my goals somewhere that’d be in front of me more often.

Here’s what I commented last year:

1. Grow my eBay store inventory to 1,000 listings. Currently at 380. – Fail (ended year with 536 listings). Although I did end up making a net profit of $10,000 flipping things last year, so I’m happy with that.

2. Reach 25,000 sessions a month on my website. – Success. Hit this one month, but haven’t done it again. I have at least stayed consistent with my blog though and closing in on year 2 so I’ve at least made it past the average life span of a blog lol.

3. Read 12 books. – Epic fail. Read less than 5 books. Need to get more disciplined with reading.

4. Get down to 150lbs and stay there. – Fail. I’m inching my way towards this though. Started Brazilian Jiu Jitsu in June and have burned some body fat and built some muscle.

5. Increase my net worth by $25,000 (almost at $100,000) – Success! Our net worth increased quite nicely by saving over $1,000 a month in my 401k as well as earning extra income through side hustles. Also didn’t hurt that the stock market kept going up and up.

For 2020, I just want to get my life as organized and focused as possible as we’re expecting our first baby in June. I’ll count it a success if my eBay business continues to grow, my blog stays steady or grows, and our net worth continues to go up.

Thanks for the post! Since you’re getting married soon, can you post your thoughts on prenups and if you’d consider getting one?

Congrats on the blog! I’m also trying to meet more financially focused people so it would be great to connect. I am writing a blog (nowhere near as good as yours yet) at http://www.investwithebele.com so feel free to have a read.