Here’s the surprising news of the month:

Ultra high savings rates – not just for online money nerds like us, apparently.

According to a recent interview with Yahoo Finance, Shaq, of all people, is one of the biggest proponents of pushing an Early Retirement Extreme style savings rate.

Reporter: What money advice would you give to your younger self?

Shaquille O’Neil: It would be the same advice that a fella gave me at a bar. He had a piece of paper and said, “This is $100.” He ripped it in half. He said, you save $50, then you can play with the other $50.

But the difference between rich and wealthy? You rip that $50 in half and with the $25, you do whatever you want. But with that other $25, you save it, too.

You know when you’re a teenager and you find out that one of your celebrity crushes likes one of your favorite bands, and before you know it, you start imagining all the other possible things you might have in common with them, and all the sudden, you’re envisioning a life together where the two of you live happily ever after? Forever and ever?

That’s kind of how I feel when I hear Shaq talking about something I’d otherwise only heard on the nerdiest of financial blogs.

Translating the Shaq Attack

Shaq’s talk about “ripping a $100 bill in half” and then ripping it in half again is a clever way to explain savings rates.

In other words, the “fella at the bar” advised Shaq to do two things:

- At a minimum, you should save 50% of your income.

- Then, you should really try to save up to 75% of your income.

Now, this advice sure is interesting, considering that I’ve shot for a 50% savings rate ever since I started this blog.

- In 2017, I aimed for a 60% savings rate, but only mustered 47%.

- In 2018, I lowered my expectations to a 50% savings rate, and managed 52%.

- In 2019, I hit my highest savings rate in recent history, at 58%.

But isn’t a savings rate just a number? Why should we even care what Shaq or this random fella at the bar is saying?

(As an aside, it turns out the fella at the bar was Lester Knipsel, a “business manager” aka Financial Planner for some of the country’s richest and most famous. His high profile clients included Shaq and Kim Kardashian.)

Why your savings rate might be the most important number in personal finance

In the world of personal finance, “Net Worth” tends to get all the credit. It’s a metric that’s big and flashy. It’s the high powered offense that everyone loves watching and talking about.

Meanwhile, the savings rate is the silent hero on this team. It’s the offensive lineman, silently doing tons of work day in and day out, without much credit. Or the offensive coordinator, whose strategic efforts make the team’s success possible, all from the quiet shadows of the sideline. Or maybe it’s even the General Manager, who gives the coaches good players to work with in the first place.

Take your pick of whatever underrated role the savings rate serves in this sports metaphor.

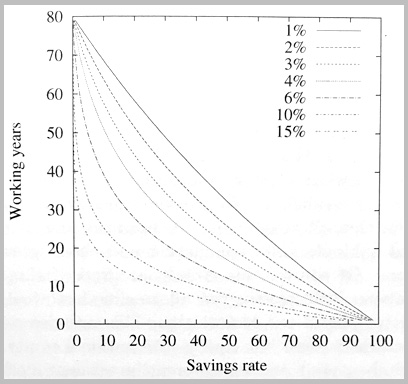

Either way, I’ve posted this graph showing the power of a savings rate a ton of times on the blog before, but it’s so important that I’ll post it again.

Graph cliff notes?

Your savings rate directly reduces your length of time until financial freedom.

If you take Shaq’s advice and save 50% of your income, every year you work puts another year’s worth of living expenses in your pocket.

If you really push the envelope and save 75% of your earnings, then every one year you work puts three years of living expenses in your pocket.

Add some compounded investment returns onto those three years of savings, and it’s not surprising to see how a 50-75% savings rate means you can completely walk away from mandatory work in just 8-12 years.

How to start cutting C-Notes in half like Shaq

Well, let’s take it step by step.

1. Start tracking your spending with something like Mint or Personal Capital, which will automatically track your money, for free.

2. Calculate your savings rate, the best way. Here’s the quick formula, and don’t worry, it’s easier than it looks:

Annual Savings Rate = (Annual Savings + Retirement Contributions + Employer Matching) / (Annual Take Home Pay + Retirement Contributions + Employer Matching)

3. If you’re like most people and nowhere near a 50% savings rate, then take a good hard look at your Big 3 Expenses and check out these 21 frugal living tips.

What if you can’t save 50%? (The 7’1” Tall Elephant in the Room)

Yes, it should go without saying that it’s a whole lot easier for somebody like Shaq to save 50% of his modest $40 million signing bonus than it is for mere mortals like you and I.

But that’s okay. If you’re not at 50%, you don’t have to beat yourself up.

The average American has a savings rate somewhere around 3-6%. Trying to save 10-15 times more than normal is no easy task.

You should treat this ambitious goals the same way you treat all ambitious goals – know it’s a stretch, but also know that most life changing results come from stretching yourself just outside of your comfort zone.

What’s that old cheesy saying? Shoot for the stars and settle for the moon?

(I just googled and apparently the saying goes the other way, which makes no sense at all considering the moon is way closer than the nearest star.)

Start with the standard financial advice of a 10% savings rate and then push it to 33%. In my experience, it’s totally possible for anyone with a decent paying job to hit a 33% savings rate if they put serious effort into their finances.

That’s an amount that can cut your working career from 40+ years all the way down to 20.

And hey, reaching freedom twice as fast is nothing to sneeze at!

If you don’t, I’ll send my new best friend Shaq after you. He’s huge. And financially savvy, too.

Do you enjoy my free blog? Share this article on your favorite social media or take advantage of free, awesome products like Personal Capital or Rakuten using this site’s affiliate links. (Like those two links!) Thanks for keeping this place alive!

Related Articles:

Shaq is the man! I remember him saying that about ripping it in half twice. Great advice 👍 I have had people make fun of me for saving so much while they just focused on income..which I never understood..the fact Shaq does it even when he’s making the big bucks is a great example for anyone forgetting about saving.

A high savings rate is the ultimate foundation. Someone who can save a ton is usually better positioned to reach their goals, because any amount of money can be blown.

I love Shaq!! I find him hilarious but also a kind, smart businessman. It’s so funny how he pops up in so many TV commercials – he’s everywhere and I love it! I saw your formula for Annual Savings Rate in this blog post. However, I thought I read in other “FIRE” blogs that when people talk about saving 50% of their income, it should be 50% of their your after-tax income AFTER 401k contribution to your savings or retirement portfolio accounts. However, it looks like you’re including your 401K contribution plus employer match? Curious what you think because I’m torn on how I should be calculating my 50% savings rate.

Annual Savings Rate = (Annual Savings + Retirement Contributions + Employer Matching) / (Annual Take Home Pay + Retirement Contributions + Employer Matching)

My way includes retirement contributions in the numerator and denominator. So I’m counting those contributions and matching as both income and savings. This is the best way because it’s the most accurate.

Ignoring retirement contributions penalizes you for maxing out your 401k, which is just silly since it’s one of the most efficient ways to build wealth.

All that said, at the end of the day the name of the game is simple – the more you save, the faster you’ll be financially independent. No matter how you calculate it.

Shaq is really impressive. When you read of many ex-nba players going bankrupt shortly after their career, he is thriving. How many NBA players are sitting on the BOD of a publicly traded company? He is a role model for the league.

Shaq is awesome!

For someone who has never looked at their savings rate before – I am pleasantly surprised and happy that mine calculated out to 41%. I am going to push for that increase each year. Great article on a simple way to look at your savings rate. Cheers!

Thanks! Keep pushing!

So would I include the $1500 to $3000 per month that I am paying extra to principal on my house (to pay off early) into my savings rate??? My interest rate is 4.875% and I will have house paid off in 2 1/2 yrs.

In that post I link to, I count the principal portion of debt reduction (the portion of your mortgage that goes towards equity) as savings. So if you’re paying extra, you could do the same for those extra payments.

In the end all these savings rate calculations are personal preference, so do what makes sense to you.

Pretty awesome that you’re getting so close to paying it off!

Just crunched some numbers and I’m on track for a 62% savings rate this year, sweet. Given that my hours have been cut recently due to the economy/covid, I’m still trying to maintain the same about of savings but with less take home pay = higher savings percentage.

We’ll see if I can endure.

62% is seriously impressive! Keep it up!

It’s refreshing to see a professional athlete share the same dogma we preach in the financial community. Great research on Lester Knipsel too, Sean. Also I love the encouragement for readers to boost savings rate. Having 2 consecutive years of +50% savings rate is sure to boost The Money Wizard’s Net Worth. Surely worth the read!