Ever had one of those brutal workdays?

The type that makes you stop and ask yourself how on earth your life brought you here.

I had one of those days recently. It was halfway through a meeting debating the absolutely mind-numbing details only the white-collar world could even begin to care about.

“Should we call them TPS Reports or TSP reports?” was the basic gist of the 55 MINUTE discussion that followed.

So I did the office environment equivalent of whipping up a comforting batch of mom’s mac and cheese. I fired up Personal Capital, checked my account balances, and started doing a level of complex mental math that would make Albert Einstein proud.

And in the process, I laid out a plan to walk away from the boring office environment in less than six years. And still end up a crazy rich multi-millionaire.

How to turn a 12 year working career into the foundation of a $4 million portfolio

Here’s what we know:

- I just turned 29

- My net worth is somewhere around $270,000.

- I saved $36,000 last year.

- And by limiting my spending to less than $30,000 this year, I’m pretty sure I can save $40,000 in 2019 and each year in the foreseeable future.

We also know that the stock market typically earns 7% per year, after accounting for inflation. (A lot of people get mixed up and think the market returns 7% before inflation, but if you don’t believe me, you can check for yourself by looking back on just about any period over the past 100 years.)

Long story short, what happens if I put that scenario on auto-pilot for the next 6 years?

For 6 short years, it’d mean waking up, putting on my business-casual clothes, and speaking the corporate jargon day in and day out. It would mean NOT flipping any tables, exercising my F-U Money, or going rogue with a $35,000 vehicle purchase to show the world how successful I feel.

On the plus, it would mean holding steady a level of annual spending that affords me a modest 1,200 square foot house near a major metro area, as many awesome travel plans throughout the year as my vacation balance will allow, and overall, an extremely comfortable day-to-day lifestyle.

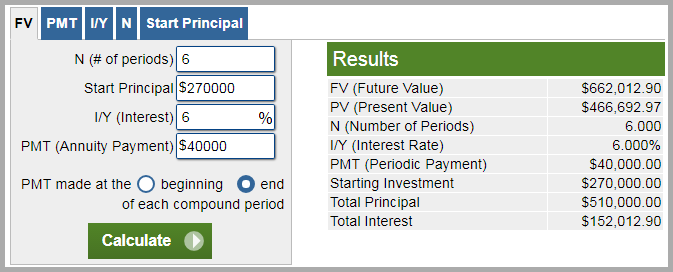

That plan sounds manageable, so let’s fire up the financial calculator and take a peak into the crystal ball of my financial future. We’ll use a 6% investment growth rate, instead of the historical 7%, just to be extra cautious.

Fast forward to a 35-year-old Money Wizard.

Here’s what that hazy crystal ball shows. Myself, as a 35 year old, with $660,000 in a mixture 401k, IRA, and stock market savings.

More interesting, my 35-year-old self now faces quite the dilemma.

Using the 4 percent rule, future Money Wizard’s $660,000 is enough to earn about $26,000 a year in passive income.

With a few clever budgetary tweaks, he could probably live off that $26K a year forever. But 35-year-old Money Wizard also has a shameless love of annual ski trips with his buddies, weekly dinners out with Lady Money Wizard, and maybe even a family to raise. (Which we’ll talk about in a second.)

He’s also aware that early retirement, in the traditional sense of never working again while you live solely off your investments, comes with some obvious risks that the rest of the early retirement community tends to gloss over.

In other words, he’d prefer a little more breathing room. And he also has a lingering goal, for better or for worse, to experience life as a multi-millionaire at some point. But he doesn’t want to slave away in corporate America for another 30 years to get there.

So, what if instead of completely checking out of the working world forever, he just took his foot off the gas pedal?

Age 35 to 65: Mixing Early Retirement with Hobby Employment

More specifically, what if he trades in his fancy corporate job, and all of its corporate headaches, for something with far more freedom?

So, at age 35, future Money Wizard finally decides to exercise his F-U money in the corporate world, flipping a table on his way out. (Or maybe just writing a thankful resignation letter and fading into the sunset. Either one works.)

Over the past 12 years, by hitting his savings goals, he’s proven to himself that he doesn’t need any more than about $30,000 a year to live what he considers an awesome lifestyle.

So, he goes job hunting.

This time, as a newly liberated corporate employee, not with the goal not of chasing a meaningless percentage point pay raise, but instead prioritizing something that will spark his passions, give him tons of free time, and earn him… no more than about $15 an hour.

Or $30,000 a year.

This opens a whole world of job possibilities he otherwise could never dream of.

- Part time consultant? Could probably earn $30K a year with that…

- Winter ski-school instructor, summer baseball coach? That sounds fun.

- Full-time MyMoneyWizard.com blogger? Might be able to pay those bills…

- Grocery store bagger? Why not!

It doesn’t really matter what I do. As long as I managed to earn a little bit of money, I could follow my passions wherever they take me.

This isn’t exactly a revolutionary idea. Everyone’s heard of the aspiring actor who moved across the country to Hollywood without a dollar in their pocket, the hopeful fashion designer getting a fresh start in NYC, or the risk-taking entrepreneur who quits their career to chase an idea.

But unlike those free spirits following their dreams like a high-wire act with no safety net, I’d hopefully have a rock-solid backup plan of over $660,000 in the bank.

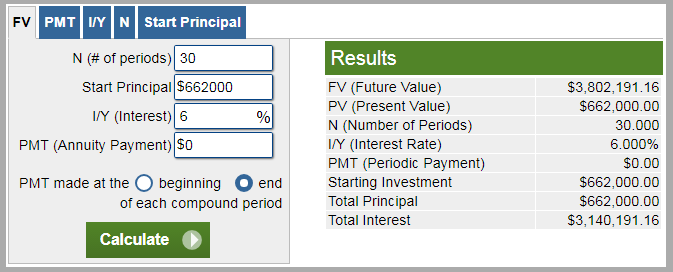

And as long as I made enough enough over the next 30 years to pay the bare minimum bills, without dipping into my lump sum of savings, that backup plan would continue to grow and grow.

Age 65+: Filthy Rich Status

After 30 years of making near-minimum wage while my investments silently compound behind the scenes, 65-year-old money wizard is looking at a new account balance of…

$3.8 million dollars.

At this point. All bets are off.

At a modest 4% return, $3.8 million is enough to spit off $152,000 a year in near-guaranteed income. Not to mention social security would likely provide another $20,000 a year or so from my 12 years in corporate America and another 30 years earning money doing who knows what.

$172,000 a year is about six times more than I’ve ever spent in my life. And… this part’s important… we’re still not even considering the nearly $4 million dollars in principal.

All in all, we’re looking at a level of wealth that’d take extremely lavish spending to ever dent. First class plane tickets, pent-house property, once-in-a-rich-person’s-lifetime experiences… I don’t even know where I’d begin with this much cash.

Or more realistically, it’s enough to fund everything I’d ever want while providing the ultimate insurance policy against any long-term health risks in old age. (Which, for the record, I think is an overblown concern.)

Hey wait, what about a family?

The most surprising part in this whole day-dreamed scenario?

The most common roadblock in the discussion of early financial freedom – a family – barely even changes any of these plans.

If married, Lady Money Wizard would likely find herself in the same boat as me – a 35-year-old looking for a hobby to cover her minimum living expenses. Like me, she’d be job hunting around the $25-30,000 a year salary range.

Kids would obviously change things too, but the only monetary impact would be increasing that minimum earnings figure between the two of us.

When you dig into the numbers, a reasonable family can raise a child for less than $10,000 a year, and there’s some shared efficiencies for a second child. In other words, we’d each be looking at raising our minimum hobby earnings by around $5,000 a year or so.

By the time the kids were college aged, we’d be approaching our 50s. Which means the silent portfolio would already be worth multi-millions, and we could either provide a little bit of parental help with the college costs or just pay the whole tuition outright. If we did the latter, we’d probably reach age 65 with around $3 million instead of $4 million.

Conclusion – Continued Employment vs. Early Retirement? How about both!

In the world of our parents and grandparents, there seemed to be one option. Get a good paying job, give up all your hobbies in exchange for extra hours at the corporation, and stay there for 40+ years. No matter how miserable you felt.

Then some early retirement folks broke the mold. Suddenly, it seemed a lot of people started targeting new goal – racing as fast as possible towards a bare minimum number, then living as frugally as possible for the rest of your life to keep from running out of money.

But from my view, both of those extreme paths limit your options.

And I’m chasing financial freedom to expand my options, not limit them. Which is why I think building up a financial safety net, then taking the plunge towards paid hobbies is the perfect solution.

I’m setting it as my new life goal. Anyone want to join me?

Jinx!! That’s what exactly my plan is. I have $150k in index funds. Working 2 jobs allows me to save $55k a year. Age 34 at present and hope to semi retire at age 40 with just over $600. I then plan to travel most of the year and work 3 months at a time (nurse) to support my travels without dipping into my investments which will be worth over $3 million dollars at age 65. If I meet Mr Right though plans may change a bit in terms of travel length but not hours worked. Good luck

Keep saving that $55K and you’ll be there in no time!

I had the same idea. Stop being a white collar worker once I get a good safety-net; throw on an apron and be the best Starbucks barista there is.

Just stumbled across your website the other day and the treasure trove of articles in your archive is fantastic.I also have my eyes on a portfolio of 3-4 million. However, it’s not going to happen until my early 60’s (I’m 25). I currently contribute 15% into my 401k, max out the Roth IRA, and put $100/month into my brokerage account. Thanks for all the information and keep up the good work.

Glad you enjoy the site! Keep up the savings!

2 HEALTHY kids will run you about $2000 a month. There are some shared economies but that mostly equates to ‘stuff’ (high chair, pack-n-play, etc.).

Plan on $400 per month to feed 2

Plan on $300 a month or so to insure them

Plan on about $50 a month, minimum, on incidentals [extracurriculars, birthday parties, etc.]. If you need speech therapy or something along those lines prepare for a biatchslap of reality depending on where you live.

Childcare is up in the air. It is critical to afford kids the best opportunity within your means as early as possible as this will save a lot of bs and expense down the line (think better 2 year old program – 3rd grade in order to get a full college scholarship). Our personal situation gives us a lot of free family child care and dirt cheap private school tuition. This plus camps, classes, etc. runs about $8500 per year total covering the 2 but it will go up for us (1 kid is very very young) and will eventually come back down.

College savings…we do a little bit each month through a 529 and they each have an utma for birthday money etc.. This again is totally discretionary but IMHO between 50$ – 100$ / month is a minimum target per kid starting in the first few months of life.

Fun stuff not including vacations…we carry about 300$ worth of memberships (zoo and whatnot) per year and more than get our money’s worth.

Vacations or any travel…there is an inverse economy of scale. Again that is a personal choice.

Not to mention Christmas and new clothes (which you have to buy at least once and can pass down, replacing worn out stuff) and other random stuff.

Not to mention medical care above and beyond routine stuff. Again this depends a lot on your situation and can be challenging to gauge. Emergency fund necessary, at least enough to cover a FAMILY deductible.

That said there are a lot of intangibles. Kids are excellent. But they are expensive. And there is a factor of lost opportunity BUT all in all the investment in family is well worth it. The alternative is to pull an ebinezer scrooge and pile up cash at the expense of relationships until your on firm financial footing and become a generous old coot at the end.

Thanks for the data point about kids!

Does that $1,000 per month per kid include your cost of camps and discounted private school?

To add another data point:

(Sorry, this became long. TLDR: you can raise kids successfully w/out tons of money)

My wife and I are raising 4 kids. We plan to possibly swap duties at some point, but currently I am working outside the home while she works raising kids inside the home. I make about 55k teaching at a community college. (Teaching is awesome, by the way, as you get a taste of early retirement every summer!) We manage to save about 22k-25k most years, so we are living on about 30-33k. We would probably still need 25k even without kids, so I would guess that we require about 5-8k PER YEAR for ALL 4 kids. So maybe $200/mo per kid tops. Now much of that is possible because we can save a ton of money by having a stay-at-home parent. (And this is not an easy, nor always fun job – and not always for everyone.) Even, then how do we do this? We don’t have some secret, but I notice that children are often the saver’s Achilles heel. Some expense is unavoidable, but creativity and value seeking can make a huge difference. For example, kids are one area where people feel the need to keep up with the Jones’. Kids don’t need designer clothes, fancy electronics, expensive vacations, gourmet dining, etc.. They DO need basic necessities, loving care from an adult, and opportunities for exploration and creativity.

The other day I realized that we are happy to appear ‘poor’ in order to become rich. A lot of people do it backwards – appearing ‘rich’ and staying poor.

There’s no question that kids complicate the FIRE picture, but they aren’t a disqualifier either..

I’m on a similar trajectory in hopefully getting out of the corporate america rat race by age 45 (8.5 yrs from now) and then picking up a hobby or part time gig to pay the bills until 50-55 when i would fully retire. Gotta say I do agree with Shemp in that your anticipated costs to raise a child seem very optimistic. Obviously the largest expense by far is daycare so if you can minimize that one you are in good shape but as with everything in life you get what you pay for. My son’s daycare alone costs us $1400 per month and this is for a good but not great school, some we looked at went as high as 2k/month. This doesn’t even include food, clothes, diapers, 529, etc. I think your 4M nest egg will afford you some flexibility but just prepared!

Are you using 6% return for your whole net worth? Or just your stocks? Because as you grow older, a smaller percentage of your holdings will be in stocks vs bonds, so it’s not really 6% all those years.

Yup! I’m on the same boat. My wife and I knew we didn’t want to stop working and focus on living as frugally as possible, but rather we wanted to work to get to a position where we could have the freedom to walk away from our jobs and find something that could potentially pay less but where we’d have flexibility and would enjoy doing – preferably part time!

I’m all about this lifestyle. I think walking away from full time work early, yet still doing some part time work would be a great way to bridge that gap between early retirement and full time work.

Doing work you enjoy for less money and ideally less time commitment can give you the sense of fulfillment while also giving you your time back! (And get you away from a soul sucking job of that applies to you).

As long as you cover some or a majority of your living expenses there is really no downside!

Agreed!

This is pretty much the same thing I have in mind. I’m a couple years behind you in age and net worth, but I see myself working for Cabela’s or maybe Costco. I might just do odd jobs and learn some trades which will translate into my own home. Just coast and front costs while the first decade of work grows.

Cool to see so many others with a similar mindset!

Hi Sean, I have been reading a few of your articles lately and I like the mindset but am curious about a few things. So the bare minimum you need to live is 30K but wouldn’t you need over 40K as your salary? I am thinking about taxes. Then the other issue is that most companies help pay for insurance like health, dental, and vision so would this be extra costs if your place of employment did not do this? Then to top it all off your model focuses on the assumption of long-term smoothing that you could live on this. I am not completely against this since you have a big basket to protect yourself, but what happens if there is an accident with, your child needs surgery, would this leave you to reshape your career moves and would this be problematic because it could force you to dip into your savings and send you back years of exponential income. Let me know your thoughts on this. I believe that you can make it work with 1.2MM saved 60K gives you much more wiggle room a year. Also are you looking to set aside money for your kids for college? Hopefully not too personal of a question, but curious since it is something I am looking to do and if that fits into your 30-35K of savings.

A couple random responses:

-You’re right about having to earn more money because of taxes; I left it out for simplicity.

-Insurance could go up as well, or you could try to find a job to help in the cost.

-Unexpected expenses could be paid for via earning more or, as a last resort, dipping into the safety net.

-I mention college in the section about kids.

Appreciate the comment!

I like the sound of this, it sounds like the idea of retiring ‘to’ something rather than simply retiring ‘from’ something.

A few of observations:

1. You might change as a person between now and 35. You may be happy living on $30k a year now but for all you know you could reach 35 and want a completely different (perhaps more lavish, perhaps more lean) existence.

2. The equities portfolio projections hinge on the expected long term returns from equities. Given recent experiments with monetary policy (e.g. low / negative interest rates and quantitative easing) I think there a possibility that the long term returns from equities could be below their historical average for the past 100 years and this will undoubtedly have an impact on the projected size of your equities portfolio.

HH

Great points! Especially about the changing as a person. Even from starting this site until now, I’ve surprised myself in that retiring forever doesn’t sound as appealing as before, and I’m instead lured into a passion project of sorts.

Good point about potential returns as well. There’s a little bit of wiggle room built in there (6% vs. over 7% historical, ending with a $4 million portfolio that I’d have almost no use for, etc.) but I think your comment highlights an important lesson. Have a plan, but don’t be afraid of change either!

Thanks for the article and perspective, Money Wiz! I think you make some great points, and I think you do a great job of challenging readers to think outside the box at ways to move on from the corporate grind.

However, I’d like to make a comment on the cost of raising a child and the data you cited. From the monetary perspective you have taken, the biggest factor to consider, by far, is whether or not you will send your young children to daycare. If, in your hypothetical, there is a stay-at-home parent (or grandparent, relative, etc who is willing and able to watch the children), then the data you cited seems reasonable, possibly even overstated. But if both parents continue working and you must pay full-time day care costs, the data you cited seems grossly understated. I know in the DFW market it was a challenge to find full-time daycare for less than $220/week (approx. $10K/year), and I assume that the Twin Cities would be similar. As you are looking forward, this is something to keep in mind!

Thanks again!

I think you’re right on the money here (no pun intended). The reality is you’ll go nuts retiring at 35 and doing nothing. It’s a much better option to find something you really enjoy and would enjoy getting some mastery out of. I also think people underestimate the amount of $ they’ll need for healthcare. It’s currently growing at 3x inflation rate. I doubt people’s investments will do that well.

Getting a job you like that provides your basic needs with healthcare and a fat nestegg is not a bad life at all.

Healthcare costs in the USA are the main problem that make me hesitate giving up my corporate job with employer-subsidized insurance for something “fun” or part-time– I’m 32 and will probably already be set with my retirement account investments once I hit 65, but is there any good solution for bridging the (long) gap to Medicare coverage? The ACA seems like a little bit of a wildcard at this point…e.g., allowing for $500-$1000/month per person kind of blows any normal early retirement budget out of the water!

So interesting to hear the jobs people would do once they left their full time jobs.

I think I would work at a make up store..

I did this for a while before I started my corporate job and I found helping people with hair, makeup, skin, beauty etc surprisingly very fulfilling. It made me feel great knowing that I was helping people with something I really understood and enjoyed talking about. Plus I loved being on my feet all day rather than tied to a computer & desk. I was sad to leave and enter the post university & full time work force.

I agree. Very interesting!

Time to start a make up company, Kardashian-style, and be worth billions??

Hi, I have a similar plan. In my case it is real estate investing though, as polish stock exchange doesn’t pay that well. One aspect that I really like is the moment of realization. I’m actually exactly at your 35 years-old-moment and I happen to be 35 🙂 I have $150k of savings, with big chunk made in the last 2 years on RE boom. The general plan was to live frugally and increase my savings. I always knew about the freedom that money brings, but the moment I cashed my investments and did the math, that I can have a passion part time job and live comfortably for the rest of my life was really liberating. Suddenly all work stresses seemed irrelevant and I started planning travels and grand plans for family. My situation is pretty different though. In Poland the cost of living is lower, lot of free education, free health insurance etc.

Overall, this is a worthy goal you’re chasing and good luck.

Awesome! Very cool story, thanks for sharing.

Couldn’t agree more, btw. When I calculated that I’d already saved enough to retire a multi-millionaire, I immediately felt all work-related stress disappear.

Greets from Brazil, Money Wizard…

Very interesting mindset and it is something I’m planning for myself too… Only problem is we can’t manage to live on a R$30.000 year budget here. But at the other side we are managing to save up to R$ 80.000 a year… We will see how it goes! Can’t wait to be able to switch to a JOB I have 100% pleasure to work for. Good luck on your journey and keep on going. Ps: Went to the twin cities and loved everything about the place… Great place to live! Personally I love the cold weather (I live in a year-long hot weather place so it’s understandable).

… how much would $172000 per year be worth in today’s dollars after being adjusted for 35 years of inflation?

I think that would be about $61000 in today’s money?

What would be $61,000? The net worth is already adjusted for inflation

How can you include the 401k money in this since you can’t touch it until you’re 65? Any annual gains on the 401k would be untouchable, unless you wanted to pay the penalty + income tax. Just trying to understand the math.

Hi, it’s actually age 59.5 to be able to withdraw money from 401k accounts penalty free. Hope this info makes your retirement planning easier!

Good luck on your new “hobby job” plan money wizard! Kids have a habit of derailing any plans you might make today… that’s just the nature of kids.

But I agree that having that safety net is an important first step.

Chris, Learn about the Roth IRA Conversion Ladder: https://www.madfientist.com/how-to-access-retirement-funds-early/

Hey Money Wizard,

I’m a big fan of your site and follow your posts closely.

My current nest egg is $330,000. I have this split between my Vanguard ($290k) and TD Ameritrade ($40k). Of my $290k in Vanguard $70k is cash in the prime money market fund. With the market near an all time high I’m hesitant to put this cash into my funds (Vanguard SP500 Index and VTIAX).

I am investing for the long term and don’t plan on touching this money until retirement. What do you recommend?

Nice plan. It takes a lot of pressure off. 🙂

a simple question that I am really pondering for a while:

If you say to need annually $30k and your guestimating by the 4% rule you’d need 30*25=$750k…..

Doesn’t that forget the fact that inflation hits your annual spendings too?!

So, say with the average inflatione rate your costs usually double every 15 years.

So in 15years you’d need annually $60k and in 30years $120k annually?

thx for clearing this issue

Yogi

Good question. The answer lies in the assumptions used for market returns.

The market usually returns 10% per year, including inflation. However, in this article and throughout the blog, I’m assuming my money only earns 6% per year. By adjusted expected returns by inflation, you’re not giving your future portfolio the benefit of inflation. That also means that any future spending from that portfolio is automatically adjusted for inflation too.

So you’re right, in the future you’d need more than $30k per year. In fact, holding all else equal, the exact amount more that you’d need would be equal to the rate of inflation. But in reality, your future portfolio would also be more than $750K, because it grew at the rate you assumed + the rate of inflation. The two cancel each other out. In other words, when you adjust for inflation on the front end, it adjusts all future spending into today’s dollars.

Run the numbers yourself and it becomes a little more intuitive. Say you’re a 25 year old who wants to retire at 40 and live off $30K per year. So you need $750K by age 40, and if you’re starting from zero, you save $32,000 a year to get there. Adjusting for inflation, we’d use a 6% return, and our future portfolio would be $744,831 – enough to provide $29,793 per year at a 4% withdrawal. But if we included inflation in the returns (which is what would actually happen in real life) we’d use something like a 10% rate of return. In that case, the future portfolio would actually grow to $1.02 million – enough to provide $40,669 of future spending. That $40.7K buys the exact same amount as $29.8K today.

thank you kindly for the detailed and quick answer!