Hey fellow Money Wizards!

It’s time! Time to see how I did on my progress towards nearly $1 million and an early retirement by age 37 35. I recently turned 29, so let’s check in on the progress so far!

Life Update: April 2019

Looking back, April was a pretty low-key month. No major headlines, no travel.

So, what did I do without the glitz and glamour of any trips?

Well, mostly, I enjoyed the simpler stuff around town.

Lady Money Wizard and I dusted off the bicycles, and we started enjoying the beautiful Spring weather here in the Twin Cities. Me and The Money Pup took a few extra walks, which also coincided nicely with our newfound blue skies.

On one such walk, we spotted our daily dose of “awwww!” when this police puppy was learning the ropes in his little police vest.

I watched him work his way through the field, alternating between seriously sniffing the ground like a good police dog in training, and clumsily pouncing through the grass with an undeniable puppy’s enthusiasm.

Eventually though, he decided he’d had enough of the working lifestyle, and would rather just get bellies:

I can relate.

Elsewhere in the month, Lady Money Wizard and I resorted to a lot more dinner and drink dates. One of those dates was definitely an interesting one – we bought tickets to the World’s Largest Bloody Mary Bar!

I was skeptical of the claim at first. But once I got there, I’d never seen anything like it.

This thing was 100+ feet of vegetables, cheeses, meats, and yes, even hamburgers… all to skewer on top of your meal in a glass.

To say we enjoyed ourselves would be an understatement. Probably not as good for the health as a bit of travel would have been… but at least all the drinks and ubers were still cheaper than airfare and hotel rooms!

All that said, there was one kind-of-glamorous splurge to the month. At the beginning of April, March Madness college basketball was coming to a close, and to the shock of the world, The Money Wizard’s Alma-Mater (Texas Tech) somehow made it to the College Basketball National Championship!

AND… that championship, by pure dumb luck, was being held in Minneapolis!

At this point, I knew my hands were tied. Within a few minutes of learning about Texas Tech’s surprise moment in the national spotlight, I had my $150 nosebleed seats in hand.

I’ve gotta say, it was pretty surreal to walk into the former home of the NFL Superbowl, over one thousand miles away from my college town, and see my school’s colors projected on the jumbotron.

Ultimately, they lost, which was a real bummer. But it was still a great time. Seeing your team play for the national championship… in person… in your city… could be a once in a lifetime experience. I’m proud of the showing either way.

Net Worth Update: April 2019

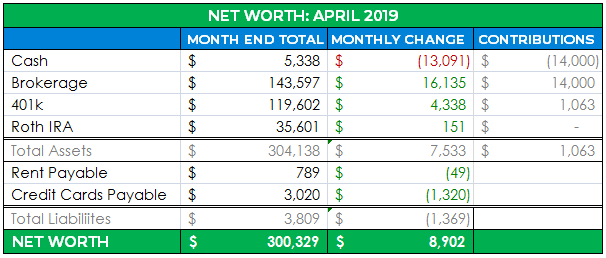

And the details:

$300K! Just barely!

A cool little milestone. Let’s just hope it holds up.

Cash: $5,388 ($13,091)

We’ve got movement, people.

Earlier this year, when I looked at the best ways to invest your cash in 2019, I decided that money market accounts were the way to go. I also decided that since Vanguard charges zero fees for purchasing and selling their funds, that it makes perfect sense to funnel all my extra cash into Vanguard’s money market index funds. (At least temporarily.)

So you can probably imagine my surprise when I blinked, realized the end of April was approaching, and then realized I still had not once made good on my strategy.

So, towards the end of the month, I moved $14,000 from my checking account to Vanguard’s Federal Money Market Index Fund. With a current interest rate of 2.3%, I should make an extra $330 per year from this move alone, at least when compared to letting that cash sit in a checking account.

Not nearly as good as the stock market, but not bad while I build up a potential rental property downpayment or otherwise consider my next move.

Brokerage: $143,597 (+$16,135)

Most of the $16,000 increase is due to the previously mentioned $14,000 cash transfer.

After the cash contribution, my brokerage allocation now sits at:

- 68% Vanguard Large Cap Index Funds (65% is the VTSAX fund and 35% is Vanguard’s VUG and VTV etfs.)

- 15% Individual Stocks back from the when I was young and dumb and thought I could beat the market

- 10% Vanguard Federal Money Market Fund

- 7% Bond Index Funds (2/3 in Vanguard’s VBTLX fund and 1/3 in Vanguard’s BSV etf)

Still might not be my perfect allocation, but I like to say – imperfect investing is better than no investing.

401(k): $119,602 (+$4,338)

$1,000 of automatic contributions including employer matching, plus $3K of market fluctuations.

I still need to do some balancing to get this exposure more in line with my desired allocation.

Roth IRA: $35,601 (+$151)

A little bit of shuffling here. You might remember that I maxed out my Roth IRA earlier this year. At the time, I put all $6,000 into Vanguard’s federal money market index, then planned on converting $1,000 a month to Vanguard’s REIT index.

Last month, I forgot to do that conversion. So this month, I converted $2,000 from VMFXX to VGSLX.

Rent Payable: $789 ($59)

The first housing payment below $800 since the start of winter! A good sign for the local weather.

For the newer readers, I live in Minneapolis in a house with my girlfriend. This cost represents my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.)

Credit Cards Payable: $3,020 ($1,320)

Always an inaccurate total due to the timing of billing cycles and the presence of reimbursable work expenses. As usual, let’s look at the spending report for better info:

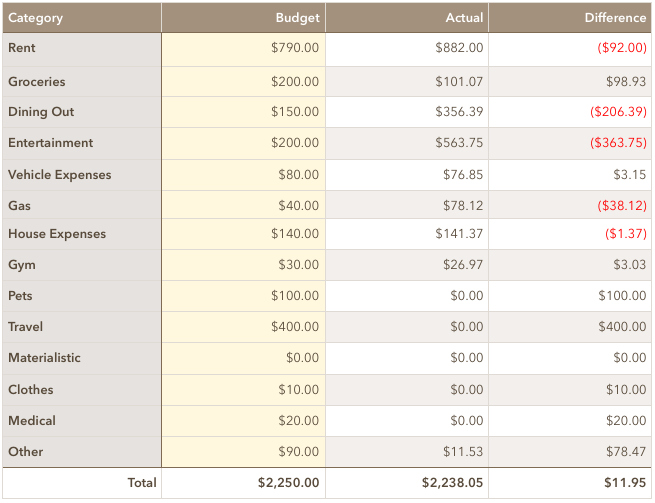

Total April Spending: $2,238

My new year’s resolution was to spend less than $2,250 a month. So far, I’m 2 for 4 on meeting that goal through April.

Groceries: $101

Dug into the freezer leftovers quite a bit this month, which helped keep costs down.

There’s also a darker factor contributing to this low total, and it’s this next category:

Dining Out: $356

Yikes! We definitely dined out quite a bit this month, so I’m actually not surprised. Which is kind of embarrassing to say when looking at a $350 bill…

Entertainment: $564

The even bigger one this month. Major items here included $50 to watch the Final Four game at a local sports bar, $300 for two National Championship tickets, $60 for tickets to the World’s Largest Bloody Mary Bar, and nearly $100 in cocktail bar/brewery trips! 😬

House Expenses: $140

Of which, about $130 from my most controversial expense – a maid.

How was your April?

My April certainly wasn’t perfect. Then again, it’s not necessary about perfection, just progress.

I hope you’re meeting your goals! Don’t give up on those 2019 resolutions just yet!

PS – If you haven’t jumped on the bandwagon yet, I’m still obsessed with Personal Capital. Personal Capital will automatically track your spending, double check your portfolio allocation, and add up your entire net worth in one place.

Related Reading:

Thanks for being so transparent with your finances. Question: Is your credit card payment debt repayment or a paid in full balance on monthly spending?

Paid in full balance on monthly spending.

I should probably clarify that in the updates. I ALWAYS pay the full statement balance completely. If I had true credit card debt, I’d be selling every single investment you see on this update to pay it off ASAP. Earning 3-7% on investments does no good if you’re paying 15-20% on purchases.

I think this concept is EXTREMELY important for most people. Paying off high interest credit card debt is a GUARANTEED double digit return on your money!

I use a 1.5% cash back CC along with a Amazon CC for purchases there with a better cash back. My wife and I have not had a CC balance in 10 years or more either.

The question I have for you is what’s your favorite CC for cash back or rewards?

Keep up the good work man, this month i’m down 2k net because i had to pay my income taxes, next few months should be a rocket ship for me might even be able to catch up to you, not that it’s a race.

Nothing wrong with a little friendly competition!

Great update, and amazing idea for money market move. Anyway you can send a link to download the net worth calculator?

Personal Capital (affiliate link) will calculate it for you. Or do you mean my spreadsheet?

If you’re in a high tax bracket, consider the Vanguard Municipal Money Market Fund for the taxable accounts. For those in top brackets, the tax-equivalent yield currently tops the yields in the taxable money market funds. Good strategy though generally. I keep all of our “excess” cash in Vanguard’s money market fund. Too bad they just did away with the Advantage account though. I now use Fidelity for our cash management account for spending monies (in lieu of a deposit account at a bank). No FDIC insurance but far superior yields and you can use it like a checking account (and get full rebates of all ATM charges).

Interesting observation.

I just did some quick math… am I correct in assuming you’re better with VMSXX over VMFXX as long as you’re in the 22% bracket or higher? Since interest income is taxed at your ordinary rate, VMFXX’s 2.36% current yield would essentially be 1.84% after 22% marginal taxes? In that case, VMSXX’s 2.02% tax free certainly wins.

Anything I’m overlooking? I’ll read into this further, but thanks for the tip!!

I’m not sure at which bracket you reach the breakeven, but I wouldn’t be surprised at it being 22%. Both fortunately and unfortunately, we’re usually in the top bracket, so we’re usually well over the breakeven on taxable v. tax-exempt funds (with similar characteristics). Having said that, you do need to look each time you may invest, as some similar taxable v. tax-exempt funds have different breakevens. I usually do the breakeven calc at https://www.calcxml.com/do/inc11.

At the risk of sounding lazy and ignorant, what is the value of tracking net worth? For example, if you see it decline, or increase, do you have a hierarchy of actions to take?

Not a bad question at all. This is actually a post I want to write.

Net worth can easily turn into a vanity metric without any real value. So for me, the true value comes in measuring the progress towards a goal. It’s a weird situation because, like you hinted, certain declines or increases are out of my control. But I also find that motivating on both ends. If there’s a good month in the market, I get to see the snowball effect of compound interest first hand. If it’s a bad month, then I feel a little extra motivation to save more and build up the underlying asset base.

Underneath it all is that I’ve decided that around $600-750K of investments is enough of a safety net that I could do whatever I wanted for the rest of my life. So I like to track to see how close I’m getting to that freedom.

Spellchecker.. Damn autocorrect.. Police.. Not policy pup, I think!

😁😜

haha, good catch! Fixed, thanks.

Congratulations! That is a remarkable achievement, especially for someone “doing it on their own” and not handed a silver spoon.

Thanks Scott!

With a retirement age of 35 and assets of almost a million are you worried about the costs of healthcare? Any special health care program that you will join? My husband maxes out his 401k and the over 50 catch up of 6000. Would you recommend IRA also? I have one through Vanguard VTI And VOO started late but trying to max out everything as only 14 more years until mandatory retirement. Wish started earlier but a million for age 35 is enough for you. Most investment companies now recommend 2.5 million. I think if we have anything extra will invest in more Vanguard. Congratulations you are almost half way there of it 750K

Typically, most early retirees get on ACA coverage, but I haven’t kept up with all the recent changes. It’s something I’ll research as I get closer.

I have issue with the $2.5 million claim. I talk about it here. IMO, your retirement number should be based on your spending. Random numbers quoted by the investment company might be a good starting point, but just seem too vague to be taken seriously.

Thanks for the comment! Keep maxing out those retirement accounts! 14 years is plenty to build up an awesome stash.

Thank you for all your suggestions.

That’s a solid month, always great to see the first digit increase to the next level! So awesome that you got to see the Final Four and your school was in it. That’s indeed a once in a lifetime scenario and you should have no shame in splurging for the tickets. I’m a big college basketball fan and I have yet to go to the Final Four. It’s on my bucket list (along with my school making it!). Maybe next year 😉

There’s always next year!

Thanks Brian.

Bloody Mary used to be my cocktail of choice, but I never had one which looked like the one in your photo!

Was wondering about the big spike in the Personal Capital number, made more sense when I saw it was cash from the checking account being deployed.

On your budget, what’s the reason for including a ‘materialistic’ entry with a zero value. Is it to remind yourself not to spend in that category of is it in case you decide to allocate some budget to those purchases in future?

More good progress. 😀

HH

Thanks Hustle Hawk.

Yeah, I’m not sure what happened with that Personal Capital spike. It looks like my net worth increased $14,000 when I purchased the money market fund, then dropped $14,000 a few days later when the money cleared my checking out. Seems like some kind of temporary double accounting by the program.

The materialistic entry is just so I have a place to categorize. I’d rather spend my money on non-materialistic stuff, but if I do blow some cash on a TV or something, I like to be able to track that.

I am curious as to what your thoughts are on taking a loan and investing it in index funds.

For example I generally invest about $10k per year into my index fund.

My bank regularly offers me loans of $20k with a fixed APR of 3.4% over 2 years making a total repayable amount of just under $20.700.

Assuming I was starting from zero, If i invested this $20k and was making 6% in compound interest over the 2 years I would have approx $22.500. However, if I invested the same $20k in monthly instalments with the same rate of return I would have $21.300.

Even taking account of the $700 paid in interest I would still be approx $500 better off.

Would you see this as a risk worth taking? Or perhaps there is a max APR rate that this would make sense for? Or am I completely missing something here?

Many Thanks

WAY too risky. For any given year, there’s around a 30% chance the market returns negative. If you’re leveraged up during an extended downturn you can get destroyed. An extra $500 isn’t even close to enough to compensate for how much extra risk you’re taking on.

Congrats on the big milestone!! Let’s hope it stays above that in the short term! I’ve got most of my cash in an Ally savings account that yields 2.2% so I’m not giving up too much by not transferring that to a money market account, it’s definitely better than any checking account can do. Sometimes the low key months can be the best ones!

How much in savings are you bringing in monthly, from your paycheck? (not including 401k contributions)

Congratulations on your 300k! Big milestone.

I am soon at 200k, so hopefully the market will continue the good ride for the rest of the year 😀

Keep up the good work!

I’ve been wondering, why Money Market index fund, if one can get a savings account with a “guaranteed” rate of about 2.20% these days (and money is insured by law). The same question actually applies to investing in bonds that are supposed to be stable, but are not guaranteed and seem to have barely better results than a savings account. Am I missing something here? Thank you!

Nothing wrong with high yield savings accounts. I talk about the pros and cons of each in this post:

https://mymoneywizard.com/where-to-invest-cash/