Hey Money Wizards,

Welcome to… another net worth update!

Oh yes! Step on down, and spin the wheel! Where will it land on the lottery of net worth!?

(If you’re new here, every month I track and share my progress in growing my investment portfolio. Originally, my goal was financial Independence by age 37. I recently updated that goal to age 35, because I’m ahead of schedule. And also, because why not?)

Life Update: September 2019

Let’s just call it – Staycation September.

I know. I rolled my eyes at that term when I first heard it, too.

But in September, Lady Money Wizard and I gave the Staycation the ultimate test.

With the coming of Fall, the original plan was to check out a small town with an Apple Orchard about an hour away. When that small town proved to be so small that they didn’t even have hotels, I moved my search to halfway point – a place called Shakopee, Minnesota.

Shakopee is a small little suburb/town along the Minnesota river. It’s home to the state’s only major amusement park (Valley Fair) although truthfully, we were more interested in the town’s whimsical main street, its meandering trails along the river, and the breweries and wineries in the area.

What’s interesting is that Shakopee sits in that awkward distance where Uber is uncomfortably expensive, yet it’s not far enough for any sane Minneapolis resident to stay there overnight.

So of course, I decided to stay there overnight.

I booked us a cheap, pet-friendly hotel room using Hotel.com rewards points. The location? A whopping 25 minutes from our house…

Staycation – Silly Waste or Totally Underrated?

The check in process went something like this:

Hotel Clerk: Welcome! Are you in town for the big event?

Money Wizard: Errr… no…

Hotel Clerk: Oh, interesting! Where are from!?

Money Wizard: Um… Minneapolis? We, uh, we’re traveling south and decided this would be a good stopping point.

I paused and chuckled at how ridiculous I sounded. Nobody in their right mind calls it a night after just 25 minutes of driving.

Nonetheless, she smiled and handed me the keys. (After filing me way on the suspicious guest list, I’m sure… )

And I have to say, the Staycation was an awesome success!

For one, we had The Money Pup traveling along with us, which was a fun change of pace.

But we also did check out the main street, breweries, wineries, and apple orchard. And most interestingly, it still felt very much like a vacation!

This led me to an interesting epiphany, which I’ll probably use to save some serious cash on travel spending over the next year:

Vacations are just as much about taking a break as they are about the glamorous location.

I would have never believed it, but there’s something oddly satisfying about spending a night away. No matter whether that “away” is halfway around the world or 25 minutes from your house.

We continued the staycation theme when we “returned.” The next week we held a picnic in a local park, and enjoyed hiking along this beautiful trail near Minneapolis:

Final Staycation Rating:

5/5 Wizard Hats

Conclusion? The staycation = totally underrated.

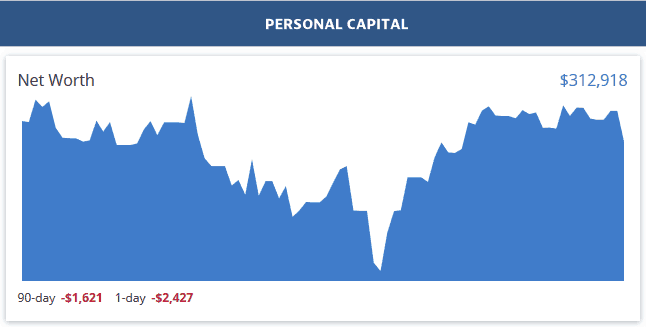

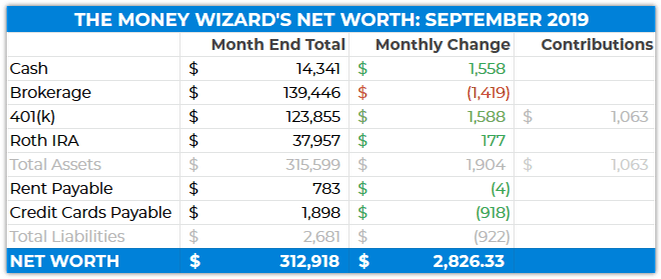

Net Worth: September 2019

A little blip at the end of the month. (Which is actually the first two days of October, thanks to my procrastination!)

Cash: $14,341 (+$1,558)

Dang! Where’d that sneaky little balance come from?

Guess my decision to move to a little more conservative allocation (read: more cash/bonds) is adding up quickly.

That said, I need to get some of this transferred over to bonds or a least a money market account. Even earning just 3% returns, which is very doable in a bond fund or some money market accounts these days, would be nearly $500 a year.

Brokerage: $139,446 ($1,419)

A tiny blip last month. (Which actually happened this month, since I’m writing this on October 2nd.) Nothing to worry too much about.

401(k): (+$1,558)

$500 of actual gains, and $1,000 of brute force savings – better known as “contributions.”

Roth IRA: $37,956 (+$177)

In the wise words of The New Kids on The Block… haaaangin’ tough.

Rent Payable: $783 ($4)

This is my half of the mortgage, utilities, and anticipated home maintenance. (We allot 2% of the home’s value to expected maintenance each year, or $300 per month.

Also, can anyone explain to me how I managed a $150 electricity bill when I didn’t run my air conditioning all month? I feel like it could be time to get those utilities guys out to double check that meter of mine…

Credit Cards Payable: $1,898 ($918)

I feel like this thing hasn’t been below $2k in months, so it’s nice to see the credit card statement drop back down to earth. I’ll pay this off soon, as I do every month.

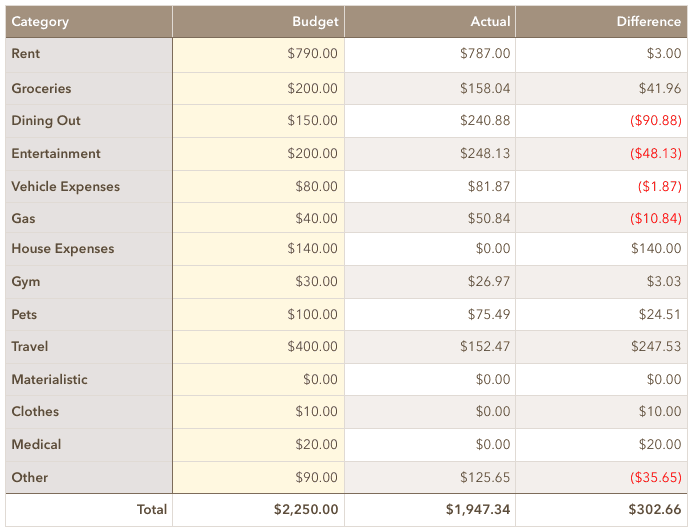

Total September Spending: $1,947

A pretty frugal month!

Entertainment: $248

This includes $60 for the bike rally I talked about last month. Unfortunately, the weather was awful. And not only were there no weather related refunds, but we went to the bar instead!

Come to notice, the remaining $150 is mostly bar and brewery expenses! 😬

That said, I did go to not one, but TWO concerts in September. (Maggie Rogers and The Head and The Heart, if there’s any fans out there.)

Pets: $75

The money pup needed a re-up of his dog food. This should last him a few months.

Travel: $152

Let’s have another cheer for the Staycation! This expense could really be considered entertainment, since the hotel was free. This is what we spent on the apple orchard, restaurants, wineries, etc. while “on the road.”

Other: $125

Just miscelanous spending. I bought some gifts for friends that totaled about $70 this month but made me feel warm and fuzzy when I gave them away. Also included here is the entire postage ($17) for our crazy cheap wedding. And we should have about $5 of stamps left over! Booya.

Rolling Into No-Spend October

Seeing the month’s total bill below $2,000 for the first time in a while has me really fired up!

So, in October, I’m throwing out a challenge – No Spend October!

We did one of these a while back. (March 2018, if you’re curious) Back then, I was able to keep my total spending below $1,500 for the entire month. (Less than $400 of discretionary spending all month)

If you’ve never tried one of these before, it can be weirdly entertaining. And more interesting, it serves as a sort of “reset” on your spending habits. And who knows, it might even lead to a few of staycation-type epiphanies for you!

Cheers!

PS – I know I’m a broken record, but I continue to recommend tracking your spending and net worth as the most powerful money move you can make. And Personal Capital is still my favorite tool to do just that.

Related Articles:

EDIT – Just noticed the table calculates the monthly change incorrectly. It says $982 when the change was actually $2,826. Not sure what happened there! Will update asap.

Just got to flip the sign on liability changes. The liabilities decrease being a positive to net worth of course!

Thanks, I’d programmed that into my old spreadsheet, but I made this new one to look cool and fancy and apparently forgot to carry that over!

“Vacations are just as much about taking a break as they are about the glamorous location.”

Very true, especially when you consider that one person’s ‘glamour’ may be another person’s everyday life. Vacation / holiday is largely about mindset.

Very true.

Just curious if you have any plans for your cash account. I know you thought about real estate or rentals before but I haven’t heard much lately. And based on your emergency fund recommendation, it seems like you’re well above what you consider a secure level. Just saving for any opportunities that may arise?

Enjoyed the update!

Yeah, the original plan was an investment property, but I haven’t been able to find any deals that I’m excited about. Plan B) would be to funnel it into bonds to get in-line with the more conservative allocation I’m shifting towards in my old age, haha. I’ve put that on the to-do list for October.

Most utilities will come in and do a free energy audit on your home, which is more extensive than just checking your meter. They can rate your insulation at walls and roof, windows, furnace, etc. and provide a list of actions you could take to drop your energy consumption.

Great tip! I am going to look into this, because our bills seem out of control! Especially in a month where, for all I can tell, we only turned on lights!

BTW, since you’re in Minneapolis as am I, I’d assume you have Excel or Minnegasco. Either way they both do this. They will also sometimes give away free things like a single pack of weather striping, a water saving shower head, light bulbs, etc. And back to the original point, just ask for an Energy Audit.

I would second getting an audit. I’m in WI, but we had one done, and it was packed with valuable info (and yeah, we got some free stuff too. lol).

Love the money pup! So cute.

No spend-October sounds like a good plan. Perhaps I should adopt that. I feel like my wallet is more empty than usual this month. One of the reasons is that I was able to save a lot. But still, I don’t have much to use.

I just released my FI update myself and September was quite good. Not sure if October will be the same. But we need to have a long horizon.

Couldn’t agree with you more! Sounded like a fantastic getaway brodude! And that local park? Charming aph. Took a staycation myself September 2-6 and it changed my life. Very relaxing. Saw a matinee (Brittney Runs a Marathon 7/10) and still had time to drink a cider before Mrs. CheapAssReviews got home. Was nice to complete some tasks around the apartment I’d been wanting to do. Now if this market volatility would just simmer down, we’d both be sitting pretty and singing pretty.

Yup, staycations can be just as fun as traveling to an exotic location. Just taking a break to see a different small town near you was a great idea!

With kids, our family doesn’t tend to do air travel all that often (the kids don’t fly well), but we do take lots of ‘mini’-vacations on the weekends… It works for us, and not once has anyone complained that they’d have rather flown to Hawaii. 🙂

I prefer staycations and being a tourist in my hometown! When you’re constantly busy, any vacations whether out of town or in-town are amazing to relax and reset.

I would have told the desk clerk you were there to check out the wineries and had no intention of driving home after.

Definitely would have been more eloquent than my response!

Congratulations on the money dog. So cute. I have 2 cockapoos. Boeing and Ella. Good luck. As for of savings, you max out your 401k and Roth IRA. Are the VTSAX is that the sticker symbol? in an ETF fund or other? I have VOO and VTI thinking of putting into VTSAX to get more returns. I am thinking of putting more money into Vanguard after we max out the 2 above. Thank you for your help.

Congrats on being ahead of schedule and updating your goal to age 35! That’s exciting stuff.

We love a good staycation as well. Mucho underrated!

Here is our Update for the month as well, a tad behind you in overall net worth at this point.

Cheers!

Chris

https://moneysavvymindset.com/personal-net-worth-update-september-2019/

Hi, your monthly updates are very interesting and helpful!

Since you contribute monthly into your portfolio, have you ever calculated the actual CAGR? or have you ever calculated the exact amount of capital contributed in your overall balances that you can check how much it’s grown?

Money pup is so cute. What type of dog? Sean I max out 401k and going to continue to max out IRA’s. Do. you recommend buying VTSAX as a mutual fund or is it an ETF? Thank you.

Hey Money Wizard.

First time reading and commentating your blog, already read about 10 blog posts in a row. Very interesting reading!

About the credit card though, do you pay extra interest on payments if you can’t pay it in 30 days or so?

Awesome, welcome aboard! Hope to see you around.

I always pay the credit cards off in full. I’ve never racked up credit card interest before – that’d be financial suicide.