Last year I dared to go where no other blogger dared to go.

I wrote a post about my New Year’s resolutions.

Okay, maybe that’s not so unusual. It seems like every blogger posts their New Year’s Resolutions these days.

But how many of those bloggers actually follow up on whether they kept those resolutions?

Get your Boos and your Cheers ready, because today we’re looking back on all of my resolutions that went well, and… let’s just say, “not so well.”

A Look Back on 2018’s New Year’s Resolutions

1. Save over 60% of my income – FAIL.

Saving 60% of my take home pay is an ambitious goal that could have me retiring in less than 10 years. For obvious reasons, it’s something I strive for every year.

Unfortunately, I fell 8 percentage points short on this one in 2018. I ended the year saving 52% of my take home pay, which, as my blogging buddy Paul explained in the comments, kicks me out of this year’s Frugality Olympics.

“But for a normal human, you’re killing it,” he conceded.

Thanks for the words of encouragement, Paul! I’m gonna do everything I can to invite myself to next year’s Frugality Olympics though!

2. Hit the IRS maximum of $18,500 in my work’s 401k plan. – Intentional fail.

I started the year on pace to make this happen, but around March I spotted an awesome rental duplex for sale at a great price.

Unfortunately, I couldn’t afford the down payment with the cash I had available. And the idea of selling stocks and taking a tax hit for rental real estate, an investment type I have approximately zero experience with, made me uncomfortable.

Worse though, I crunched some numbers and realized that with the bulk of my savings funneling into my 401k, it’d be another 2-3 years before I’d have the cash built up to afford my first rental property.

So, with over $200,000 in stock market exposure already, around May-June I dialed back my 401k contributions down to the employer-matching minimum, in hopes of building up a cash pile to buy my first rental real estate.

That said, despite the shift, I’d gotten a little more than 1/3 of the way to my original goal by year’s end. All in all, I contributed $7,000 to my 401k in 2018. ($13,400 if you count employer matching.)

3. Save $20,000 – sort of success.

By the end of the year, I saved $22,800 in cash, which makes it look like I knocked this ambitious goal out of the park. There’s a Font Size 72 asterisk to that statement though.

I originally intended that $20,000 to be saved after the previously mentioned 401k goal. Instead, I lived not-quite-as-frugally-as-planned (I’m looking at you, $6,000+ kitchen remodel) so hitting this goal was mostly the result of redirecting my 401k contributions towards cash savings.

4. Max out my Roth IRA for the 2018 tax year – success, but a little late.

In 2018, I specifically said I hoped to max this out throughout the year, instead of waiting until the last minute. Again.

And yet, for some reason, I found myself looking at my accounts on December 31, 2018, with a big fat $0 of Roth contributions during the year.

Because you have until April to make the previous year’s Roth contributions, I contributed $2,500 to my Roth in January 2019 and will contribute the remaining $3,000 in February.

(I chose to spread out the contributions slightly because Vanguard doesn’t charge trading fees, so entering a month apart reduces risk slightly at no additional cost. Although it probably won’t matter a decade from now.)

5. Keep MyMoneyWizard.com rocking. – success!

Well, that’s a vague goal…

But according to some words I wrote last year, this included three parts.

a) Send out a survey to my email subscribers about the topics they want to see me write about. – Fail. Although I did bring this up during email conversations with readers, which helped me pick up some valuable insight.

b) Do a better job answering reader emails. – Success! I think I responded to as many reader emails as my schedule would allow. That said, the inbox kept-a-flooding, and I realized that with MyMoneyWizard’s ever-growing traffic, spending several hours a week answering box loads of emails just wasn’t sustainable, unfortunately.

So, I started up the reader mailbag series, which I hope will allow me to leverage my time and let even more readers to benefit from similar questions.

c) Shoot for quality over quantity, with roughly 1 awesome post per week – Success! At least I think the posts are awesome…

Overall, I’m really proud of this one.

In 2018, I posted 3-6 articles every month, for a total of 54 articles during the year.

While it pales in comparison to some of the more efficient writers out there, it’s still crazy to think that the average post on MyMoneyWizrd.com is at least 1,500 words. In other words, I was basically writing a 6-page college essay in my spare time, every week. Put another way, I wrote enough words in 2018 to fill the average 300 page novel!

Not bad for a dude with a full time job!

I’m proud I made writing a priority even with all sorts of crazy stuff going on in my life, because penning this blog is without a doubt one of the most rewarding things I’ve ever done in my life.

6. Use my time more efficiently – Success (with a ton of room for continued improvement)

Another three part resolution:

- Less time on my phone – A constant work in progress, but I definitely cut down.

- Better use of the morning commute – I successfully banned radio from my car this year, and the result has been learning all sorts of cool stuff while driving, thanks to the magic of podcasts and audiobooks.

- Outsourcing aspects of the blog I know I’m terrible at – I did this on an elementary level in 2018 by outsourcing nearly all technical work. There’s no sense beating my head against the wall for hours when someone else can fix it in minutes.

In the last few months of the year, I also started experimenting with tracking my time during the day, down to the half hour. And yes, I realize this makes me sound like an OCD wacko.

But I figured if tracking your spending is far and away the best way to manage your finances, then tracking your time must be a pretty solid way to increase productivity.

So, I created a basic spreadsheet in the numbers app, with one column showing the time and the other showing what I did.

And so far, the results have been astounding. When I want to be productive, I start tracking. Somehow, just knowing that my time will be logged steers me away from unproductive sinks and keeps me laser focused on the productive ones.

I did get away from this during the start of 2019, so it’s something I can keep working on.

7. Read 20 books – FAIL.

Last year, I only read 9 books. I was a streaky reader too, since I read 6 of those 9 during an enthusiastic two month reading rampage between July and August.

(Shout out to my favorite book of the year, How to Get Rich, which I showcased in my post about Britain’s most eccentric billionaire.)

8. Enjoy Life – Success.

Saving the most important for last.

Throughout all of 2018, I slowly crept closer and closer to my 29th birthday. And 29 is a terrifying close to 30, and at that point we’re practically ready for our midlife crisis.

I joke, but this did serve as a constant reminder of just how short life really is. It’s something I considered frequently throughout the year, usually to help put my first-world problems into perspective, get out of my own head, or remind myself how good I’ve got it.

Speaking of which, a quick review of life’s Big 3

I consider a few main staples of this “life” category to be Home, Health, and Money. I’ll take a quick minute to run through each of those to finish out this post.

On the relationship front, Lady Money Wizard and I approached our fifth anniversary. All is good there, and I feel incredibly fortunate to have found such an awesome partner.

Home Ownership Update

Together, we settled into our first full year of home ownership. The big news there was our massive renovation of the kitchen, which turned a nearly unusable space into the most functional room of the house.

We did pay big bucks for that privilege, but we also took on some minor projects ourselves. We painted some walls, installed new light fixtures, landscaped the garden, and fixed a few doors. All pretty minor projects, and all supposedly “as easy as it gets,” at least according to the DIY youtube videos.

And yet, in the process, I learned how incredible NOT handy I actually am.

There are people who just love working with their hands. And then there’s me.

Give me a computer and a random objective any day of the week, and I’ll get lost in the hours as I happily research until the sun sets and then rises again. I won’t think twice about throwing together spreadsheets, cranking out blog posts, or whatever else involves a keyboard and a mouse.

But when it comes to construction, the minutes drag by, and it usually only takes a few until I’ve created a total disaster. Which wouldn’t be so bad, and is somewhat expected of a first time home owner, except that I’ve learned I don’t enjoy the process of figuring it out. At all.

To be honest, the homeownership thing has been interesting, and I absolutely love our house. But for personality reasons, it definitely has me reconsidering the rental property goal.

Health Update

Early in the year, one of my closest friends got a surprising cancer diagnosis.

It was my first experience with the horrible disease impacting someone my own age. Overnight, cancer went from a really bad thing in the world to a really bad thing in YOUR world. Right now. The next few months were an awful reminder not to take anything for granted.

But I’m happy to report that after a year of battle, the friend is doing well.

In light of the roller coaster, my new favorite motto is that health is greater than wealth. I tried to live out that motto as much as I could, although I did see-saw on the preventative health side of things.

I held my 165 pound frame steady throughout the year, but during the summer my gym routine slipped, and I went nearly all of June through August within hitting a single gym.

In Minnesota, the great irony is that it’s somehow harder to stay in shape when it’s not freezing outside. As the patios open up and the beers start pouring, it seems every day is a cause for celebration. The gym took a backseat during those summer months, unfortunately.

Recently though, I’ve really stepped up my game. With ski season just around the corner, I’ve consistently gone to gym at least three days a week since November. Sometimes four!

I’ve also foregone the beach muscles, and instead focused almost entirely on cardio. And I’ve gotta say, I feel fantastic! Nothing like the fear of your legs giving out on top of a 14,000 ft. tall mountain to keep you motivated!

All this to say, I’m counting myself incredibly lucky to have stayed healthy during the year. Perhaps there’s no better proof of this than my mind-blowing medical spending of less than $25* during the year.

Net Worth Update

The reason you’re all here!

That said, I’ll keep this somewhat brief, since this post is getting long, and I literally write an article about this every month.

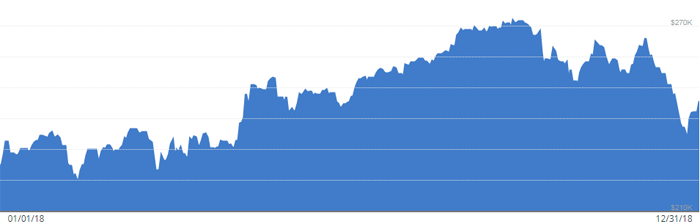

In 2018, my Net Worth grew from $228,000 to $249,000:

The growth was pushed along by $36,253 of savings last year, although the stock market’s crash in December did its best to temporarily erase some of that work. At one point, my net worth was a startling $271,000, before the market’s 15% tumble to close out 2018.

That said, I’m happy with where I am. I socked away a ton of money, and I mostly avoided lifestyle inflation.

But most importantly, I set myself up for a fantastic 2019. Which is what our next post will be all about.

Stay tuned!

Congrats on the great year! It’s good to set goals for the year, but priorities change over such a long period so some goals are not always applicable by the end of it. Seems like you hit most of the worthwhile ones!

Just because you don’t feel like you aren’t handy doesn’t mean rental properties aren’t for you. Just means you’d need to find someone who is handy to make all those needed repairs 🙂

I also have found it funny on the paradox of not working out nearly as much during the summer. You would definitely think it would be the time to do more of that!

Glad to read this today while we Minnesotans are trying to survive 60 below wind chills!!!! Stay warm and keep rocking your Money Success!!!! ☺

Solid progress in 2018 Money Wizard. Don’t sweat the 52% savings rate, for a mere mortal that’s pretty good! 😉

In 2019, I challenge you to 70%. Need to up your game a little!

During my saving years, I think my best year ever was about 75%.

Excellent year! Keep up the good work and great blog posts!

Thanks!