Hey Money Wizards,

Welcome to the second monthly update of 2020. (And number too-high-to-count since starting this blog!)

If you’re new here, every month I track my progress towards financial freedom by age 35. I’m currently 29 with a net worth of… well you’ll have to keep reading to find out. 🙂

Lift Update: February 2020

February was another action packed month. For the second month in a row, Lady Money Wizard and I did a lot of travel, but can you blame us? It’s the Winter, and we live in Minnesota!

The first trip was to accept an invite to ski with friends in Park City, Utah. When we realized how expensive flights from Minneapolis to Salt Lake City were, we pulled off a unique, if not clunky, travel hack.

Instead of flying to Salt Lake City, we flew to Phoenix, enjoyed a quick weekend in Sedona, Arizona, and THEN flew to Salt Lake City. All for cheaper than MSP-SLC roundtrip!

Obviously, it takes a little extra time off from work to pull something like this off, and after the extra three days of vacation, I’m not sure it actually saved us any money. That said, it sure beats overpaying for a plane ticket! And it made for a really awesome adventure, too! (As did packing for warm desert hikes followed by cold winter skiing!)

Sedona was one of the most photogenic places I’ve ever been.

I’ve raved before about the frugality of a good old fashioned hiking vacation, and Sedona was no different.

Immediately after, we were skiing in Utah. Quite the shift in landcape!

Meanwhile, back in the frozen tundra of Minnesota, we fully embraced winter. We took a super cool (and free!) night walk hike in a local state park.

And explored frozen lakes with The Money Pup.

Yes, that ear perk was his actual reaction to the cheese question.

After all that fun, I was a little surprised when the whole world seemed to fall apart at the end of the month.

Yeah, I’m talking about the stock market’s TANKING from the Coronavirus panic. I wrote my initial thoughts on that “worst” crash ever here, but let’s take a closer look.

Net Worth Update: February 2020

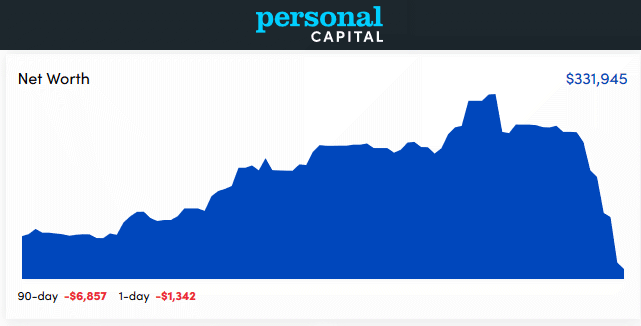

Boom. Yeah, that’s the impact of the fastest 10% drop in the history of the stock market.

All total, the market fell around 15% last week, bringing my portfolio from a high of $365,000 in mid-February to $331,945 just a week later.

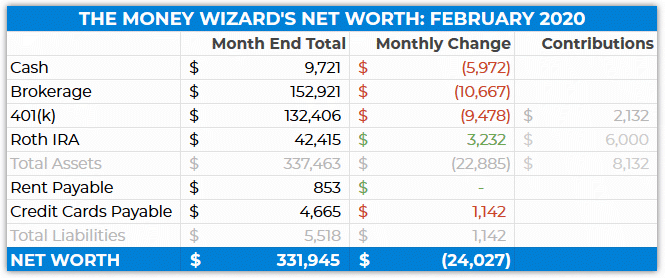

As you can see from the detailed spreadsheet, my own savings and contributions did their best to battle against the loss, but their effort was futile.

Although this is a February update, we’ll also peak into the first few days of March. Since those charts, the market chaos continued.

On Monday, March 2, the market bounced back nearly from the dead like an apocolypse zombie. (A zombie infected from Coronavirus, I’m sure!) Stocks ended the day up 5%, one of the single largest rallies in months.

Then, on Tuesday, March 3, stocks began crashing again. The Fed responded with an “emergency” interest rate cut to hopefully spur on on the economy, but as my buddy Nick tweeted, their attempt looked something like this:

Exclusive footage of the Fed’s rate cut today: pic.twitter.com/UiHStLBNQS

— Nick Maggiulli (@dollarsanddata) March 3, 2020

Where it will go from here, nobody knows.

In the grand scheme of everything, this “massive drop” is just a tiny blip compared to the market’s growth through history. If you’re still building your portfolio, history would tell you to ignore the noise and continue building that portfolio.

What am I personally doing?

Well, I’m in the odd spot of both building my portfolio AND protecting it for a potential retirement in just 5 years. Which is why, a few months ago, I settled on a more conservative portfolio allocation that included around 10% cash and 10% bonds.

I’m still not at that allocation yet, so… I’m not deploying any of my cash or bonds yet to buy these “on sale” stocks.

It’s possible the virus fizzles out and we look back at these prices as a nice buying opportunity. It’s also possible that the 750 million people quarantined in China and growing panic in the U.S. causes some serious disruption to the world’s supply chain, and that’s the spark that lights an extended recession that many have wondered about for so long. In my opinion, things could certainly go either way, and it’s too early to tell.

If the zombie massacre continues, and we do enter a true recession (as defined as two consecutive quarters of negative GDP growth, and usually accompanied by 30-40% drops in stock prices) then I may reconsider. At that point, the stock discount may be too large for me to ignore, but we’re probably still a few months away from that. (IF it ever even happens.)

Cash: $9,721 ($5,972)

In early February, long before a virus tried to wipe out the world’s population, I moved $6,000 from my checking account into my Roth IRA.

Brokerage: $152,921 ($10,667)

Nooow we’re getting to the madness.

A roughly 7% drop month over month. (The 15% drop you hear about in the news is from the mid-February highs)

401(k): $132,406 ($9,478)

More drops! Is something going on in the stock market right now? 😉

Note that this would have been closer to an $11,000 fall without my $2,000 of automatic paycheck contributions.

PS – here’s an interesting tip, for those tempted to buy on the recent market dip. If you’ve got a 401k set up with automatic contributions, you’re already “buying the dip” with each paycheck’s contribution. 🙂

Roth IRA: $42,415 (+$3,232)

Really, this account actually dropped $3,000 too, but was propped up by $6,000 of contributions made at the beginning of the year.

Rent Payable: $853 ($0)

In a strange turn of events, my utility bill was the exact same as last month. What are the chances!?

For newer readers, I split a mortgage for a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $4,665 (+$1,142)

A massive credit card bill, mostly because I fronted a several thousand dollar ski condo rental for a March trip with my friends. This will go away when their venmos come in. (My friends are good for it, right? Right!?)

To get a better feel for the spending, I like to share my exact spending reports:

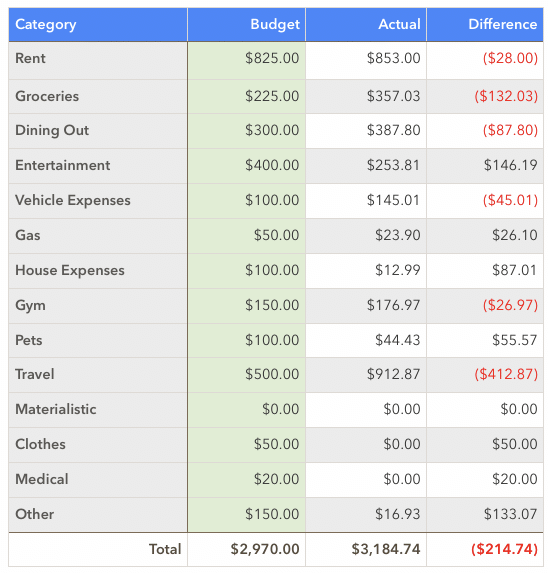

Total February 2020 Spending: $3,185

Groceries: $357

Yes, I made a Coronavirus fueled Costco run…

Crazy? Maybe. An overreaction? Probably. But I figured there’s really no harm in stocking up on stuff I’d use anyway, especially when buying in bulk usually saves over the grocery stores I usually use.

Worst case scenario? My friends get a good laugh at my descent into Prepper Status, and I still save money on future grocery costs.

Dining Out: $357

A little over budget as I continued my quest to spend an extra $500 a month, this time with a fancy Valentine’s dinner that Lady Money Wizard and I really enjoyed.

Entertainment: $253

Mostly a coupe bar crawls with friends.

Vehicle Expenses: $145

Slightly over budget because I had to renew my driver’s license.

Gym: $177

I mentioned before that I hired a running coach to help dial in my form and avoid injury. So far, it’s been money well spent, but now that I’ve got the basics down, I’ll probably cut this cost in March and return to me lowly $33/month gym membership.

Pets: $44

Can’t leave The Money Pup out if this thing goes World War Z!

The $44 was his food.

Travel: $912

Despite my best efforts, and despite my generous friend who shared a free place to stay in Park City, ski trips aren’t cheap! With lift tickets running well over $100 a day, they must think I’m Tom Brady or something!

That said, I still kept costs down on the Sedona portion by finding an $80/night hotel on Hotwire.com (Shout out to their dirt cheap Hotrates!) and booking the flights with credit card/airline miles. Oh, and enjoying the great outdoors, which is totally free.

Readers, how are you weathering the market madness?

Hang in there! Everything fluctuates, and hopefully, 30 years from now when our consistent investments have made us millionaires, we’ll look back on this temporary scare with a good laugh!

PS – If you want to stay on top of the recent changes to your portfolio (and more importantly, your most updated allocation) then Personal Capital is still the best tool I’ve found to do that. And it’s free!

Related Articles:

I’m down over $200k so far and that’s with a portfolio less than half in stocks. But that’s not significant, I’m not spending any of it yet going on my fifth year of retirement. Hobby jobs for entertainment pay the bills so it really doesn’t matter how the portfolio does. I’m watching things with a mild sense of detachment.

Thanks for sharing your update. I’m curious why you made a one-time $6,000 investment in your Roth IRA (I may have missed your explanation, if you had one in your earlier post). Would it be better to spread out your contributions throughout the year to capture the possible dips in the stock market?

That is trying to time the markets. In the long run, it is best to put 6000 in your Roth IRA on Jan 1st so it sits in the market the longest.

Sorry, I wasn’t clear and didn’t mean trying to time the market but just investing regularly biweekly or monthly and over time, the variations would “average” out.

I’m sure both methods have its own pros and cons but I feel like investing regularly poses a lesser risk than doing a lump sum at the start of the calendar year. Take this year, for example.

I would agree with your view on that Cory. Makes sense split money out over regular time intervals – especially when markets are as volatile as they currently are!

Great to see your transparency and lightheartedness in spite of the craziness in the markets Money WIz. I’m certain you’ve written this somewhere, but for your 10% cash allocation in your portfolio, is that sitting in checking, Vanguard money market fund, high yield savings account, or some combo of the three?

As for how I’m doing in the market madness, I’m feeling reassured at the decision to invest in rental real estate starting in 2018. That comes with its own headaches, but I do see it making my portfolio and net worth more resilient to stock shocks like these. Since making that decision I went from an allocation of ~90% stocks in my long-term investments to more like 55% stocks, 5% bonds, 40% multi-family real estate.

The stock portion of my portfolio is still feeling the pain, but the real estate is at least not giving me the daily feedback on the valuation and the tenants keep paying rent and paying off my mortgage.

No mention of the vortex on Bell Rock? I woulda put my whole portfolio into that if I could have figured out how to manifest it into a vortex agreeable form. It started to get late though and I was hungry, so I had to come down. Beautiful vacation photos!

What’s the Coronavirus? :0)

Always enjoy the updates and following your journey. As a fellow 29 year old in the Twin Cities on a quest to financial freedom, you are an inspiration! Can you share what the state park you did the night hike was? Definitely want to check that out.

Great post and your vacation looked awesome. I need to do more weekends. Am I a terrible person for wanting this to continue for another couple weeks? I get my bonus and my tax return so will have 15-20k to deploy into the markets in my TFSA (Canadian roth). Maybe if I’m real lucky they will let us work from home to avoid the Corona virus so i don’t have to go to the office.

On a Ski note up to 12 days in the Rockies and Kootenays and 7/12 have been powder with more foretasted for the weekend! I hope you find more pow this winter!

What camera did you use for those photos of Sedona?