Hey, welcome!

Every month I track my progress to my goal of about $1 million in net worth, which I’m hoping will allow me to take an early retirement from my white collar office job. I’m currently 31 and hoping to retire within the next 4 years. (That’s coming up fast!)

Read on for the latest progress!

*As always, I am not an expert or financial advisor, so nothing on this site should be considered financial advice. These are just like, my opinions, man. Always do you own research, and always abide by The Dude.

Life Update: May 2021

May was actually a pretty fun month!

Here in Minnesota, May always acts like a weird hybrid of Spring and Summer, all in just 31 days.

Often, the month starts cold and chilly (still!), flips a switch early on, and seemingly overnight, flowers are blooming and greenery is back!

You know the season must be a huge morale booster if yours truly is taking phone pics of random flowers!

Most locals commemorate the occasion by finding someone, ANYONE, with a lake cabin and tagging along for the celebration.

In May, we weren’t any different. A friend was celebrating a birthday and decided to rent an awesome place on one of Minnesota’s 10,000 beautiful lakes, so Lady Money Wizard and I happily tagged along:

Back in the cities, the warming weather and ever-increasing vaccination rates sent the celebratory atmosphere into overdrive.

I found myself doing all sorts of stuff I couldn’t dream about doing just a few short months ago, like a trip to a Minnesota’s Twins game:

I feel like I’ve said this every update for the past few months, but it’s shocking how much comfort you can take in an ordinary event after you’ve gone without it for a while.

A baseball game? In person? I felt like the stunned spectators of the early 1900s, back in an era when visiting a baseball game was such a special occasion that the men dressed in suits and the kids got excited about their only chance to watch the sport. (No TVs back then!)

Such is life after The Great 2020 Reset…

Net Worth Update: May 2021

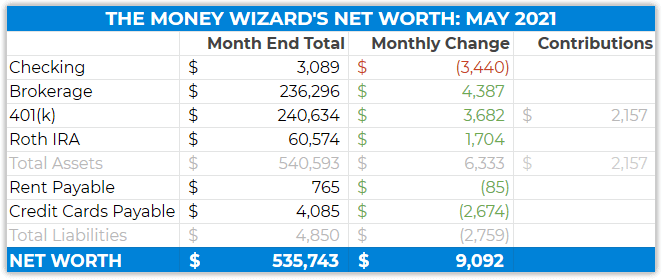

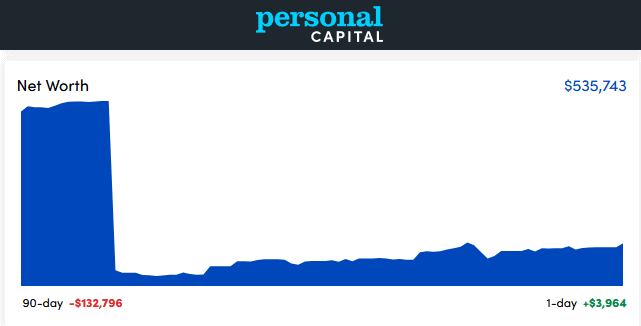

I’m sounding like a broken record, but ignore the Wall of Doom on the left side of the graph. That was just Personal Capital glitching out for a minute. Thankfully, I did NOT lose $132,000 over the last 90 day. (Net worth is actually up $31,283 over the past 90 days)

Can’t complain about a $9,000 increase in one month! In fact, any time your net worth grows 3x faster than your monthly spending, you know you’re heading in the right direction.

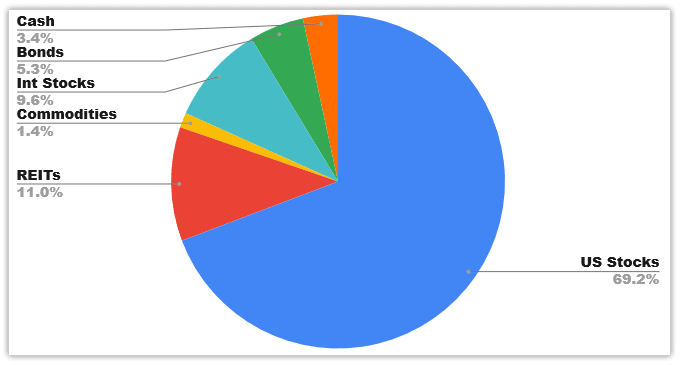

Portfolio allocation is pretty steady compared to previous months, although cash is noticeably down. Speaking of which…

Checking: $3,089 ($3,440)

Well, it only took me a few years, a huge unexpected tax bill, and a withdrawal or two to buy the dip in crypto, but I finally got my checking account balance to what I’d consider a more productive number.

Most people will look at such a low amount of cash and squirm. Dave Ramsey and Suzie Orman might even admit me to a mental hopsital!

But to that, I say:

- I’m one guy with modest living expenses. I don’t need an $800,000 emergency fund right now.

- I actually have about $15,000 cash in a Vanguard Money Market Fund (under my brokerage account)

- If something really disastrous ever happens, well that’s when the other $535,000 in my portfolio comes in handy.

For the foreseeable future, I’m going to try to keep my checking account below $5,000, so I can invest as much of my money into income producing assets as possible.

Brokerage: $236,296 (+$4,387)

A 1.9% increase over the previous month, due entirely to market movement. Interestingly, that increase was about the same as my entire take home pay from my six figure salary. Definitely getting close to financial independence!

For newer readers, the brokerage account is almost entirely broad stock market index funds. (Mostly VTSAX) If you’re ambitious or craving particulars, you can rummage through previous net worth updates where I provided exact numbers.

401(k): $240,634 (+$3,682)

I’m still contributing a hefty $2,200 per month to the 401k. That number is a combination of maxing out my $19,500 of personal contributions plus a generous employer match.

My contributions still break down to:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $60,574 (+$1,704)

The Roth passing $60K for the first time!

The portfolio itself is still about 75% VGSLX and 25% VTIAX.

PS – here’s why I like VTIAX more than VFWAX.

Rent Payable: $765 ($85)

The only variable in this expense is my half of utilities, which were way down as the weather started getting oh-so-pleasant around Minneapolis.

For new readers, I’m still splitting a mortgage with Lady Money Wizard. This number includes my half of all mortgage payments, insurance, utilities, etc.

Credit Cards Payable: $4,085 ($2,674)

I won last month’s battle against the credit card company, who messed up the auto payment and charged me a whole bunch of interest and late fees. By the way, now might be a good time to plug an old blog post: What to do if you miss your credit card payment.

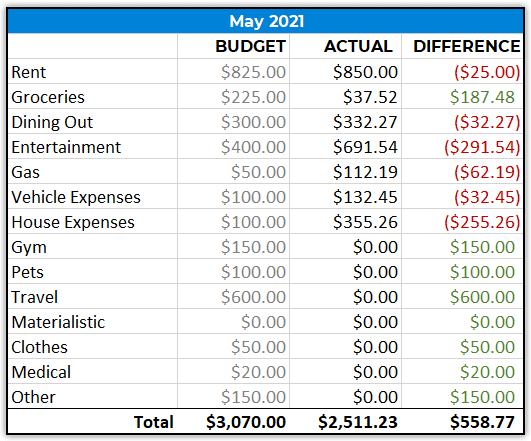

Total April Spending: $2,511

Groceries: $37

Sure, I might only spend $35 per week on groceries, but this is unusually low, even for me. I think Lady Money Wizard happened to pay for most of the groceries this month.

Entertainment: $691

Mostly the friend’s weekend cabin rental, mixed with some return to normal life, like the Twins game and other shenanigans.

House Expenses: $355

No idea how this one was so high. The always-controversial maid came, so that definitely contributed to it. Otherwise I think we might have gone a little crazy with this year’s garden…

I’ll let you know whether it was worth it after after our first harvest!

How was your May?

Crazy that we’re already in the depths of summer.

Hope everything is great with you all!

PS – If you’re serious about tracking your net worth, here’s my favorite tool to do so.

Related articles:

Where your crypto stuff at? I thought you were getting into it too?

Unfortunately they’re not included in NW updates for security reasons.

security reasons? Not sure i understand. You seem to show everything else and your holdings, whats different with crypto? Sorry i just might know so having issue understanding what are the security reasons.

Traditional banks and brokerages provide added protections just by the nature of them being huge institutions with big IT teams, vaults, branch offices, etc. With crypto, you’re removing the middle man and making yourself responsible for your own security. So publicly discussing what you have is a bigger risk.

Looks like building a portfolio of real-estate-rentals is out, and you are all in on Crypto.

Rentals aren’t entirely out… I’m still open to it (just like I’ve been saying for a decade, haha!) but the logistical challenges are proving tough. I’m sure from the outside everyone is saying “Yeah right, this dude’s never gonna pull the trigger.” Maybe that’s right, but mentally I haven’t gotten there yet.

I’m a big believer in crypto, but I wouldn’t say I’m “all in” on it, either. As excited as I am about it, it’s still only a single digit percent of my portfolio. And most of that amount is still price appreciation, since I bought the majority before the price took off.

Should include crypto and just lump all your taxable accounts together

Also, are you including equity from the house? is it half yours?

Nice suggestion, I like that idea.

I don’t count home equity. I should write a post explaining why, but my basic thought process is that you have to live somewhere, so a home isn’t a cash flow generating asset that could actually fund early retirement. (It’s more of an expense reducer… still a benefit, but I’m not sure what added benefit tracking the equity would bring.)

I know for my wife and I, we have 2 rentals in addition to our primary.

I keep track of:

-Liquid account balance (taxable (brokerages, crypto), tax advantaged (roth, 401k, 457), bank accounts, and pension balances.

– Rental property equity (market price (ie from redfin) minus the loan balances). I don’t keep track of the cash flow for NW purposes as that is reflected the contributions

– Primary home equity (market price (ie from redfin) minus the loan balances))

I then have a spreadsheet I created that tells me:

– Liquid Net Worth

– Net worth with Liquid and Rentals

– Net Worth of Liquid and primary (in case we sell everything and go move somewhere)

I also track in my spreadsheet assumptions of:

– Expected contributions, % returns, salary raises, etc for all account types and how that compounds through the years

– What would happen if I just stopped investing, assuming 7% growth on current balances

What is cool is you can see your projections and then how you beat or miss those projections. I keep models from previous years on what my anticipated growth would be as well as keeping up to date models. It is fun to see how well ahead you are or how you can advance to your FIRE number even earlier than you anticipated in the models. Quite motivating

One gap I’m missing is how will you account for health insurance in retirement? Thanks again for all of your insights!

That’s definitely the biggest unknown, but early retirees have four options:

1) Pick up a hobby job that includes health insurance coverage.

2) Live frugally enough to get discounted coverage under the affordable care act.

3) Move to another country where you’re covered.

4) Just budget another $1K a month.

#1 or #4 is most likely for me at this point, but we’ll see what the future brings.

Extremely helpful! Thank you

Congrats on another great month, let’s see you reach that $1mil mark by the end of the next four years!

It is quite surprising just so much people are cheering that we can actually start to go out to things and actually… do stuff….

I can’t wait until the lockdowns are over. Although, we don’t know what will happen with the bird flu from China that happened but from what I’m reading, it sounds like an extremely rare case of the bird flu.

No more lockdowns in the foreseeable future!

Congratulations on further progress towards your goal!

Nice to see more things opening up and people getting out and doing things again 🙂

How do you manage to max out your 401K without going over the $19,500, or do you go over and then have the IRS cut you a check? This is the first year I’ll max it out and I’m actually projected to go over, so I don’t know the best way of finagling things to max it out without messing up my tax filing.

Hi Heather, couldn’t you ask your employer to simply change your contribution amount since it’s still only june?