Hey there, you Wiz, you…

You’ve stumbled onto that woooonderfuul tiiiiiime ooofff the year.

No, I’m not talking about the incessant Christmas music belted out nonstop these days. I’m talking about another monthly net worth update!

If you’re new here, I’m sprinting towards a finish line with a $1 million-dollar (ish) portfolio at the end. As a 28-year-old Average Joe, I’m hoping to hit that figure in less than 9 years. At which time, I’ll be completely free to adopt the sort of “work is completely unneeded” attitude that would make the main character from Office Space proud.

Every month, I share an update on that goal. The purpose of these updates isn’t to publish some sort of cleverly disguised humble brag. Instead, I hope to shine the spotlight on a completely taboo subject, highlighting all the details that only an anonymous money blogger can provide.

Life Update – November 2018

As I sat down to write this month’s edition, I found myself staring in the face of the all-too-common writer’s block. So, I did what any desperate blogger would do. I fired up my own archives, and started reading my old posts in search of inspiration.

What did I find?

Well, this month has some huge shoes to fill.

Because in my last November update, I made the small life change of… buying and moving into a new house.

And the November before that, back in 2016? I bought a whole new car.

So, what sort of crazy life changing event did November 2018 have in store for me? New job? Crazy new investment strategy? Life changing epiphany?

Nope, none of that noise.

Other than flying home to Texas for Thanksgiving, November was peacefully uneventful.

I did go to a no-name concert, and took a couple restaurant trips with Lady Money Wizard. But otherwise, November was so uneventful, the only picture worth documenting was The Money Pup about to chomp on this piece of turkey leg:

Which is just a-okay, as far as I’m concerned. And in some ways, it’s a little symbolic.

Because in an era of Facebook brags and Instagram flash, there’s nothing wrong with keeping things a little lower key.

I’ve got my first quarter-million saved. My friends, coworkers, and neighbors would never know it. I’m comfortably settled into a house with Lady Money Wizard, with a cat and a dog and a nice reliable car that should carry me through the next decade or two.

From the outside, I look like every other rat-racing wage slave. Grinding it out with no end in sight.

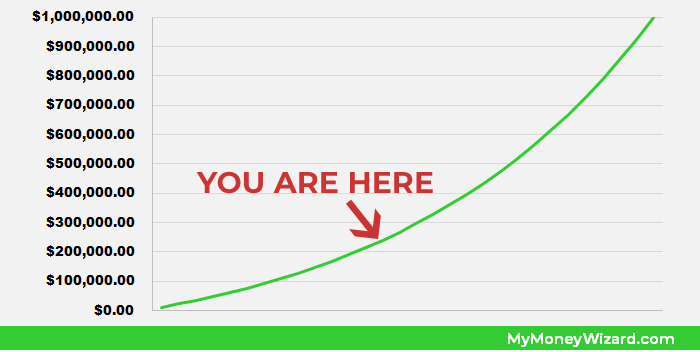

But I’m in the trough of the wave. The bend before the exponential curve in the hockey stick. If my journey were on a map, it’d look something like this:

I seem to be in the part of the story where it’s all about the grind. I’ve figured out the strategy, and now it’s all about repeating out the process again and again. Which, hey, that sure sounds like the secret to success, anyway.

Because if I do, this whole thing is about to explode upwards and outwards and every which direction, in the best way possible. I’m on the verge of busting through those cubicle walls and into the confetti of more money than I’ll ever know what to do with.

But for now, we wait…

Net Worth Update – November 2018

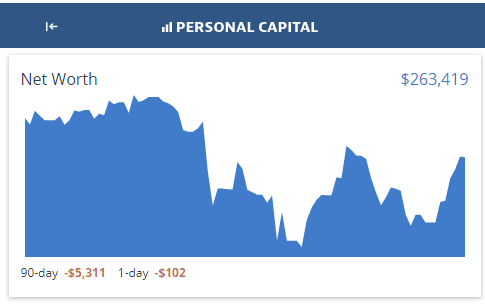

It’s getting a little bumpy! Let’s check out the detailed table:

After last month’s sea of red, it didn’t take much correction to bump things back up. The S&P 500 recovered only around 0.83% percent in November, but as you can see, the dollar impact on my portfolio seemed a lot bigger.

What we’re starting to see is the compounding effect of a larger portfolio. Now that my net worth is over the quarter million mark, and roughly 80% of it is invested in stocks and real estate funds, a very small percentage change can still create a very big dollar change to my final net worth.

This is why it’s so important to do everything you can do build up a meaningful portfolio as fast as you can. Once you get that initial mass behind you, the momentum of even the tiniest market gains can make you staggeringly wealthier.

It reminds me of this great post I found on fourpillarfreedom.com earlier this week. In it, Zach gets behind the math of why your net worth tends to go crazy after saving your first $100,000. He uses a perfect example to show that thanks to compounding, it will take you longer to go from $0 to $100,000 than from $600,000 to $1,000,000. (7.84 years versus 6.37, assuming you’re saving the same $10,000 every year)

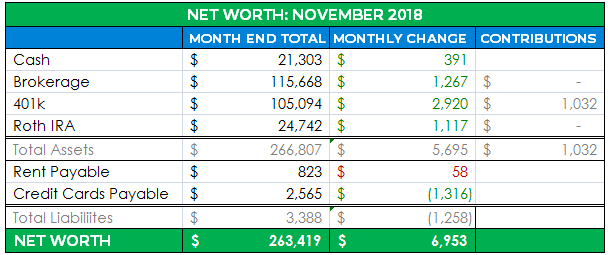

Cash: $21,303 (+$391)

I paid off an unusually large credit card bill, so the monthly cash gain was a little less than usual.

On one hand, I’m glad to see my cash growing after setting out to save money for a down payment on a rental property. On the other hand, I’m sad to realize it’s already December and I still haven’t contributed to my Roth IRA yet this year. (Discussed further below)

Brokerage: $115,668 ($1,267)

After last month’s 6.5% drop off a cliff, my brokerage account increased 1.1% this month. Which is about in line with the 0.83% increase to the S&P 500. This makes sense, considering my brokerage account breakdown is:

- 50% in Vanguard’s Total Stock Market Index Fund.

- 30% in a mixture of Vanguard growth, value, and bond ETFs.

- 20% in individual stocks, back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

401(k): $105,094 ($2,920)

The 401k benefited from my usual $1,000 of monthly contributions / employer matching. Absent that, the monthly gain amounted to about 1.2%.

This also makes sense, considering my 401k breakdown is similar to my brokerage. The main difference is a slight tilt towards the “riskier” small cap and international stock index funds, which explains the increased volatility and the 0.1% difference in gain.

- 50% in Large Cap US Stock Index Funds.

- 35% in Small Cap US Stock Index Funds.

- 15% in International Stock Index Funds.

Roth IRA: $24,742 ($1,117)

Whoa, a surprising gain of over 4% to Vanguard’s REIT Index Fund in November, which my entire Roth IRA is invested in.

I’m guessing this was driven by a bunch of Wall Street investors, who probably fled the rocky ride of stocks in favor of the safety of real estate. Although honestly, that’s a total guess, and I have no idea if it’s actually true. With my 10+ year investing time frame, I couldn’t give two flips about Wall Street’s drama.

Aside from that, all I have to say is… Damn! I’ve already let almost an entire year go by without contributing anything to my Roth IRA in 2018. Back in January, I made a public goal specifically NOT to let this happen.

Whoops!

Rent Payable: $823 ($58)

Rent payable going way up because of two things:

- It’s officially winter now, so the heater is working overtime.

- We got our new tax assessment, water rates, and trash rates from the city, which served as a friendly reminder from The Man that even home ownership won’t let you escape from yearly cost of living increases.

For the newer readers, I live in Minneapolis in a house with my girlfriend. This cost represents my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month, which lets us pay for any miscellaneous house expenses, stress free.)

Credit Cards Payable: $2,565 (+$1,316)

October’s credit card bill was monstrous, so it’s nice to see this amount come back down to earth. Speaking of which, let’s check in on November’s spending:

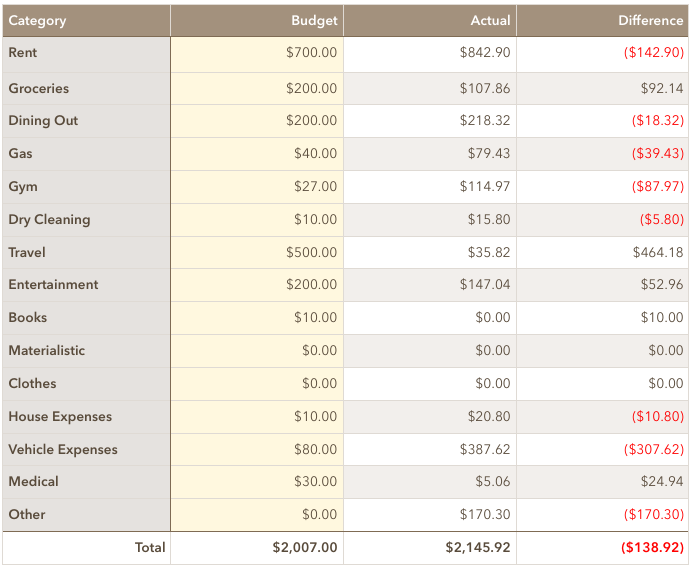

Total November Spending: $2,146

Seriously over budget in some areas, yet seriously under budget in others:

Groceries: $108

I just started a post explaining how I keep my grocery spending so low. Keep an eye out for it!

Dining Out: $218

Shout out to the new, dangerously delicious Mexican restaurant that Lady Money Wizard and I found this month…

Gym: $115

My typical gym fee is $27 a month (partially discounting thanks to my health insurance – look into that if you haven’t!)

But with my first trip of ski season a few months away, Lady Money Wizard and I started brainstorming interesting ways to get more motivated for the gym. That’s when I came across a Groupon for a couple month trial at a local boxing gym, which rounded out the rest of the cost. Is it just me, or is there something attractive about launching punches after a rough day in the office?

(PS – If you’re not buying your Groupons at a discount through Ebates, you’re doing it wrong!)

Travel – $36

I used points for the Thanksgiving flight, but I did rack up $36 of Lyft rides to and from the airport.

Entertainment – $147

Mostly the previously mentioned concert, a Thanksgiving get together with friends, and a spur of the moment bowling and brewery outing.

House Expenses – $21

Christmas lights for the house!

Vehicle Expenses: $387

It’s hard to believe, but my car keys literally grew legs and walked away.

What’s not hard to believe, is that the car dealership took the opportunity to slam me for a $300 replacement.

Other – $170

Mostly some Christmas presents for friends, family, and of course The Money Pup and The Cash Cat!

How was your November?

Staying on track during the madness of Black Friday and the holidays is no easy task. Keep those money goals in mind, but don’t be afraid to embrace the holiday cheer, either!

For the newer readers, if you’re looking to track your own Net Worth, I still love Personal Capital. It automatically tracks all your income and spending, plus it keeps up with any changes to investment accounts, retirement accounts, etc. For me, it’s made putting together and staying on top of these Net Worth Updates precisely 14 times easier.

Related Articles:

Hello Money Wizard,

Thank you for your awesome blog. I love reading it. I had a question. I am reviewing your NW updates and my question is did you stop adding money to these accounts and just let the market ride? Or are you still adding personal money regularly? If not, when did you stop adding money, was it when you reached $250k? Thanks

Glad you’re enjoying it!

The contributions column in the detailed net worth table shows how much I added to the accounts during the month. I haven’t contributed much of anything ever since I started saving up cash for a rental property. Although I still contribute 7% to my 401k each paycheck, plus employer matching.

Lol Quarter ‘mill in the bank = an uneventful month. #Ballin! You should give an advance warning of when you’re about to post – would be interesting to see what the numbers are like after the big updating in stock prices for the day.

“I’ve got my first quarter-million saved. My friends, coworkers, and neighbors would never know it.” Just out of interest is there anyone you know on your immediate contact group that is also pursuing FI? It’s really cool connecting with like-minded people online but sometimes the radical idea of ‘spending less than you earn’ can seem like heresy in the real world.

Keep on crushing it (as they say, no news is good news).

HH

No there’s not… for all the talk about FIRE going mainstream, I’ve still still never met anyone outside of fellow bloggers who are doing it.

Nice work! You’re in an exciting spot right before that exponential growth starts to kick in. Best to ignore the markets and stay the course!

That is a brutal fee for replacing car keys by the way…

Haha, tell me about it. They don’t include that part in the new car sales pitch.

Great work, insights and analysis. Eating out is one my greatest indulgences. I am inspired to contribute more to my ROTH IRA next year based on your progress. Thank you for the Monday motivation Money Wizard. Have a great December ahead.

Awesome to hear! Max that roth out!

Looking forward to the grocery post! I follow a few blogs that do these monthly breakdowns and I find that my grocery spending is way over most of them every month, including yours. And I’m just a single guy! haha

Hopefully there will be a few good tips in there that I can use to cut down on grocery spending a bit.

It’s been a heavily requested post, so I’m looking forward to putting it out there!

I have a question regarding your Vanguard REIT Index in your Roth IRA. Are you considering re-balancing out of this position when you purchase your first rental to reduce your overall real estate exposure on your net worth, or are you going to keep it in order to continue having exposure to commercial properties?

(Also, if somebody could point me in the direction of the post stating why the Money Wizard house isn’t included in these monthly reports that would be much appreciated!)

Happy Holidays!

Good question! Re-balancing would probably be the “correct” answer, although I’d just as likely start contributing to a different asset class moving forward.

The main reason is that the house is technically in Lady Money Wizard’s name.

Question, I see you are contributing 7 percent into your 401k. Is your salary over six figures to contribute over $1,000 monthly? Sorry if you answered this before?

Thanks.

No, this year I make high 80s. Before that I was making 50-75ish for the first several years on the job.

My portion of the contributions is only about $500 per month. The other half is employer matching.

That is a great match, my company only does 1.5 percent but they spin it to say 50 percent of the first 3 percent! lol

Another solid month in the books. Keep grinding away at it MoneyWiz!

Thanks, Mr. Tako!

Have you heard of Huel? Cheap nutritious “meals” that are super convenient. Did I mention….cheap!

Been using it for lunches at work the last week, very handy.

I haven’t heard of it. Is it a meal service?

I’ve put your nest egg of $263k into a future value calculator and in 9 years with a 7% interest rate it comes out in the $500k range. Half of your $1 million goal for 9 years… what is it that I’m missing? I’m curious because I have the same amount in my nest egg and I am hoping to have a similar path to yours. However my time to a $1 million portfolio appears much longer than yours for whatever reason. Thank you for your help and inspiration!

Seems like you’re missing the additional contributions, Nik. Your calculation assumes the Money Wizard is not adding another penny to his portfolio over that time period.

Yep. I’m saving $30-35K a year right now, which has the calculator putting me at $850,000 to $900,000 in 9 years.

Your not the only one who has had a rocky few months. My stock portfolio has been up and down every day with no prediction where it will go next. I’ll have to check out that article by fourpillarfreedom.com, it’s about where my net worth is at the moment. Keep investing Money Wizard, you’ll get their soon enough!

– Money Professor

Hi Money Wizard!

I’m a novice FIRE aspirer and really appreciate your blog, so thank you!

Just curious – when you talk about your “brokerage” account, are your referring to a taxable investment portfolio (not your 401k or IRA?). Just curious as one of my banks calls my IRA a “brokerage.”

Thanks!

Yep! I call my taxable investments my brokerage account.

Thanks for the shout out on the $100k post! Glad you found it useful. And nice progress this month – like you said, you’re in the “trough of the wave” about to hit the serious exponential growth that really reveals itself after the $250k point. Looking forward to following your journey 🙂

I was using Discover Deals, though discover card, to purchase groupons. The % varied, but many times was 20% cash back! Now, it’s been discontinued and I use Ebates too! I was very surprised, but they also have Amazon on there too, but it’s only valid for certain departments.