Money Wizards,

Welcome to another Net Worth Update. And not just any Net Worth Update. A year end update!

Every month, I track and share my progress towards growing my investments towards roughly $1 million.

The end goal? Financial freedom by age 35. I’m currently 29 with a few hundred thousand to go, so let’s close out the year and check out the progress.

Life Update: December 2019

What’s there to talk about during December, besides the most wonderful time of the year?

The Christmas festivities ramped up on all fronts. We strung up our Christmas lights, and The Money Pup put on his Christmas best to go meet Santa at a local brewery:

Eventually, I flew to Texas for an early Christmas with my family, where I spent an amazing week catching up with relatives before heading back to Minnesota for Christmas with Lady Money Wizard’s family.

For some reason, the sentiment of this holiday season hit especially hard. I spent a lot of time thinking about how lucky I was to be where I was, and I spent even more time making sure to appreciate the good times while they were here.

I feel like the personal finance community in particular can get especially caught up in permanently delaying gratification. Taken to the extreme, it’s easy to fall into the mindset trap that “Once I hit X number of dollars, THEN I’ll be able to really enjoy life.”

I’m as guilty of it as anyone. Heading into the New Year, I’m doing my best to remind myself to appreciate how good I’ve got it.

I wish there was a way to know you’re in the good old days before you’ve actually left them.” -Andy Bernard, The Office

With that out of the way, it is the end of the year! Which means I’ll keep this intro light, and we’ll instead take a bit more time reflecting on what you came here for. You know, those financial details, like portfolio allocations and investment plans, which can actually make us all richer.

So, let’s take a look!

(In the coming weeks, I’ll have a whole post or two reviewing my year’s spending, my successes and failures, and my goals for next year. Consider this a teaser!)

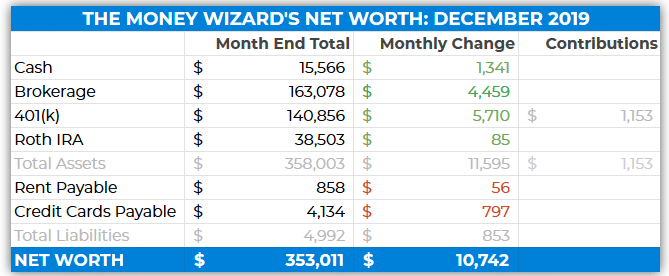

Net Worth Update: December 2019

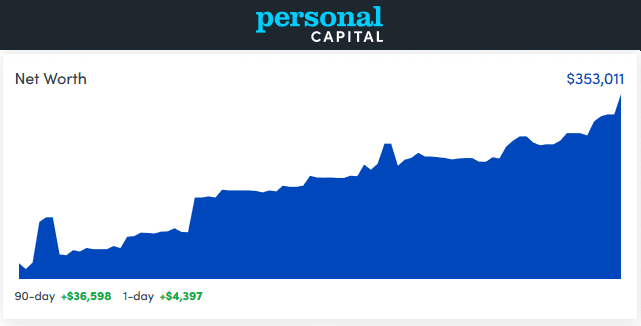

Stepping back in the time machine, my net worth was $249,012 last December. A year later, my net worth has grown to $353,011.

Getting out the trusty calculator… checking the math… carrying the two… that means my net worth grew a staggering $103,999 in 2019!

As far as I can tell, that’s ridiculous. A six-figure jump, driven by some serious compound interest in a runaway stock market, plus a last minute raise at work, and maybe most importantly, over $40,000 of straight-up savings. (Teaser #2: I’ll have an exact breakdown of my 2019 spending and savings in an upcoming post.)

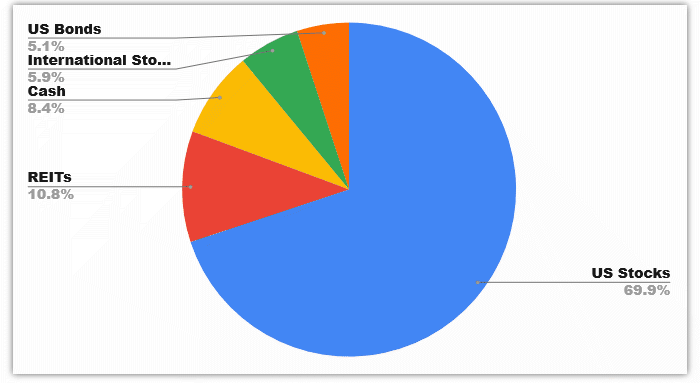

And since it’s the end of the year, I thought it’d also be smart to check in on the portfolio allocation:

Not perfect, but we’ll get to that.

Cash: $15,566 (+$1,341)

I’m really happy with where the cash fund is, and it’s time to start making moves.

$15K should be enough to drop $6K into my 2020 Roth contributions (we’ll get to that in a few paragraphs), $4K for my massive credit card bill this month (we’ll get to that in a few paragraphs, too) and then have a reasonable amount left over to start the year with my idea of an emergency fund.

Brokerage: $163,078 (+$4,459)

Stocks ended a high year on a high note, which meant the brokerage account continued to go up, up, and up.

By my calculation, the market returned over 20% in 2019, which is significantly higher than the average stock market return.

In fact, the brokerage account’s growth, which has the highest amount of US stocks compared to all the other parts of my portfolio, actually skewed my portfolio allocation a bit. If you take another look at the pie chart above, you’ll see US stocks at nearly 70% of my portfolio.

In 2020, I plan to address this through my 401k. Speaking of which…

401(k) $140,856 (+$5,710)

It’s hard to talk about my 401k without going through a quick flashback.

For the first few years after starting my career, I maxed out my 401k religiously. But then, once my 401k was set to compound to a couple million dollars, I started wondering whether I should actually dial back those 401k contributions for the first time in years.

So, in late 2018, I reduced my 401k contributions down from $19,000+ per year to just enough to get my employer’s full matching benefit. My idea was to build up a cash pile to eventually invest in rental properties.

And well… an attractive deal on a rental property never came. Which wasn’t all bad. I still got the benefit of increasing my cash, while shifting my portfolio towards a little more conservative position. (Aka… invested in more cash/bonds than before.)

But then at the end of this year, I got thrown another hanging curveball. And there’s only one thing to do with hanging curveballs – knock them out of the park. I’m talking about that six-figure promotion, which brought a new first world problem along with it – having to pay tons of taxes.

All that to say, we’re back to square one, and in an effort to lower my tax bill, I’ll again be maxing out my 401k in 2020.

I still haven’t set the exact contributions, but my tentative plan is to invest those contributions a little more heavily towards international stocks, which should help address the overweight position of US stocks in my portfolio at the moment.

Roth IRA: $38,503 (+$85)

Long time readers know I have a history of procrastinating on my annual Roth IRA contributions. I’d wait months before ever contributing anything, which meant missing out on mucho compound interest and frequently stressing over lingering chores.

My affliction eventually led me to say enough is enough. And for the first time last year, I plopped down the entire $6,000 of allowable Roth contributions in January 2019.

I was pleased with how that worked out. It’s always nice to cross off a chore early! So, I plan on doing the same thing in January 2020.

Which means that for now, no news to report in the IRA account this month. (Other than $85 a random monthly fluctuations.)

Rent Payable: $858 (+$56)

Utilities have been all over the map this year. I got lulled into a super cheap month of heating last month, before getting blindsided by a $300 heating bill this month. Not sure what to say there. I do still need to take up some reader’s suggestions on getting my energy company out for a free audit.

(For newer readers, I share a house owned by my fiance. My rent payment to her includes my half of the mortgage, utilities, and anticipated home maintenance. We allot 2% of the home’s value to expected maintenance each year, or $300 per month.)

Credit Cards Payable: $4,134 (+$797)

A MASSIVE credit card bill this month. At first I thought I got a little carried away with the holiday gift giving this year, but as we’ll see in the next section, December actually came in under budget.

It turns out, towards the end of the December I pre-paid nearly all of my travel through June 2020. And it also turns out, those hotel stays, ski lift tickets, and airline flights actually cost some money! Who knew!?

(Just FYI, I’ll be paying the credit card statement in full at the end of the month. I never carry credit card interest, because that’s just a financial disaster.)

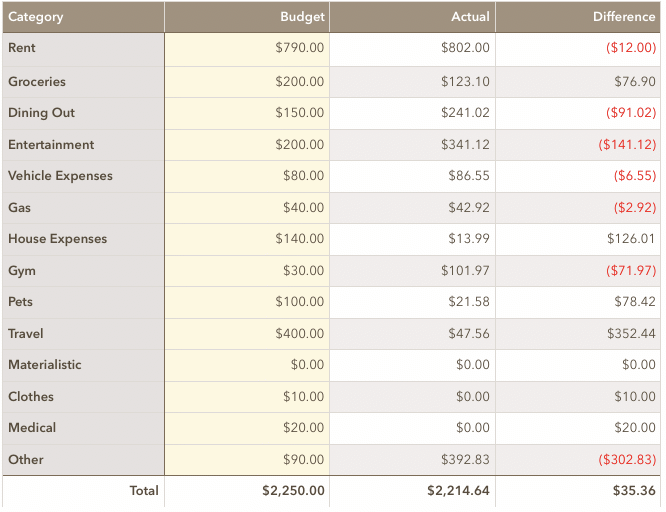

December 2019 Spending: $2,215

(FYI #2: There’s a big difference between my credit card bill and my total spending amount. That’s because I prefer to break down my monthly spending in the months I actually use those goods. For example, even though I paid $200 towards a hotel stay that I’ll use in February, I won’t count that as spending until the February update. I find that keeps things much more organized for me.)

And now, a quick a summary of the biggest/most interesting monthly expenses:

Dining Out: $241

Of which, nearly half came in the form of a $110 New Year’s Eve fancy-pants tasting menu that Lady Money Wizard and I enjoyed. Between our engagement, my promotion, losing one cat and adopting a new one, and a host of other things, 2019 was a big year for us, and we wanted to reflect on it in a special way.

Mission accomplished – I was a little nervous the meal would be one of those stereotypical overpriced dinners, but it was actually delicious. And a total blast.

In 2020, I may shoot for a quality over quantity approach to our dinners out. Meaning less frequent Chipotle burrito runs, and more frequently applying those savings towards some fancier places we’ve wanted to try for a while. We’ll see.

Entertainment: $341

Highlights here included a bus-tour with friends to gawk at Christmas lights, a Groupon sale on tickets to a local arcade, and a massage to address some crazy soreness after doing my best to get into skiing shape.

Oh, and a big brewery trip, so The Money Pup could get his picture with Santa, of course… (featured at the top of this post!)

Gym: $102

Speaking of the gym and getting in shape for ski season, in December I tried out something I’ve long avoided – running.

But after starting, I couldn’t get the thought of a long lost meme out of my head. It read:

What’s the most frequently misused piece of equipment at the gym?

…The Treadmill.”

I also know that for many, running is a one-way ticket to banged up knees and other nagging injuries. So I decided to spring for a $75 private lesson with a professional runner. She spent over an hour critiquing my form and setting up a training plan.

Like most health related spending, so far it’s been some of the best money I’ve spent, and I’m really excited where it will take me.

Travel: $48

The trip to Dallas was all airline miles and cashing in rewards points at the hotel of Mom and Dad. 🙂

The $48 here is just Ubers and Lyfts.

Other: $393

Turns out I did get a little carried away on the Christmas gift spending, including over $100 to fly down all my favorite Minnesota beers to share with my Texas family. Plus another $100 towards my favorite Christmas tradition – a shopping spree for Toys for Tots.

Happy Holidays!

MyMoneyWizard.com readers are amazing. I hope you all had a fantastic holiday season, and best wishes on your 2020! Here’s to a new decade!

Related Articles:

Nice job Money Wizard!! You had another home run this year. Your quote, I wish there was a way to know you’re in the good old days before you’ve actually left them.” -Andy Bernard, The Office, made me think of a book called Why Buddhism is true.

TL;DR: The best way to be happy is to be grateful. You don’t need to recognize you are in the good old days, you just need to look around and be thankful to all you have – and never let that mind frame slip.

Happy New Year and keep up the great work here!

Very interesting perspective. Thanks Handy Millennial, and Happy New Year to you too!

Nice job Wizard, you deserved the break. Good to see that you are back. I have noticed that it is really hard to come back after this holiday. Will have to pull myself together and get back in the saddle myself.

My savings grew by about $58,000 last year and I am really satisfied with the result. Now the ball will just start rolling 😀

That’s incredible growth. Plus, like you said, the more it grows the more momentum you’ve got moving forward. Congrats!

Hi! I’m 28 y/o with a similar networth and financial mindset, so always love reading your updates/posts. I really look forward to it and believe it or not, it holds me accountable! Quick question on your monthly change/contributions category. If contributions is blank, but monthly change is green, can I assume that was purely from market movements? If I’m interpreting it correctly, it seems you only contribute to your 401k but your networth continues to increase….is compounding interest that powerful?! Ha!

Yes, aside from the cash category. I “contribute” to cash via my paychecks but don’t specifically track that in the table. Otherwise, you’re right that the only section I contributed to this month was the 401k. You’ll notice it grew by an extra $1,000 vs. the brokerage, which is basically equal to my contributions. The brokerage growth was just market movements.

So long story short… yes! Compound interest is that powerful. 🙂

Hey Money Wiz, thanks for another great update! Here’s to another great year (and decade!) of growth.

Question for you – where do you include donations/charitable contributions, do you account for that separately? or is that something that is pursued once financial independence is reached? Thanks in advance.

In the other category. So using this month as an example, my donation to Toys for Tots would be counted as “spending.”

My take on charitable contributions is that while I’m still working, roughly 30% of my salary goes towards federal and state income tax, and 60% of those taxes are used to pay for various social welfare programs. That’s about $18,000 per year. Once I’m financially independent, I’ll pursue more personal charitable causes more seriously.

As Felix Dennis said, get rich… but remember to give it all away.

Great article, besides financial intelligence you have a great writing skill. After stumbling upon your website my mind is racing. I have read so many pages of your website while doing research on google as well for investment opportunities, compound interest and any opportunities that can help my money grow.

I am kind of starting a little late since I am the breadwinner of the family and I have more responsibilities.

One of the things I would like to share with you is how I paid off my student with minimum interest.

I took a loan for college. Loans were disbursed per semesters so the interest varies. Some of my loans had about a 6.8% interest rate. The average rates of all of my loans were still over 4%. While I was paying my loans and seeing hefty interest per month, I was constantly asking myself how can I pay it off as soon as possible?

So the best approach I found was using credit card balance transfer. Most credit card companies only charge 3% fees to transfer money into your account or pay off the loan. They provide 18 months to pay off loaned amount. So the payment I was making to my loans I started making to my CC. I never paid a pennyworth of interest on my credit card besides 3% transfer fees.

I saved so much interest in using this approach.

Now that I am done paying off my loans. I have to be a little more aggressive towards my investment to reach my goal. since I’ve started a little later and taken care of other family matters.

Very cool strategy! Thanks for sharing.

If you were able to save enough to pay off your student loans, you’re already won half the battle of investing. Just keep up the savings – now you get to use that money to pay yourself instead of the loan companies!

Wow MW,

100k growth in a year is very impressive! you have me handily beat yet again! I gained $82k this year. I keep trying to catch up to you but can’t seem to close the gap! When i started tracking my net worth in Jan 2017, you had $50k more than me and now, three years later, you have $80k more! Maybe one day my tilt towards international equities will pay off haha, or maybe i could actually do something about it that I can control and cut my spending.

Where is your annual ski trip this year going to be? I just moved back to Calgary from Toronto and Lake Louise and Sunshine village have been getting some of the best early season snow they have seen in years. I have been out 4 times and 3/4 have been powder days with one 48cm day! If you end up at Sunshine or Louise, I am happy to share all the hard to find gems on either of those massive mountains.

May you get richer and happier in 2020!

$80k is nothing to sneeze at! That’s amazing, congrats!

This year the big trip is to Salt Lake City, and then we’ll be flexible from there. Probably Alta/Snowbird, Solitude/Brighton, or Snowbasin. Also taking shorter trips to Park City and Whitefish, MT. Lake Louise/Sunshine village is definitely on the bucket list though!

Always enjoy talking skiing with you, Dan. Enjoy the turns!

Looking forward to your post Ski-Trip post! I have heard great things about whitefish and may have to make the trip there soon as i’m not as far away as i used to be!

Since you’re making over 100k and contributing full 19000 into 401k. The best way to deduct from a paycheck is to contribute the maximum percentage until 19k is reached. My company provides an option to contribute 50%. The sooner your money gets into 401k account the sooner your money is making money.

Your money started making sooner rather than later. You paid a minimum initial tax, but eventually, you have to pay the tax bracket you fall under. Since we do not get paid interest on tax, it’s better to let the tax go from last quarters paycheck than first quarter. The total tax amount won’t be different.

Great content man! But I did have a couple questions. A majority of your assets are linked to the stock market. Are you concerned with being over exposed? How might an economic downturn affect your long-term strategy of retiring early?

Thanks TJ. I talk about your question here:

https://mymoneywizard.com/recession-2021/

A very nice net worth increase Money Wizard! You certainly can’t complain about those kind of gains!

I haven’t added up my net worth increase for the year, but I’m pretty certain it’s going to be significant. I keep telling myself to not let it go to my head, but that’s a tall order after 2019.

Well done and great year! $100K increase is amazing!! Keep that momentum rolling into 2020!

I don’t currently have a taxable brokerage account but have been considering it lately to stash some extra cash I’ve built up in recent years. To be perfectly honest, I don’t have any experience with investing outside my regular retirement accounts. I’ve read about a new online money management platform called Round that provides active investing services. Fees are 0.5% but are waived monthly if your portfolio shows a loss. Have you heard much about it, and what are your thoughts? I’m specifically looking to weigh the pros/cons vs. a service like Betterment or Wealthfront.

I just have to say, this is very inspiring. I’ve been tuning in for about two years now and at the time I think your net worth was about 170,000 to my 10,000 in cold cash. Keep up the great work! You, graham stephen, and Andrei jihk are my go to sources of counsel on finances besides my own research. So thanks and best wishes on the rest of your journey!

Thanks Mike! And yes, it’s wild how quickly it’s added up. Obviously the positive markets have helped, but still amazing to see the outsized effect of consistent savings and compounding.