Last Updated: April 2018

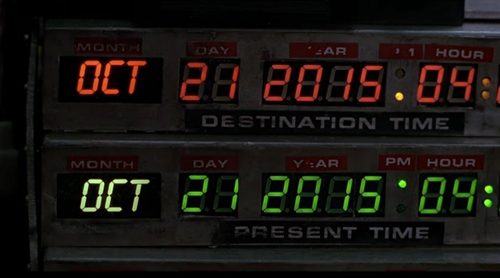

October 21, 2015 marked a huge announcement which I’m sure many Money Wizards were eagerly awaiting.

Aside from being the official Back to the Future Day…

…the IRS also announced 2016 retirement plan limitations.

For those who don’t care to sift through thrilling paragraphs that read like this:

The Code provides that the $1,000,000,000 threshold used to determine whether a multiemployer plan is a systematically important plan under section 432(e)(9)(H)(v)(III)(aa) is adjusted using the cost-of-living adjustment provided under Section 432(e)(9)(H)(v)(III)(bb). After taking the applicable rounding rule into account, the threshold used to determine whether a multiemployer plan is a systematically important plan under section 432(e)(9)(H)(v)(III)(aa) is increased in 2016 from $1,000,000,000 to $1,012,000,000

…are they kidding? I wonder how many people would read my blog if I wrote like that?

Anyway, I went ahead and read all of that bone dry IRS language so you don’t have to. In 2018, you can:

- Contribute up to $18,500 to your 401K plan at work.

- Also contribute up to $5,500 to an individual retirement account.

- If you’re single and your adjusted gross income is less than $31,500 ($63,000 if married) you can receive the saver’s credit, aka FREE MONEY.

In other words, the maximum amount you can contribute to your 401K and Roth/Traditional IRA stays the same as 2015. The cutoff for being eligible for the saver’s credit increased a little.

“For the what?”

Hold your horses there, pal. We’re talking about taxes remember? Nobody is supposed to get that excited talking about taxes.

Nonetheless, today we will be discussing two things: the incredible power of maxing out your work sponsored 401K, and how to get savings on top of savings (booya!) through the saver’s credit.

How I learned to Stop Worrying and Love The 401K

When I got my first real job out of college, I continued to invest nearly all my money into taxable stocks and index funds. I contributed the bare minimum to my 401K, just to get the employer match, but I was reluctant to invest anything beyond that.

“I’m young,” I thought to myself. “I don’t want my money locked up for years in a retirement account. I want my money ready and available, in case a huge business opportunity comes crashing through my window and needs a notable amount of capital.”

The details are a little hazy, but I imagined it all going something like this:

Cue The Money Wizard, surfing away on the internet, when SMASH! The world’s greatest business opportunity comes blasting through the window, Kool-Aid Man Style.

I imagined the sales pitch in crystal clarity. “Hey Money Wizard, this is the best business idea EVER! Start up this business, and you’re guaranteed to be a MILLIONAIRE, from pure passive income. The idea just happens to need the EXACT SAME amount of money you’ve been savings these past few years. And the best part, there’s no risk. Plus, you’ll get a date with Scarlett Johansson.”

I’ll admit my mind may be more ridiculous than most, but I’m willing to bet the majority of people scared of maxing out their retirement accounts think something similar.

The problem is, that line of thinking is WRONG. And it’s costing you thousands.

Why Investing in Your 401K is THE Most Powerful Investment

1) Your 401K contributions directly reduce your taxable income. Lower taxable income, lower tax bill. I save over $6,000 per year just by maxing out my 401K.

2) Employer Matches are literally the best investment ever. Quick, name me an investment that provides a 100% return, guaranteed. The answer: your employer’s 401K match.

Say your employer matches the first 5% of your 401K contributions. If you make $50K per year, that means the first $2,500 you contribute automatically and instantly doubles to $5,000, thanks to your employer match – an immediate 100% return on investment.

Even the Kool Aid Man up there can’t promise returns like that.

3) 401K money can actually be accessed before age 59 1/2, contrary to popular belief. Options include taking a loan against your 401K (not at all recommended) or using the tax loophole known as the Roth IRA Conversion ladder (very recommended).

Showdown: Money Muggle vs. Money Wizard

Let’s consider two tales to show how unbelievably powerful the 401K effect really is.

Before you started reading this gem of an article, you may have been tempted to be like the Money Muggle. He graduated college last year and scored a decent gig paying him $45,000 per year. But he doesn’t care about investing, so he doesn’t contribute to his 401K at work and receives no employer match and no tax breaks. (Or he’s like I was, and he’s waiting around for a Kool Aid Man shaped hole in the wall along with the incredible business plan he’s bringing.)

At the same company, there’s the Money Wizard, who’s a coworker of the Money Muggle. The Money Wizard is earning the same $45,000, but he knows about the power of the 401K, and he’s determined to grow his wealth at the fastest rate possible. To do this, he lives a modest yet happy life while contributing $18,000 (the 2016 IRS maximum allowed) to his 401K.

For this example, we’re assuming they’re both law abiding, tax paying citizens. I’m using Minnesota’s state income tax rate and used two handy online tax estimators: Bankrate’s Income Tax Calculator and Smart Asset’s State Income Tax Calculator.

| Money Muggle | Money Wizard | |

| Annual Income | $ 45,000 | $ 45,000 |

| Annual 401K Contribution | $ 0 | $ 18,000 |

| Employer Match | $ 0 | $ 2,250 |

| Adjusted Gross Income | $ 45,000 | $ 27,000 |

| Standard Deduction | $ 6,300 | $ 6,300 |

| Taxable Income | $ 38,700 | $ 20,700 |

| Total Federal Taxes Paid | $ 5,469 | $ 2,644 |

| Total State Taxes Paid | $ 2,020 | $ 893 |

| Total Taxes Paid | $ 7,489 | $ 3,537 |

Because of his 401K contributions, the Money Wizard reduced his taxable income by $18,000. How much less tax did he pay? Right around $4,000 dollars. ($3,952)

We’re talking $4,000 of hard earned, real money which can be kept, rather than thrown into the never ending sinkhole of taxes.

Looking at it another way, by contributing $18,000 to his 401K, he’s effectively receiving an immediate return of $6,250. ($2,250 of employer match plus $4,000 in taxes saved.) That’s an annual return of 35%!

Let’s put a 35% return into perspective.

- Housing prices during the real estate bubble leading to the Great Recession returned about 6% per year.

- Warren Buffet, the greatest investor in the history of the world, has averaged a return of 20% during his investing career.

- Even Apple stock, perhaps the best performing large stock in the past 15 years, has returned less (about 30%) since the release of the iPod 1.

How hard would you study if you knew your investments could outperform one of the biggest real estate run ups ever, the most profitable stock in recent history, and the greatest investor of all time?

How hard would you work for a nearly $6,500 raise at your job?

Good news, you don’t need to study or work harder. Instead, just delay that new car for a year, log into your work’s payroll program, and change a decimal or two on the contribution allotment. Boom, easier than a Facebook status update.

Take that, Warren Buffet.

Could it get any better?

Actually, it can. Because you’re receiving those tax breaks by investing in a productive asset like a 401K and not say, a house, you’re starting with a larger snowball of wealth rolling down the mountain. And that big sucker has some mass behind it.

Just one year of financial savvy from a young college grad who decides to max out his 401K and invest the tax savings, leaves him roughly $300,000 richer by age 60. From just one year of financial discipline.

$18,000 Honda this year or a $300,000 Ferrari at retirement? The choice is yours.

What if he keeps maxing out his 401K every year throughout his working career? He will be retiring with, wait for it… $3.9 million dollars.

No doctors, lawyers, or lottery winners required. He could be the worst worker ever, never receiving a raise, and on the verge of a layoff for his entire career. But with just a post-grad starting salary, time spent in the market, and a little knowledge of an often misunderstood benefit, we are now looking at a multi-multi-millionaire.

I’m starting to sound like a late night infomercial scammer, but there really is more. What if I told you the IRS will pay you to retire with nearly $4 million dollars?

The Saver’s Credit, A Young Money Wizard’s Best Friend

The savers credit is an awesome tax incentive which rewards “low income earners” for contributing to their 401k or employer sponsored retirement plan. Basically, a low income wage earner can receive a tax credit for anywhere between 10-50% of their first $2,000 in retirement account contributions.

The coolest part? While that whole “low income” bit makes the entire thing sound like some sort of government welfare program, in reality a gainfully employed millennial with a decent post-grad salary can easily qualify for this tax break using a little basic money wizarding.

And remember, this is a tax credit, not to be confused with a tax deduction. In the world of confusing government jargon, tax credits are the most beneficial tax break in the world.

Credits don’t just reduce your taxable income (that would be a tax deduction). Oh no, tax credits reduce the amount of taxes you OWE, dollar for dollar.

A quick example of Tax Deductions vs. Tax Credits

Oversimplification time: say I make $45,000 per year and have a $1,000 tax deduction. I could have gotten this deduction for a number of reasons, maybe I donated to a charity, own a home, paid student loans, or had some medical expenses. In any case, my $1,000 deduction makes it so my taxable income is only $44,000, and I pay taxes on that $44,000.*

Now let’s say I have a $1,000 tax credit on top of all of the above. My $1,000 tax credit wipes clean $1,000 of taxes that I owe. Boom. Just like that, the tax man gets $1,000 less of your money.

Making sense? Getting excited? I am!

*Real tax law is a little more complicated than this, and most young money wizards will just take the $6,300 standard deduction in this instance. Remember when I said it was an oversimplification?

Now let’s see it all in action.

Using the Saver’s Credit to Get Paid for Saving

Remember our Money Wizard in the above example? He really was wise. Because as a single guy earning $45,000 he knew about the savers credit, and his goal was to reduce that income in the IRS down to less than $30,750 so he is eligible for some FREE MONEY.

His $18,000 contribution to his 401K did just that. His adjusted gross income was reduced to $27,000, which means he was now well within the $30,750 range of a “low income earner” eligible for the savers credit.

Based on a fancy IRS tax table, we see the Money Wizard’s adjusted gross income qualifies him for a saver’s credit equal to 10% of his first $2,000 in 401K contributions, or $200. This means the measly $2,600 he owed in federal taxes just got sliced down to $2,400.

So, not only does he pay less than half of the taxes as our poor Money Muggle example, he’s also getting a $200 paycheck for his efforts. I believe the very technical name for this is savings on top of savings.

Cue up that “all I do is win-win-win no matter what” song please…

Perfect, thanks.

The cost for all of this money saved? $18,000 into HIS OWN retirement account. He’s saving himself money today by giving himself even more money in the future. And getting paid in the process.

To qualify for the saver’s credit, you have to be over 18 years old, not a full time student, and not a dependent. Click here for more info from the IRS.

We’ve thrown around a lot of numbers in this article, and we are dealing with the most boring of the boring topics here. If you made it with me to this far, props to you! By the power invested in me (which is none) I am rewarding you with the five step process to kill your tax bill and retire even richer for your efforts.

How to Maximize Your Retirement Accounts in 2018

So, to reach maximum wizard status, here is the best tax strategy for 2018:

1) Make sure you are contributing enough to your employer sponsored 401K to receive any and all possible employer matches.

2) Open a Traditional or Roth IRA outside of work, and invest up to the IRS limit of $5,500.

3) Continue those 401K contributions until you max out the IRS limit of $18,500.

4) If any of these admirable feats drop your adjusted gross income down to $30,750 ($61,500 if married) do not forget to get your free money through the saver’s credit.

5) Enjoy your minuscule tax bill today and your massive retirement account in the future.

And if you’re serious about planning your retirement, I continue to recommend a free Personal Capital account:

Great article!!! I do have a question though. I work in an industry where, unless you’re a corporate chef, you don’t get a 401k. But I do have my own Roth IRA. Can I still qualify for all of this awesomeness with only a Roth IRA?

Hey Christa, glad you liked the article!

Employees who aren’t offered a 401K definitely have it a little tougher. That said, it’s awesome you’re taking advantage of your IRA! I’d definitely suggest contributing the $5,500 limit to your IRA in 2016. (Protip: you can actually make 2016 IRA contributions all the way through April 2017)

Depending on your exact work arrangement, you may also want to look into whether you qualify for a SEP-IRA or Solo-401K. Lots of awesomeness in those two plans. Both have higher contribution limits, and the Solo-401K acts more like the corporate 401K I described in the article. Check out lifehacker’s guide for retirement plans when you’re employer doesn’t offer one for more info.

Thanks for making this topic fun to read about! Perfect timing! I am in the process of increasing my deferred compensation to more fully fund my 401K. But I only have 7 more pay periods through the end of the year, so I won’t be able to hit $18,000 this year. If I can also fund an IRA for myself and a spousal IRA for my disabled husband, that will help. Are there any income limits that would prevent me from being able to do Roth IRAs?

BTW, I am 55 years old.

Glad you enjoyed it Kathy! I wouldn’t sweat not being able to max out your 401K this year. Just the fact that it’s on your radar is awesome! It took me a few years myself before the timing worked out so that I could hit the ground running in January. Sounds like you’re on your way, which is awesome!

For married filers, you have to be earning over $194,000 combined before Roth IRAs are not allowed. The phase out starts at an adjusted gross income of $184,000. Here is a handy IRS table on the subject. And because you’re over 50, you’re allowed to contribute $6,500 per year instead of the $5,500 I mentioned in the article. (assuming you’re earning less than $184K)

I’m not as familiar with disability, but usually spousal IRAs are allowed even if one spouse received no taxable income.

The matching is huge. I went from having ZERO matching at my last job, to a 6% contribution from my current employer, which has allowed me to save the same amount of money into my retirement accounts, even with a massive paycut. Definitely do anything you can to grab that match!

Not ever gonna be able to get that savers credit, but really nice job doing the heavy lifting and researching all that stuff I tried to read that tax code you quotes and my eyes glazed over…and I’m a lawyer that reads boring stuff like that for a living.

Yeah, that’s one thing I’ve realized as I test drive this working world for the first few years out of school. Employer matches and the other non-salary related benefits are huge, and usually affect your bottom line just as much the salary number everyone likes to brag about.

Haha, isn’t that dry tax code language ridiculous? Just unreal…

Just crazy boring.

Also, I need to stop typing on my phone. I looked back at what typed before and it’s just riddled with typos. Autocorrect isn’t doing anything for me!

I also use my 401K to lower my income to get more EITC every 1000 I put in my 401K I get 200 dollars more in EITC plus state of Iowa give you 15% of that as tax credit. Been doing it for years. My CPA just shakes his head at me. It pays to know the tax laws.

Way to go Todd!

I love this! You’re doing great work in helping to educate others on the power of saving and tax benefits! I do have a question about the order in which you recommend to invest money:

1) At the very least contribute to the 401K match

2) Max out 401K

3) Contribute to / max out IRA (Traditional or Roth) provided income requirements are met

Based on that order, most people may never open an IRA because they’re stuck trying to max out their 401K which is very difficult for most.

The order I’ve been a strong advocate of is:

1) At the very least contribute to the 401K match

2) Contribute to / max out Roth IRA Only provided income requirements are met

3) Use any additional money that you can to max out 401K

My reasoning for this is because first off, though you may pay taxes now on the Roth, you don’t may anything later on contributions or returns. (Would you rather pay taxes on the seed or the Harvest?) Do you believe that your tax rates are going to go up, down, or stay the same by the time you retire? That answer should dictate how people invest whether Pre or Post Tax.

Having a healthy Roth and 401K to pull from will greatly ease anyone’s tax burden later in life.

I’d like to get your thoughts on this.

I’m loving your posts, and I’m glad I found out about you. I look forward to keeping track of your journey! I’m 32, and I have early retirement / financial independence in mind as well – just a little bit later than yours though.

Glad you’re enjoying the posts. You bring up a great point that’s worthy of a whole post in itself. You are right in that I had the implicit assumption that our hypothetical investor in the article had the ability to max out both the $18K 401K and a $5.5K Roth IRA. When having to decide between the two, the door is opened for a little bit of debate and personal preference.

IMO, really what your question is boiling down to is all else being equal, should someone invest in a Traditional or Roth IRA? There is a ton of differing opinions on this in the personal finance world. It all boils down to this: nobody knows exactly what their tax rate will be, and nobody knows exactly what taxes will look like in retirement. Which means we have to rely on assumptions, and assumptions are never perfect. Enter the room for debate.

Personally, when faced with the same situation and some uncertainty about Roth IRA vs. 401K, I did what any risk averse investor would do. Diversify. I invested until I got the employer match, then maxed out the Roth at $5.5K, then invested any leftovers back into the 401K.

I’ve since learned about the benefits of traditional 401Ks over Roth IRAs for early retirees. Now I would continue contributing to a traditional 401K/IRA over a Roth. For someone not planning on retiring early, following your advice would definitely be sound though.

Wizard – “I’m since learned about the benefits of traditional 401 Ks over Roth IRAs for early retirees.” …..

What are those benefits?

and, why for early and not later retirees?

Thx

Early retirees can use what’s called a Roth IRA conversion ladder to withdraw traditional 401K dollars before age 59.5, penalty free and often tax free. It involves transferring money from your 401K account to a Roth IRA, waiting five years, and then withdrawing the transferred money. I plan on during a full write up about it in the future.

Hi there, my company is partnered up with Fidelity in offering us 401(k) accounts; however, my company provides no matching benefits. Is there basically no point to going through work/fidelity in this case? Would I be better off exploring 401(k) options elsewhere? What would you recommend?

Thanks for the help!

401(k) accounts can only be contributed to through your employer. it’s an employer sponsored plan. You can’t contribute elsewhere. Your options are to use IRA accounts, which can be opened anywhere.

Mike is right here. If you go outside of your work in this case, you will be limited to the $5,500 IRA contribution limit, as opposed to the $18,000 401K contribution limit. I don’t know all the specifics of your case, but based on what you’ve said, finding cheap place to set up your IRA (Vanguard, most likely) and contribute $5,500 to the IRA, then any leftover savings (up to $18,000) to your employer’s 401K could make the most sense.

Awesome article! curious about the roth IRA option. How would i go about actually investing in something like that outside of my work place?

With Vanguard, it’s about as easy as signing up for Facebook. You create a log in account, link up your bank account, sign a few edocs, and then select Roth IRA from the dropdown. They provide pretty solid directions, although I plan on providing a step by step walk through in the future.

First off, I just want to say congrats on your saving discipline. You’re also a talented writer that has the ability to keep things simple and succinct. I only have one suggestion for future articles: make sure to mention your assumptions in any compound growth scenario, namely the average annual rate. I hate to sound like a bear but I think it’s worth noting that it’s very possible the next 30 years look nothing like the last 50. It’s more likely than not that the new normal is 4-6% per year.

Thanks Nick. I agree, investing 101 says that past returns do not indicate future performance. That said, it’s the best indicator we’ve got, and history is marked with inaccurate predictions about huge adjustments to average returns. This time is different, many will say, but we’ve heard that before too.

Could returns be lower moving forward? Wouldn’t surprise me in the least. But I’m also not sweating it. Nobody can be predict the future, but we do know that living below your means and investing the difference is the most surefire path to wealth around. Even assuming only 4% returns per year, a maxed out 401K over a working career totals $2 million.

I have a few questions for you:

1. Is your 401k the only vehicle you’re saving into for retirement?

2. I believe I read somewhere that you want to be financially independent by age 37. If this is true, how do you define “financially independent”

3. Have you taken into consideration your tax liability you’ll have in retirement? You seem to be neglecting this.

4. Why would you contribute, in excess of your match, to a 401k before a traditional IRA?

5. What level of income(after tax) are you planning for retirement?

6. What rate of return do you assume in your investment accounts?

Thanks for your help.

Hi Matthew, quite the laundry list there. I’ll try to answer as best I can.

1) I save in a bunch of different vehicles. Check out Business Insider’s article for a pretty detailed breakdown or any number of the Net Worth Updates on this site. Here’s the cliff notes version: I’m currently investing about $18K into the 401K, $5.5K into a Roth IRA, and $12K into taxable index funds.

2) Having the choice of whether I want to work another day in my life or not, at a lifestyle I’m comfortable with.

3) Yes I have, although nobody knows what taxes in the future will be, so dwelling on this too much is recipe for banging heads against walls. What I do know is it’s hard to go wrong saving the vast majority of your income. I’ll worry about the details as I get closer towards financial independence, or follow the lead of some other earlier retirees who successfully have a 0% tax rate.

4) Contributing to a Traditional 401K and a Traditional IRA have the exact same benefits, tax wise. If you’re referring to the limited options in your employer’s 401K, then it could make sense to open a traditional IRA after the matching is met.

5) About $30K. I currently live off $20-25K.

6) I usually use a real rate of return of 6 percent.

I appreciate the response. I’ve ran your numbers taking into account your account values, contributions, ROR, retirement age, retirement income, and a few other factors. with this info, you would be projected to run out of money at age 55. However, you would be on track if you pushed your retirement back to 45. I also want to mention that i LOVE how much you are saving, your discipline, and your commitment. I don’t want you to think I’m attacking you… i think one of your faults is your application of the 4% rule. Firstly, the 4% rule was intended to only apply to a 30 year retirement. Second, the validity of the 4% rule has come under intense scrutiny recently. I recently attended a presentation by Dr. Michael Finke, where he address this notion. Dr. Finke is the Dean of the American College. Here is an article pertaining to his research: http://www.thinkadvisor.com/2013/01/17/finke-study-warns-4-retirement-rule-is-dead-long-l

Matthew, I appreciate the concern. I have seen these fear stirring articles before. Of the many factors they fail to take into account, the most notable is the possibility of an early retiree adjusting his spending during down market years. Instead, they assume complete inflexibility in spending, which although a common assumption for most financial advisors, is directly at odds with the fundamentals of this site.

Second, while it’s true the original 4% rule was only analyzed for a 30 year retirement, this was mostly due to a lack of 60 year windows to evaluate, and not indication that a retirement longer than 30 years is a recipe for failure. Think of it this way, at the time of the trinity study, analyzing a 60 year retirement would mean the freshest sample would have the hypothetical retiree starting his retirement in 1938. The fact this wasn’t analyzed doesn’t imply that a retirement longer than 30 years is unsafe; it only implies there wasn’t enough data to reach a conclusion. In reality, we can use some basic finance to find the answer. Conceptually, we can think of withdrawals on a portfolio much like amortization of a loan. Drop your interest payments even a little bit, and your principal runs away to a several-hundred year mortgage. Increase your payments, and the loan is gone in just a few years. Similarly, the length of your retirement has little effect on the withdrawal rate calculations, and there is almost no difference in the safe withdrawal rate results between a 30 year retirement and a 300 year retirement.

Love the discussion. You had mentioned that in a down market that you wouldn’t try to spend as much. Do you think that you have that flexibility when you’re already only living off of 30k/yr? Also, I don’t think I would consider the article “fear inducing”. It’s reasearch by the dean of the American college. I don’t think you could find a more credible source. It’s a quick read if you haven’t had a chance to check it out. Also, an unforseen event, like long-term care or disability, could have a pretty devastating effect since there isn’t really much wiggle room. It also might not be a bad idea to look into investing into non-market correlated assets. That could help your “down year” scenario if you have a pocket of money to go to that didn’t lose value in a down market.

Definitely. My fixed expenses are only around $12K per year while the rest is discretionary, so there’s wiggle room if needed.

I didn’t mean to implying the dean’s research was poor, and I do enjoy the differing perspective. I just find the assumptions built into the research as least applicable to people able spend consciously and live frugally, which describes nearly all early retirees.

As far as non-correlated assets, my Roth IRA is invested entirely in REITs, and I do hold a small amount of bonds. Diversifying further is something I will look into as I near closer towards retirement. Right now I’m squarely in the accumulation phase, and my allocation reflects that. I’ll keep focusing on saving over 60% of my salary and stacking 25x my annual expenses, then take it from there.

Investing Traditional vs Roth really comes down to 1 main factor…paying taxes over your 30 – 50 year career (Roth), vs paying taxes over a longer period of time of your career plus your retirement (Traditional), totaling 50 – 75 years. Making a decision based off of anything beyond this is really a bet on whether your tax bracket will increase as a result of salary increase, or government tax increases. If your tax bracket isn’t somewhere close to zero, you probably shouldn’t be using a Roth. The one plausible argument for the Roth IRA is that it’s much more likely that the (Federal) government just raises taxes rather than try to find a way to get at Roth money in the future.

The way you describe the Traditional IRA’s tax advantage in your article is misleading….the effect of reinvested tax savings for Traditional 401ks is void because those reinvested tax savings will on go to pay taxes in the future assuming you’re in the same tax bracket. A person who invests 10k now and pays a 20% tax on the future value will be at the same exact level as someone who invests 8k now and doesn’t pay taxes on it later. The same way that a Traditional saver might reinvest their tax savings, a Roth IRA saver could just not save as much, counting on not paying taxes later.

Your point still stands as far as investing in a Traditional for a tax advantage. Here’s the punchline….paying taxes over a shorter amount of time through a Roth IRA increases your tax bracket and tax rate for the taxable years of your working career, whereas if you spread your total “income” over your retirement years as well, you are lowering your tax bracket and tax rate throughout. A Roth is a reasonable bet that taxes might be higher in the future, but in most cases it’s superseded by the fact that spreading your taxable income over your retirement years will result in a lower tax bracket. I honestly think the Roth IRA isn’t all it’s cracked up to be and is really just something created by the debt laden government to get more taxable income.

Your points are sound, but remember this website is primarily about pursuing early retirement. For early retirees, Traditional 401Ks have several benefits over the Roth. With a little strategy and low living expenses, an early retiree can defer taxes on a Traditional 401K/IRA and then avoid them completely. My buddy Mad Fientist ran some great articles on the subject.

Just started my job in July (22 years old) and of course I’ve been thinking about these questions being someone extremely conscious of my personal financial future. I make pretty good money: $60,000 a year. However, My employer match is 5% but doesn’t kick in until 1 year of service which will be next July. My goal was to save $30,000 this year on top of my 401k. I have a few questions, though:

1. The markets are near all-time highs, which makes me hesitant to go all-in right now. Should I contribute the max anyways rather than contributing 7% like I am now and investing on my own once markets fall maybe 5%+?

2. I am contributing all to Roth 401k right now. Obviously this doesn’t reduce my current tax burden but it does reduce my future tax burden. Do you recommend going all Traditional 401k or would you go a certain portion towards each or all Roth if I believe I’ll be making a lot more later on?

Thanks for a great article!

Thanks for the great article. I am working at the non-profit organizations, and our plan is 403(B) not 401(K). I checked our HR website and the limits for max contributions are the same. I just wanted to ask do you know any other differences between these 2 types of retirement plans?

Thanks.

I appreciate it, Kerim. Usually the only difference between 401ks and 403bs is the nonprofit status of the company running them. There’s some behind the scenes stuff about 403bs costing the nonprofit less to operate than a 401k, but that’s unlikely to show up in the administrative fees you pay, and the end result for the employee is usually the same – same tax advantages, same contribution limits.

Glad to hear that. I will definitely max out my contributions and will watch and see how it grows over years 😉 Thanks again.

403Bs also aren’t held to the same standards 401ks are. There is no law that states a 403B provider has to act in the best interest of the employee, which is why there are tons of very high fee options and some predatory practices in 403Bs. The New York Times is running a couple of pieces on it right now.

This article was super super helpful!

Can you speak a little bit about how you decide whether to invest in a pretax or a roth 401(k)??!

Thanks!

Hi!

I just found your site and have a quick question. My work place provides a 401k which is automatic, not questions, you’re in for 7% of your salary. It’s matched 100% but you cannot add more than the 7% of your pay.

The other benefit is that they also provide a couple more vehicles. An option of a 403B and a 457A (if I recall correctly).

So I’m assuming let’s say my salary is a hypothetical $50k so that means at 7% it’s $3500 and my employer matches $3500. That $7000 is part of the $18000 limit so which vehicle next would you want to put that last $11000?

Also, in a real world example most people have debt and should a person focus paying all their debt first before investing in above the mandatory 7% of the salary. It would take years before all the debt is paid off and I’m just looking towards advice as to which way to go.

I know there’s other factors such as being married and having 2 children…lol but anything would help.

Thanks!

Employer matches should not count towards the $18K limit. Whether to pay off debt or contribute to a 401K depends on the interest rate of the debt and how badly you want to be debt free. As a very rough rule of thumb, if the debt’s interest rate is below 4% or so, I’d say contribute to your 401K before paying down the debt.

457s are amazing for early retirement, subject to the fine print. Usually they are set up such that once you leave your job, you can withdraw money whenever you want, penalty free. The things to look out for are high administration fees and whether the assets in the 457 plan are held in a trust for employees or are considered assets of the employer. The latter is troubling because you could be screwed if the employer ever were to go out of business.

Thanks for the information. I was told by an adviser for a large investment firm that met with me that the employer’s portion counted towards that limit. That’s good to know that it doesn’t so more can be contributed.

Debt wise, that will be the first thing that I tackle since it’s due to a side business and at times it profitable and other times I’m pulling money out of my account to pay the credit cards used. Might have to revisit the plan for the side business..haha.

Yes I was told with the 457 that I can withdraw the funds after I leave without any penalty and I can pick the investments with the money contributed. I don’t have to worry about the business going out of business if the funds are considered assets since this is very large university that I work for.

So would you suggest that the 401k has $3500 automatically, then contributing $14500 into the 457 and then $5500 in an IRA thus maxing out the contribution in that way? Ignoring the 403b?

Thanks again!

Hey Money Wiz– Love your blog and your writing style. I’m 52 and a writer in the investing/retirement saving industry. I plan to retire at 55. I just wish I had your insights when I was your age, but hey, I’ll still be retiring a decade earlier than most of my contemporaries.

A couple of comments:

1. You can also access your 401(k) and 403(b) without penalty starting the year you turn 55, but you have to “sever from employment” (i.e. leave the company)

2. The Roth is a great way to diversify your taxes. It’s also a great place to keep emergency money because you can access your contributions (but not any earnings) at any time without penalty or additional taxes. I’m grateful I started contributing the year they became available because when I got married my wife’s income pushed us over the limit. It’s a nice problem to have! For those who want a super safe place to keep their emergency money, check out the new MyRA (“My Retirement Account”). It’s a version of a Roth with a guaranteed interest rate and U.S. government backing. MyRA.gov.

3. For those whose companies offer a health savings account (HSA), these are an amazing tax break: Reduce current income tax, no tax when withdrawn (if used for qualified medical expenses) and no tax on earnings. You can use the money on stuff like eyeglasses, dental visits, prescription meds — all the stuff your health insurance doesn’t fully cover. Not to be confused with a flexible spending account (FSA) which is use-it-or-lose-it annually. HSA money rolls over indefinitely and can be invested like an IRA. Some companies also make company contributions: BONUS! I haven’t touched mine since I opened it, and I’m up to nearly $10k.

4. For those with a 403(b), pay very close attention to the expenses. These plans have less oversight than 401(k)s and people are often pushed toward very expensive choices like tax-deferred annuities, variable annuities and indexed annuities — all major screw jobs in my opinion. If the sales chump (er, I mean “licensed professional financial adviser”) can’t give you a complete and total rundown of every fee (expense, charge, penalty, cost or whatever other lame-ass euphemism he wants to use), run away and invest in a Vanguard index fund– just compare the expense ratio. For me, the expense ratio is THE most important consideration for investing. Anexchange-traded fund (ETF) is usually even cheaper. Unless you’re getting a matching contribution (rare in the nonprofit and govt. world these are typically offered), you’re probably better off maxing out an IRA (again, in my opinion). And for the love of God, people, do not invest in ANY mutual fund that has a sales charge/load (Class A, Class B, Class C shares) or charges a 12-b1 fee. Another total screw job. I worked for a mutual fund company for a dozen years and now work for an insurance company that manages 403bs, 401ks, 457s and that stuff. Yes, I work in the devil’s lair. But the pay ain’t bad and the education has been incredibly valuable.

Great comment El Cheapo. Couldn’t agree more about HSAs and expense ratios, but your whole comment is filled with solid advice. Thanks for typing it all out!

I appreciate your article and somewhat understand. I do understand about the $18,000 limit for 401K and the tax saver $61,500 if married, which I am, but I just don’t see how we can take advantage of these. Between my husband’s and my paychecks, we barely make $60,000 a year, but that is not our take home. I do have some put in a Roth/IRA account, but it is minimal at best. With my other deductions (taxes, healthcare, union, etc) I bring home less than $19,000 a year. If I put 18,000 in a 401K, I’d be living on $1000 a year. My husband also maybe brings home the same amount, again we would have another $1000 a year to live off, totaling $2000 a year. That is NOT feasible. We are very close to retirement now, so we cannot rely on other jobs, and/or 20 years to save this kind of money. We have zero debt and pay cash for everything now (after years of lavish spending mistakes) and we can maybe save between $500 and $1000 a month combined, but that is about all we can spare. I’m just not seeing how individuals on a limited income can do what you are able to do. I wish I could because I would definitely be doing it. I do applaud you, but in our case, I can’t see it happening.

Kathy,

Sounds like you’re doing a pretty good job given your situation. Just staying debt free and living within your means places you ahead of most people.

One thing to keep in mind, 401K contributions are taken out of your pre-tax income. So in your case, you’d have more than $1K to live on if you contributed $18,000 to a 401K, because your paycheck’s tax deductions would decrease as your 401K contributions increased, thus making your take home pay more than $19,000 a year.

That said, I still agree that maxing out a 401K for low income households may not be as realistic as for higher earners. At these levels of income, it takes more extreme frugality to get ahead. Things like earning $100 per year using Bing and alternative living arrangements become more beneficial.

Great article. Just an FYI and it may have come up in a later comment, but you forgot to throw in the personal exemption when reducing your taxable income as well, which would be another $4,050.

Good catch Nick, thanks.

Wait, why is the savers credit only 10%?

The percentage of the saver’s credit is based on your filing status and adjusted gross income. For a single filer earning $20-31K, it’s 10% of up to $2,000 of your 401K/IRA contribution. Married filers can make more money and receive a larger percentage.

You can find all the specifics in the IRS tax table.

What are your thoughts on when/if you should contribute to a Roth 401k instead? Thanks!

Great article! I did have a question though…What should be my priority, opening a Roth IRA or continue to save money in my emergency fund and then use any remaining money to pay off student loans? I should also note that I haven’t been maxing out my 401k cause I feel like I wouldn’t have enough leftover to save elsewhere….should maxing out my 401k be my top priority? I’ve read a ton of articles and they each offer different advice so I feel like my head is spinning right now!

Natalie,

Probably a big reason you’re seeing different advice everywhere is because the little differences aren’t that critical in the grand scheme of things. As long as you’re saving and investing, you’ve already won the majority of the battle.

From there, I’d recommend my article about emergency funding like a pro, but keep in mind this stuff is different for everyone, so your situation may call for a larger emergency fund.

Personally, maxing out my 401K is my top priority, but if I was in debt with anything above a 4-5% interest rate I’d shift that priority to paying down debt. This probably includes your student loans if you haven’t refinanced through LendEdu or SoFi. Unless you’re getting some big time employer matches in the 401K, paying down the debt is a smart and safe way to go.

Hi, you said employer matches the first 5% of the contribution. If you contribute the max of $18,000, the first 5% of that is $900. So i dont see how you came up with $2,500 as the employer match. Am i missing something here?

The employer match isn’t 5% of what you contribute, it’s up to 5% of your gross salary. I.e. If you made $100,000 and your match was 5%, you would get a match from your employer for up to $5,000 annually.

Great article. Here is where I would like a little clarification. My husband maxed out his 401k at 18k bring in our combined income to 72k after maxing out the 401k. We then wanted to max out our traditional IRA at 5500 each. We were told by our cpa that I could (because I didn’t have a 401k), but he could not contribute to his IRA because he maxed out his 401k at 18k. Is that accurate?

Absolutely not. You need to find another CPA or find a CFA. A married couple can contribute up to $11,000 per year combined (on top of a 401k)into a roth or traditional IRA. There are income limits to the Roth, but your combined income is well below this threshold.

Nice post on 401ks. Another important point is that if you are self employed and have no full time employees you can also add a profit sharing component and get an addition 20-25% (depending on the structure). This essentially allows you to super charge your 401k. You can also use this strategy if your spouse works in the business. 401ks are great retirement vehicles!

I’m not as familiar with the self employment options, but that sounds incredible. Any suggestions for further reading there?

If this is attractive enough, I might just have to ditch this work thing and become self employed through MyMoneyWizard.com!

You only make a 35% rate of return in the first year you save the money. The years after that you make what every the rate is of your investments. So, each year you make your 35% on the $18,000 going into the 401k for that year only. It is not 35% compounding. That would give you $7.3 million dollars after 20 years if is was 35% compounding on just saving $18,000 for one year. I hope that make sense.

This 35% is not compounding like Warren Buffet’s 20% through his WHOLE life. There is a big difference here. Sure, making 35% on your money one time is a good thing, too!

A good distinction. The example was just meant as a fun exercise to show what an incredible deal a 401k with matching is. Of course, if we could all make 35% compounded every year just by investing in our 401k… well then Warren Buffett wouldn’t be all that special.

Great article, but the most impressive bit is an allusion to Dr. Strangelove from a twentysomething… Nicely done

I’m sure it’s good for young people to start life thinking so positively about finances – believing with a little discipline, it will be simple to be a multi-millionaire by the time they are in their 60’s. The fact is that the average 55 to 64 year old has only $104,000 saved in their 401k. 29% of people over 55 have nothing – zero, in a 401k, and likely little or no other savings either. Additionally, 20% of men will die before retirement age, and a lesser percentage of women will die. The problem with these rosy articles is that they fail to take one simple thing into consideration – that life happens. And coming from this 50-something saver/investor/been there,done that person, I can tell you, that unless your life starts out with a silver spoon in your mouth and the most perfect of circumstances during your life, you might easily find yourself right there amongst the average 55 to 64 year olds, and quite far from where you intended to be. One needs to ask themselves a lot of questions, like the following: Do I want to live like a hermit/nun my entire life? Do I want to live my life never traveling anywhere? Do I want to own the same car my entire life? Do I want to live with my parents until I’m 45? Can I live life by never going skiing or buying a snowboard or a motorcycle or a parasail or a Jeep or a Porsche or a Ferrari or a Corvette, or eating in nice restaurants, or overindulging in alcohol or weed once in a while, or…. You get the idea. Who wants to save all their money, never getting to enjoy any of it doing some of the things that make life worth living, and then die before being able to withdraw it? This article doesn’t consider many of the things in life – even a boring life – that tend to whittle away at your good intentions. So you make $45k and you invest $18k in a 401 and $5500 in an IRA. That leaves you with $21,500. Ok, then if you don’t want to live at home with mommy, you’re looking at $1500 in monthly rent, which leaves you with $3500. Then you have utilities, food, student loan payments, car expenditures like gas and oil changes at the least, car insurance, renters insurance, etc., etc. You’re now getting the idea of the costs of life. How possible is that Porsche sounding now? You’re lucky if you can in reality invest in the 401 at work at all. About the same time you’ve graduated from college, you’re looking to move out on your own, because if nothing else, it is going to be seriously socially unacceptable for you to be living with your parents. And about that same time, you’ve either got or going to get a boyfriend or girlfriend, which will further eat into your earnings/savings. And that girlfriend will be a worse saver than yourself because it’s all about the “excitement” for women, and if you don’t keep doing exciting things, she will leave for the BBD ASAP. So, she manages to stick around because she thinks you’ve got money, because you’re spending on her constantly, and then she gets pregnant. Then you have to spend a fortune to get married, and when the kid comes, the expenses get greater, the pressure gets greater, etc. So several years and several kids and several animals perhaps down the road, and its not working out – you get divorced. Yes, you do – 55+ percent of you. And there goes half of your savings to her and then you’re paying child support as well. The rest of you are forcing yourself to be content with a less than exciting sexual relationship, and you just grit your teeth and bare it – you know you are. You dumb down your sex drive just to try to live with the situation because you don’t really want to be alone, and certainly don’t want to lose half your hard earned savings to her. I digress. And then, like most investors, you’re going to have to try your luck in the stock market because you really know technology inside and out. Then you lose $300-500k in a dot com crash. Yeah, you did. You jump jobs a few times, salary doesn’t really increase, expenses increase, you’re drinking more, smoking more, wasting more money, fitness declining, etc. Do I have heart disease? Do I have prostate cancer? Arthritis? Hearing loss? Oh my God, Alzheimer’s runs in my family! Shit, I’m going to die before I’m 65. If I have Alzheimer’s I might live to 100, but being in the nursing home will chew through any savings that I might have had in a couple years. I’m sorry kiddies, Life happened, and neither you nor I have little to show for it, and didn’t have that much fun getting here to old age either. If you manage to save 2+ million by 65, I applaud you. I also think you likely inherited or married most of that. And that’s the truth according to Rich. Like Arnold says, “Hear me now, Believe me later.”

Lord. You are the most negative and depressing person in the world. Just because you life sounds like shit , doesn’t mean our lives are like yours. Plus, if you don’t enjoy this web site , then don’t dread it , and get the hell out. Tough luck for you, snow flake. I, divorced I’m doing pretty well , have a decent net worst and I am only 30. Bet your ass by the time I’m 57 , because, yes I am retiring at 57 I will have a better life than you as a retiree. Actually, I already have a better life than you. You are nothing but a depressed hater that couldn’t make it in life. Tough up and be a man and grab the bull bi its horns.

So here is the *million dollar* question: is there a time when maxing out no longer becomes as beneficial and taking the money (even if it is taxed) and putting it toward paying down something like student loans, or putting aside for a down payment on a house makes sense.

I’ve been doing some research on this, and can’t seem to find an answer, other than the fact that I am well on track in terms of my savings. So here is my breakdown:

Age: Almost 35

401k account: $295k

Home: Owner occupied three family and live in one unit (so I get rental income) – took out a loan on my 401k to cover down payment, and still owe myself approximately $40k + whatever interest I will end up paying myself on that.

Salary: $105k +/-

Employer match: 8% of total salary (regardless of whether I contribute a single penny)

So here is my question: having plugged in these figures into various 401k online calculators, it would seem that if I just leave it alone my final figures (assuming retirement at around 62) would not be DRASTICALLY different than if I continue maxing it out. To be sure, it is still a fairly sizeable amount (something along the lines of $300k), but when your final figures are in the $3mil+ range, I am not sure if I want to continue living paycheck to paycheck, especially with other expenses such as kids school coming into play.

So what would be your thoughts on cutting back, being taxed, but also having more money to put away now, and maybe further diversifying by putting aside money for a downpayment for another investment property?

Money Wiz – thanks for the article! You talk a lot about Roth IRAs but not Roth 401(k)s. My company offers the option to give to either a Roth or Trad 401(k) and I typically give $9K to each. Do you have any thoughts? Thanks!

As a financial planner, I totally understand

where you’re coming from. I read your site fairly often and I

enjoy your posts. I shared this on twitter and my followers enjoyed it too.

Kepp up the good work!

An important point is that if you are self employed and have no full time employees you can also add a profit sharing component and get an addition 25% in if you like. This allows you to get a larger chuck into your solo 401k.

Not really man. This is the kind of saving strategy that is going to make you feel poor in the long short term, and have less real money in the long term. 401(k)s are great but inflation will make long term savings worth less. So even though they are tax sheltered they are not inflation sheltered. Also you could be investing that money which will experience a capital gains tax (much lower than income tax) and have a higher margin. Also if someone is making a savings account right after college that they cant touch until they are 65 without penalties, putting anything over 10% of your salary into it is absolutely foolish.

Don’t drink the 401(k)ool aid people there are far better ways to avoid taxes, and grow the money that you’re “protecting”.

I disagree with you, because most of what you are saying is not correct.

1) 401k money can be accessed prior to 59.5 (65 is a social security cutoff, not a 401k) without penalties using a few different strategies. I talk about the most popular here.

2) 401k money is protected against inflation, because the underlying earnings of the stock market adjust for inflation constantly.

3) You’re missing the point on taxes. The advantage of a traditional 401k is that the money is available to invest before paying any taxes at all. With your plan, you give away thousands of dollars each year to income tax before you ever get the “benefit” of also having to pay capital gains taxes too.

Roth vs Traditional 401k

Hey Sean, I love all your articles and insights into investing at a young age. It’s great finding quality content out there, especially for all of us in our mid 20s/right out of college

Quick question, I just started my career and have read numerous articles about investing in roth vs traditional 401k’s. I ended up investing 6% in the roth 401k (my company matches 50% of contributions up to 6%). My reasoning is because I live in Texas where there is no state income tax, so in total taxes are only around 20% for my 50k salary. Since I am being taxed less compared to someone living in Illinois, I thought it’d be a good idea to contribute post-tax. What are your thoughts on that reasoning?

I have a lot if high interest credit cards that I am struggling to pay due to a divorce. I currently contribute 11% of my income to my 401K. Should I stop contributing to the 401K until I am able to pay my current bills with my take home pay? Or since the contributions to the 401K is pre-tax, the difference in the take home pay is negligible?

Money wizard. I am considering doing this strategy and max out my government retirement account. I would need to change it from ROTH to traditional. I also already have a ROTH IRA so just like you said , I am planning on maxing that out too. But, my concern are taxes. Are you concerned that the hopefully massive amount balance by the time you retire aren’t also not going to get massively hit by taxes ? Because is a traditional 401K and not a ROTH? I’m trying to decide. What’s your say?

Hey 🙂

You mentioned that you want to retire by 40 but i don’t quite understand how you can do that if the majority of your wealth will be tied up in an inaccessible account like 401K where you can access the funds after 59.5. Most financial experts say you need to invest in a taxable account if you want to retire early.

Can you please explain this?

See question #1:

https://mymoneywizard.com/reader-mailbag-1/

An important point is that if you are self employed and have no full time employees you can also add a profit sharing component and get an addition 25% in if you like. This allows you to get a larger chuck into your solo 401k.

Re: Maxing out the 401(k)…Increase your tax exemptions (W-4) and increase your 401(k) contributions with what would have been the increase in your net pay. Good idea , or not?

Thanks,

Jim

My husband is maxing out his 401k and contributing the extra 6000 for age 50 and above. Once we reach retirement at 65 should we leave the money in the 401k or roll it into an IRA. What is the best option? We would like for our funds to continue to grow and hopefully we won’t have to take out RMD until 70.5. Thank you.

I love your articles! What do you think about the 401k vs the Roth 401k? My tax advisor reccommended paying higher taxes now to allow the amount to grow tax free until I retire. What do you think?

Glad you like them!

It’s all about whether you expect your tax bracket to be higher or lower in the future. I wrote an article all about this:

https://mymoneywizard.com/deciding-between-a-roth-or-traditional-ira/

Hello!

I really love your article about 401K strategy! I am 25 years old, member of older Gen Z. I started my career at Walmart that they offered 6% match free! I deposit $440 monthly in my Walmart 401K, even they pay me at $12 per hour so it is low-paid job, but it is very worth to take OPPORTUNITY to build wealthy for 40 years! That’s so interesting your information that I learned form you. Also, I would like to get second job as my side hustle to support my needs and wants also possible to open 2nd 401K too to get double power! Do you think it is good idea to have 2 401K accounts at same time?

Thanks!

Alex

Knock yourself out! As long as your total contributed doesn’t exceed the $19,500 yearly limit.

Love your page, just discovered it and am binge reading! I am currently contributing 6% to 401k and my employer matches that. Having read a lot of your page, I am starting to look much more seriously at forecasted retirement pot. Couple of questions.

– Should I work towards the maximum allowed 401k contribution, and only after getting there THEN look at a Roth IRA?

– Or, should I look at a Roth IRA now and invest up to the max IRS limit (you have put this as step 2 before maxing the 401k allowance as step 3). If its this, why is that? Is it just because it’s easier to withdraw from later in life?

– Then I have a question around investing in standard taxable index funds – should I only do this after I have done both of the above (apart from my “emergency fund” which is already in there with vanguard thanks to you)? I know we call these “taxable”, but do I actually have to pay tax on any returns on these on an annual basis or only when I liquidate?

Thanks, apprecaite the help.

what happened to you, last blog update was last january 31st 2023, thats over a year ago after doing your monthly update without fail,

hope all is well, and if there are still any readers out there looking for a similar blog like this, then please consider my blog https://www.investingforbeginnerscommunity.com/post/how-to-make-20-to-40-yearly-returns