Hey Money Wizards!

Another month, another update. As the regular readers know, every month I share my progress towards a roughly $1 million portfolio and an early exit from the working world. I’m currently 30 and shooting to walk away from my full time job at age 35. Let’s check in on the progress.

Life Update: September 2020

September started on a strange note.

For whatever reason, I decided I was going to start flipping antiques. I made this decision based on my absolutely zero experience with antiques dealing.

But I figured if we can make money flipping furniture, how hard could it be?

So I set out on a mission, hitting up a half dozen estate sales and garage sales in the area. Most sold junk, but I was convinced I’d struck gold (literally) when I was one of the first people in the door of a nearby estate sale. Once inside, I found three pieces I was sure would make me millions.

1. A vintage Tonka truck – purchased for $25

2. A vintage Monopoly board – $5

3. A literal gold coin. – $3

So I shelled out a $33 investment and started dreaming of riches.

Unfortunately, my main experience with vintage trucks was limited to a hazy memory of receiving one as a toddler. My expertise with monopoly collectibles consisted of buying McDonald’s soft drinks in hopes of scoring their million dollar prize. And the closest I’d ever come to real gold was an ETF in my brokerage account.

So maybe then I shouldn’t have been surprised when I got home and finally started doing some more research.

I listed the antique truck online for a slight profit ($40… the $15 profit would hopefully cover my gas mileage and keen eye for value.) To my astonishment, three weeks later and I still haven’t received any takers.

More online research proved the vintage monopoly board was a 1941 to 1951 original. Really cool, but worth an astounding… $10. Instead of using it to fund my future offspring’s education, Lady Money Wizard and I used it for a quarantine game night.

And the gold coin? Not gold. “An interesting commemorative token,” a local gold appraiser told me. “But not worth anything.”

Surely there’s a lesson in here about doing your research before jumping into your investments? Stick to what you know, don’t let your emotions get the best of you, it takes a long time to become an expert, etc…?

Right?

Failed antique dealing aside, I had a fun month around home.

Minnesota flipped the switch onto Fall, which is by far my favorite season in the state. I celebrated by spending as much time outside as possible.

We enjoyed the Fall apple orchards around Minneapolis, stocking up on pick your own raspberries for Winter smoothies:

I also sought out the best spots around the Twin Cities for viewing the start of nature’s amazing Fall color display:

And The Money Pup and I enjoyed a beautiful day at the giant cherry spoon, one of Minneapolis’s most touristy attractions:

Net Worth: September 2020

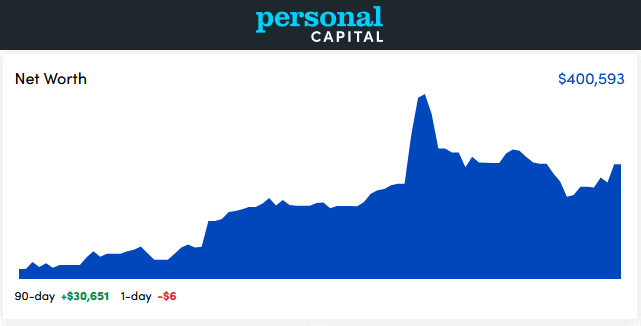

On the money side, the stock market didn’t have as much fun in September as I did. The Dow ended the month down 2.3% and the S&P 500 even worse – down 3.9%.

The MMWI (that’d be the My Money Wizard Index – a dumb name I just decided to coin for my portfolio) fared a little better thanks to diversification, ending the month down just 2.2%.

It was the first time my net worth didn’t increase month over month since the start of the Coronavirus pandemic. But at least my total net worth stayed above $400K!

Isn’t it funny how those little milestones seem to make such a big difference? Whether the month ended $399K or $400K clearly won’t have a huge impact on me, yet for whatever reason, I feel like all is fine since it’s over $400K. What an irrational little investor I am…

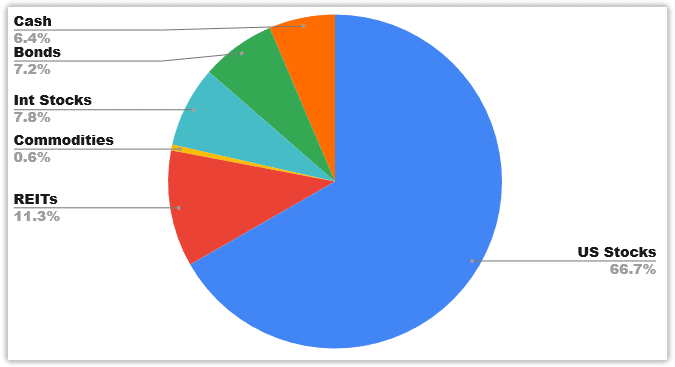

The biggest news is that I shifted $2,000 from my checking account into a whole new asset class within my brokerage account. Let’s take a look!

Portfolio Allocation: September 2020

Yep, the MMWI (hey, that goofy term seems to be sticking around!) made its first investment into commodities. That’d be a small amount of gold and silver, specifically.

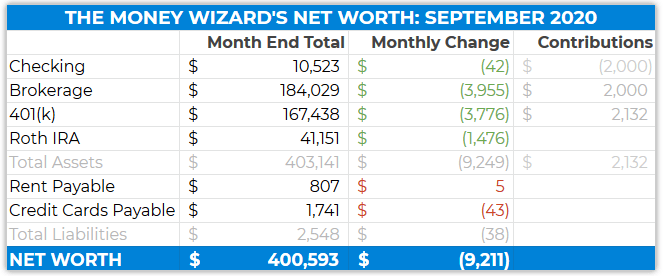

Checking Account: $10,523 ($42)

Overall, I padded the checking account by about $2,000 in September, but that was offset when I made the equal-sized transfer to invest in my brokerage account.

Brokerage Account: $184,029 ($3,955)

The brokerage account dropped a bit in the month thanks to the market’s poor performance, but the loss was partially offset by my $2,000 contribution.

I’ve planned a few upcoming posts which will explain why I chose to invest a tiny amount of my portfolio in gold and silver. But for now, we’ll just look at the impact about $1,800 worth of GLD and $200 worth of SLV has on my total brokerage account:

- Vanguard Total Stock Market Index Fund (VTSAX): $115,000

- Vanguard Total Bond Market Index Fund (VBTLX): $28,000

- Vanguard Money Market Fund (VMFXX): $14,000

- Gold and Silver ETFs: $2,000

With the rest being some random individual stocks that I’m not really in love with but also don’t want to sell due to tax implications.

401(k): $167,438 ($3,776)

My $1,600 monthly contributions to my 401k are still broken up as:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

I also get a decent match to these contributions from my employer.

Roth IRA: $41,151 ($1,476)

Still just market movement to the following accounts, since I hit my $6,000 maximum Roth IRA contribution at the beginning of 2020.

- Vanguard REIT Index (VGSLX): $35K

- Vanguard Total International Index (VTIAX): $6K

Rent Payable: $807 (+$5)

For newer readers, I split a mortgage for a house in Minneapolis that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $1,741 ($43)

With COVID-19 limiting the spending possibilities, it’s been easier to keep the credit card charges lower each month.

As usual, this amount gets paid in full before I pay any interest.

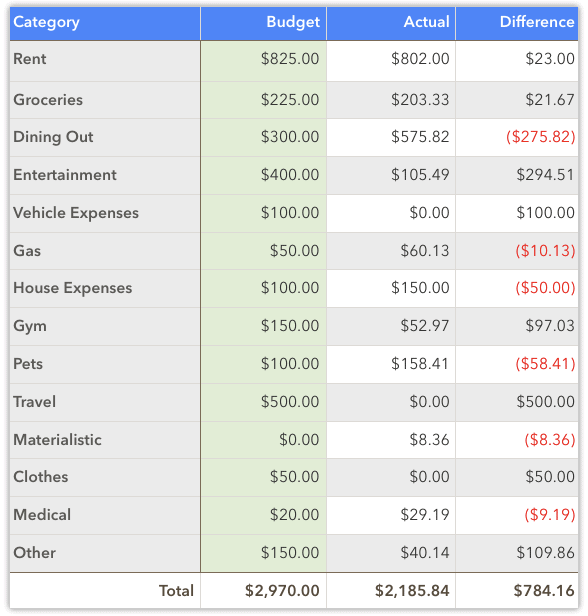

Total September Spending: $2,186

Dining Out: $576

What the…?

I think we got a little stir crazy from COVID this month, so we found ourselves doing some patio and take out dinning. And by a little, I mean $600 worth!

This was mostly due to The Big One… Lady Money Wizard picked up a new job, so we enjoyed a very fancy meal out to celebrate!

Since I said I wanted to strategically spend a little more money this year, I’m actually surprised that I have no regrets about this one.

Entertainment: $105

Mostly limited to backyard campfires these days. As frugal as it sounds, this still came with some expenses for firewood, drinks, etc.

Gas: $60

I was driving all over creation during my temporary infatuation with antique dealin’, so I think that’s the main reason I spent a little more on gas this month.

I think I spent a little more on gas because I was driving all over creation during my temporary infatuation with antique dealin’.

Gym: $53

I cancelled my gym membership a while back because of the outbreak. This month, I got back into the groove by paying for a popup yoga class. But more importantly, I also grabbed what I expect might be my greatest purchase of 2020: a set of gymnastics rings.

In a world where every piece of workout equipment is either sold out or suddenly subject to a 300% markup, the rings’ $30 price tag was a pleasant surprise.

I hung these suckers in the rafters of my basement, and I’ve gotta say… so far the workouts from these two pieces of wood rival anything I could have gotten from a multi-thousand dollar set of dumbbells. Super excited about these!

Pets: $158

Lots of pet supplies needing re-upping this month – mostly food, pet shampoo, etc.

How was your September?

As always, I really enjoy hearing from everyone. So leave your comments below!

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Interesting time to pick up anything gold and silver. I held a ton of physical silver and sold most of it off. I just don’t see it going much higher than when it was 29-30. Good luck with that one.

Gold & Silver look good to me as well. Can’t spend the kind of money the government is spending and not devalue the dollar. We will have to pay for all this someday. Nice Move. May I suggest buying a little physical gold & silver each month?!

I should have an article about buying physical bullion coming out soon!

I would be curious to learn what exactly those individual stocks are that you purchased when you started your investing journey.

I’ve written about them before in the earlier updates. Off the the top of my head it’s mostly some pharmaceutical companies, cell phone providers, and computer companies. Basically just a few failed attempts to implement Buffett’s value approach.

There’s even some Uranium producers that I thought would recover after the Fukushima nuclear disaster. Whoops! Pretty sure one of those literally went to zero.

https://mymoneywizard.com/buying-stocks-teenager/

Silver is a commodity. It has a dozen industrial uses. There are also rumors of near-future high-tech requirements for silver that will use up the current supply. I *always* keep a modest hoard of silver tucked away somewhere (the physical bullion). Visual Capitalist recently published a very interesting graph about the history of silver.: https://www.visualcapitalist.com/silver-bulls-how-silver-performs/

I understand your portfolio allocation goals, but can you explain why your 401K is aggressive with 100% invested in equities, while your brokerage account has a high concentration in bonds and cash? Is it because of your investment options in each of those accounts? I thought for tax-efficiency purposes, it was best to keep bonds in a retirement vehicle?

You are correct. If you’re following the textbook, keeping a higher percentage of bonds in the 401k makes more sense for tax efficiency.

My thought is that I most likely won’t touch my 401(k) for another 30 years, so “smoothing out the ride” with a bunch of bonds isn’t very important to me. On the other hand, it’s pretty likely that I’ll live off some portion of my brokerage account when I leave my job within the next five years, so it’d be nice if that portfolio is a little more diversified and protected against a big crash.

Thanks for the explanation WIZ. Looking at the moves you have made with your cash these past two months, it looks like you have ditched the “rental property idea” for the umpteenth time? You sure know how to go back and forth, and I bet that process has caused you countless sleepless nights over the past few years!!!! No need to reply….and the monthly updates make for great reading! Thx.

What’s next after your job?