Hey fellow Money Wizards!

Welcome to a very special edition of the monthly net worth updates!

If you’re new here, every month I share my progress in growing my investment portfolio to a point that will let me walk away from work by age 35. I’m currently 29 with a couple hundred thousand to go, so let’s see the latest!

Life Update: May 2019

After a sleepy April, May was one of my most action packed months in a while!

There’s a lot to talk about, but the real headlines started when Lady Money Wizard and I took an anniversary vacation to California.

We planned on this being a nice and frugal trip to Yosemite National Park. Unfortunately, that plan was foiled about an hour after touching down at San Francisco International.

It turns out, as we stopped in one of San Francisco’s nicer neighborhoods to grab a quick 45 minute lunch before the long drive to Yosemite, a local resident welcomed us to the state in the friendliest way possible. He bashed in the rental car’s window and dashed away with half of my luggage.

He managed to score a few expensive items, like Lady Money Wizard’s iPad and my prescription glasses, but was nice enough to dump the stuff that would require effort to make him richer, like Mark Cuban’s book about business. Another San Francisco resident, who was actually friendly, found those on the side of the street and turned them into the police station. (Although he did keep my copy of The Power of Habit… I’m guessing he’s got some bad habits he wants to break?)

All in all, it could have been MUCH worse. Really, A LOT worse… I’ll explain why in a minute.

After a few hours of police reports, insurance phone calls, and trading out the rental car for one without a shattered window, we began our four hour drive to Yosemite National Park.

Once there, Yosemite greeted us with some of the most beautiful scenery I’ve ever seen. I especially appreciated the relaxing scene after such a chaotic start, and it allowed me to snap one of the best pictures I think I’ve ever taken in my life.

Shortly thereafter, under the snow covered giant sequoias, I reached into the other suitcase (the one the rental car thief didn’t steal) pulled out a family heirloom engagement ring, and asked Lady Money Wizard to marry me.

And to my huge sigh of relief, she said yes!

(Like I said, that lost bag could have been A WHOLE LOT worse…)

What’s the engagement mean for The Money Wizard’s future?

Well, I’m not sure exactly.

Financially, it shouldn’t have too big of an impact. Like I mentioned, I avoided the diamond scam by getting a free ring from my long lost Aunt.

We also plan on avoiding the $32,000 wedding, since we’ve both always imagined our ideal “wedding” as a small get-together in a park somewhere, complete with hot dogs and a cooler or three of beer.

We’re thinking the actual event will go down next summer. Until then, Lady Money Wizard even threw out the idea of us side hustling our way to a free wedding. (Did I get a keeper or what!?)

Stay tuned on that progress!

I’m also not sure whether we’ll be combining finances moving forward or not.

For now, after 5 years of dating, we’re just enjoying getting acclimated to the term “fiance.” 🙂

The Rest of May 2019

After that big happy event at the beginning of the Yosemite trip, we spent the next three days doing our best to enjoy the park.

That said, we faced some admittedly first world problems on the trip. It rained or snowed every single day. Half the park was closed due to said rain and snow. And our “heated” canvas tent turned out to be not-so heated, and we woke up in the middle of the night to a 30 degree tent and no equipment to deal with it.

But, like I said, first world problems! I can’t complain too much while on a vacation, and we both still left very happy campers.

Once back in Minnesota, The Money Pup reminded me that it’s pretty much summer:

So I brought him along for a Memorial Day weekend, when we followed some friends and family up north to help them open their lake cabin for the season.

Talk about a relaxing finish to the month! Now, to the money!

Net Worth Update: May 2019

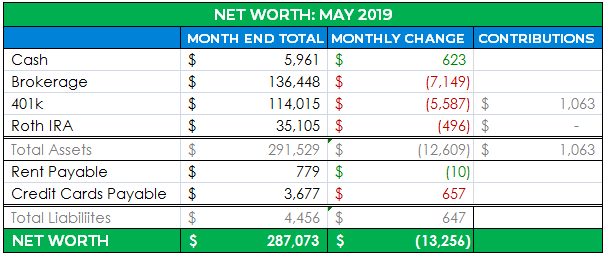

And the spreadsheet view:

Since we had so much to talk about in the intro, this section will be a little shorter than usual. Partly, that’s because I don’t want this post to turn into an unwieldy monster. And also, that’s because I’ve been too busy traveling, getting engaged, and dealing with theft to keep up with my finances like I should.

Cash: $5,961 (+$623)

Nothing crazy here, just an increase from the savings of my salary.

Brokerage: $136,448 ($7,149)

The main news here is the S&P 500 falling 6.5% in May alone. This was caused by Trump taking a hard stance on tariffs. Or something. (Nobody really knows the true causes of daily or monthly stock changes.)

My overall portfolio, including this brokerage section, fell 4.4% over the same time. This makes sense considering I’m mostly invested in indexes which roughly reflect the S&P 500. My portfolio performing a little better than the overall stock market is probably due to:

- Diversification – I’ve taken a bigger position of cash and bonds in the last year or so.

- Earning and saving money – All else equal, I’m growing the value of my portfolio as I try to save $40,000 this year.

I’ll have a more in-depth breakdown of the exact brokerage allocation next month, but the portfolio remains roughly 70% in Vanguard index funds, 15% in individual stocks, and 20% in Money Market/Bond funds.

401(k): $114,015 ($5,587)

Another $1,000 of automatic contributions and employer matching, which still wasn’t enough to offset the drop in value.

Roth IRA: $35,105 ($496)

You might remember that I maxed out my Roth IRA earlier this year. At the time, I put all $6,000 into Vanguard’s Federal Money Market Index fund, then planned on converting $1,000 a month to Vanguard’s REIT index.

I forgot to make that conversion this month, so I’ll convert the last $2,000 next month.

Rent Payable: $779 ($10)

For the newer readers, I live in Minneapolis in a house with my girlfriend fiance. (Weird!)

This cost represents my half of the mortgage, utilities, and anticipated home maintenance. We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.

Total May Spending: $3,714

Ahh! After hitting my spending goal in half of the past few months, I totally blew the budget in May!

Let’s see what happened:

Dining Out: $265

Although I actually went out to eat fewer times this month, the restaurants I chose were a little more expensive than usual.

Entertainment: $120

I went to a 1990s party at the beginning of the month, where I spend about $30 on fruit rollups, and Ace Ventura outfit, and a throwback Walkman CD player. Other major items included expenses for the Broadway Play “Dear Evan Hansen” and the cost of supplies for the cabin trip.

House Expenses: $171

Including $150 paid to the maid.

If you’re thinking $150 seems more expensive than the previous months, I agree. To my surprise, my cleaning service charged me 100% more than ever before. Me and the cleaners eventually agreed to split the difference, and I also agreed to find a new service. (More first word problems…)

Travel: $1,417

Given the occasion, rather than sharing the vacation costs 50/50 like Lady Money Wizard and I usually do, I offered to cover all the costs of our trip.

Still pricier than expected, mostly because of two things:

- The unexpected snow tied my hands into upgrading the rental car to an SUV at the last minute, which added a few hundred bucks to the deal.

- California is ridiculously expensive. Like, $4.90 a gallon expensive.

Materialistic: $64

My old headphones died, so I bought this awesome pair for $30.

Then, some Californian thug stole my backpack and headphones, and I bought the same awesome pair again.

Clothes: $52

Dry cleaning and some thrift shop finds for my summer work wardrobe.

Medical: $70

Replacement medication from my stolen toiletry bag.

Other: $436

Almost entirely replacement costs from the stolen backpack, including half the cost of a new iPad, a new electric toothbrush and razor, miscellaneous toiletries, etc. Crazy how much the small stuff adds up!

How as your May?

Thanks for reading along! I look forward to hearing about you in the comments!

PS – If you haven’t jumped on the bandwagon yet, I’m still obsessed with Personal Capital. Personal Capital will automatically track your spending, double check your portfolio allocation, and add up your entire net worth in one place.

Related Articles:

Congratulations MW and LMW!

Thanks Cole!

Congratulations on your engagement!

Always a breath of fresh air reading you blog posts. And how you have managed to keep this calm about having a load of your stuff jacked is beyond me! At least you had insurance though.

I did have a question which is broadly around this personal capital app. Since I live in the UK, its not available to me.

I use an app called moneybox for and Stocks and Shares ISA, pay most cost effective contributions into my pension (I’m guessing that’s the same as your employers 401k plan over the pond) and have shares in the company I work for. I have built myself a financial progress spreadsheet, but its painful having to manually update them all each month.

Do you have any suggestions on UK services?

Love the content – don’t give it up just because you are getting married 😉

Thanks!

One of my favorite parts about saving tons of cash is how stress-free you become about little money problems. IMO, if it can be fixed with money, it’s probably not worth stressing over. Otherwise, what’s the point of all the saving? That mental peace is a luxury way more powerful than any luxury good I could ever buy.

Oh, and the fact they missed the priceless heirloom really helped me see the glass half full too!

Wish I could help with the UK question. Any other UK readers have any suggestions?

That is an amazing way of looking at it. I’ve only managed to save a little so far, but it still gives me the ability to be more stress free. Ask me in 2 years how I’m doing and no doubt it will be even more stress-free!

Would be great to connect with any UK readers on this. Evidently, there seems to be a gap in the market which I’m sure we could exploit if we put our heads together…. 😉

How about branching out overseas Money Wizard? 😛

Congrats on the engagement! Being recently engaged myself, the fiance and I decided to merge our finances, live off one income, and stash the other for future investments. While it’s not for everyone, we’ve seen some great benefits already in a short amount of time. If one day once the dust settles you consider this path, would love to read your thoughts. Other than this money stuff, congrats and best wishes!

Thanks Bray!

I love this idea. Especially if you live off the smaller income! It’d be so epic to have a 100% savings rate on my entire salary every year.

For sure, that’s what we do live off the smaller income, it is an epic feeling to get to 100%.

Another great post. Congrats on your engagement!

My net worth grew by .6% this month, which I was pretty happy about considering the state of the market.

I’ve moved a good deal of my 401k (30ish%) to bonds in the last 9 months, and about half of my brokerage account is in cash. Still doing DCA into both, but I want to sit on a larger chunk of cash to invest in a potential dip in the next 12-18 months. This strategy has saved me a good deal of downside recently.

Thanks again for sharing. Love your content.

Thanks Joe! Impressive return on a brutal month.

I definitely follow your thought process. But I just get worried – I’ve expected a potential dip since 2015 or so, and yet the market has kept going up for the past four years. How long are you willing to hold your more conservative position?

I’m looking for a 10% pullback from the high. When the Dow hits 24,000, I’ll probably put half of my cash back in. Then I’ll do the same with another 10% pullback.

10+ years of a generally bullish market means we’re positioned for a correction. But to answer your question, if I don’t see that pullback within two more years, I’ll probably put it all back in.

Wow congratulations! That is so exciting! Very unfortunate about the theft, I’ve dealt with that before and it is such a hassle. Like you said it seems like it could’ve been a lot worse though!

Thanks Young FIRE Knight.

And yeah, definitely could have been worse! And the hassle almost seems worse than the cost.

Congratulations on your Engagement. All the best. A big step for both of you.

Thanks Tracy!

Congrats on the engagement Money Wizard!

Thanks Garrett!

Congratulations on your engagement

Thanks, Mercy!

Congratulations on your engagement!

I bet you were seriously relieved to see the thief had not taken your most important bag!

No kidding! At first, I didn’t even realize the other bag was missing, just because I was so relieved to see the important one still there!

Congratulations on your engagement! Very happy for you both!

Thanks, Scott!

All the best MW and LMW.

I hope we can hear about your marriage, and then about BMW as well.

Ha Ha Ha

I wish you both only the best.

BMW = Baby Money Wizard

Just so that some NMW’s do not get confused.

Ha Ha Ha again.

Haha!!! Love it.

Hey, congratulations MoneyWizard! That’s some pretty impressive luck too, not getting the ring stolen.

Can’t wait to hear more your and Lady MoneyWizard’s adventures!

Thanks, Mr. Tako! Lots more updates to come.

Congratulations to you! Big time bummer about the low life in San Francisco but at least you made the best of it into a great trip!

Thanks Brian!

Congrats Money Wizard! As someone following your blog for i while it feels kinda like i know you so this is exciting!

Love the idea of a low key wedding. One of my fiends/co-workers had a pretty sick low key wedding. It was a backyard wedding at his parents house and for catering he got a food truck, which is probably one of the cheapest ways to cater a wedding, who thing was a couple grand. It was a BBQ food truck and was awesome, they stuck around and did the midnight snack as well (poutine, since it was a Canadian wedding). He had a keg of beer and some 60s of booze and it was a great day. He said the best part of planning the wedding was doing a food truck tour of Calgary with his fiance and trying to pick which one they wanted to hire.

I figured i would throw it out there since you and the Money Lady love food experiences.

Dan, you really must really know me, because we started looking into food trucks a few days ago! Good idea though, I think we’ll have to add a food truck tour to those plans… 😉

Congratulations! I am impressed that you recognize that the problems you endured are first world problems, it shows you are well grounded! Props to your parents!

Congrats! Sorry to hear the theft, but at least he didn’t get the ring! Maybe that’s a sign the engagement was meant to be 🙂

I really like how you break your net worth down! Need to revise my update report to make it cleaner like yours.

Just want to say congrats on the engagement! I have been reading your articles for a while now and love how real you are about everything! I have taken quite a few lessons away from your blog and largely attribute surviving the last couple of months to how well we have planned and lived off of as little money as possible. We have had many life changes in the past couple of months ( lost a job, decided to live off of the hubs income, had a child, opportunity came up and husband quit his job and opened a business and lived off of our savings the past 2 months and now I go back to work in 2 weeks and we will continue to live off of 1 income!…phew!). A few years ago I would have told people they were crazy to just do what we did but now that we are in the grove of not being big spenders, it has been the best life style decision we have made. So thanks for the insight we have taken away from your blog and keep at it! I am excited to see how things morph in your and LMW future!

Congrats man… you’ve been an inspiration to me and so many others. You deserve this!

Hey MoneyWiz! I have been investing in the VTSAX fund you recommended but specifically what else do you invest in on Vanguard? Please help! Lol

Check back next month or read up on the past updates. I typically include it all. You’ll also like this post.

Hello to the Money Wizard,

This is my first time on this incredible blog that you have here about personal finance. I have a question, for the cash proportion, do you pay off your credit cards every month with that cash or do you leave a specific amount of cash on the side to pay off the credit cards when ready to do so? For example, I have $10,000 worth of credit card debt, do I keep $10,000 in a money market fund?