Welcome to another monthly net worth update!

Every month I track my progress to my goal of about $1 million in net worth, which I’m hoping will allow me to take an early retirement from my white collar office job. I’m currently 31 and hoping to retire within the next 4 years. (We’re getting close!!!) Read on for the latest progress!

*As always, I am not an expert or financial advisor, so nothing on this site should be considered financial advice. These are just like, my opinions, man. Always do you own research, and always abide by The Dude.

Life Update: April 2021

April was the month of travel.

I can’t believe I’m typing that!

All vacc’ed up, we strapped on the N95s and got to flying. For the first time in over a year!

Gotta say, it’s always surreal to experience something you’ve done a thousand times for the first time again. You start to appreciate so many small things you used to take for granted.

For me, that was mostly the hype and anticipation of an upcoming trip. It was weird to actually have travel to look forward to again! And then even weirder to have pictures to look through of somewhere that isn’t my home office.

So with that… I think we can just close out this section with some of my photography from Death Valley National Park (and also, Alabama Hills, just a few hours outside the park limits.) Both places were truly underrated and otherworldly parts of this crazy country of ours.

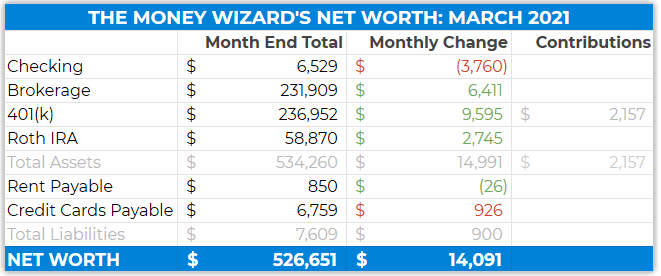

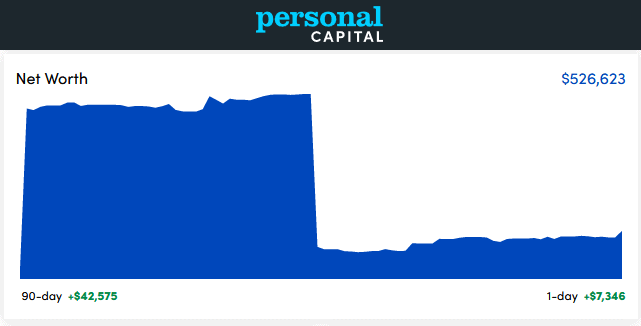

Net Worth Update: April 2021

Don’ fret! That cliff of a chart is actually just a weird glitch between Vanguard and Personal Capital a few months ago. (Thankfully, I did NOT lose $100,000 in a day, like that wall of doom would have you believe!)

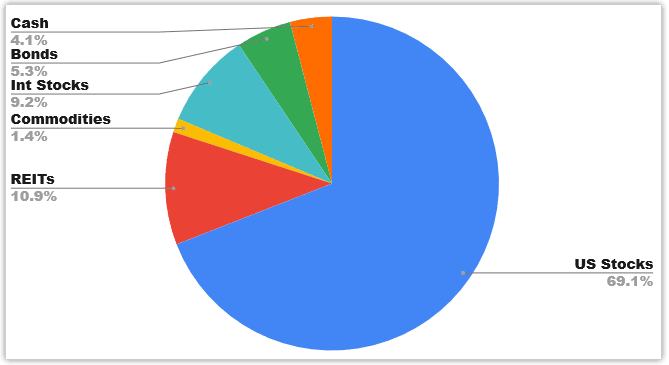

And the latest portfolio allocation:

At the request of readers, I’m still considering adding my crypto exposure to this pie chart. That hard-to-ignore investment has rallied its way to about 10% of my net worth, but I’m not sure about the safety of discussing it publicly. (Don’t want to get hacked!)

Checking: $6,529 ($3,760)

Checking account is way down this month, mostly from the sting of paying a big fat tax bill. Plus another $2,000 invested into the brokerage account.

Brokerage: $231,909 (+$6,411)

I think my chart up there is wrong – I did actually make a $2,000 contribution to the brokerage to increase my commodities exposure (Gold).

For newer readers, the brokerage account is mostly just general stock market index funds, like VTSAX. (If you’re ambitious or craving particulars, you can rummage through previous net worth updates where I provided exact numbers.)

401(k): $236,952 (+$9,595)

Between my paycheck contributions and employer matching, I’m still contributing a hefty $2,200 per month to the 401k.

My contributions are still invested like so:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

With my total portfolio’s international exposure dropping below 10%, I plan on changing my future contributions to be a higher percentage of the international stock market index fund.

Plus, if Elon Musk succeeds in using satellites to get the whole world 5G internet, that’s gotta be good for the stock market of developing countries, right??

Roth IRA: $58,870 (+$2,745)

Just more market movement here, since I maxed out the Roth in January.

The Roth is still about 75% VGSLX and 25% VTIAX.

PS – here’s why I like VTIAX more than VFWAX.

Rent Payable: $850 ($26)

Actually a little disappointing here – our utilities savings from spending $5K to insulate our whole house look to be less than expected. Sad. But at least the house is more comfortable!

Credit Cards Payable: $6,759 (+$926)

Now this is just infuriating.

There was a glitch in my credit card’s auto payment which had me paying double on my credit card statements some months. The bank promised they took care of it, but then this month my auto pay didn’t even go through, and I got hit with a late charge + interest fee.

I’m currently gearing up for battle to get that resolved, with all fees reversed.

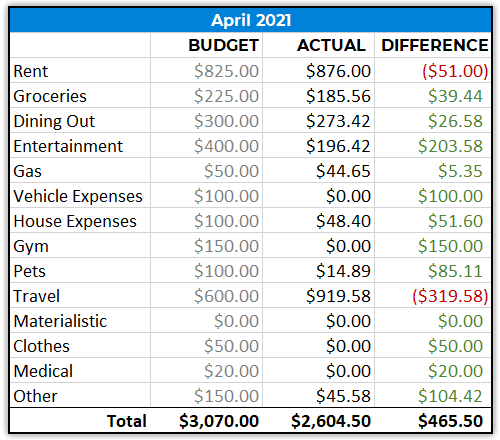

Total April Spending: $2,605

Pretty usual spending this month, with two exceptions…

Travel: $919

Looks like a big bill, but not bad compared to most travel options. National Parks are once again a pretty frugal win!

Entertainment: $196

A few hang outs with friends. Could things actually be going back to normal!?

How was your April?

Both financially and not…? financially.

I always appreciate hearing from you all!

-Sean aka The Money Wizard

PS – Want to track your net worth like this? Here’s my favorite tool to do so.

Related articles:

You don’t have untility bills??

I do – they’re included in my monthly rent. Lady Money Wizard and I split them along with the mortgage

Hey Money Wizard,

I look forward to reading your post each month. Do you think you could add a chart from when you started this blog to current day showing your net worth along with the 90 day chart? I’d love to see the total journey, it’s quite impressive.

Thank you,

Ed

Cool idea!

You’ll probably like my year by year breakdown to $500,000. I include a full graph there:

https://mymoneywizard.com/saving-500000-dollars-age-30/

Cool you got to travel again. I’m thinking about traveling to Hawaii in June once I’m fully vaccinated. But I’m not feeling very motivated.

We are at is, the more things open up at home, unless there is of a need to travel.

Let’s hope the bull market continues! But I’m taking down risk all the same.

Sam

Hawaii sounds great! But you’re right… it’s pretty fun to just to re-explore your own city as it opens back up.

How do you plan on taking down risk?

Beautiful pictures from your travels! It feels like we’re finally turning a corner with the pandemic (at least in the US) and we’ll hopefully see a lot more traveling from everyone soon.

Another great month! Do you take pictures on your phone or a camera?

Both. I have an old Canon DSLR (Rebel T2i) that I use mostly when traveling. Most of the Death Valley photos are shot with that, although sometimes I use my iPhone 11 Pro if Lady Money Wizard is using the camera. (The first picture in this post was iPhone, the rest are DSLR.)

Beautiful pics! I admire your bravery going into crypto, google makes me regularly I need to change my passwords, so putting any amount of money into crypto makes me nervous, I think I’ll just stick to (your) original game plan to get to an early retirement!

Thanks!

Honestly, crypto sounds a lot harder and scarier than it is. No shame in sticking with a plan though!

(Sorry if you covered this in another article) You said you had a hefty tax bill- does that mean you opt out of paying tax from your paychecks and instead pay it come tax day?

Sounds like another all time high month, Sean. What if you hit all time highs for every month till the end of the year?!

Good thing you’re traveling. I’m slowly warming up to the idea too. Don’t want to stay cooped up…

Auto payments credit card/ bank – i do not trust them anymore. So, on the last Sunday every month i do

the payments manually – trust me it’s no hassle compared to getting the bank/credit card companies to admit that THEY faffed the payments up. You will NEVER get them to admit it’s their fault. Also – paying

the old fashioned way you get to keep an eye on the ball, which stops “payment creep”.

Awesome progress Money Wiz! +1 for voting you include your crypto as part of the pie chart without giving details on specific investments or exchanges.

You may have already done this, but as a long time Personal Capital user I’ve had a handful of giant jumps in my networth chart. If you reach out to them with the dates and impacted accounts, they can typically fix the spike or drop in a week or two to clean up your view.

I’ll second Jeff’s vote for crypto! If you weren’t aware, Personal Capital recently added a Cryptocurrency (Beta) feature. Rather than connecting to an account, you manually enter the quantity of each token. The volatility is interesting to watch, as compared to the steady uptick of traditional accounts. Also, if you’re concerned about being hacked, you might look into a hardware wallet. It’s how I store my bitcoin and various altcoins and I have been very happy with it.

When you increase your commodities exposure do you buy physical (such as gold) or do you just trade on it?

Great post!

I’m also in an uninsulated house in a cold climate and still curious to know what type of insulation and method you used to insulate, even if it didn’t fully reduce your bills?

Thanks!

Aron

Hey Aron, we went with blown cellulose. Not as perfect as foam, but also a fraction of the price and supposedly the 80/20 of insulation. (Gets you 80% of the way there for about 20% of the cost…)

Thanks for the details! I don’t think cellulose or foam are options for us. We are considering “air-krete” but it’s remarkably undocumented except by the sales people…

I don’t fully understand how you providing a crypto wallet balance puts you at risk of hacking – can you explain? I don’t remember if you have shared this, but if you don’t indicate where you are holding your assets or even what assets you are holding, I suspect your risk will be even lower.

One solution would be to include a percentage on the pie chart and round off the balance a bit (perhaps to the nearest $10K). It’s clear that your balance “approaching 10%” puts you in the $45K-$50K range anyway!

Thanks for sharing this. It’s always fascinating to see a window into someone else’s finances.

I know REITs are pretty highly correlated with the stock market in a crash. I wonder if it would be worth it to buy actual real estate or do an alternative investment like fundrise instead.

Beautiful pictures.