Well Money Wizards, another month is on the books, so now’s the time for that regularly monthly update.

On time this month!

If you’re new here, every month I share my progress towards a nearly $1 million portfolio and an early retirement by age 37. Money tends to be a pretty taboo subject IRL, but I hope that sharing all my details here will help you in your own situation.

Unlike last month, my March didn’t feature any weekend getaways to the Great Lakes or ski trips to the Rockies. Which is probably a good thing, especially after all the wallet damage I inflicted upon myself to start the year.

Instead, I headed into March with a frugal challenge!

Nothing too official (because what’s the fun in that?) but a frugal challenge nonetheless.

At the beginning of the month, Lady Money Wizard and I made a little pact. We’d do our best to eat out waaay less often, or at least dig into the overflowing coupon drawer whenever we did. Instead of defaulting to the expensive date night options, we’d google for free things to do instead. And any big purchases would have to wait until the next month, just to double check that the impulse wasn’t dead by then.

We jokingly started referring to it all as “No Spend March.”

The name was a bit of a lie, since you’ll soon see we did actually spend money during the month, but our exaggeration was effective enough anyhow.

If only I had a dollar for every time this conversation went down…

- “I don’t feel like cooking tonight, let’s just pick up Chipotle.”

- “Can’t. It’s No Spend March.”

Or…

- “That’s pretty cool, how much is it?”

- “Doesn’t matter. It’s No Spend March.”

Or…

- “What a day. Let’s go to the brewery.”

- “No Spend March!”

Oh wait, I do have a dollar!

In fact, I have way more than a dollar, because every one of those conversations saved me $5-30 each!

We didn’t go full miser, but we did re-arrange our options to the cheaper choices.

Date nights turned into finally using those ancient Groupons we’d been holding onto forever, instead of just going wherever we craved most. Entertainment featured more trips to the gym or hiking local parks with The Money Pup, which I’m sure he appreciated. We spent more time cooking healthy meals at home, and instead of relying on fancy restaurants to fulfill those random guilty cravings, we gave ourselves permission to whip up cheat meals in the comfort of our kitchen.

Hey, I’ll pit my homemade gumbo, or even the trashy but oh-so-comforting Annie’s Mac and Cheese, against the trendiest restaurant meal any day!

To our surprise, the month didn’t feel like a sacrifice at all! Instead, it felt like a fun little diversion from a rut of thoughtless spending we’d fallen into.

Sure, we weren’t perfect. You’ll see further down there’s still room for a whole lot of improvement.

But that’s okay. We saved a lot of money compared to the past few months, and we had a blast doing it.

The whole little experiment was so successful, I’m already planning my quips about No Spend April.

That said, I’ll warn you now. There’s a tidal wave coming in April, and it’s called “a $10,000 kitchen remodel.” Here’s to hoping I don’t drown!

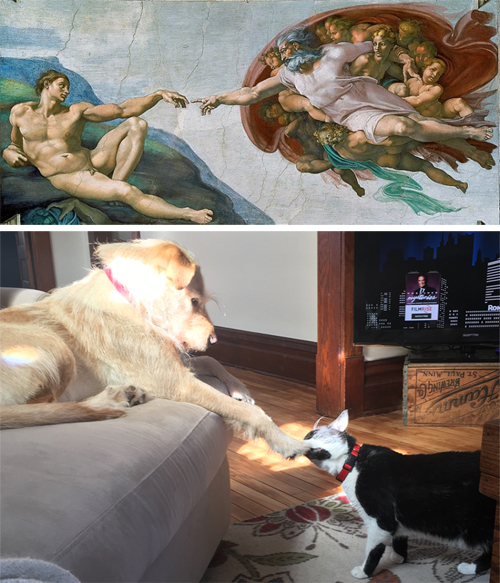

Because of the frugal efforts and a lack of travel, I don’t have the usual fancy pictures to share with you. BUT, I do have this picture of The Money Pup and The Cash Cat acting out Michelangelo’s Creation of Adam:

Net Worth Update: March 2018

And the detailed update:

For the second month in a row, all three major stock market indexes fell again. The Dow fell 3.7%, the S&P 500 lost 2.7%, and the NASDAQ fell 2.9%. Ouch.

What do I think about all this?

I’m not sure the technical term, but “big-freakin-deal” about sums up my feelings.

Hey, just through my 401(k) contributions, I’m consistently buying more than $18,000 of stocks during the year. Plus employer matching. If those buys happen to occur at a price a little bit lower than an all-time high, that’s a-okay with me.

Cash: $12,759 (+$3,660)

Since I was so late with last month’s update, I haven’t had to pay a credit card bill since our February update. In other words, pure profit for the cash account, although I’ve schedule a round of credit card payments for tomorrow.

Brokerage: $109,420 ($4,794)

Womp, Womp, Womp.

A crappy month for the market, compounded by writing last month’s late update during the market’s early March peak. Since then, the market’s tumbled mostly on:

- Concerns over a looming trade war with China.

- Facebook scandals leading to sell-offs within the technology sectors.

In other words, a whole lot of speculation and not a lot of substance. Like I said, I’m not concerned. After all, I’m investing for the next 7 decades, not the next 7 months.

My breakdown remains roughly:

- 50% in Vanguard’s Total Stock Market Index Fund. (See: How to Choose a Vanguard Index Fund)

- 30% in a mixture of Vanguard growth, value, and bond ETFs.

- 20% in individual stocks, back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

401(k): $91,474 ($1,990)

Despite $2,000 of auto-contributions from my paychecks, the 401(k) still tumbled with the rest of the market.

Roth IRA: 22,254 (+$187)

Hey, the rest of the stock market crashed, and my real estate REIT stayed stable. That’s diversification in action, folks!

Mortgage Payable: $759 ($70)

FINALLY, some relief from the bitter cold, and my heating bill dropped by a couple hundred bucks. (Split with Lady Money Wizard)

Credit Cards Payable: $1,997 ($177)

Nice to see a credit card bill below 2 grand again. As usual, this is inflated by some reimbursable work expenses, so let’s look at the detailed spending report:

Total March Spending: $1,452

What?? That sure seems like a lot of money for “No Spend March.”

Like I said… a good start, but lots of potential improvement. Here were the main expenses:

Rent: $820

Winter’s last hurrah on my monthly utility bills. That said, I should adjust my budget, because $800 per month seems to be pretty standard these days.

Lady Money Wizard and I split housing costs, which total $1,100 per month in mortgage payments, insurance, property taxes, internet, and a home warranty plan for our little 3 bed/2 bath in the Twin Cities. We also contribute $300 per month to a “maintenance fund” which we keep in case the roof caves in. We share utilities, which seem to range from anywhere from $100 to $350 depending on how hard the heater is working.

Dining Out: $99

The good news? I only ate out five times in all of March, which is a new record for this website.

The bad news? Despite my best grouponing efforts, two of those trips were $40 tabs.

Entertainment: $86

What can I say? I’m a millennial. I can’t quit my brewery habit cold turkey.

House Expenses: $41

Had to pay the quarterly trash bill. Come to think of it, I should probably include that in the monthly “rent” payments. On the other hand, meh.

Vehicle Expenses: $82

Just the ‘ole monthly car insurance.

Other Expenses: $155

Almost entirely from my share of a $300 annual vet visit. Dogs are expensive, mmm’kay.

And that’s a wrap on “No Spend March.”

Join me next month for No Spend April. Just try not to buy a $10,000 kitchen.

If you’re looking for an easy way to track your spending (or hopefully, lack thereof!) I still recommend Personal Capital. It will track everything for you automatically. For free!

Readers, how was your March?

Related Articles:

Your no spend March looks good, you were quite far below budget.

And I loved the sistine animal pics, just like Michelangelo painted!

Thanks Ms. ZiYou! Those two goofball pets had me dying laughing.

To only spend $1500 in a month is insane. Extremely impressive and very inspiring. I think my record is $2300. Keep up the good work.

Thanks Jacques! I think I was hoping for a big fat $0 spent… but maybe that’s not too realistic. 😉

I can’t wait to hear about your kitchen remodel. I am looking forward to a lot of remodeling in the next few years but feel very stressed about trusting other people to do a good job and not charge too much. Try and share as many details and advice as you can. Thanks for your honesty in your blogs!

It seems miles away right now, but once this remodel gets wrapped up I plan on devoting a huge post to it. And as usual, it will be filled with my 100% guinea pig transparency.

Thanks for your feedback, it will help me when I’m writing!

Wow that no spend looks pretty good to me! By my count that’s less than $500 on non mandatory spending, and even lower if you take out the vet visit for your dog.

Being flexible is a huge part of financial independence and when the market is in turmoil it’s good that you can adjust your spending as necessary!

True, the vet visit wasn’t a very discretionary part of the discretionary spending.

Great point about being flexible. I think everyone should give one of these frugal months a try, if for nothing else than to see how little you could live on if you had to.

I think I spent enough in March for all of us! Which has ushered in no spend April…

I think gamification of spending restraint can be a great way to prevent yourself from burning out when you’re budgeting / economising.

HH

So true, Hustle Hawk. Turning the “sacrifice” into a fun challenge totally changes the perspective.

The same could be said for just about anything, btw. Job interviews, office politics, a big test, etc… Turn those into a game, and I find it’s a lot less stressful and a whole lot more interesting.

Looking forward to hearing about the kitchen remodel – I’m soon to be facing the same challenge.

Stay tuned for one of my usual “tell-all” posts on it!

Wow I can only imagine spending $1500 a month. Just for our 2 mortgages we pay over $4500 a month not counting any utilities or repairs

That’s a hefty fixed cost. What’s the reason for the second mortgage?

One is a rental with a 1k per month mortgage the rest is our house in SoCal

Ah, SoCal… That’s tough. Hopefully your income in California is bumped up enough to offset it a little bit.

Well done on the food budget this month! It’s pretty impressive to spend less than $200. That is my goal each month but have been closer to $300 most of the time.

Also, impressed/jealous with your low gas bill. Living closer to work is on my to do list for sure.

Keep it up!

Thanks Gary. My grocery spending isn’t exact, since Lady Money Wizard and I alternate who pays for trips. Some months it’s artificially low if she happens to have gotten the first and last trip of the month, or something similar.

Best way I’ve found to save on food is to stop shopping at Whole Paycheck at other ridiculously priced stores. Not sure if they have Aldi in your area, but their prices are unbelievably cheap.

Why do you still have 20% of your portfolio as individual stocks if you recommend not trading them? I am currently invested in 1 company and am hoping their stock goes back up before I get out (too intense for me, I’ve realized I now prefer index/mutual funds haha). Also is your whole Roth IRA in that real estate fund? Or is the money in your Roth in multiple funds?

The individual stocks are leftover from a 19 year old version of myself who was convinced he could beat the market. I haven’t sold them because I don’t want to pay the capital gains tax.

Yeah, the whole Roth IRA is in Vanguard’s REIT index. I was more comfortable with that allocation when we were still renting an apartment. Now that we’re exposed to real estate via a $180,000 mortgage, I’m brainstorming other ideas for the Roth IRA. Always open to suggestions!

And good luck on your one egg one basket strategy, haha! Definitely too intense for me, too.

I need to adopt more of your attitude about the market. We don’t have 401ks, but remembering that maxing out our Roths is steady progress no matter the market trends (go back up, go back up!) is important. Good luck with April!

No 401ks for teachers? Not even 403bs or TSPs? What’s up with that??

How much do you eat out regularly? I’m so jealous. Our dog’s insurance costs us $25-35 dollars a month but we never see it taken out because it’s gone before the paychecks come to hubby. No complaints though. Love our doggy:)

A lot. Too much! $200/month on dining out has been pretty standard, but I’m working to keep it down.

I’m not the biggest fan of pet insurance:

https://mymoneywizard.com/is-pet-insurance-worth-it/

But no judgments! I know it’s worth it for some people.

I lost some money in Q1 2018 as well, but I’m still happy after massive gains in 2017. I think this is just a correction and not the start of a bear market.

Nice job! I am going to adopt your “No Spend April” 🙂

Just wanted to leave a couple of tips on 2 expenses I recently changed that are drastically reducing my monthly costs.

1) Car Insurance – I ditched my traditional car insurance provider for a pay-per-mile service with MetroMile. While I don’t know if they service all of the U.S., they are in my home state of California. This works by connecting a device to your car which has GPS tracking and counts how many miles you’ve driven. For me, this has worked out wonderfully since I only drive a few miles a month (average around 600/mo) … I’m now paying 27% of what my old car insurance was.

2) Mobile carrier – I also ditched the traditional cell phone service provider for Mint Sim. They use the T-Mobile network so most places in the U.S. are covered 🙂 My cell phone bill will now be 22% of my old cell phone bill!

Wanted to share this with your readers 🙂

Thanks for sharing, Mary!

I’ve heard good things about MetroMile. I drove about 800 miles a month last year, and I’ve been meaning to run the numbers to see how much I could save. Thanks for the reminder!

Nice job keeping the costs low in March MoneyWiz!

We spent a ton of money in March because we were on vacation. Thankfully our investment portfolio spits out a ton of cash in March too!

We more than covered all of our expenses with dividends alone!

Would you include the equity/balance of your house in your net worth calculation?

I don’t, partially because the house isn’t in my name, and partially because the house isn’t actually an asset making me money.

But at the end of the day, it’s really up to you. And including your home’s value is technically the correct way to calculate net worth.

Have you ever considered pulling out of the market and sitting in cash for a few months? With the market near all time highs and rising interest rates we can assume a hard correction within the next 12-18 months. You could then buy in near the lows and make up for the lost time of sitting in cash. Just a thought, really inspired by your openness btw. Thanks

I have. I especially considered it around 2013, when I was convinced the recovery wasn’t real. Since then, the S&P has only increased… wait for it… 94%!!

I don’t think I could have ever made up for those lost returns. Lesson learned? Market timing is a dangerous game.

Great progress on your net worth. I looked at your other page (https://mymoneywizard.com/net-worth/) and your overall history looks a lot like mine did when I was your age (I’m 46 now), with one exception. You have a much clearer strategy and drive than I did at your age and are worth more than I was at your age. My net worth is about $1.65M right now with about $1M in investments and the rest in real estate (two homes) and other misc. If you keep pushing along like you are, you will likely far exceed our net worth at the same age! I didn’t start keeping spreadsheets and really pay attention to our net worth until about age 30 and my net worth at 30 was less than yours is now. It’s crazy how quickly the values rise with compound interest and consistent savings!!